Can LeTV Innovation Break Out of the AI Glasses Competition: From Technological Layout to Ecosystem Construction

![]() 02/14 2025

02/14 2025

![]() 531

531

2025 is widely acknowledged as the "Year One" of AI smart glasses. As tech giants enter the fray, a fierce "hundred-glasses war" spanning technology, capital, and ecosystem development has commenced.

Domestic players like LeTV, Xiaomi, Huawei, and ByteDance are rising in tandem, while international giants Meta and Snap are even more aggressive.

However, the current AR market is nascent, with challenges like an immature industrial chain and a lack of a robust content ecosystem confronting manufacturers. Technology, capital, and ecosystem development are paramount for the growth of the AI glasses industry.

In this context, LeTV Innovation has embarked on an exclusive strategic partnership with Alibaba Cloud and in-depth offline channel cooperation with Boshi Optical. Can the company emerge victorious in the hundred-glasses war amidst Xiaomi's strategy of using low prices to capture market share?

Below is the main text:

2025 is universally recognized as the "Year One" of AI smart glasses. With the intensive layouts of companies like Meta, Huawei, and LeTV Innovation, this race has advanced from the early stages of concept verification to the brink of large-scale commercialization.

According to Wellsenn's forecast, global shipments of AI smart glasses will surpass 4 million units in 2025. With more players entering the market and decreasing AI prices, the consumer market is poised to open up.

From technological infancy to the pivotal moment of market explosion

AI glasses are rapidly entering the public eye and various industries, transitioning from "tech demos" to "productivity tools" and becoming a new hotspot in the tech world.

At the market level, there is an explosion in demand for both consumer-grade and industrial-grade AI glasses.

IDC predicts that global shipments of AI glasses will reach 12.8 million units in 2025, marking a year-on-year growth of 26%. Among them, China's AI glasses market is anticipated to ship 2.8 million units in 2025, with a year-on-year growth rate of up to 107%.

AI-empowered AR glasses companies have become new favorites of capital, with cumulative financing exceeding 1.5 billion yuan in the first half of 2024.

Among them, LeTV Innovation announced the completion of its B+ and B++ rounds of financing in September 2024, jointly invested by Jiaxing Nanhu Keying, Jiaxing Nanhu Jiaxin Chuanghe, Wuxi Huikai Zhenghe, and Wuxi Huishan Science and Innovation.

The company's financing funds will primarily be used for AI+AR technology research and development, as well as the expansion of production and research manufacturing bases; to date, LeTV Innovation's total financing in the past six months has exceeded 500 million yuan.

From the perspective of the secondary market, domestic investors remain optimistic about the AI-empowered AR glasses sector.

Additionally, cost is a significant focus in AR glasses development.

Meta's Orion costs over $10,000, but due to the gradual maturity of technology, the cost of some AR glasses components is decreasing, with prices of key components falling by nearly 30%, paving the way for further market explosion.

However, whether from the consumer market's perspective or that of the supply chain and application ecosystem, the AR market as a whole is still in its early stages.

The current AR market lacks a mature industrial chain, hardware standards, and software ecosystem.

Currently, the content ecosystem for consumer-grade AR glasses is insufficient and far from comparable to that of smartphones, and there has yet to be an application-side breakout hit.

Consequently, products with inadequate ecosystems are bound to become idle on the user side, while manufacturers struggle to establish effective business models due to poor customer feedback, creating a vicious cycle.

Moreover, the content ecosystem cannot solely rely on AR glasses manufacturers for development but also necessitates collaborative construction by partners across various industries, which is not a quick fix and highlights the importance of industrial chain construction for the industry's sustained upward trajectory.

Simultaneously, limited by speech recognition, image recognition, and augmented reality technologies, AR glasses' application scenarios are primarily concentrated in gaming, movie watching, etc.

Statistics from the Guanyan Tianxia Data Center reveal that among consumer-side applications of AR glasses in China, gaming accounts for 35%, live streaming of movies and TV shows for 32%, and travel and social shopping for 33%.

These three types of application scenarios are not irreplaceable, and consumer-grade AR glasses still lack a compelling demand to support them.

As a result, the XR field has always grappled with the challenge of genuine demand.

Entrepreneurs are overly eager for the "ultimate solution," hoping to become the next Apple with a single product that offers multiple functionalities; however, the accumulation of features leads to excessive product weight and high prices, with the tipping point yet to arrive, resulting in the opposite effect. Thus, the AR glasses industry still experiences a false boom.

However, compared to past years, practitioners no longer seem to be gazing at the stars and indulging in the vast sea of technology but have begun to traverse the "valley of death" of innovation by starting with niche scenarios and leveraging continuous iteration.

"Hundred-glasses war" under the scrutiny of giants

The increasing entry of companies into the AI glasses field has intensified market competition, propelled rapid technological development, and driven continuous product innovation, sparking a fierce "hundred-glasses war."

Abroad, Apple's Vision Pro 2 is poised for mass production, while Meta has collaborated with Ray-Ban to launch a new product priced in the thousand-yuan range. Domestically, companies like INMO, LeTV, and Rokid are engaged in fierce competition, while tech giants such as Huawei, Xiaomi, and Baidu are also paying close attention and actively participating.

BOCI International once compared Meta's first-generation AR glasses, expected to launch in 2025, to the iPhone 1 in the smartphone era.

By 2027, Apple's first AR glasses may propel the entire industry into a new phase of rapid development, akin to the impact of the iPhone 4 in its time.

Simultaneously, domestic manufacturers face challenges from international giants Meta and Snap.

Snap released the new generation of Spectacles AR glasses, Spectacles '24, in September 2024, primarily targeting developers with a paid model of $99 per month for one year.

Spectacles '24 employs waveguide + LCoS optics, offering a FOV of 46°, PPD of 37, equipped with 4 tracking cameras, supporting the Snap spatial engine, powered by dual Qualcomm Snapdragon processors, with a single continuous usage time of 45 minutes, pre-installed with Snap OS, supporting gesture recognition and voice input, and weighing approximately 226g.

In the future, Snap will also collaborate with OpenAI to plan for more intelligent context recognition capabilities for Spectacles '24.

Moreover, Meta, through its partnership with Ray-Ban, has sold over 1 million units of Ray-Ban Meta AI glasses.

Subsequently, Meta reached a new agreement with EssilorLuxottica, Ray-Ban's parent company, extending their collaboration until 2030, and Meta's AR glasses are anticipated to continue the previous cooperation.

Currently, the company's Meta Orion AR glasses, which have not yet been officially launched, have already occupied a central position and emerged as an undeniable dark horse, revolutionizing traditional glasses through the AR glasses Orion, the independent computing unit Compute Puck, and the EMG neural wristband.

The domestic landscape is equally fragmented.

In April 2024, Xiaomi's Mijia Smart Audio Glasses Enjoy Edition were officially released; in May, Huawei unveiled smart glasses equipped with the HarmonyOS 4 operating system and integrated with the Pangu AI large model.

Domestic competitors are primarily divided into three categories.

First, XR-related companies represented by LeTV view AR glasses as a transitional product for the ultimate VR device. Second, large model companies like ByteDance see AR glasses as a crucial scenario for large model implementation. Third, hardware manufacturers such as Huawei view AR glasses as the next generation of more intelligent products.

For LeTV Innovation, large model companies like ByteDance, backed by e-commerce platforms, inherently possess vast traffic pools and always have the upper hand in promotion. Meanwhile, domestic 3C giants like Huawei and Xiaomi come with their own traffic and brand, making them virtually unbeatable in channels.

The three mountains of technology, capital, and ecosystem

Currently, the essence of the "hundred-glasses war" has evolved into the ultimate competition of triple capabilities: technology, capital, and ecosystem.

First, technology is the core competitiveness, and enterprises lacking future technological iteration capabilities will ultimately be abandoned by consumers.

The core technologies of AR glasses are primarily concentrated in optics, display, and perception, with current main components mostly procured from related companies and then tuned by OEMs.

In the early stages, AR glasses often face the challenge of being usable but not user-friendly, and small to medium-sized manufacturers often lack R&D capabilities, having little influence on the supply side, resulting in product homogeneity and occasional incremental improvements.

For AR glasses, a true "AI Agent" necessitates a deep integration of software and hardware capabilities.

Relying solely on the large model itself is difficult to achieve genuine intelligent interaction, necessitating the enhancement of the AI's decision-making ability, interaction ability, and scene adaptability through the Agent architecture.

However, AR glasses manufacturers excel at resolving hardware product issues like optics but struggle with large models requiring tens of millions of graphics cards for training. Independent development is not only costly but also lacks corresponding technology and talent.

Currently, it is common to directly purchase basic large models or use open-source large models for product implantation, but product experience has become a hurdle in making glasses user-friendly.

Second, AI glasses represent a typical heavy-asset sector, where capital strength directly determines the survival cycle of enterprises.

Small to medium-sized enterprises struggle to survive the early stages of industry development due to capital chain disruptions, making capital strength crucial for determining their lifespan.

Simultaneously, the ultimate competition for AI glasses is the battle for closed ecosystems, necessitating the construction of barriers in content, developers, and scenarios.

Relying on the world's strongest hardware supply chain, domestic smart glasses manufacturers have never faced hardware issues but rather software and backend challenges.

As a global social media giant, Meta boasts a plethora of powerful social products, enabling Ray-Ban Meta smart glasses to seamlessly support video live streaming and video calls on Meta platforms like Instagram and Message.

In contrast, domestic manufacturers like LeTV Innovation have yet to establish business connections with mainstream social platforms such as WeChat, Douyin, and Weibo, and manufacturers including Huawei and Xiaomi only support basic voice functions, making them more akin to glasses with smart earphone capabilities.

Currently, the development of the content ecosystem for AR glasses is quite limited, and for consumer-grade players, it resembles "old wine in a new bottle," still relegated to the status of a "high-end accessory" for smartphones.

As an upgraded version of AR glasses, AI glasses have become the Holy Grail for LeTV Innovation and even the entire industry, with ecosystem construction emerging as a long-term strategic high ground.

Strategic map of low prices for market share

"AR is the future general-purpose computing platform, so LeTV's core goal is to succeed in that future era." This is the underlying logic of LeTV Innovation's development mentioned by Li Hongwei in an interview.

On this foundation, the company has outlined three product directions.

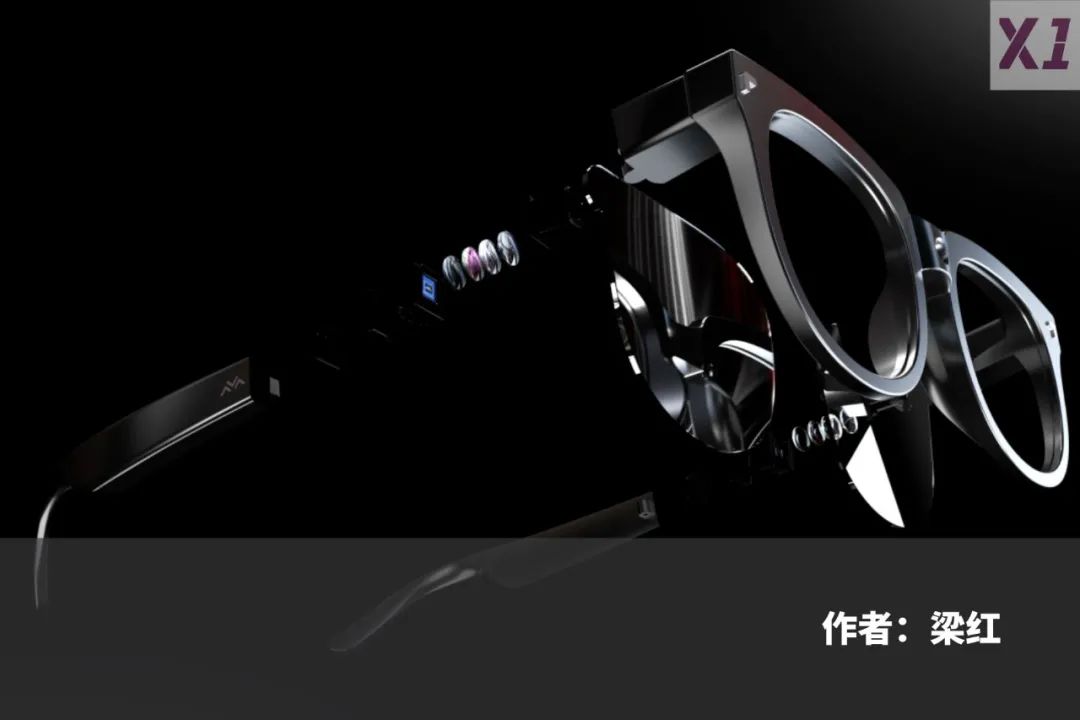

The first is for future true AR glasses, such as LeTV X2 and X3. The second is BirdBath glasses for portable large-screen viewing and entertainment scenarios, like Air 2s and related terminal accessories. The third is smart glasses integrated with AI technology.

However, the theory of customized development is challenging to realize commercially, initially bound to face high costs and difficulties in large-scale sales.

On January 2, 2025, LeTV Innovation and Alibaba Cloud held a strategic signing ceremony, announcing an exclusive in-depth cooperation in the field of AI glasses.

Building upon the Tongyi series of large model bases, Alibaba Cloud has crafted an intricate multimodal interaction architecture tailored specifically to the scenarios and hardware attributes of LeTV AI glasses. This endeavor has culminated in a bespoke "cloud + terminal" model, ensuring a swift, low-latency, and high-quality multimodal AI interaction experience for users.

Concurrently, both entities will delve into function customization and development tailored to the actual usage scenarios of the glasses. This collaborative effort will involve continuous iteration and updates to enhance the LeTV AI glasses products.

Apart from Alibaba Cloud, LeTV Innovation has forged a partnership with Boshi Optical to expand offline sales channels, thereby attracting a broader audience of traditional glasses users.

In Li Hongwei's perspective, the essence of AI glasses lies in upgrading traditional glasses by infusing them with cutting-edge AI and AR capabilities, while retaining their core functionalities.

For instance, AI glasses cannot circumvent the necessity of prescription services, a fact that extends to all XR head-mounted displays, glasses, and other wearable devices. This is precisely where the expertise of professional optical dispensing terminals, such as Boshi Optical, shines.

Beyond their robust commercial collaboration, LeTV has accelerated its strides in independent research and development. As an AR enterprise with end-to-end capabilities in independent research, development, and mass production of core optical solutions, LeTV Innovation leverages concurrent deployment of technologies like MicroLED + waveguide, MicroOLED + BirdBath, and AI to amass resources, cultivate capabilities, and achieve rapid growth across cycles.

The company's in-house team has independently developed the AI social application ChatBird, which integrates the multi-Agent framework of large models with virtual social scenarios to facilitate intelligent interactions.

According to the latest data from CINNO Research, LeTV Innovation captured a 38% market share of consumer-grade AR glasses in China during the first half of 2024, firmly securing the top position in the domestic market.

Despite the vast potential for AR device market growth, global annual shipments have yet to reach the million mark, indicating that the category has not yet matured into mass consumer goods. In this nascent market, LeTV's leading position remains precarious, as any competitor could potentially overtake them.

Faced with intense industry competition, the company has resorted to aggressive pricing strategies.

In essence, LeTV Innovation aims to disrupt the industry landscape with a "Xiaomi-style" approach.

A search for "split AR glasses" on e-commerce platforms reveals prices mostly exceeding 2000 and 3000 yuan. In contrast, the everyday price of LeTV Air 3 is 1699 yuan, which drops further to 1499 yuan during promotional activities.

During the 2024 "Double 11" shopping festival, LeTV Innovation topped the sales charts in the XR industry on JD.com and Tmall, with a market share of up to 42%.

The newly launched LeTV Air 3 emerged as the top-selling XR product, and LeTV store sales surged by 220% compared to the 2024 "618" shopping festival.

Utilizing low prices to capture market share is undoubtedly an effective tactic during the early stages of emerging industry development.

However, caution is warranted. While LeTV's strategy of "trading low prices for market share" may yield swift results in the short term, it may prove unsustainable in funding the company's substantial R&D investments in the long run.

Ultimately, the key to winning the market share battle hinges on a company's ability to establish unique competitive advantages in hardware, AI, and other facets, while constructing a robust content ecosystem. Failure to do so could lead to a similar fate as LeTV in the TV industry, where it "lost money to make a noise."

Epilogue

AI glasses represent not just an evolution of smart terminals but a paradigm shift in human-computer interaction.

However, the outcome of this competition is not determined by a single technology or capital influx but by the holistic synergy of ecosystems and user experiences.

The "Hundred Glasses Battle" in 2025 could usher in a brutal industry shakeout, with companies failing to meet technical standards, lacking sufficient capital reserves, or possessing weak ecosystems being eliminated en masse.

Only those companies capable of transforming technology into commercial value, leveraging capital to catalyze ecosystem expansion, and utilizing the ecosystem to support technological iteration will emerge victorious from this fierce competition.

And the winners will undoubtedly be those "all-round players" who excel in both hard technology and soft power.