Zhao Ming's Sudden Departure: Will AI and Imaging Propel Honor Out of Its Stalemate?

![]() 01/20 2025

01/20 2025

![]() 580

580

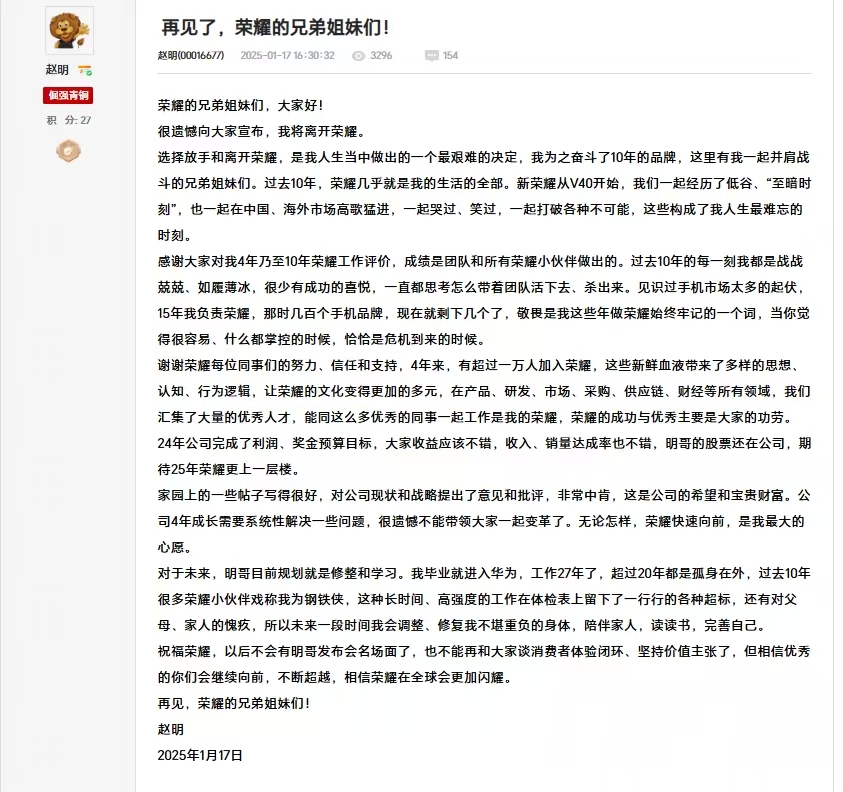

On the 1485th day after the inception of the new Honor, Zhao Ming, the company's iconic leader, unexpectedly announced his resignation.

On January 17, Zhao Ming posted a resignation letter on the company's internal network, stating, "Due to the immense physical strain and a desire to spend more time with family, I have decided to step down from Honor." The letter also revealed two crucial points: Zhao Ming still holds a substantial share in Honor, and he believes that Honor will continue to shine brightly on the global stage.

Since joining Huawei in 2001 and leading the newly independent Honor in 2021, Zhao Ming has served in his position for 27 years. With Honor's IPO on the horizon, the question arises: Is Zhao Ming's departure a blessing or a curse for the company?

Will Zhao Ming's strategic vision for Honor, particularly its focus on AI, endure?

On January 22, 2021, the newly independent Honor held its first press conference, showcasing the V40, a former mid-range flagship model in the V series. This phone was equipped with the MediaTek Dimensity 1000+, a seemingly step backward from the Honor V30, which featured the previous-generation Kirin 990 5G flagship chip.

However, being able to utilize the Dimensity 1000+ was the best option available to Honor at that time for the V series. Zhao Ming also mentioned at the three-year anniversary of the new Honor and the Honor 100 series press conference that it was challenging for the newly independent company to immediately re-enter the mobile phone market, abandon the previous Kirin platform, and find a new direction. Fortunately, after closely collaborating with Qualcomm, the new Honor found common ground with Qualcomm upon switching to its platform.

(Image source: Honor)

For the new Honor, the most daunting task was choosing the right path. When Honor was still a sub-brand of Huawei, it was positioned as an internet mobile phone brand, directly competing with REDMI. For instance, the REDMI K20 Pro's "K" had a hidden meaning, standing for "Kill," as Redmi launched this series to compete with the then-current Honor 20 and Honor V20.

Upon returning to the mobile phone market, Honor promptly realigned its product line positioning. Firstly, the V series, initially an online mid-range flagship series for Huawei, was completely discontinued after the launch of the V40, as the new Honor lacked the resources to support a mid-range flagship series targeting the online market. Secondly, the number series, previously used as a flagship series to compete with Xiaomi's number series, was transformed into a mid-range product targeting the offline market.

The Enjoy X series, launched in 2013 to compete with the Redmi Note, featured a thousand-yuan price point and an octa-core processor. After the new Honor became independent, the X series was continued but repositioned as a high-quality series. For example, the Honor X50 sold over 15 million units, setting a new sales record for Android phones.

(Image source: Honor)

More significantly, there's the Magic series. In August 2021, the Magic3 series, the true flagship phone after the new Honor became independent, was officially released. It was equipped with the Qualcomm Snapdragon 888 mobile platform and a triple camera system comprising a 50-megapixel wide-angle lens, a 64-megapixel black-and-white lens, and a 13-megapixel ultra-wide-angle lens. Looking back, the new Honor's first flagship after independence suggests a somewhat unsuccessful start. In 2021, the mobile phone market had already begun competing in hardware, heat dissipation, and algorithms, and Honor, which had just switched from the Kirin platform to Qualcomm, struggled to keep pace.

After completing the comprehensive transformation of its product lines, Honor also started focusing on the market. Unlike its previous positioning as an "internet brand," Honor directly targeted offline channels. Public information shows that in September 2021, Honor signed cooperation agreements with over 30 large distributors to expand its offline channels. However, Xiaomi was also accelerating its offline market expansion, with Lu Weibing stating that the goal for Xiaomi Homes in all provinces, cities, and counties nationwide in 2021 would reach 3,500 stores.

Objectively speaking, in the first two years after the new Honor became independent, it impressively performed in the shrinking mobile phone market with its two mid-range lines, the number series and the X series. According to the IDC report, in 2021, Honor shipped 38.6 million units with a market share of 11.7%, returning to the top 5 in China's mobile phone market. In 2022, Honor was the only vendor among the top 5 to achieve positive growth, with shipments surging 34.4% year-on-year.

However, 2022 was also a pivotal moment for the mobile phone market, with vendors such as Xiaomi, vivo, and OPPO focusing on the high-end market. Xiaomi partnered with Leica to launch the Xiaomi 12S series, becoming a contender in the high-end mobile imaging segment. OPPO released its self-developed MariSilicon chip, becoming one of the few domestic vendors capable of developing imaging chips. At that time, Honor was just regaining its footing and returning to the top 5.

(Image source: Xiaomi)

For Honor, succeeding in the high-end market is paramount. Only a true flagship phone can refresh consumers' inherent image of the Honor brand. In 2024, riding the wave of AI, Honor swiftly found its unique direction. At the MagicOS 8.0 Developer Conference at the beginning of 2024, it unveiled the first mobile operating system equipped with large model technology.

Simultaneously, Honor partnered with Porsche Design to launch two luxury flagship phones, the MagicV2 RSR Porsche Design Edition and the Magic6 RSR Porsche Design Edition. In the same year, Honor emphasized portrait photography, collaborating with the French portrait studio Agence Vu on the Honor 200 series to introduce three special portrait modes: Texture, Vivid, and Black & White.

(Image source: Lei Technology live footage)

Fully embracing AI was the wisest move the new Honor made after its independence and the key to gaining market recognition anew. At the end of 2024, Zhao Ming's use of YOYO intelligence to order 2,000 cups of coffee at the Magic7 series product launch became a headline in major mainstream media's social news sections. This was a rare instance in recent years where a mobile phone made the news in non-digital sections with a positive image, sparking intense online discussions. Lei Technology also listed this event as one of the top ten memorable moments in the mobile phone industry in its 2024 year-end review.

(Image source: Lei Technology live footage)

Objectively speaking, the new Honor's rise from just a 3% market share in its first year of independence to returning to the top 5 is closely tied to Zhao Ming's repositioning of product lines and proactive exploration of new directions. However, for Honor, which only became independent at the end of 2020, the mobile phone market had already stabilized at that time. Vendors such as vivo, OPPO, Xiaomi, and Huawei already had well-established online and offline channels, clear product positioning, and strong consumer perceptions of their brands. The fact that the new Honor was able to achieve such results actually exceeded market expectations.

Are AI and imaging the keys to Honor's rebirth?

Data from the third-party market research firm Canalys shows that Honor's market share in the first three quarters of 2024 was 16%, 15%, and 15%, respectively, with a 1% drop in the fourth quarter, ranking fifth among mobile phone vendors.

The core impact on Honor in 2024 came from Huawei. In 2023, Huawei officially returned to the market with the Mate60 series, ending the year with a 12% market share, becoming the fourth-largest mobile phone vendor of the year. By 2024, with the dual flagship launches of the Pura70 series and Mate70 series, Huawei's market share increased from 12% to 16%, pushing Honor, which was already ranked lower, further down the list.

In fact, the new Honor has been unable to shake off Huawei's shadow in the two years since its independence. Even at Huawei's farewell ceremony for Honor at the end of 2021, Yu Chengdong made it clear that when the two sides meet again, they will definitely compete as rivals. It was not until 2023 that Honor officially separated its cloud services from Huawei accounts and switched to Honor cloud services. Additionally, Honor channel partners stated in an interview with relevant media in 2022 that Honor's new stores were almost always opened next to Huawei stores, with the clear goal of attracting a large number of customers from Huawei, which had temporarily left the mobile phone market.

Therefore, with Huawei's return from the Mate60 series, it began to regain its footing, and with the continuous improvement of the HarmonyOS ecosystem, more and more users are returning, further reducing the appeal of the Honor Magic series.

From a market perspective, investors' trust in the new Honor undoubtedly stems from its previous relationship with Huawei, but their expectations for the new Honor are naturally to find a new path after its independence. Honor is indeed building its own ecological empire, such as the MagicBook notebook product line, the MagicPad tablet product line, headphones, educational hardware, etc. However, it seems there is still a long way to go.

At last year's IFA, Lei Technology learned in an exclusive interview with Zhao Ming that he had repeatedly explained Honor's "AI vision" to the outside world. He believed that in the current AI revolution, the core value of terminal vendors lies not in providing single application-level AI functions but in building system-level AI capabilities. Therefore, Honor pays more attention to "building end-side, platform-level AI and reshaping the operating system through AI," and on this basis, opens up terminal AI capabilities to third-party large models, applications, and services, working with developers to create better services, richer values, and superior experiences for users.

This vision was demonstrated at the Magic7 series flagship product launch just over a month later. However, for consumers, this seems to be insufficient.

(Image source: Honor)

Returning to the most crucial mobile phone business, the new Honor has a certain degree of sensitivity to new trends, such as AI. Honor was one of the earliest Chinese vendors to implant large models into the system level. However, it relies too heavily on AI to stimulate new consumption. Similarly, vivo and OPPO, which have also focused heavily on AI, have received high recognition from consumers with vivo's continuous efforts in imaging and OPPO's playful approach with live photos and fruity effects.

This includes Honor's second dilemma: imaging. The entire imaging solution in the early days of the new Honor was essentially a copy of the previous Huawei Mate series' solution. For example, the Magic3 series still used the familiar color + black-and-white lens combination. It was not until the Magic5 series launched in 2022 that Honor first proposed the original imaging solution of the "Eagle Eye Camera," focusing on snapshot capabilities and rapid imaging.

But at the same time, other mobile phone vendors had already focused on large sensors and high-pixel sensors, putting in a lot of effort in the telephoto segment. For example, the Xiaomi 12S Ultra was the first to feature the Sony IMX989 1-inch large sensor main camera, and the vivo X90Pro+ was equipped with an OV64B 64-megapixel 1/2-inch large sensor periscope lens. Not to mention that both vivo and OPPO have launched their self-developed imaging chips specifically for algorithm processing in cameras.

Today, although Honor has introduced an AI large model telephoto algorithm, the direction of mobile imaging is shifting towards professional video creation. Obviously, in mobile imaging, Honor seems to be slightly behind the market trend. The problem is that consumers are quite sensitive to mobile imaging.

(Image source: Lei Technology live footage)

Overall, the new Honor faces dilemmas from various aspects, including competitors, brand image, technology accumulation, as well as challenges in channels, agents, and supply chains. To overcome these dilemmas, Honor may need more time, but with its IPO looming, the capital behind it cannot wait.

Zhao Ming leaves, and Honor embarks on a new journey.

Initially, when rumors of Zhao Ming's resignation circulated, it was not just Zhao Ming leaving alone but with the entire Magic7 team. Many may not have noticed why there were rumors of a company CEO leaving with a certain team. In fact, as the CEO of the new Honor, Zhao Ming was fully responsible for its high-end product lines, namely the R&D team of the Magic series.

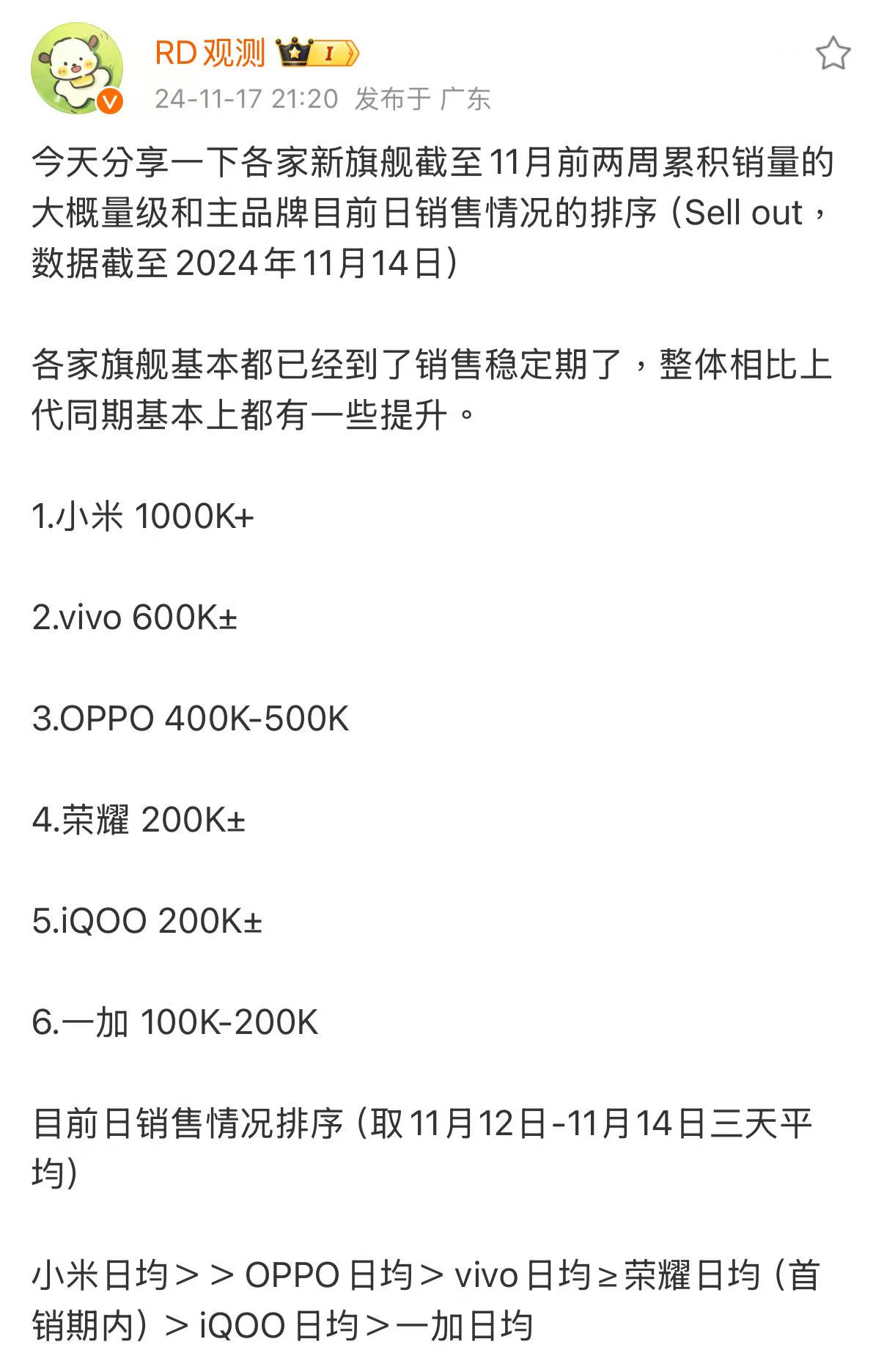

After the Magic7 series was launched in 2024, its performance was disappointing. According to Weibo RD observation data, the Magic7 and Magic7 Pro were among the worst-selling flagship models of their time, even outperformed by the Magic6 series launched earlier in the year.

(Image source: Weibo)

From a product standpoint, the Magic7 series was actually quite impressive. It pioneered the integration of the Qualcomm Snapdragon 8 Gen 1 processor, 3D ultrasonic fingerprint recognition, 3D facial recognition, subwoofer technology, and the Oasis eye-care display. Essentially, it featured all the most sought-after hardware of its time, and its pricing was comparable to its predecessor. The only area where it fell short was in imaging, a traditional weakness for Honor.

However, when compared to its competitors, the last two iterations of the Honor Magic series have not quite lived up to the expectations of being a true "imaging flagship." In an era where mobile imaging is valued even more than the device itself by consumers, this has hindered Honor's market presence.

Li Jian has succeeded Zhao Ming. According to Zhao Ming's resignation letter on the internal network, Honor may shift its focus towards developing overseas markets. Li Jian shares a similar background with Zhao Ming – he joined Huawei in 2001, was deployed to Nigeria as a product manager in 2017, and became a core member of the Honor management team in 2021.

(Image source: Weibo)

While Li Jian also possesses a technical background, he boasts more extensive experience in overseas markets compared to Zhao Ming. During his overseas assignments, he demonstrated strong sales acumen. By promoting Li Jian, Honor seems to be signaling its ambitious plans for international expansion. In fact, as early as the IFA 2024, when Honor held an overseas press conference, Leitech had already sensed Honor's resolve to go global. At that event, Honor unveiled three major products: the Honor Magic V3, Honor MagicPad 2, and Honor MagicBook Art 14. Although these products had already been launched domestically, Zhao Ming also introduced some unique new features and services, such as the collaboration between the Honor Magic V3 and Google Cloud, which provided local consumers with multiple end-cloud collaborative innovations based on the Honor AI Security Framework, encompassing AI removal, AI translation, and other cutting-edge AI technologies like AI face-swapping detection and AI defocusing eye protection.

Objectively speaking, if Honor chooses to concentrate on overseas markets in the future, it would align more closely with its current situation, particularly given the intense competition in the domestic market. Going global could help Honor build greater confidence and momentum.

Undoubtedly, the fact that Honor has managed to establish a strong presence in the mobile phone market within just four years of independence has surpassed market expectations. As for the strategic shifts that Honor might undergo with Zhao Ming's departure and Li Jian's appointment, only time will tell. It can be said that, at present, Honor's challenge lies in the lack of time to solidify its brand image, accumulate technology, and enhance its ecosystem. Therefore, the fifth year of the new Honor will be particularly pivotal.

Source: Leitech