State-owned Enterprises Dominate Large Model Procurement Market with $4.7 Billion Investment

![]() 01/20 2025

01/20 2025

![]() 674

674

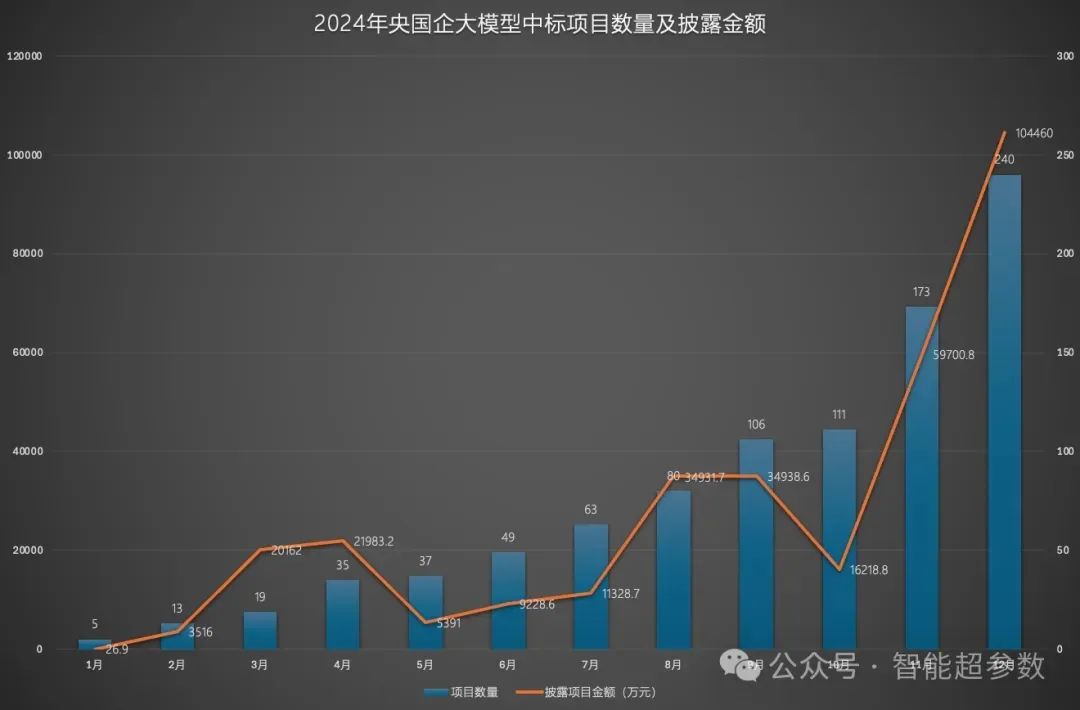

Throughout 2024, Intelligent Hyperparameter recorded 931 large model procurement projects won by state-owned enterprises. Among these, 380 projects did not disclose the winning amount, while the disclosed amount totaled approximately $4.7 billion. State-owned enterprises primarily encompass large central enterprises, local governments, or enterprises controlled by state-owned assets.

For a deeper understanding, you may refer to my November article, "Why Does the Commercialization of New Technologies Start with 2G2B? This is the Key to Large Model Commercialization!", which delves into why the commercialization of new technologies often begins with government-to-government (2G) and government-to-business (2B) initiatives. Similarly, the commercialization of large models, as a cutting-edge technology, heavily relies on the support of 2G2B frameworks.

In 2024, state-owned enterprises accounted for 61.25% of the total large model procurement projects in the market and approximately 49.8% of the disclosed winning amounts. Both in terms of quantity and value, state-owned enterprises emerged as the dominant force in the large model procurement market, capturing half of the market share.

Behind the extensive deployment of large models by state-owned enterprises lies a decisive factor: policy promotion. According to Dune Academy, since 2023, the State-owned Assets Supervision and Administration Commission (SASAC) has repeatedly emphasized the development of artificial intelligence in central enterprises. Notably, at the special promotion meeting on AI in central enterprises in February 2024, it was proposed that central enterprises should embark on "AI+ special actions." During this meeting, 10 central enterprises signed an initiative, pledging to proactively open up AI application scenarios to society.

In July of the same year, the State Council Information Office held a series of themed press conferences on "Promoting High-Quality Development," outlining that in the next five years, central enterprises are expected to invest over $445 billion in large-scale equipment renewal and transformation, deploying advanced, high-efficiency, and reliable equipment.

01 Distribution of Procurement Project Categories by State-owned Enterprises

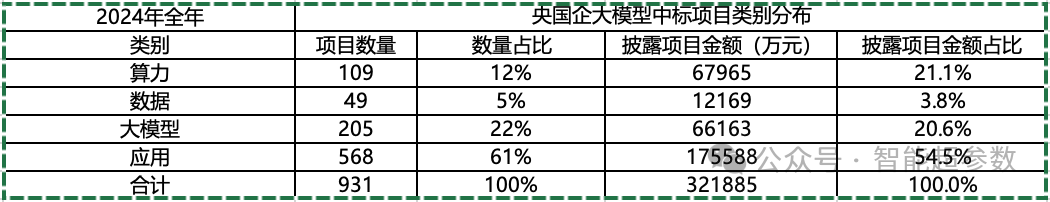

Throughout 2024, the categories of large model procurement projects by state-owned enterprises, as recorded by Intelligent Hyperparameter, were as follows:

Currently, state-owned enterprises primarily focus on two aspects in deploying large models: intelligent computing centers and industry applications.

Intelligent computing centers serve as essential infrastructure for large models. According to incomplete statistics from the China Academy of Information and Communications Technology, as of the end of July 2024, 87 intelligent computing centers (both completed and under construction) were being monitored. Typically, these centers are led by local governments or telecommunications operators.

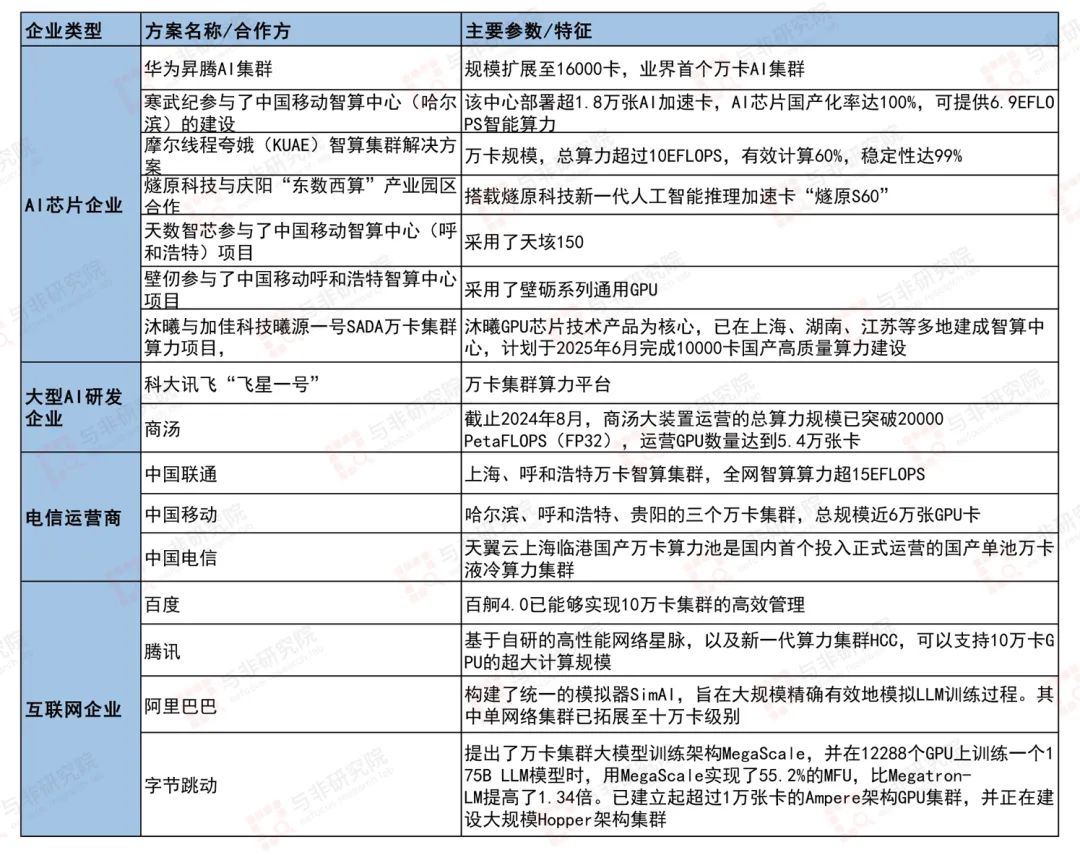

Currently, a 10,000-GPU cluster has become the standard configuration in the race to deploy large models. Without such a cluster, it might seem inadequate to claim significant investment in the large model sector. Besides large technology companies, the three major state-owned telecommunications operators have also established their own 10,000-GPU clusters.

Table: Domestic 10,000-GPU Cluster Projects and Construction Status

(Source: Public information, compiled by

In addition to intelligent computing centers, another key focus for state-owned enterprises in AI large model construction is industry applications, involving the development of large model platforms or applications tailored to specific scenarios.

Application projects accounted for 61% of the total, higher than the overall market share of 56%. Meanwhile, the procurement of large model projects accounted for 22%, also surpassing the overall market share of 19%. This underscores state-owned enterprises' emphasis on acquiring large model technology and implementing it in real-world business scenarios.

02 Industry Distribution of Large Model Projects by State-owned Enterprises

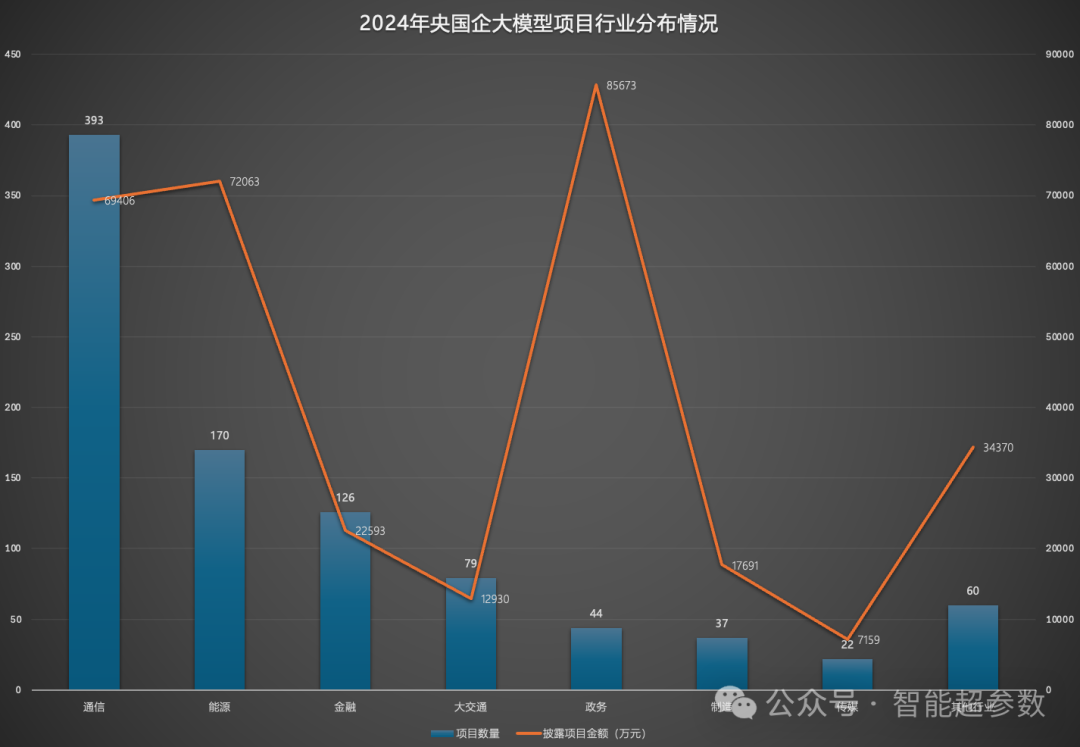

Throughout 2024, the 931 large model procurement projects initiated by state-owned enterprises, as recorded by Intelligent Hyperparameter, were primarily distributed across industries such as communications, energy, finance, transportation, government affairs, manufacturing, and media.

In the communications industry, the three major operators are the primary procurement forces, with China Telecom's provincial companies and technology subsidiaries leading in procurement volume. China Mobile and China Unicom's provincial companies and subsidiaries also have significant procurement projects.

In the energy sector, State Grid and China Southern Power Grid companies are the main players, joined by large state-owned enterprises in fields like petroleum, coal, and nuclear power, such as the China Energy Investment Corporation and the State Pipe Network Group Corporation.

In the financial industry, banks dominate procurement, with securities and insurance institutions also accounting for a significant proportion. Overall, an increasing number of financial institutions are initiating large model bidding projects, fostering the implementation and innovation of large models across various application scenarios.

Although the government affairs industry has fewer projects, the amounts are substantial due to local governments often conducting large-scale integrated project bidding through state-owned enterprises under their direct control. For instance, the Yunnan Kunming AI Empowerment Center Construction and Operation Integration Project, won by SenseTime Technology, has a single project value of approximately $286 million, with the bidding entity being Yunnan Cloud Big Data Industry Development Co., Ltd.

Different industries have varying demands for AI large models, leading to distinct project focuses. For the government affairs and operator industries, the higher proportion of intelligent computing centers is driven by both policies and the need for privatized and local deployment, particularly in the government affairs sector. In contrast, other industries focus more on developing large model applications for specific points or links, whereas the demand for large models in government affairs and operators is more systematic, requiring the integration of resources from GPUs to computing power scheduling platforms.

Furthermore, it's noteworthy that industries with higher expertise requirements are more selective in choosing winning bidders. For instance, when selecting computing power scheduling platforms and large model pre-training and development stages, the winning bidders are often AI enterprises led by Baidu and iFLYTEK. For specific technical research during large model development, they prefer medium-to-large IT enterprises with deeper domain expertise.

Intelligent Hyperparameter closely tracks the winning bids of six general large model vendors. Since most of their winning projects originate from state-owned enterprises as bidders, these vendors' rankings in the state-owned enterprise large model market align with their overall market performance.

Collectively, these six general large model vendors secured 20% of the state-owned enterprise large model procurement projects and approximately 32.5% of the disclosed winning amounts throughout 2024, demonstrating their leading competitive edge in this market.

Medium-to-large IT enterprises are also significant players in the state-owned enterprise large model market. According to 2024 statistics, AsiaInfo Technologies, Orient Information, Guochuang Software, Haitian Ruisheng, Nantian Information, State Grid NARI, and ECOM Networks are strong contenders, winning numerous large model projects from state-owned enterprises. Notably, AsiaInfo Technologies and Orient Information have won more projects and amounts than some of the general large model vendors we track.

Note: Some winning projects mentioned in the report did not disclose the winning amount. For statistical convenience, these project amounts were calculated as 0, potentially leading to omitted project statistics. Additionally, project and industry classifications are not strictly defined, which may impact the final statistical analysis results. Please consider this when using the information for reference.