AMD: Deepseek Intensifies Competition, ASIC Threatens GPU "Backup" Dream

![]() 02/06 2025

02/06 2025

![]() 649

649

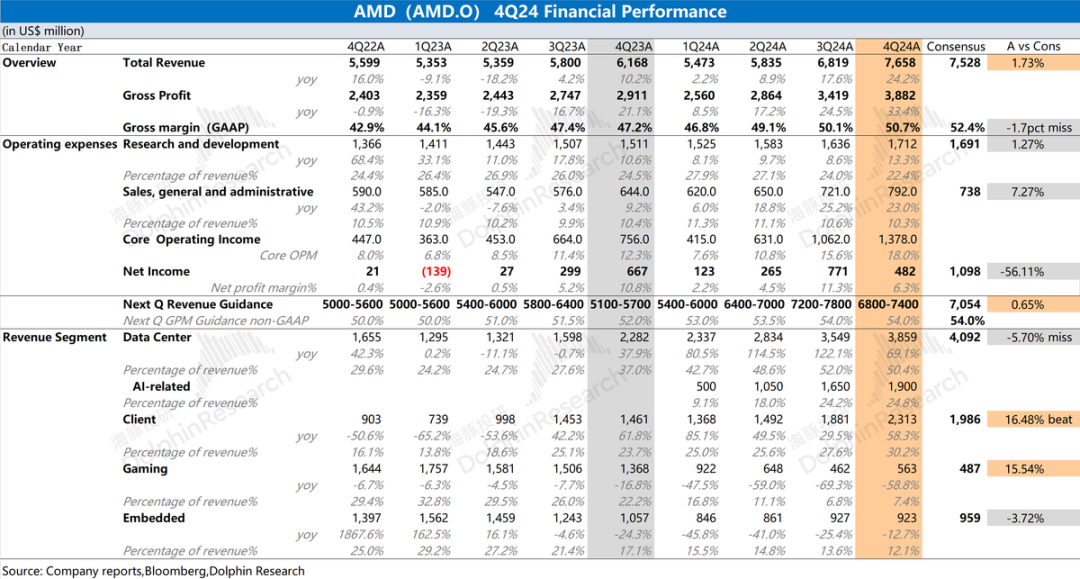

AMD (AMD.O) released its fourth-quarter 2024 financial report (as of December 2024) after the U.S. stock market closed on the morning of February 5, 2025, Beijing time. The key highlights are as follows:

1. Overall Performance: Core operating profit continues to rise. AMD achieved revenue of $7.658 billion in the fourth quarter of 2024, a year-on-year increase of 24.2%, in line with market expectations ($7.528 billion). Quarterly revenue growth was primarily driven by the client and data center businesses. AMD reported a net profit of $482 million for the fourth quarter of 2024, primarily impacted by acquisition costs and tax expenses. From an operational perspective, the company's operating net profit for the quarter was $1.378 billion, with the core operating profit margin increasing to 18%.

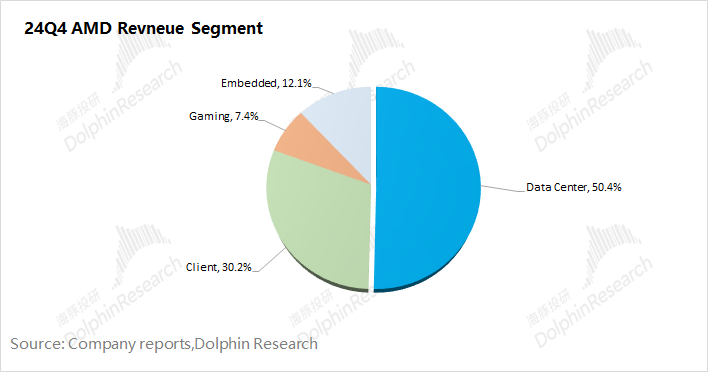

2. Business Segments: Client business captures market share, while data center shows underlying concerns. Driven by the growth of the data center and client businesses, the combined revenue of these two segments accounted for 80% of the total.

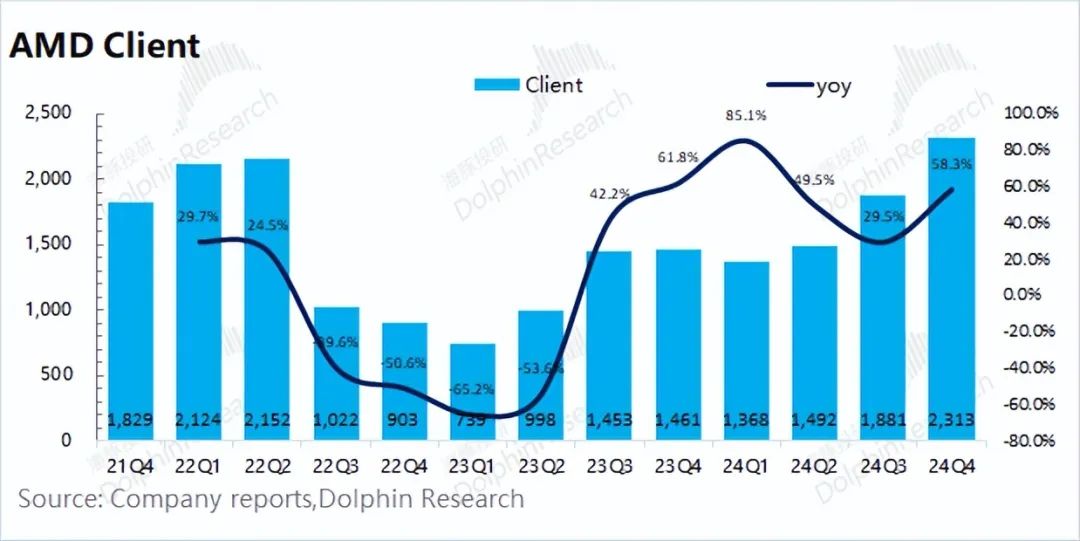

- Client Business: Quarterly revenue increased to $2.313 billion, a year-on-year increase of 58.3%. Amidst the slow recovery of the PC market, the company's client business achieved high growth, primarily due to an increase in AMD's market share in the PC market.

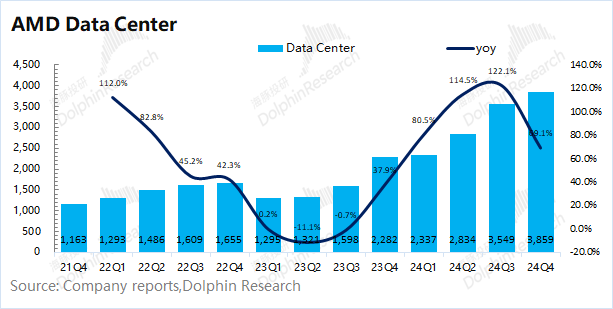

- Data Center Business: Quarterly revenue was $3.859 billion, a sequential increase of 8.7%. Growth in the data center business was primarily driven by an increase in shipments of related products (GPU and CPU), fueled by capital expenditures from core cloud vendors. However, the emergence of Deepseek and ASIC may both adversely impact the company's data center business.

3. AMD's Guidance: Expected revenue for the first quarter of 2025 is $6.8-$7.4 billion (market expectation is $7.05 billion), a sequential decline (3.4%-11.2%). The company expects a non-GAAP gross margin of around 54% (market expectation is 54%). These two core guidance figures are largely in line with market expectations.

Dolphin's Overview: AMD's financial report this time is not ideal.

The company's revenue grew as anticipated this quarter, primarily driven by the data center and client businesses. With a slight increase in gross margin and a decline in the expense ratio, the company's core operating profit continued to rise.

From a business segment perspective, the company's current core businesses are the data center and client segments:

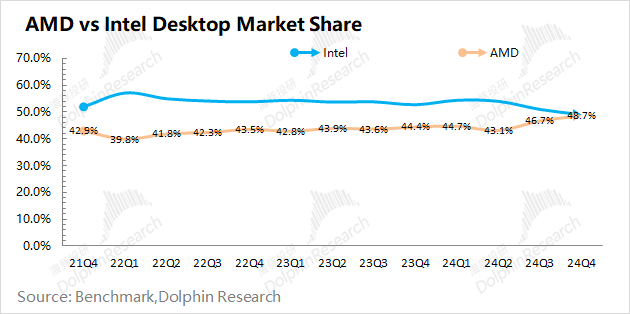

- Client Business: It was the main segment that exceeded expectations this quarter, primarily due to AMD's CPU gaining a higher market share in the PC market. Combining industry data, AMD's market share in the desktop market this quarter has caught up with Intel and shows a trend of further overtaking. Although the PC industry is currently in a slow recovery phase, AMD's market share in the PC market has been steadily increasing, which is expected to continue driving business growth.

- Data Center Business: This is the segment that the market pays the most attention to, but it fell short of expectations this quarter. In terms of quarterly sequential growth, the first two quarters saw increases of $500 million and $700 million, respectively, while this quarter only increased by $300 million, indicating a significant slowdown in growth. Additionally, considering the company's next quarter guidance, the data center business may even experience a decline in the upcoming quarter.

Considering the current market conditions, there are several bearish factors: ① The emergence of Deepseek may affect the capital expenditures of major cloud service providers; ② Custom ASIC chips may also erode the market share of computing power chips. Under this double impact, the company's next quarter guidance is also "lukewarm," with a certain sequential decline, which will amplify market concerns.

Furthermore, the company's acquisition of ZT Systems is expected to be completed in the first half of 2025, which will also have a dilutive effect on the company's performance. Overall, although the company is gradually gaining an advantage in the client business, the pressure on the data center business remains high. AMD itself is only the second choice for GPUs in the market. If overall capital expenditures decline or custom ASICs take off, it will directly impact the company's performance. If AMD cannot provide a robust response, it will only further lose market confidence.

Detailed Analysis:

I. Overall Performance: Core Operating Profit Continues to Rise

1.1 Revenue

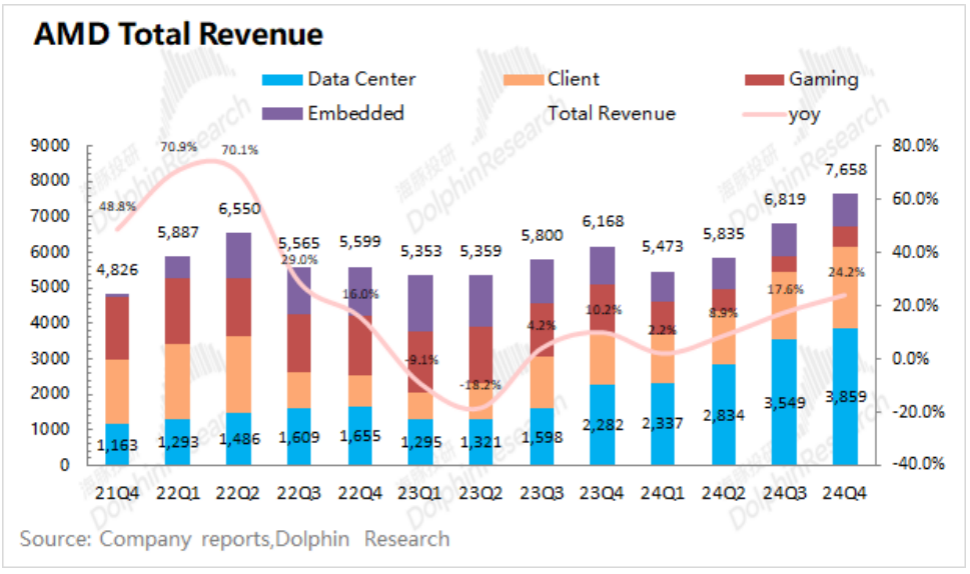

AMD achieved revenue of $7.658 billion in the fourth quarter of 2024, a year-on-year increase of 24.2%, in line with market expectations ($7.53 billion). Although the company's gaming and embedded businesses still declined this quarter, the growth of the data center and client businesses drove overall revenue growth.

1.2 Gross Margin

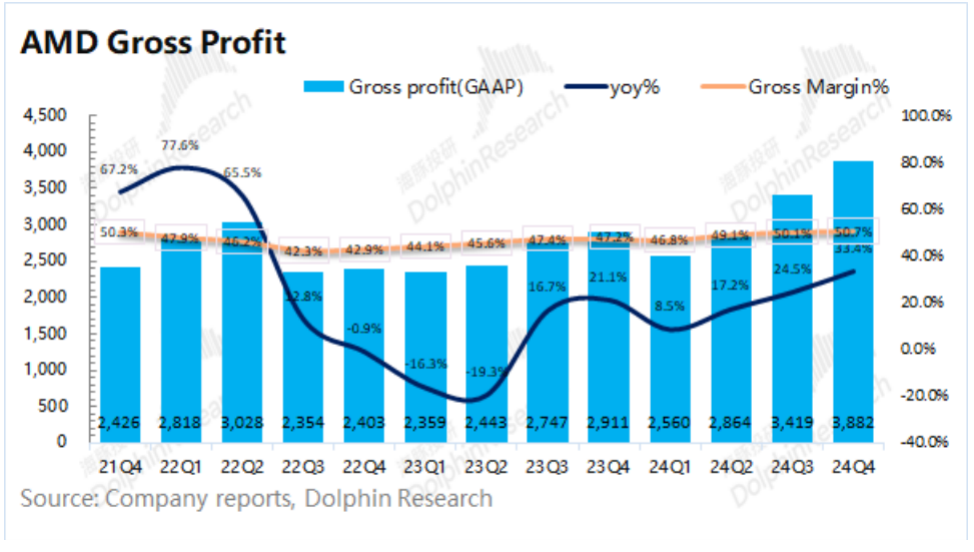

AMD achieved a gross profit of $3.882 billion in the fourth quarter of 2024, an increase of 33.4% year-on-year. The growth rate of gross profit exceeded that of revenue, primarily due to an increase in the gross margin.

AMD's gross margin for the quarter was 50.7%, a year-on-year increase of 3.5 percentage points, lower than market expectations (52.4%). The gross margin increased slightly quarter-on-quarter, primarily due to adjustments in the business structure. Currently, the company's data center and client businesses account for an increased proportion, thereby driving the recovery of the gross margin.

1.3 Operating Expenses

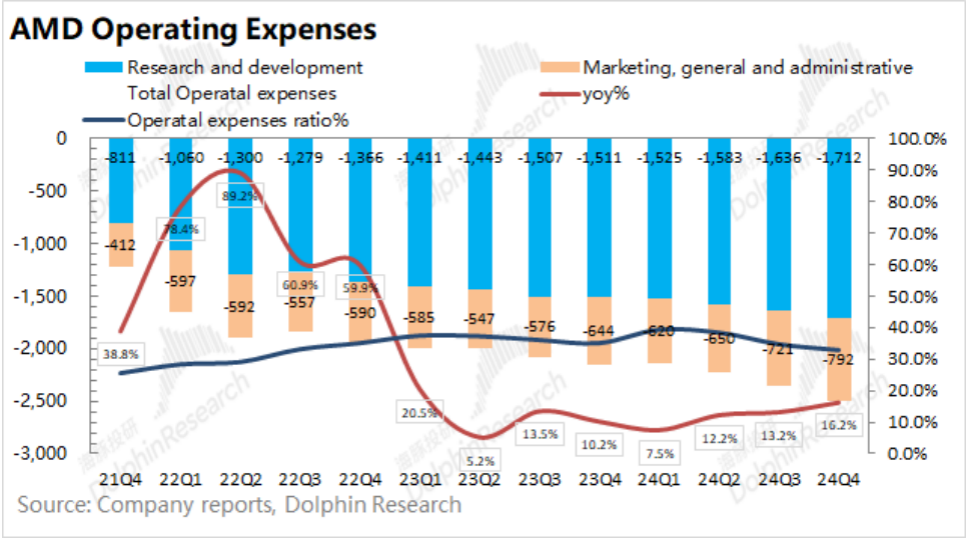

AMD's operating expenses for the fourth quarter of 2024 were $2.504 billion, a year-on-year increase of 16.2%. Operating expenses continued to increase quarter-on-quarter, but due to a lower growth rate than revenue, the operating expense ratio continued to decline. This quarter, the operating expense side also included $186 million in restructuring-related expenses.

Specifically, the expenses are broken down as follows:

- R&D Expenses: The company's R&D expenses for this quarter were $1.712 billion, a year-on-year increase of 13.3%. R&D expenses have been showing an increasing trend. As a technology company, AMD continues to prioritize R&D. At the same time, due to the increase in revenue, the company's R&D expense ratio for this quarter continued to fall to 22.4%, within a relatively reasonable range.

- Sales and Administrative Expenses: The company's sales and administrative expenses for this quarter were $792 million, a year-on-year increase of 23%. The expense situation on the sales side is highly correlated with revenue growth, and the growth rates of the two were relatively close this quarter.

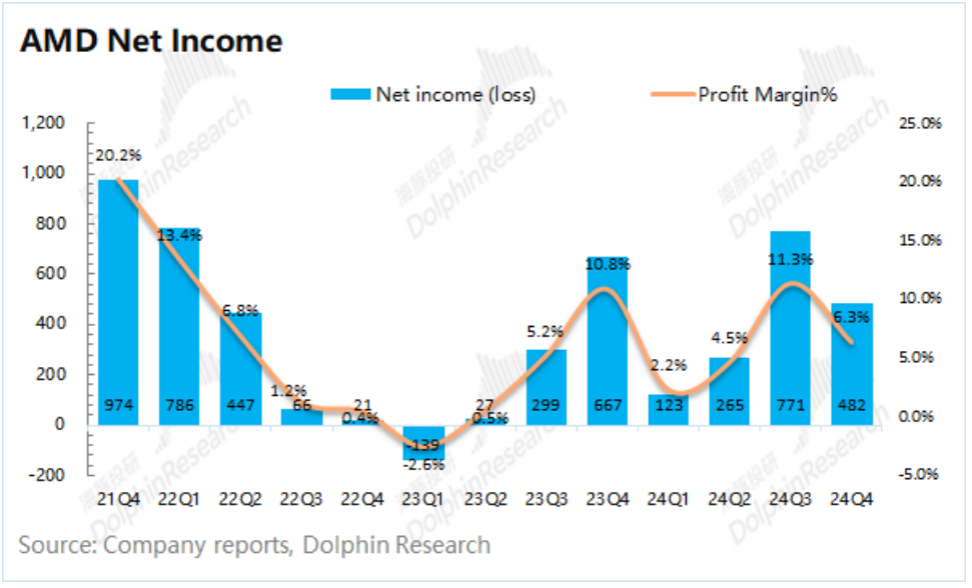

1.4 Net Profit

AMD achieved a net profit of $482 million in the fourth quarter of 2024, with a net profit margin of 6.3%, falling again.

Due to AMD's continued acquisition of Xilinx, which has generated significant deferred expenses, it will erode profits for some time to come. For the actual operational performance of this quarter, Dolphin believes that "core operating profit" is a more accurate indicator.

Core Operating Profit = Gross profit - Total core operating expenses

After excluding the impact of acquisition costs, Dolphin estimates that AMD's core operating profit for this quarter was $1.378 billion, a sequential increase of 29.8%.

The growth in the company's operational performance this quarter was primarily driven by the growth of the data center and client businesses. Additionally, the gross margin increased slightly, and the related core expense ratios declined, ultimately achieving continued growth in the company's operating profit.

II. Business Segments: Client Business Captures Market Share, Data Center Shows Underlying Concerns

From the perspective of the company's business segments, the data center and client businesses are AMD's current core businesses, accounting for 80% of the total. Among them, with the growth of AI demand, the proportion of the data center business has increased to 50%, playing a pivotal role in the company's performance.

2.1 Data Center Business

AMD's data center business achieved revenue of $3.859 billion in the fourth quarter of 2024, a year-on-year increase of 69.1%, lower than market expectations ($4.09 billion). This quarter's growth was driven by sales of AMD Instinct GPUs and fourth- and fifth-generation AMD EPYC CPUs.

The company's core CPU and GPU products: 1) Among cloud service providers, AMD EPYC processors have a market share of over 50%, and their adoption rate among enterprise customers has increased significantly; 2) AMD Instinct GPUs have been adopted by more than 12 cloud service providers globally, and this number is expected to continue to grow in 2025.

Regarding the progress of the MI series products that the market is concerned about:

- MI325x: Mass production began in the fourth quarter of 2024, and more customers are expected to adopt it in the first half of 2025.

- MI350 series: Originally planned to be launched in the second half of 2025, but due to excellent product performance and strong customer demand, mass production was advanced to the middle of 2025. The MI350 series is expected to bring significant performance improvements and market competitiveness.

- MI400 series: Under development, expected to be launched in 2026, and will support large-scale data center-level solutions.

Although AMD's MI350 product mass production was advanced, this positive factor is not enough to alleviate market concerns: ① The popularity of Deepseek may affect the capital expenditures of major cloud service providers; ② Some major players have begun to customize ASIC chips, creating competition in the GPU market. The former may affect the total market size, while the latter may affect the distribution of market share. However, the company's financial report this time did not provide a very strong response, which may further erode market confidence.

2.2 Client Business

AMD's client business achieved revenue of $2.313 billion in the fourth quarter of 2024, a year-on-year increase of 58.3%, significantly better than market expectations ($1.986 billion). The growth in the client business was primarily due to increased sales of the fifth-generation Ryzen CPUs.

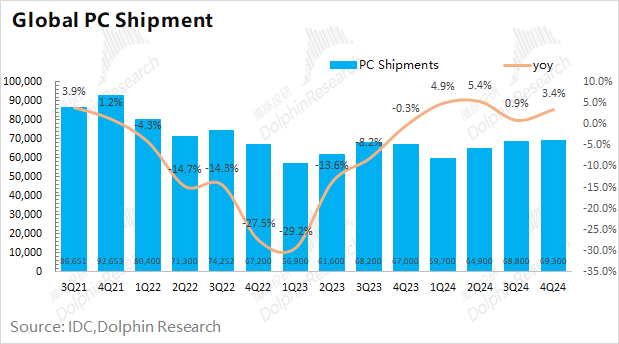

Combining industry data, global PC shipments in the fourth quarter of 2024 were 69.3 million units, a year-on-year increase of 3.4%. At the same time, AMD's client business achieved a year-on-year growth rate of nearly 58.3%. In comparison, Intel's client business declined by 9.4% year-on-year. Amidst the slight growth of the overall market, Dolphin believes that AMD achieved a larger market share in the PC market this quarter.

AMD's market share in both the desktop and notebook markets is increasing. Although Intel is still leading in the notebook market, AMD's market share in the desktop market has caught up with Intel this quarter and is expected to further achieve overtaking.

The company expects the PC market to grow by about 5% year-on-year in 2025, and AMD is expected to increase its share and achieve excess growth performance based on its product capabilities.

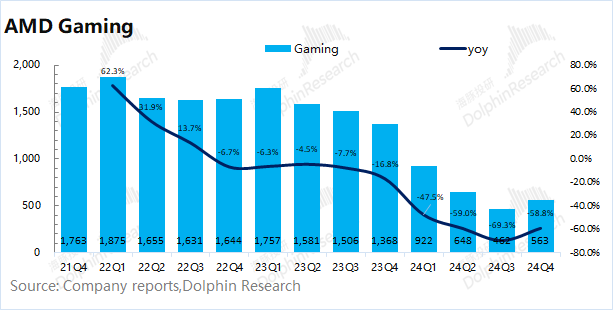

2.3 Gaming Business

AMD's gaming business achieved revenue of $563 million in the fourth quarter of 2024, a year-on-year decline of 58.3%, better than market expectations ($487 million). Semi-custom sales declined due to Microsoft and Sony reducing channel inventories, and are expected to return to normal in 2025. The gaming graphics card business is accelerating inventory clearance for the launch of the next-generation product, and RDNA 4 architecture products will improve performance.

The sequential recovery of the company's gaming business this quarter was primarily driven by Sony's launch of the PlayStation 5 Pro, for which AMD provides semi-custom SoCs. However, the gaming graphics card business is still in the inventory clearance stage, with no significant improvement.

2.4 Embedded Business

AMD's embedded business achieved revenue of $923 million in the fourth quarter of 2024, a year-on-year decline of 12.7%, slightly lower than market expectations ($959 million). The company's embedded business is primarily based on the previously acquired Xilinx, and overall demand in the terminal market remains sluggish. However, the company has expanded its adaptive computing product portfolio, supporting the revenue performance of the embedded business.

produce, copy, replicate, reproduce, forward, or create any form of copies or reproductions in any manner, and/or (ii) directly or indirectly redistribute or transfer the report to other unauthorized persons. Dolphin Investment Research reserves all relevant rights.</p></div>

<!-- <p><span style=)