The Ascent of the AI-Powered CPO Market: Charting the Future Trajectory

![]() 01/21 2025

01/21 2025

![]() 968

968

Produced by Zhineng Zhixin

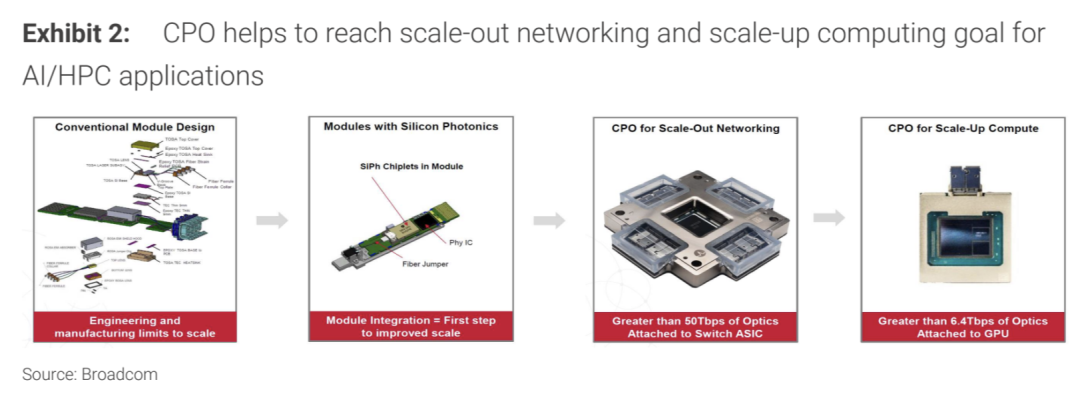

Spurred by surging demand for Artificial Intelligence (AI) and High-Performance Computing (HPC), Co-Packaged Optics (CPO) has emerged as a cornerstone technology for modernizing data center networks.

According to Morgan Stanley's research report titled "AI Supply Chain: Identifying the Key Beneficiaries of CPO," the CPO market is projected to achieve a compounded annual growth rate (CAGR) of 172% from 2023 to 2030, soaring from its current value of $8 million to an astonishing $9.3 billion.

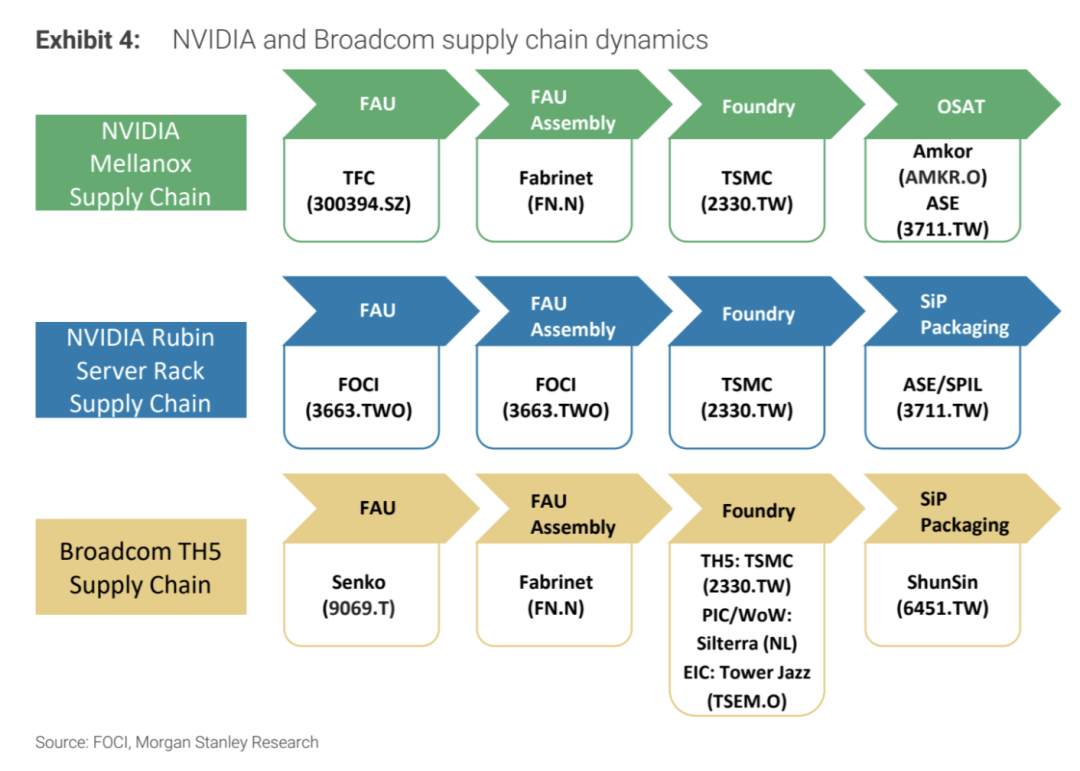

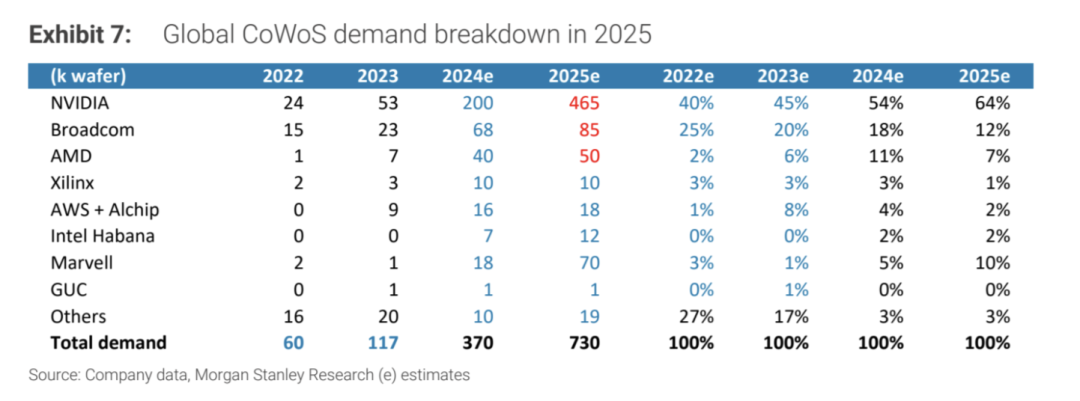

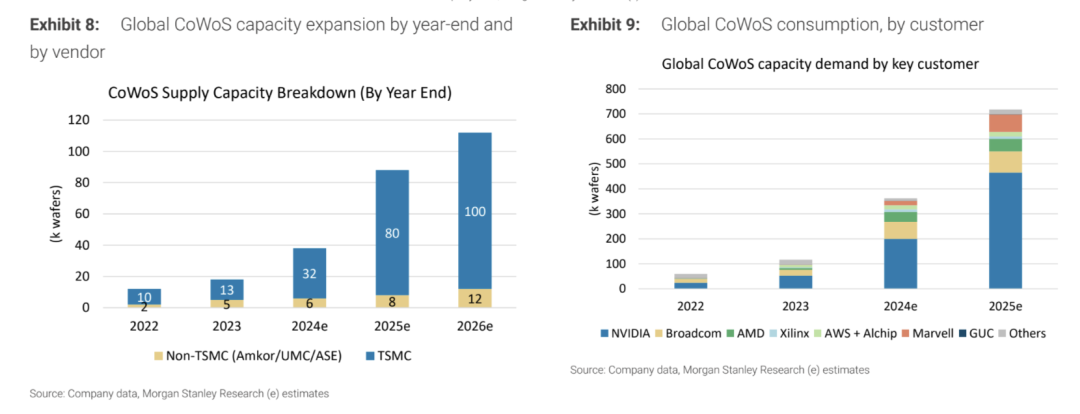

Technological breakthroughs, epitomized by Nvidia's Rubin GPU, are propelling the adoption of CPO in AI and HPC applications. Key players in the supply chain, including TSMC, Marvell, and Broadcom, play pivotal roles in advancing the CPO ecosystem.

Part 1

Strategic Importance of CPO: Enhancing AI Data Center Performance

By seamlessly integrating optical components directly into the processor package, CPO significantly amplifies data transmission efficiency and minimizes power consumption. This innovative design furnishes AI data centers with high-bandwidth, low-latency network capabilities, effectively alleviating the bandwidth constraints of traditional electrical interconnects.

These advantages will be particularly vital for future AI training and inference workloads. Nvidia's Rubin GPU and its NVL server architecture are poised to revolutionize the commercialization of CPO, with system demand anticipated to account for 75% of the global CPO market by 2027. The Rubin GPU is expected to generate substantial demand for Fiber Array Units (FAUs), further cementing its position in the HPC realm.

The CPO market is rapidly expanding, anticipated to surge from $8 million in 2023 to $9.3 billion in 2030, fueled by the burgeoning demand for efficient network connectivity in AI and HPC applications.

- Key Players:

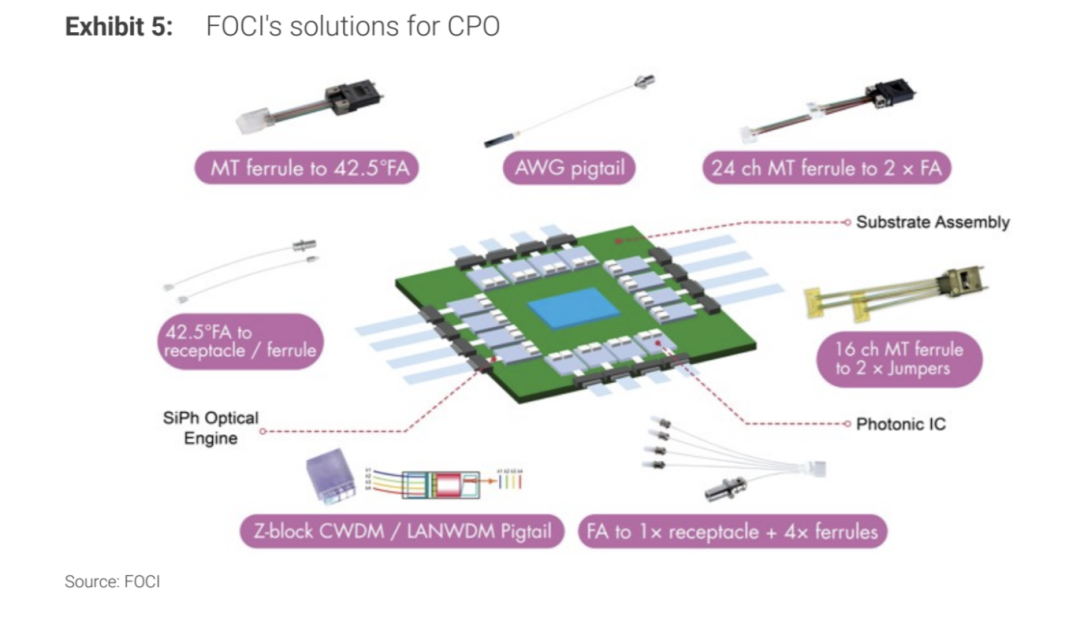

- FOCI: A leader in FAU and related optical services, playing a pivotal role in the CPO supply chain.

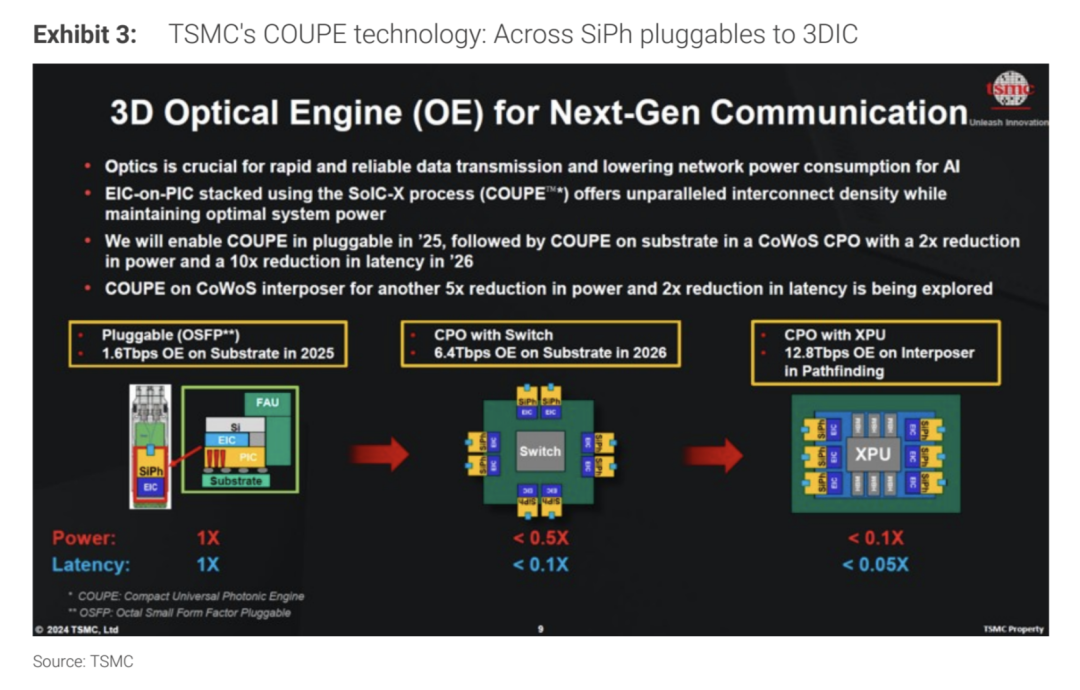

- TSMC: Demonstrating robust integration capabilities in silicon photonics (SiPh) and 3D packaging through its COUPE technology.

- ASE: As a pioneer in advanced packaging, ASE offers System-in-Package (SiP) solutions for CPO chips, anticipating revenues of $400 million and NT$1.4 billion in 2026 and 2027, respectively.

FOCI: Core Strength in CPO Component Supply

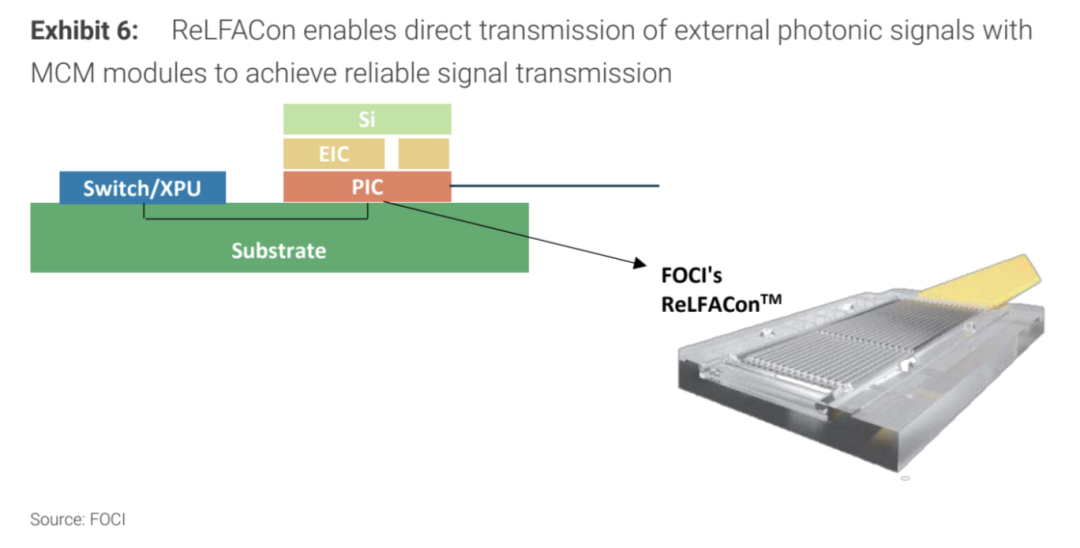

FOCI holds a vital position in the CPO supply chain, focusing on the provision of Fiber Array Units (FAUs) and ancillary services such as optical packaging, fiber patch cord systems, and cables. In Nvidia's next-generation Rubin GPU server rack system, FOCI is expected to be the primary supplier of FAUs and related services, leveraging its cutting-edge technical expertise and extensive R&D and production experience in optical communication components to meet the stringent optical component requirements of CPO technology.

FOCI's alignment with TSMC's localization strategy also serves as a competitive advantage. As the global semiconductor supply chain undergoes realignments, localized production and supply become paramount. FOCI's close collaboration with TSMC enables it to better adapt to these shifts, ensuring stability and timeliness in CPO component supply. With the gradual market penetration of CPO technology from 2026 to 2027, FOCI is poised for significant revenue growth, with its CPO-related business set to become a key driver of corporate performance.

ASE: A Holistic CPO Solution Provider

- Comprehensive Capabilities: ASE showcases comprehensive service capabilities in the CPO field, encompassing a wide array of solutions ranging from traditional to advanced packaging.

- Packaging Technology: In CPO packaging, ASE leverages its VIPack platform to offer hybrid bonding technology for PIC/EIC integration, along with OSAT services for PIC/EIC/Switch/XPUs and SiP packaging for complete CPO chips.

- Market Potential: Taking Broadcom's TH5 as an example, while Shun Sin previously provided SiP packaging services, ASE, with its proactive market strategy and technology R&D investments, holds significant potential in the CPO market. Morgan Stanley's analysis estimates that 0.65 million and 2.275 million CPO-related components (including CPUs, GPUs, etc.) will require packaging in 2026 and 2027, respectively. If ASE charges $20 per SiP packaging, this could generate approximately NT$400 million and NT$1.4 billion in revenue, underscoring the immense business opportunities in the CPO packaging market.

AllRing: Focused on silicon photonics research and development, investing around 10% of its human resources in technical research and achieving notable progress in CPO-related equipment development, particularly in the realm of FAU optical coupling equipment. With growing market demand for CPO technology, AllRing's FAU optical coupling equipment is anticipated to contribute significantly to the company's revenue in the first half of 2026, establishing its position in this niche market and poised for further market share expansion as CPO technology proliferates in data centers and beyond.

Other notable companies are also showcasing their strengths in the CPO domain:

- TSMC: Utilizes COUPE technology to integrate the optical and semiconductor markets, with CPO business expected to become a future growth driver despite its modest revenue contribution in 2026.

- MediaTek and Alchip: Incorporate CPO technology into ASIC design services, offering more competitive solutions.

- Landmark and VPEC: Concentrate on silicon photonic epitaxial wafers, supporting CPO solutions.

The synergistic efforts of these companies will collectively propel the advancement of CPO technology and market expansion.

Part 2

The Future Trajectory of CPO: Ecosystem Development and Regional Dynamics

The core strength of CPO technology lies in its ability to achieve deep integration of optical communication and chip packaging, providing robust support for AI and HPC applications.

Compared to traditional pluggable optical modules, CPO technology excels in increasing bandwidth density and reducing system power consumption. In large-scale data center computing scenarios, signal transmission loss and power consumption issues under traditional architectures increasingly become performance bottlenecks. By tightly coupling optical devices with chips, CPO technology enables higher data transmission rates in a smaller footprint while decreasing energy consumption in intermediate connection links, thereby enhancing the energy efficiency ratio of the entire data center and lowering operational costs.

The rapid evolution of the CPO market places heightened demands on the supply chain, encompassing optical packaging to the integration of silicon photonics platforms. Global supply chain coordination will significantly influence the adoption rate of CPO technology.

Challenges Facing CPO Industrialization:

- High Initial Costs: The packaging and testing of CPO chips are more expensive than traditional methods.

- Technical Integration Complexity: Combining optical modules with electrical chips necessitates cross-domain collaboration.

- Supply Chain Complexity: Major component suppliers are globally dispersed, with technological barriers posing additional challenges to supply chain management and the successful large-scale commercialization of CPO technology.

Ecosystem Development of CPO: Revolves around three key areas—advancements in silicon photonics (SiPh) technology, large-scale production of advanced packaging, and enhancements in standardization and compatibility.

- SiPh Technology: Leading companies like TSMC and AllRing invest in SiPh R&D, laying a solid technical foundation for CPO applications.

- Advanced Packaging: Firms such as ASE and FOCI accelerate the industrialization of CPO solutions through System-in-Package (SiP) and Hybrid Bonding technologies.

- Standardization and Compatibility: Establishing unified technical standards during CPO development is crucial, as it reduces development costs, enhances market acceptance, and promotes the widespread adoption of CPO technology globally.

Summary

The ascendancy of CPO technology is not merely driven by the necessity for data center network upgrades but also a natural progression in the evolution of AI and HPC ecosystems. The rapid growth of the CPO market will usher in unprecedented opportunities across domains such as optical packaging, silicon photonics, and advanced packaging.