Comprehensive Analysis of the Unmanned Delivery Vehicle Industry Chain

![]() 04/22 2025

04/22 2025

![]() 606

606

The unmanned delivery vehicle industry chain is a sophisticated, multi-faceted network, driven by technological advancements, cost management, scenario adaptability, and policy guidance. Below, we delve into the chain, segmented into upstream, midstream, and downstream components, and explore the intricate logical relationships within it.

Upstream: Core Technologies and Components

The upstream sector lays the technical foundation for the entire industry chain, shaping the performance and cost of unmanned delivery vehicles. Innovations in upstream technologies lead to enhanced performance and reduced costs. Key advancements include:

1. Perception Layer: Sensors and Navigation

(1) Sensors: LiDAR (core for positioning and obstacle avoidance), cameras (for visual recognition), and millimeter-wave radars (for all-weather perception) form an environmental perception network. The LiDAR market is booming, with YOLI Industry Research Institute predicting a global market size of around 43.18 billion yuan by 2026. Key players include Hesai and Robosense.

Unmanned delivery vehicles often sport 4-8 industrial cameras for a 360° field of view, utilizing deep learning algorithms to detect pedestrians, vehicles, and traffic signs, adapting to varying lighting conditions.

Ultrasonic sensors, installed at the front/rear and sides, offer low-speed, short-distance obstacle detection and parking assistance, with strong anti-interference capabilities and low costs.

(2) High-Precision Positioning and Mapping: Relying on Beidou/GPS and SLAM technology, there is a growing demand for lightweight high-precision maps to cut deployment costs. Well-known map service providers include Gaode and Baidu, while inertial navigation system suppliers, known for their discretion, provide centimeter-level positioning for unmanned vehicles.

2. Computing Platforms and Chips

(1) Automotive-Grade Computing Platforms: Supplied by NVIDIA Drive, Mobileye EyeQ, Cambricon, and Horizon Robotics, these platforms support real-time computation for perception and decision-making algorithms.

(2) AI Chips: Handling data processing and decision-making, GPUs currently dominate, but NPUs and ASICs are gaining ground due to their high energy efficiency. According to ZhiKe Book Club's research, the AI chip market is projected to reach 153 billion yuan by 2025, bolstering the operation of complex algorithms.

(3) Communication and V2X Modules: Encompassing in-vehicle cellular communication (2G/3G/4G/5G) modules, CV2X dedicated modules, and supporting hardware, software, and services, major vendors include Quectel, Fibocom, SIMCom, Qualcomm, and Autotalks, with products supporting LTE/5G, LTEM, NBIoT, CV2X, and other protocols.

Operators (China Mobile, China Unicom, China Telecom) provide dedicated V2X networks and IoT data packages for stable connections, complemented by remote OTA upgrades, edge computing, and cloud platforms for vehicle status monitoring, scheduling, and data analysis.

3. Chassis, Batteries, and Actuators

(1) By-Wire Chassis and Power System: The by-wire chassis is pivotal for vehicle motion control, with redundant design enhancing safety. Battery technology (e.g., lithium iron phosphate) balances range and cost, with automotive-grade standards becoming the norm.

(2) Power Batteries and Motors: Dominated by CATL and BYD, motors and electronic controls are supplied by leading domestic electric drive manufacturers.

4. Autonomous Driving Algorithms and Software

Autonomous driving technology leverages deep learning and large autonomous driving models (e.g., DriveGPT) to enhance adaptability in complex scenarios. The data closed loop (collection-training-iteration) presents a technological hurdle, while the amortization of R&D expenses impacts overall vehicle cost.

Midstream: Solutions and Equipment Manufacturing

The midstream sector focuses on the integration and mass production of unmanned delivery vehicles, balancing performance and cost. Key challenges include scaling and scenario adaptability, with technology route choices (e.g., number of LiDARs, reliance on high-precision maps) influencing commercialization speed.

1. Vehicle Design and Manufacturing

Adopting modular design, vehicles can be customized with cargo boxes, sensors, and endurance to suit various scenarios like express delivery, supermarkets, and parks. Hardware costs are reduced through supply chain integration (e.g., reusing passenger car supply chains) and minimizing LiDAR usage.

Traditional automakers like Dongfeng, Great Wall, and SAIC-GM-Wuling have modified unmanned delivery solutions on their commercial vehicle platforms. Startups such as Zhenji Intelligence, Pudu Robotics, Neolith, and White Rhino specialize in designing and mass-producing small delivery vehicles.

2. System Integration and O&M

Cloud Scheduling and OTA Upgrades: Real-time vehicle status monitoring, path optimization, and remote maintenance reduce operational costs.

Safety Redundancy Mechanisms: Multi-sensor fusion, emergency braking systems, and collision warnings ensure the reliability of unmanned operations.

Specifications of unmanned delivery vehicles from Neolith, JD.com, Meituan, and Baidu Apollo. Source: Neolith official website, KuaiKeJi, Meituan official website, Apollo official website

Downstream: Application Scenarios and Demand Drivers

Downstream demand shapes the path to commercialization, hinging on scenario adaptability and policy dividends. Scenario complexity dictates technological requirements (e.g., seamless indoor-outdoor switching for community delivery), while policy dividends (e.g., open road rights) and costs influence commercialization pace.

1. Main Application Scenarios

Unmanned delivery vehicles are crucial for solving the "last mile" logistics problem, replacing short-distance transportation from distribution points to depots in traditional express delivery and e-commerce, freeing up human resources for endpoint deliveries. They are commonly seen in residential areas and around office buildings. In scenarios like supermarket restocking and food delivery, with high delivery frequencies and small loads, unmanned vehicles efficiently cover 3-kilometer living circles, significantly improving delivery timeliness. Standardized environments like enclosed parks and ports, with fixed routes and easy management, receive priority policy support, offering ideal commercialization spaces for unmanned vehicles.

2. Policy and Standard Drivers

The unmanned delivery vehicle standard system is gradually improving, providing institutional support for industry growth. Internationally, the IEC has issued the IEC63281-3-2 standard for testing components and complete vehicles. Domestically, institutions like the Beijing Municipal Science and Technology Commission lead standard formulation, with cities like Beijing, Shanghai, and Shenzhen issuing road management rules and testing road plans, promoting legal open-road operations. Additionally, standards like "Technical Specifications for Unmanned Delivery Vehicle By-Wire Chassis" and "Technical Requirements for Autonomous Driving Systems" facilitate systematic standardization, accelerating technology implementation and large-scale application.

3. Market Demand Growth

With the express delivery business volume growing at an average annual rate exceeding 20%, couriers in first-tier cities earn around 7,000 yuan per month, and labor costs continue to rise, driving rapid automation in terminal logistics. According to Zhiyan Consulting, China's unmanned delivery market will reach 17 billion yuan by 2025.

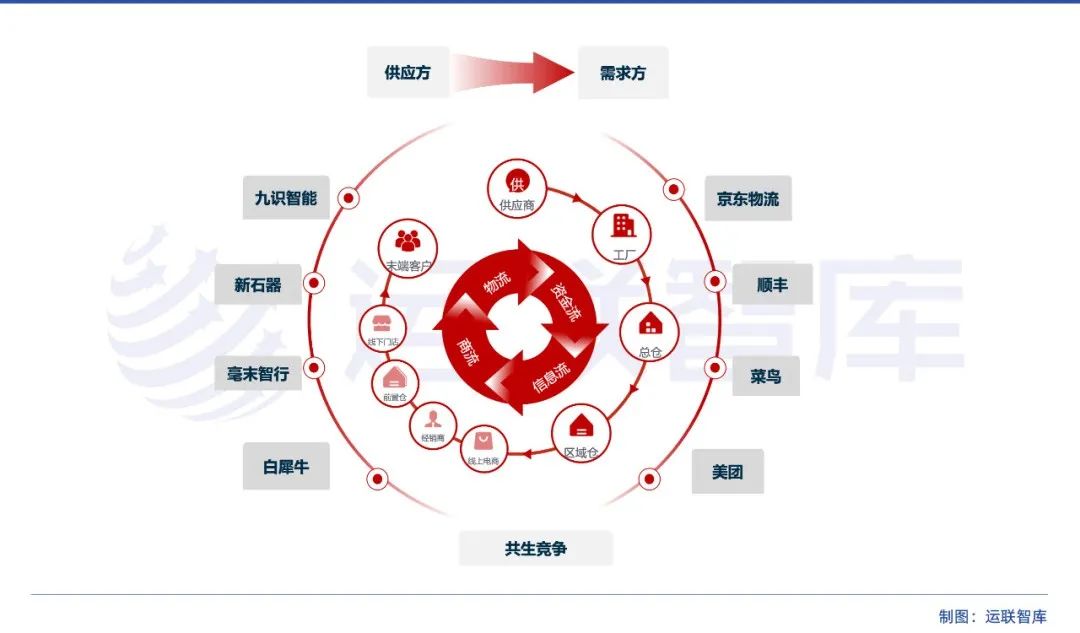

Industry Chain Synergy and Future Trends

Unmanned delivery vehicle development faces technical, industrial, and social challenges and breakthroughs.

At the technical level, recognition of dynamic obstacles in complex road conditions and adaptation to extreme weather need improvement, with biomimetic designs like stair-climbing robots expanding application boundaries.

At the industrial level, mass production of core components like LiDAR has significantly reduced overall vehicle costs, fostering a 5S service system integrating transportation capacity, vehicles, and system tools, driving a closed-loop ecosystem.

At the social level, unmanned vehicles can replace some transportation links short-term but also create new positions like dispatchers and O&M personnel; long-term, they may reshape the logistics industry's human resource structure, shifting from physical labor to high value-added services.

Implementation Progress Hinges on Single-Vehicle Costs

In the unmanned delivery market, express terminal outlets have significant influence, with varying application expectations. This prompts most unmanned delivery companies to prefer "selling vehicles" or offering autonomous driving software service fees over direct logistics operation.

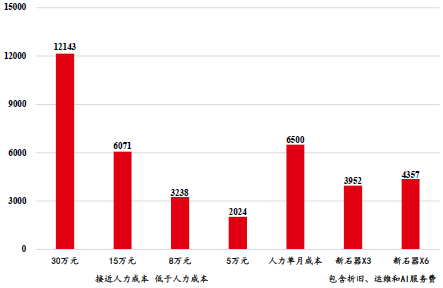

Thus, single-vehicle cost is crucial: high prices or quality issues hinder operational profitability. Thanks to autonomous driving advancements, unmanned delivery vehicle unit costs approach human-driven vehicle economic thresholds.

Autonomous driving technology impacts cost structure in two ways: higher vehicle intelligence boosts urban delivery efficiency, increasing revenue; and stronger performance ensures vehicle stability and reduced human intervention, lowering backend O&M and monitoring costs.

Whether in open urban roads or enclosed scenarios like ports and mining areas, core competitiveness lies in continuous, stable, and intensive unmanned operation, coupled with excellent hardware durability and cost-effectiveness.

Calculation of Unmanned Delivery Vehicle Total Lifecycle Software and Hardware Costs (in ten thousand yuan). Source: Euromonitor International, Neolith official website, Jiushi Intelligence official website

Pricing models for unmanned delivery vehicles vary, often including one-time purchase or monthly/annual rental. Many companies enter the market with low vehicle prices, achieving profitability through subsequent autonomous driving system service fees, lowering initial investment thresholds.

Technological advancements must prioritize safety. L4 autonomous driving systems must withstand complex open-road scenarios, ensuring stability during long-term, high-frequency operations. The industry has extensive experience in autonomous driving safety, with rare active collision accidents.

From an application perspective, the unmanned delivery market is in its nascent stage. In urban logistics alone, there are over ten million light commercial trucks with low market penetration. Early entrants were mainly technology enterprises and express delivery franchisees; recently, express delivery giants have incorporated unmanned vehicles into their processes.

However, this transition is not merely a straightforward replacement but necessitates a multifaceted, deep integration encompassing scenario-specific process reengineering, technological adaptation, and system integration. This places heightened demands on the seamless collaboration between upstream and downstream entities within the industry chain. Presently, several enterprises have garnered a solid reputation among users, prompting many customers to initiate repurchases.

Comprehensive Monthly Costs of Unmanned Delivery Vehicles (Source: Euromonitor International, Neolith official website)

Conclusion

The evolution of the unmanned delivery vehicle industry chain adheres to the pivotal logic of "technological cost reduction – scenario adaptation – policy enablement – demand explosion," catalyzing the shift from pilot projects to large-scale commercial deployment. Currently, autonomous driving technology is progressively maturing, and international and domestic standard systems are taking shape, furnishing a unified framework for industry access and testing.

Within the industry chain, the four pivotal components—hardware components, algorithm platforms, vehicle integration, and operation services—are increasingly synergistic. Externally, they are jointly propelled by standards and policy directives, cloud platform empowerment, and capital market impetus.

As costs continue to decline and application scenarios broaden, driverless delivery vehicles are poised to become a cornerstone of the smart logistics system within the next 3-5 years, underpinning the intelligent transformation of city- and park-level terminal delivery networks.