AI Video in 2025: The "Price War" Commences – Which Large Model is Best Suited for "Boarding"?

![]() 01/24 2025

01/24 2025

![]() 549

549

By | Smart Relativism

After a ten-month hiatus, Sora has returned and retained its status as a "top streamer." Following its official launch, Sora elicited a strong response from global users, occasionally overwhelming the server, prompting OpenAI to intermittently halt new user registrations to maintain the stability of its generation speed.

Yet, amidst the hustle and bustle, the introduction of Sora signifies a crucial inflection point in the AI industry – OpenAI has finally placed the commercialization of AI-generated video models on the agenda.

Currently, mainstream AI-generated video platforms have successively implemented membership fee systems. So, for general users, which platform offers the most reasonable pricing? As 2024 draws to a close, let's delve into some leading AI-generated video platforms and discuss the future trajectory of AI video content.

The AI-generated video race has sparked a "price war"

As OpenAI's flagship product, Sora does not come cheap. While Sora is free for the general public, this "general public" primarily refers to ChatGPT Plus and Pro users.

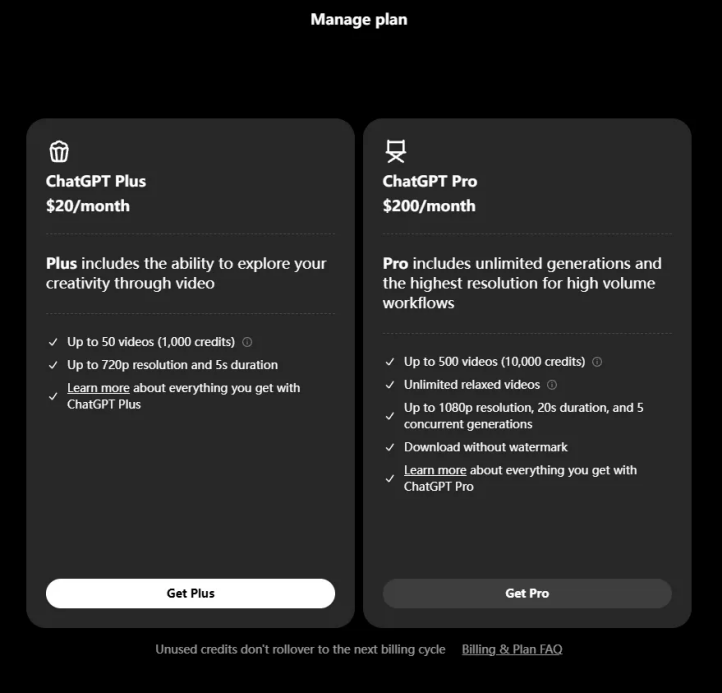

Plus users pay $20 per month (approximately RMB 145) and can generate up to 50 videos with a 480p resolution, each up to 5 seconds long. Pro users shell out $200 per month (approximately RMB 1452) and can create up to 500 videos with a resolution of up to 1080p, each up to 20 seconds long. Additionally, Pro users can download watermark-free videos and generate up to 5 videos simultaneously.

Although OpenAI offers a flexible point-based payment strategy, it is not cost-effective compared to Plus and Pro subscriptions. Currently, for an ordinary user to create a 5-second video using Sora, the cost ranges from approximately RMB 4 to 30. This cost escalates with complex operations such as remixing, re-editing, and storyboarding.

Foreign products tend to charge higher fees. Luma's Lite version costs $7.99 per month (approximately RMB 58.2) and does not even permit commercial use. The Standard version, which allows for commercial use of generated videos, costs $23.99 per month (approximately RMB 174.7).

In comparison, OpenAI appears somewhat more "conscientious." A more affordable option comes from domestic vendors, known in the industry as "price killers."

Kuaishou's Keling AI offers a Gold membership for only RMB 66 per month, supporting the generation of 66 high-performance videos. There is no functional difference between membership tiers, only a cost distribution. Higher tiers enjoy the same services but allow for the generation of more videos at a lower average cost. For a standard member, the cost of generating one video is approximately RMB 10, while for a higher-tier Platinum member, it is RMB 8.87, and so forth.

It's worth mentioning that Keling AI currently offers a limited-time discount, further driving down prices in the realm of large AI-generated video models. The first month of Gold membership is only RMB 19, and the second month's renewal fee is RMB 58, essentially undercutting the pricing standards of other large model vendors in the industry.

Also belonging to the domestic camp, ByteDance's Jimeng AI boasts relatively affordable prices. Currently, the most cost-effective option is the annual membership, with the Standard version costing only RMB 659, or an average of RMB 54.91 per month. There is no functional difference between membership tiers. To further reduce costs, Jimeng AI provides different members with discount vouchers for points consumption when generating videos during off-peak hours, offering a 50% discount for basic members, a 70% discount for standard members, and a 90% discount for premium members.

The courage to charge reflects that the product's maturity has been accepted by most market users. With domestic products like Keling AI and Jimeng AI consistently passing on benefits to users, sparking a "price war," it is evident that competition across the entire race has fully commenced, and monetization is bound to be a priority.

Have Keling AI and Jimeng AI turned a profit?

Amidst such a high-cost race and market expansion at affordable prices, have local large model vendors already achieved profitability under this model?

Currently, the commercialization process of Keling AI is very promising. During Kuaishou's third-quarter earnings call, Kuaishou Technology's founder and CEO Cheng Yixiao stated that Keling AI has served over 5 million users, generating 51 million videos and over 150 million images. Additionally, Keling AI's user retention has been improving monthly, achieving over 1.5 million monthly active users in September.

Most crucially, Cheng Yixiao specifically mentioned that as of now, Keling AI's commercialization has generated over RMB 10 million in monthly revenue, progressing in line with team expectations. Next, they will explore more diverse monetization models and are confident in achieving rapid growth in Keling's revenue scale next year.

It's worth noting that Keling AI only began gradually opening its membership payment system in domestic and international markets at the end of July. Perhaps, with such a development momentum, Keling AI may recreate a "Kuaishou" success story.

In fact, the commercialization of Keling AI is inseparable from the support of short video platforms. Originating from the prosperity of local short video content, a large number of content creators have swiftly latched onto the AI video race, utilizing platforms like Keling AI to create engaging and quirky short video content, which is then published on social media platforms such as Kuaishou, Douyin, Xiaohongshu, and WeChat Video Accounts, garnering favor from a vast user base and gradually establishing a relatively complete AI video content creation industry chain.

According to QuestMobile data, in June 2024, the monthly active user base of AIGC apps reached 61.7 million, a year-on-year increase of 653.3% (a net increase of 53.5 million). Meanwhile, some AI "magic modifications" and "meme" videos have even attracted the attention of the State Administration of Radio and Television. On the afternoon of December 8, the SARFT's Network Audio-Visual Department issued the "Management Tips (AI Magic Modifications)," pointing out that recently, AI "magic modification" videos have frequently been used to deceive and "magically modify" classics, requiring short video platforms to investigate and clean them up.

Regardless of whether it's good or bad, the myriad information suggests that the AI-generated video race is truly heating up. For large model vendors like Keling AI, holding both AIGC platforms and short video platforms undoubtedly places them at the forefront of the trend, and their commercialization process may be smoother than that of Sora.

Correspondingly, with ByteDance owning Douyin and Jimeng AI, its commercialization process for AI-generated videos should also be promising. Although Jimeng AI has not yet released specific data, its daily active user base has surpassed the 100,000 mark, giving it a first-mover advantage over Keling AI.

This implies that while many AIGC platforms are still "competing" on technology, domestic platforms like Keling AI and Jimeng AI have actually answered questions such as "What can AI videos do and how to make money," and are gradually building an increasingly robust content ecosystem in collaboration with third-party content creators.

This is commendable and will be the key to local AIGC platforms swiftly navigating the path to commercialization.

Final Thoughts

Interestingly, not long ago, Baidu's Robin Li explicitly stated: "The investment cycle for video generation like Sora is too long, and business revenue may not be achieved in 10 or even 20 years. Therefore, no matter how popular it is, Baidu will not pursue it."

In other words, even if the commercialization path for AI-generated videos is cleared, there is still a long way to go before it can ultimately cover costs and achieve profitability.

Market research firm Factorial Funds once calculated that the Sora model requires at least 4,200 to 10,500 NVIDIA H100 GPUs, and if it is to be applied on a large scale, an additional approximately 720,000 NVIDIA H100 GPUs will be needed. Consequently, in terms of GPU investment alone, the cost of Sora would exceed $20 billion.

This is a substantial figure. At this juncture, whether it's Sora, Keling AI, or Jimeng AI, their main rivals may not be each other. The market is still growing rapidly, and what they need to address most urgently is the issue of huge costs.

*All images in this article are sourced from the internet