Tencent AI: Identifying the Most Lucrative Ventures

![]() 02/18 2025

02/18 2025

![]() 494

494

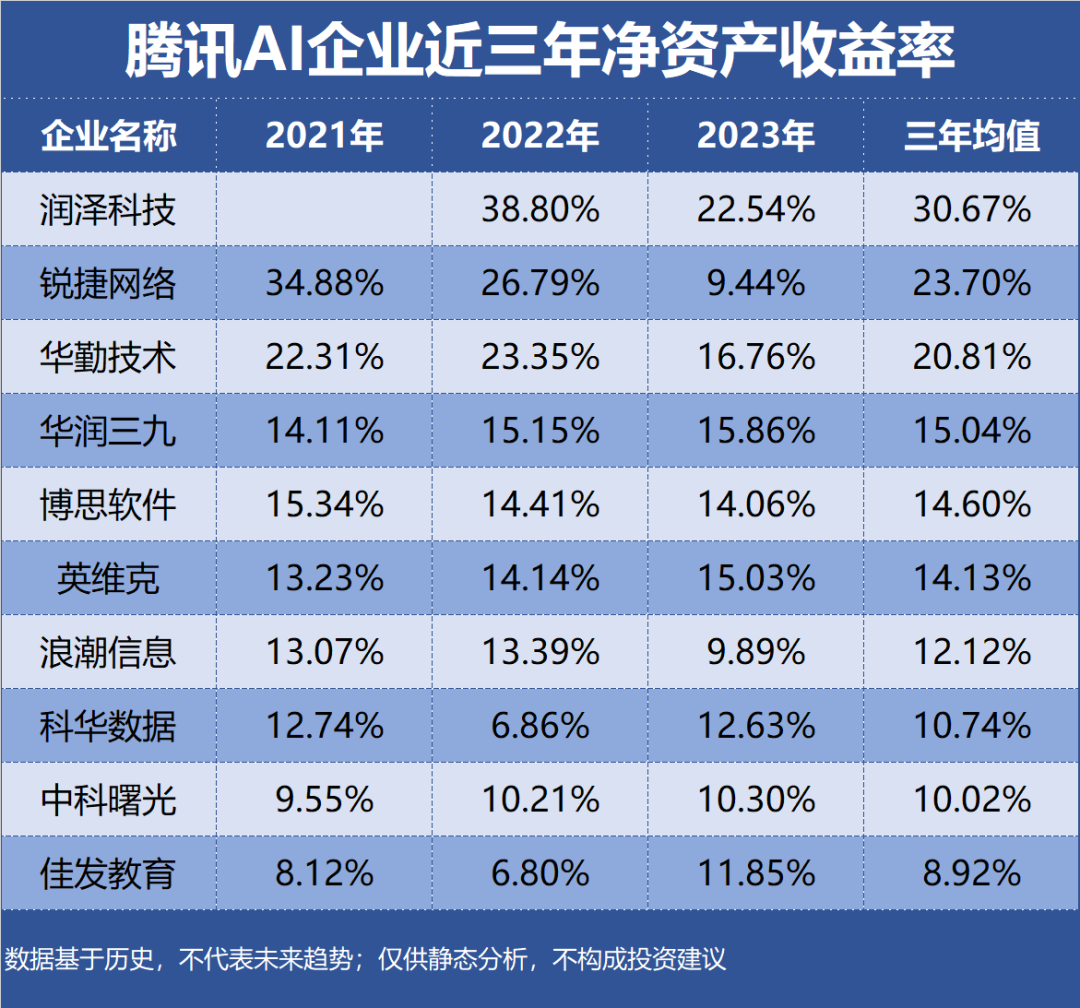

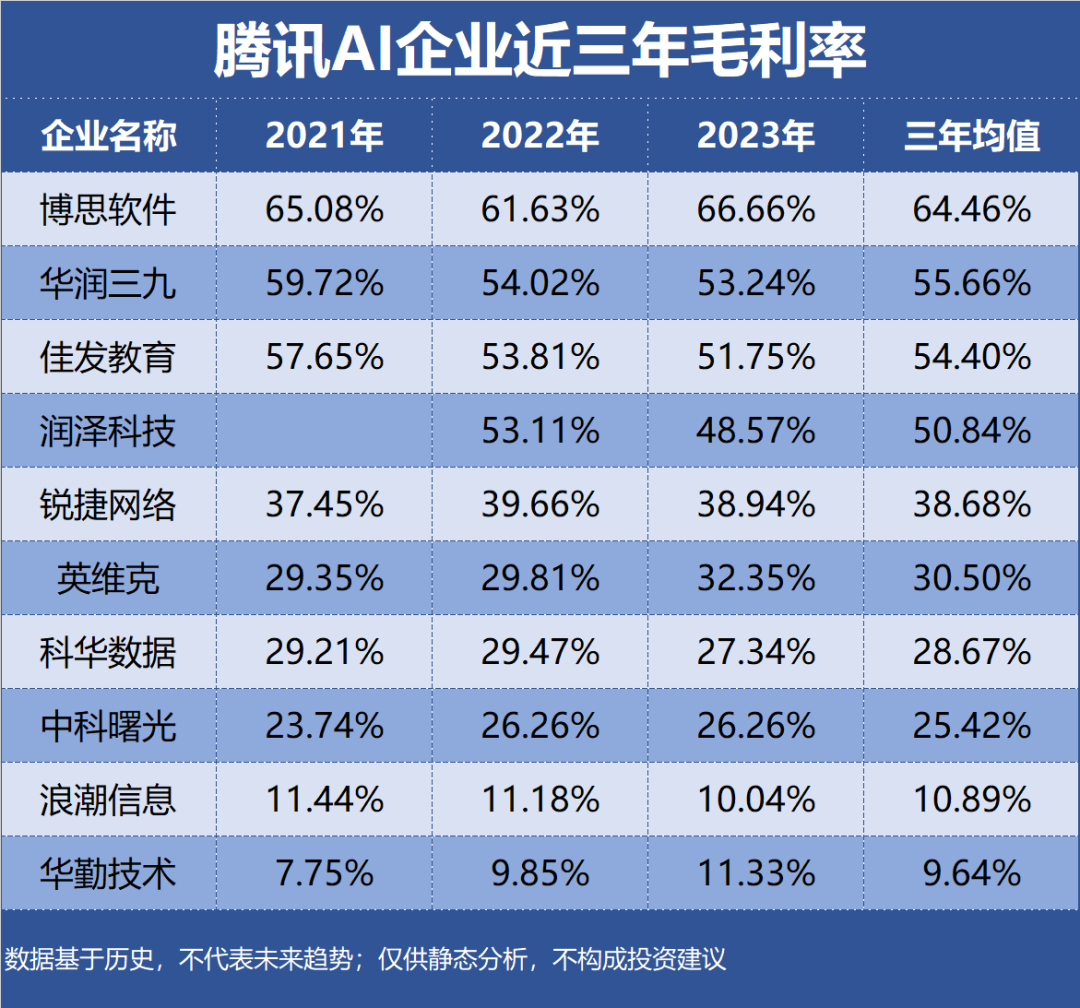

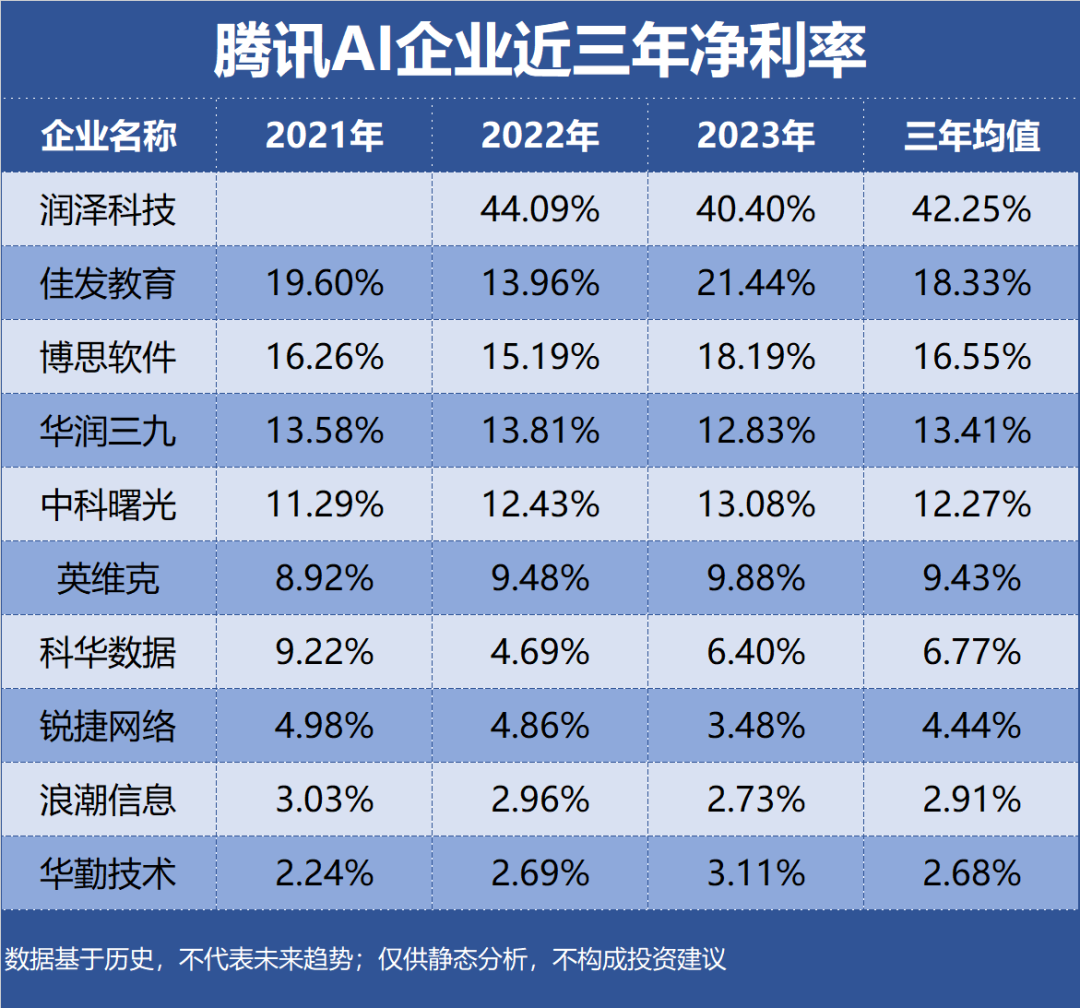

Tencent's AI industry chain encompasses a vast array, spanning from chips, servers, and computing infrastructure to various industry applications, forming a comprehensive and robust ecosystem. In terms of investment strategy, Tencent has established a comprehensive "chip-model-application" ecosystem by investing in upstream and downstream enterprises such as Suiyuan Technology (AI chips), MiniMax (open-source models), and Shenyan Technology (NLP). This article is the [Profitability] chapter of the Enterprise Value series, featuring 46 Tencent AI enterprises as research samples, evaluated using metrics such as return on equity, gross profit margin, and net profit margin. Note that the data is based on historical information and does not predict future trends; it serves solely for static analysis and does not constitute investment advice.

Top Ten Most Profitable Tencent AI Enterprises:

10th: Sugon

Industry Segment: Other Computer Equipment

Profitability: Return on Equity 10.02%, Gross Profit Margin 25.42%, Net Profit Margin 12.27%

Performance Forecast: ROE has risen steadily to 10.30% over the past three years, with the latest forecast averaging 10.58%

Main Products: IT equipment, contributing 89.74% of revenue with a gross profit margin of 24.72%

Company Highlights: Sugon and Tencent Cloud have signed the "Sugon Core Partner Cooperation Agreement," deepening collaboration in areas like city clouds, industry clouds, and big data.

9th: Inspur Information

Industry Segment: Other Computer Equipment

Profitability: Return on Equity 12.12%, Gross Profit Margin 10.89%, Net Profit Margin 2.91%

Performance Forecast: ROE has fluctuated between 9%-14% over the past three years, with the latest forecast averaging 11.29%

Main Products: Servers and components, accounting for 99.57% of revenue with a gross profit margin of 7.65%

Company Highlights: Inspur Information and Tencent Cloud jointly released a white paper on data center fault operation and maintenance.

8th: Jiafa Education

Industry Segment: Vertical Application Software

Profitability: Return on Equity 8.92%, Gross Profit Margin 54.40%, Net Profit Margin 18.33%

Performance Forecast: ROE has fluctuated between 6%-12% over the past three years, with the latest forecast averaging 9.99%

Main Products: Education exam standardization testing site products and overall solutions, contributing 67.00% of revenue with a gross profit margin of 60.18%

Company Highlights: Jiafa Education's AI technology collaboration with Tencent focuses on intelligent speech recognition in the company's English listening and speaking products.

7th: Ruijie Networks

Industry Segment: Communication Network Equipment and Devices

Profitability: Return on Equity 23.70%, Gross Profit Margin 38.68%, Net Profit Margin 4.44%

Performance Forecast: ROE has declined to 9.44% over the past three years, with the latest forecast averaging 11.32%

Main Products: Network equipment, contributing 79.01% of revenue with a gross profit margin of 37.29%

Company Highlights: Ruijie Networks was an early domestic pioneer in white-box switch products and has won multiple data center construction tenders from leading internet vendors like Alibaba, Tencent, and ByteDance.

6th: Kehua Data

Industry Segment: Other Power Equipment

Profitability: Return on Equity 10.74%, Gross Profit Margin 28.67%, Net Profit Margin 6.77%

Performance Forecast: ROE has fluctuated between 6%-13% over the past three years, with the latest forecast averaging 11.33%

Main Products: New energy products, contributing 51.83% of revenue with a gross profit margin of 16.88%

Company Highlights: Kehua Data and Tencent Cloud signed the "Tencent Customized Data Center Cooperation Agreement," collaborating on Tencent data center construction in certain regions.

5th: Huaqin Technology

Industry Segment: Consumer Electronics Components and Assembly

Profitability: Return on Equity 20.81%, Gross Profit Margin 9.64%, Net Profit Margin 2.68%

Performance Forecast: ROE has fluctuated between 16%-24% over the past three years, with the latest forecast averaging 12.72%

Main Products: High-performance computing, contributing 56.31% of revenue with a gross profit margin of 9.58%

Company Highlights: Huaqin Technology has achieved mass deliveries of the NS8420 switch, designed for ultra-large-scale data centers, to leading internet customers including Tencent.

4th: CR Sanjiu

Industry Segment: Traditional Chinese Medicine

Profitability: Return on Equity 15.04%, Gross Profit Margin 55.66%, Net Profit Margin 13.41%

Performance Forecast: ROE has risen steadily to 15.86% over the past three years, with the latest forecast averaging 15.30%

Main Products: The pharmaceutical industry, contributing 86.11% of revenue with a gross profit margin of 60.33%

Company Highlights: Tencent's Yuanbao brand intelligent agent zone launched with CR Sanjiu as one of the first invited partners.

3rd: Bosisoft

Industry Segment: Vertical Application Software

Profitability: Return on Equity 14.60%, Gross Profit Margin 64.46%, Net Profit Margin 16.55%

Performance Forecast: ROE has declined to 14.06% over the past three years, with the latest forecast averaging 14.65%

Main Products: Technical services, contributing 84.61% of revenue with a gross profit margin of 61.97%

Company Highlights: Bosisoft and Tencent have leveraged their respective resources in areas like electronic invoices, smart cities, blockchain, and payments, achieving deep business collaboration.

2nd: SunwayCooler

Industry Segment: Other Special Equipment

Profitability: Return on Equity 14.13%, Gross Profit Margin 30.50%, Net Profit Margin 9.43%

Performance Forecast: ROE has risen steadily to 15.03% over the past three years, with the latest forecast averaging 18.69%

Main Products: Data center temperature control and energy-saving products, contributing 49.96% of revenue with a gross profit margin of 30.62%

Company Highlights: SunwayCooler's customers include large data center cooling systems and products for users such as Tencent.

1st: Runze Technology

Industry Segment: Communication Application Value-Added Services

Profitability: Return on Equity 30.67%, Gross Profit Margin 50.84%, Net Profit Margin 42.25%

Performance Forecast: The highest ROE over the past three years was 38.80%, with the latest forecast averaging 21.81%

Main Products: AIDC business, contributing 57.46% of revenue with a gross profit margin of 22.14%

Company Highlights: Runze Technology provides core AI capabilities such as search, summarization, and writing for the Tencent Yuanbao app, leveraging the Hunyuan large model.

Net Profit Margin, Gross Profit Margin, and Return on Equity of the Top Ten Most Profitable Tencent AI Enterprises Over the Past Three Years: