Five Companies Surge on Hong Kong Stock Exchange Debut, Robot Concept Firms Swarm to Market

![]() 07/10 2025

07/10 2025

![]() 506

506

Author | Duoke

Source | Beiduo Finance

On July 9, the Hong Kong Stock Exchange rang six gongs to mark the listing ceremony.

Concurrently, five companies debuted on the Hong Kong Stock Exchange, alongside one ETF: Lens Technology, FORTIOR (Fengshao Technology), Centron Communications, Geek+, Mass Dental, and Hang Seng Morgan Stanley US Equity High Income Active ETF (Hang Seng Morgan Stanley US Income ETF).

As initially planned, Shougang Lange was also set to list on the Hong Kong Stock Exchange on July 9. However, on July 2, the company announced a delay in its global offering and listing due to involvement in a civil lawsuit. Subsequently, the company reopened share subscriptions from July 7 to July 10 and is now expected to list on July 15, 2025.

On their first day of trading, all five companies—Lens Technology (HK:06613), FORTIOR (Fengshao Technology, HK:01304), Mass Dental (HK:02651), Centron Communications (HK:02597), and Geek+ (HK:02590)—opened higher. Additionally, the Hang Seng Morgan Stanley US Income ETF (HK:03476) maintained an upward trend.

During the trading session, these five companies exhibited varying performances. Both Centron Communications and Geek+ briefly dipped below their issue prices. For instance, Geek+ had an IPO issue price of HK$16.80 per share, opening at HK$16.90, with a low of HK$16.06 and a high of HK$17.80.

In contrast, Centron Communications opened at HK$14.52 per share (issue price: HK$13.55), reaching a low of HK$12.20 and a high of HK$14.52. Notably, Centron Communications (NQ:832646) is also listed on the New Third Board, closing down 6.08% on July 9.

By the end of trading, Centron Communications' share price stood at HK$13.58, up 0.22% from its IPO issue price. Geek+'s share price closed at HK$17.70, a 5.36% increase from its issue price. Lens Technology's share price rose 16.02%, FORTIOR (Fengshao Technology) surged 16.02%, and Mass Dental gained 3.50%.

For this listing, Centron Communications offered 30.44 million H shares, raising approximately HK$342.5 million, with a net amount of approximately HK$367.5 million. In terms of fundraising scale, Centron Communications and Mass Dental were relatively close, with the latter raising approximately HK$217 million from the issuance of 10.8618 million shares at HK$20.0 per share, resulting in a net amount of approximately HK$178 million.

Unlike Centron Communications and Mass Dental, Lens Technology, Geek+, and FORTIOR (Fengshao Technology) raised significantly larger amounts. Lens Technology offered 262 million H shares at HK$18.18 per share, raising approximately HK$4.768 billion, with a net amount of approximately HK$4.694 billion.

For its Hong Kong listing, Geek+ issued 161 million shares at HK$16.80 per share, raising approximately HK$2.712 billion, with a net amount of approximately HK$2.545 billion. FORTIOR (Fengshao Technology) issued 18.7444 million shares at HK$120.5 per share, raising approximately HK$2.259 billion, with a net amount of approximately HK$2.136 billion.

By comparison, FORTIOR (Fengshao Technology)'s share price was notably higher than other companies listed on the Hong Kong Stock Exchange that day. According to Beiduo Finance, both Fengshao Technology and Lens Technology are A-share listed companies. On July 9, 2025, Fengshao Technology (SH:688279) closed at RMB 182.25 per share, down 0.52% from the previous trading day.

Similarly, Lens Technology's share price also declined in the A-share market on July 9. As of the close of trading on July 9, 2025, Lens Technology (SZ:300433)'s share price in the A-share market was RMB 22.69 per share, down 2.74% from the previous trading day.

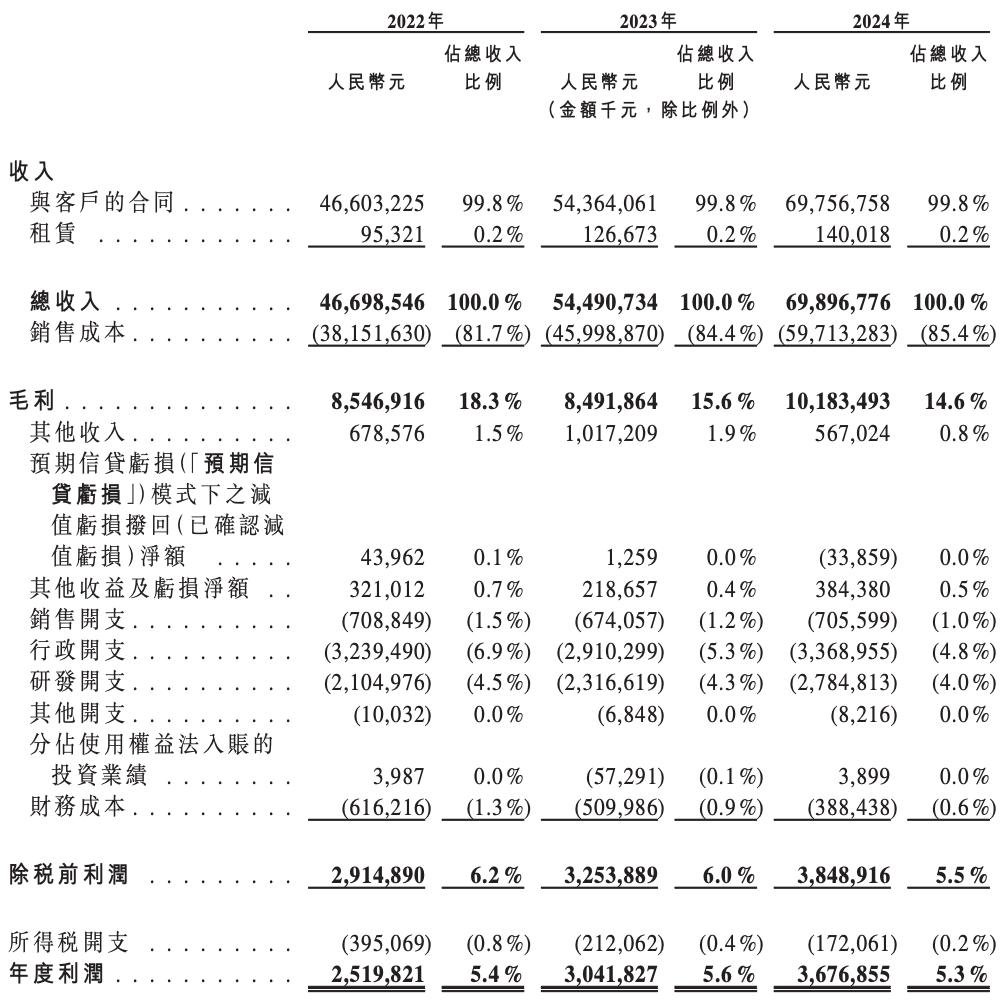

In terms of performance, Lens Technology significantly outpaces the rest.

In 2022, 2023, and 2024, Lens Technology's revenue was approximately RMB 46.699 billion, RMB 54.491 billion, and RMB 69.897 billion, respectively. Its gross profits were approximately RMB 8.547 billion, RMB 8.492 billion, and RMB 10.183 billion, respectively. Net profits stood at approximately RMB 2.52 billion, RMB 3.042 billion, and RMB 3.677 billion, respectively.

Next is Geek+, which is still incurring losses. According to its prospectus, Geek+'s revenue in 2022, 2023, and 2024 was approximately RMB 1.452 billion, RMB 2.143 billion, and RMB 2.409 billion, respectively. Gross profits were approximately RMB 257 million, RMB 659 million, and RMB 837 million, respectively. Net losses amounted to approximately RMB 1.567 billion, RMB 1.127 billion, and RMB 832 million, respectively.

On a non-IFRS basis, Geek+'s adjusted net losses were approximately RMB 821 million, RMB 458 million, and RMB 92.237 million, respectively. EBITDA was approximately RMB -1.429 billion, RMB -1.041 billion, and RMB -765 million, respectively. Adjusted EBITDA was approximately RMB -683 million, RMB -372 million, and RMB -25.413 million, respectively, indicating a substantial narrowing of losses.

Furthermore, Centron Communications' revenue in 2022, 2023, and 2024 was approximately RMB 810 million, RMB 916 million, and RMB 918 million, respectively. Gross profits were approximately RMB 195 million, RMB 196 million, and RMB 203 million, respectively. Net profits were RMB 74.66 million, RMB 76.584 million, and RMB 50.642 million, respectively.

In 2022, 2023, and 2024, FORTIOR (Fengshao Technology)'s revenue was approximately RMB 323 million, RMB 411 million, and RMB 600 million, respectively. Gross profits were approximately RMB 185 million, RMB 217 million, and RMB 316 million, respectively. Net profits were approximately RMB 142 million, RMB 175 million, and RMB 222 million, respectively.

In 2022, 2023, and 2024, Mass Dental's revenue was approximately RMB 409 million, RMB 442 million, and RMB 407 million, respectively. Gross profits were approximately RMB 148 million, RMB 168 million, and RMB 152 million, respectively. Net profits were approximately RMB 56.45 million, RMB 67.038 million, and RMB 62.5 million, respectively.

It is evident that only Geek+ is still incurring losses. However, the company's losses have consistently narrowed. Additionally, Mass Dental's performance has fluctuated, with revenue and net profit declining in 2024. Meanwhile, although Centron Communications' revenue has grown, its net profit has declined for two consecutive years.

Notably, Geek+ is the only robot company listed on the Hong Kong Stock Exchange this time.

According to its prospectus, Geek+ provides AMR (Autonomous Mobile Robot) solutions aimed at enhancing warehousing fulfillment and industrial handling scenarios. As of December 31, 2024, Geek+ had delivered approximately 56,000 AMRs to more than 40 countries and regions worldwide.

According to CIC data, in 2024, Geek+ accounted for 9.0% of the global warehousing fulfillment AMR solutions market and approximately 1% of the global warehousing automation solutions market. In terms of revenue in 2024, Geek+ became the world's largest provider of warehousing fulfillment AMR solutions.

For this listing, Geek+ secured four cornerstone investors: Xiong'an Robotics, Arc Avenue, Eastspring Investments, and Egger, which invested US$41.3 million, US$25 million, US$15 million, and US$10 million, respectively. Collectively, they subscribed for approximately US$91.3 million (approximately HK$717 million) worth of shares offered by the company.

According to Tianyancha App, Geek+ was founded in February 2015. Currently, the company has a registered capital of approximately RMB 1.159 billion, with Zheng Yong as its legal representative. Major shareholders include VERTEX GROWTH FUND PTE.LTD. and NHTV Swarm Company (Hong Kong) Limited.

Zheng Yong serves as the executive director, chairman, and chief executive officer of Geek+. The company's senior management team also includes Executive Director and Chief Technology Officer Li Hongbo, Executive Director and Vice President Liu Kai, Executive Director and Vice President Chen Xi, Chief Financial Officer and Secretary of the Board Liu Hongyan, among others.

In the robotics industry, the Hong Kong stock market already hosts listed companies such as UBTech (HK:09880), Horizon Robotics (HK:09660, referred to as "Horizon"), and Kinova Robotics (HK:02432, referred to as "Kinova"). Additionally, Xianggong Intelligence, Ludong Robotics, Wo'an Robotics, Standard Robotics, and ESTUN have submitted listing applications, joining the queue for IPOs.

According to Beiduo Finance, UBTech listed on the Hong Kong Stock Exchange on December 29, 2023, with an issue price of HK$90.0 per share, raising approximately HK$1.015 billion, with a net amount of approximately HK$906 million. As of the close of trading on July 9, 2025, UBTech's share price was HK$77.60 per share, down 13.78% from its issue price, with a market capitalization of approximately HK$34.3 billion.

In contrast, Horizon listed on the Hong Kong Stock Exchange on October 24, 2024, with an issue price of HK$3.99 per share, raising approximately HK$5.407 billion, with a net amount of approximately HK$5.142 billion. As of the close of trading on July 9, 2025, Horizon's share price was HK$6.49 per share, up 62.66% from its issue price, with a market capitalization of approximately HK$90.1 billion.

Furthermore, Kinova listed on the Hong Kong Stock Exchange on December 23, 2024, with an issue price of HK$18.80 per share, raising approximately HK$752 million, with a net amount of approximately HK$681 million. As of the close of trading on July 9, 2025, Kinova's share price was HK$57.20 per share, up 204.26% from its issue price.

Looking ahead, more technology companies with a robotics concept are anticipated to enter the capital market.