Who Will Dominate the Second Half of High-Level Intelligent Driving?

![]() 02/06 2025

02/06 2025

![]() 651

651

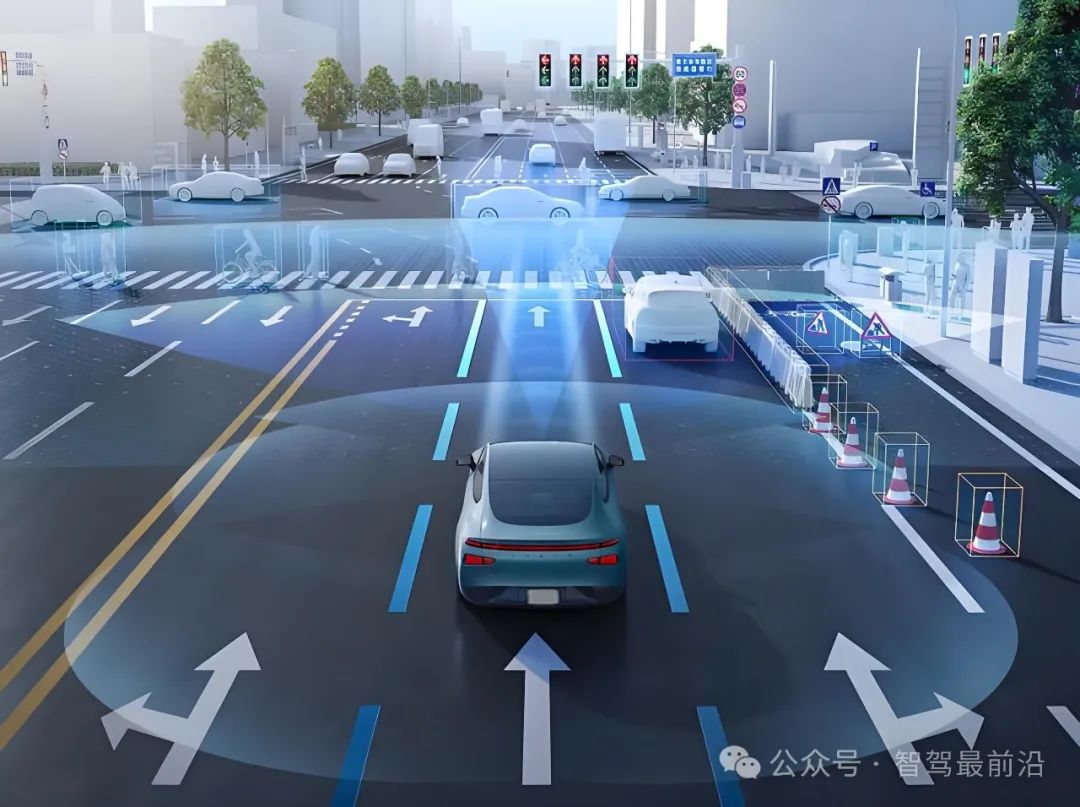

As we enter 2025, the autonomous driving industry has transitioned into its second phase. The frontier of innovation, represented by high-level intelligent driving technology, is gradually supplanting advanced driver assistance systems, becoming the pivotal battleground for automakers. From Tesla's FSD-embodied end-to-end large model to locally developed solutions spearheaded by brands like Huawei and Xpeng, global automakers are redefining the technical standards and business models of intelligent driving.

The evolution of intelligent driving technology is intertwined not only with technological advancements and breakthroughs but also with profound shifts in the overall market landscape. The debate between modular and end-to-end architectures directly mirrors companies' strategic choices in the realm of intelligent driving. Domestic and foreign automakers are placing bets on intelligent solutions, aiming to enhance user experience through technological upgrades and compete for high-end market share. Additionally, regulations, road infrastructure development, and consumer acceptance of intelligent products are significantly influencing the progression of high-level intelligent driving.

Amidst this complex backdrop, the practical implementation of high-level intelligent driving technology faces numerous challenges. From a technological perspective, how to address the safety and reliability concerns of autonomous driving? Industrially, how to achieve collaborative optimization at the hardware and software levels? Commercially, how to maximize technology's value through commercialization? These issues are crucial in determining the future success or failure of high-level intelligent driving.

Debate on Technical Paths for High-Level Intelligent Driving

In the race for high-level intelligent driving, the choice of technical path has undoubtedly emerged as one of the core issues for automakers. This field primarily revolves around two technical concepts: "heavy perception, light map" and "light perception, heavy map." While both aim to achieve efficient, safe, and stable autonomous driving, their technical implementations and focuses differ vastly, reflecting profound disparities in automakers' technical strategies and resource allocations.

The "heavy perception, light map" approach advocates maximizing reliance on the vehicle's sensor system to achieve real-time environmental understanding and decision-making through deep perception and calculation. This approach minimizes reliance on high-precision maps, emphasizing real-time data from sensors (such as lidar, cameras, and millimeter-wave radars) and utilizing robust computing capabilities for real-time modeling and path planning of the vehicle's surroundings. Tesla's pure vision solution, which relies on powerful visual processing algorithms and self-developed chips to recognize the environment solely through cameras, is a quintessential example of this path. Its advantage lies in reducing the cost of creating and maintaining high-precision maps, enhancing the technology's scalability and adaptability. However, it may struggle with complex edge scenarios like severe weather and changing light conditions, posing challenges to system reliability.

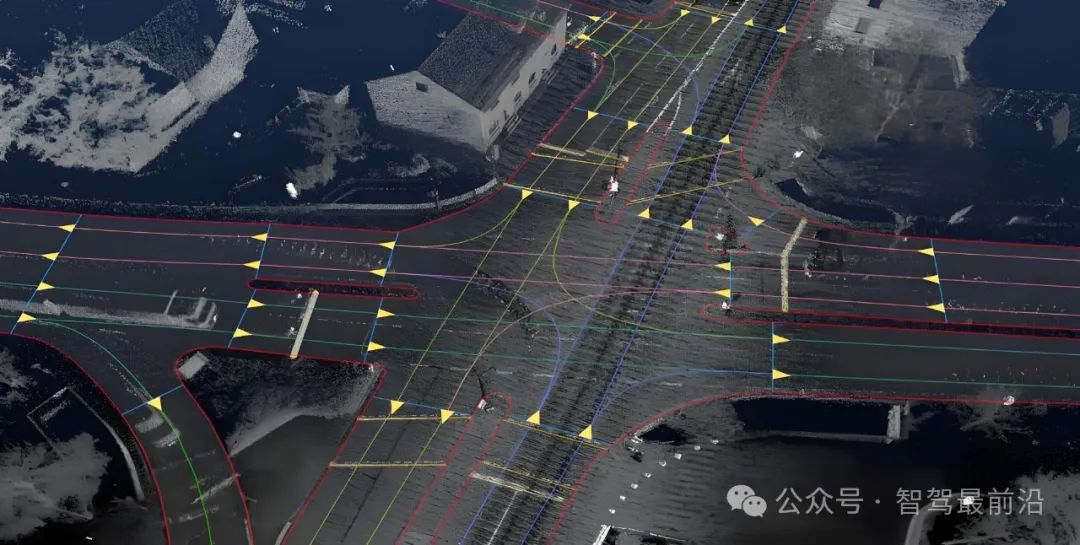

Conversely, the "light perception, heavy map" approach relies more heavily on high-precision maps and positioning technology. In this scheme, vehicles preload detailed high-precision maps and complete positioning and path planning by comparing map information with the actual environment through sensors. This path emphasizes mastery of global information, with its core being the precise restoration of the road environment through ultra-high-resolution maps combined with real-time sensor data to optimize decisions. Some domestic automakers adopt a multi-sensor fusion solution that integrates high-precision maps with lidar, achieving precise environmental perception and vehicle control under complex road conditions. This model excels in safety and stability in scenarios with minimal dynamic changes, particularly suitable for urban arterial roads and highways. However, updating and maintaining high-precision maps require significant human and financial resources and may lead to decision-making delays in scenarios with significant dynamic changes.

Besides the debate between perception and maps, the choice between end-to-end and modular architectures is also a crucial aspect of the technical path debate. The end-to-end architecture attempts to integrate perception, decision-making, planning, and control into a cohesive whole through a unified neural network model, directly outputting driving instructions. This architecture theoretically achieves more efficient computational performance while reducing system integration complexity. Automakers like Tesla continuously optimize the driving experience through end-to-end large model technology. However, the black-box nature of the end-to-end architecture raises doubts, particularly in extreme scenarios where interpretability and controllability of system behavior remain critical issues.

In contrast, the modular architecture divides functions such as perception, decision-making, planning, and control into multiple independent modules, each optimizable separately. This architecture boasts higher system transparency and controllability, especially in complex scenarios where the modular design facilitates problem localization and system optimization. However, it may incur performance losses in data interaction and system integration, accompanied by higher hardware resource requirements.

The debate on technical paths underscores the different trade-offs enterprises make regarding market strategies and technical resources. Automakers opting for "heavy perception, light map" often aim for rapid scaling by minimizing infrastructure dependence, while "light perception, heavy map" focuses more on technology's safety and reliability, aiming to win market trust through robust solutions. Similarly, proponents of the end-to-end architecture hope to simplify the development process and enhance user experience through AI and computing power advancements, whereas modular architecture adherents lean towards traditional engineering thinking, emphasizing technology's interpretability and adaptability.

With continuous technological advancements, these paths are not mutually exclusive but may gradually converge, with high-level intelligent driving's technical paths potentially exhibiting more diversified trends. Companies' technical choices will increasingly prioritize user needs, coupled with dynamic adjustments based on the policy environment and market demand.

Analysis of Technical Routes for Domestic and Foreign Automakers

In the realm of high-level intelligent driving, domestic and foreign automakers exhibit diverse and differentiated characteristics in their technical route choices. This diversity stems from companies' comprehensive considerations of market demand, policy environment, technical reserves, and R&D capabilities. Foreign automakers, renowned for their rigorous technology, typically emphasize stability and reliability as the core of their technical routes. In contrast, domestic automakers prioritize rapid market response, gradually exploring autonomous innovation in hybrid paths, and emphasizing the efficient implementation of technical solutions.

Foreign automakers, known for their rigorous technology, often emphasize stability and reliability in their technical routes. German automakers BMW and Mercedes-Benz adopt a multi-sensor fusion plus high-precision map solution, constructing a robust perception system through various sensors like lidar, millimeter-wave radars, cameras, and ultrasonic radars. This solution's core lies in using high-precision maps to provide global environmental information, combined with real-time sensor data for precise vehicle positioning and path planning. This technical path emphasizes redundant design, ensuring multiple safety guarantees at the perception and decision-making levels to maintain system stability even in extreme conditions. Mercedes-Benz's Drive Pilot system, relying on sensor and high-precision map synergy, enables highly automated driving on urban roads and highways, aiming for a "zero accident" vision. However, this technical route has obvious limitations, as high-precision maps are costly to produce and update, and reliance on map data may lead to system response delays in dynamically changing environments.

Tesla, a global leader in intelligent driving, takes a markedly different approach in its technical route. Tesla has chosen the "pure vision + end-to-end algorithm" path, emphasizing minimizing external data dependence and maximizing the vehicle's ability to perceive its environment and make real-time decisions through its sensors. Tesla's FSD (Full Self-Driving) system relies solely on cameras and self-developed chips throughout the vehicle, processing environmental information through end-to-end deep learning algorithms to generate driving decisions. This solution reduces reliance on high-precision maps and lidar, enabling vehicles to adapt more flexibly to dynamic environmental changes while significantly lowering technical implementation costs. Its advantage lies in strong scalability, especially in global markets, where it can quickly adapt to road conditions in different countries and regions without map dependence. However, Tesla's solution has faced controversy, particularly in extreme weather or poor lighting conditions, where sole visual perception may lead to insufficient perception, thereby affecting driving safety.

Conversely, domestic automakers place greater emphasis on flexibility and practicality in their technical routes, gradually forming a comprehensive "multi-sensor fusion + dynamic map" solution. Represented by companies like Xpeng, NIO, and Huawei, they have built robust high-level intelligent driving systems by integrating perception hardware like lidar, millimeter-wave radars, and high-resolution cameras, along with real-time dynamic map update technology. Xpeng's XNGP system achieves high-precision perception and decision-making for complex urban traffic scenarios through lidar and vision integration. NIO's NOP (Navigate on Pilot) further enhances real-time road information processing, enabling smooth transitions between highways and urban roads.

As an autonomous driving solution provider, Huawei's exploration in intelligent driving technology presents a unique perspective. Leveraging its strong ICT technology background, Huawei proposes the "heavy perception, light map" concept while emphasizing a "computing power first" technical strategy. In its ADS (Advanced Driving System) solution, Huawei leverages a high-performance computing platform and intelligent sensor cluster for deep analysis of complex driving scenarios, relying on dynamic map technology to compensate for high-precision maps' real-time performance limitations. This technical route's core lies in minimizing static map data dependence through powerful computing power and real-time perception capabilities, adapting to China's complex and diverse road scenarios and meeting the rapid iteration demands of the Chinese intelligent driving market.

In choosing technical architectures, domestic and foreign automakers also differ. Foreign automakers predominantly adopt a modular architecture, separating functions like perception, decision-making, planning, and control, and enhancing system stability through independent module optimization. In contrast, domestic automakers lean towards an end-to-end unified architecture, attempting to directly output driving instructions through AI algorithms, improving system development efficiency and response speed. The rapid development and fierce competition in the domestic market have prompted automakers to prioritize the cost-performance balance in their technical route choices, while foreign automakers, due to their brand history and market positioning, tend to choose mature and robust solutions to ensure user experience.

Industry Trends and Competitive Outlook

Technological development in high-level intelligent driving is undergoing rapid iteration, with global industry trends and competitive landscapes continuously evolving. With advancements in artificial intelligence, cloud computing, and high-performance sensors, the industry is transitioning from functional products to systemic solutions, and market competition is gradually shifting from pure technological rivalry to a contest of comprehensive capabilities. This trend suggests that the future of high-level intelligent driving is not solely about technological upgrades but also about ecosystem improvement and deepened industry cooperation.

From a technological standpoint, the advancement in perception and computing capabilities serves as the pivotal driver for the evolution of high-level intelligent driving. Historically, perception systems have been reliant on the singular functionality of lidar, millimeter-wave radars, and cameras. However, current technological advancements are catalyzing the proliferation of multi-sensor fusion, which not only amplifies the precision of perception but also bolsters adaptability to intricate scenarios.

The surge in computing power has similarly breathed new life into high-level intelligent driving. The development of high-performance computing chips is fortifying real-time data processing capabilities, while deep learning algorithms grounded in artificial intelligence empower the system to autonomously learn and refine driving strategies, particularly excelling in path planning and decision-making control. This trend underscores the industry's shift towards "hardware-software integration" in high-level intelligent driving systems, where technological synergy further elevates product performance.

In the global competitive arena, domestic and international enterprises are engaged in a race along distinct technical trajectories. Pioneers like Tesla and Google Waymo have established a lead in end-to-end algorithms, data accumulation, and the autonomous driving software and hardware ecosystem. Waymo, with its profound expertise in lidar and high-precision map technology, has achieved commercial Robotaxi operations, setting benchmarks for system reliability and safety within the industry.

Domestic enterprises are steadily closing the gap through robust engineering capabilities and swift market responsiveness. Chinese automakers, exemplified by Huawei, Xpeng, and NIO, have devised a range of cost-effective intelligent driving solutions, leveraging their profound understanding of the local market. Especially in urban settings and complex scenarios, domestic automakers are progressively achieving technology localization and implementation through integrated perception, lightweight algorithms, and efficient computing resource management. This competitive dynamic not only highlights the technical path differences between China and foreign countries but also enriches global intelligent driving technology development options.

Shifts in market demand are profoundly steering the industry's trajectory. As consumer appetite for intelligent driving experiences grows, automakers are transitioning from "experiential" to "practical" technology. The widespread adoption of L2-level intelligent assisted driving functions has significantly altered driving habits, while high-level intelligent driving functions at L3 and beyond have further inflated users' technological innovation expectations. To meet these demands, automakers are accelerating the development of multi-scenario solutions. The realization of these functions hinges on the seamless integration of perception, decision-making, and execution systems, necessitating the integration of cloud data services for dynamic updates. Thus, the diversification of consumer demand is driving the refinement of technological systems and accelerating industry iteration.

As the implementation of high-level intelligent driving accelerates, industry competition extends beyond singular technological breakthroughs to encompass ecosystem creation and industrial chain collaboration. Traditional automakers and technology companies are actively collaborating to harmonize technological standards and enhance ecological systems.

Conclusion

The progression of high-level intelligent driving technology signifies a monumental leap for the automotive industry, transitioning from traditional manufacturing to intelligence and digital transformation. Continuous advancements in this field not only uphold the mantle of technological innovation but also bear the social responsibility of reshaping future mobility. From the divergence and rivalry of technical paths to the strategic maneuvers of global automakers, and the interplay between market demand and policy support, high-level intelligent driving technology is advancing at an impressive pace, inexorably edging towards commercialization.

In this exploration of technology, markets, and societal futures, opportunities vastly outweigh challenges. High-level intelligent driving is not merely a technological revolution in the automotive sector but a critical compass guiding the evolution of future transportation. This will be a transformative wave with far-reaching implications for both industry stakeholders and everyday consumers.

-- END --