Video Conference Systems Rise as the Preferred Choice for Enterprises Amid Economic Pressures

![]() 02/27 2025

02/27 2025

![]() 575

575

Amidst the current economic pressures, the budgets of most small and medium-sized enterprises have undergone significant contraction. The "2024 Video Conference System Market White Paper," released on February 26th, reveals a pivotal shift: as enterprises iterate and upgrade their conference equipment or make new purchases, they are increasingly opting for video conference systems that offer superior cost-effectiveness and robust reliability.

According to the white paper, from 2019 to 2022, enterprises underwent substantial iteration and upgrade of conference display products to meet the burgeoning demand for online meetings, leading to explosive growth in the conference display market. However, by 2023, shipments of conference display equipment declined sharply. The latest data indicates that in 2024, shipments of conference display equipment (encompassing video conference systems, interactive conference tablets, etc.) fell by nearly 5% year-on-year, with interactive conference tablets experiencing a more pronounced decline. Conversely, video conference systems demonstrated signs of stabilization, primarily because they have usurped part of the market share previously held by interactive conference tablets due to their overall cost-effectiveness, thus becoming the preferred choice for enterprises during equipment upgrades.

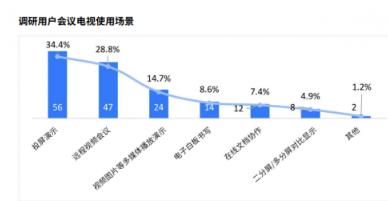

The core distinction between conference tablets and video conference systems lies in their interactivity and touch sensitivity. Conference tablets, leveraging touch technology, facilitate operations such as writing, zooming, and annotating, making them ideal for meetings requiring frequent interaction. However, for most enterprises, the frequency of utilizing these interactive features is relatively low. As a display terminal, video conference systems are better suited for scenarios dominated by video conferencing and screen projection demonstrations, aligning more closely with the actual needs of internal meetings, external presentations, reports, forums, and other high-frequency enterprise scenarios.

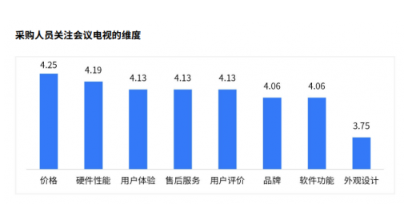

Moreover, the white paper highlights that price remains the primary concern for enterprises when procuring conference display equipment. Due to the high integration of touch screens, sensors, and software ecosystems in conference tablets, their production costs are relatively high, translating into steeper market prices. In contrast, video conference systems, devoid of such high-integration technologies as touch screens, offer enhanced equipment stability, longer service life, and more affordable prices for enterprise buyers, especially in the current economic climate where procurement decisions tend to be more conservative. Notably, China's video conference system technology has attained a high level of maturity. Taking TCL as an example, as the only Chinese TV brand with self-developed and self-produced screens, it not only provides globally leading technological innovation and production capacity but also achieves full-chain autonomy from product design to production and after-sales, significantly reducing production costs and creating a highly competitive price advantage.

The white paper data underscores that the proportion of enterprises with purchase budgets ranging from 2000 to 6000 yuan is as high as 50.1%, and the usage ratio of enterprise video conference systems to interactive tablets in 2024 is approximately 3:1. This underscores the profound market potential of video conference system products, which offer relatively low prices while fulfilling the needs of most actual meeting scenarios.

With the proliferation of remote work, online meetings, and the deepening of enterprise digital transformation, the video conference system market is poised for rapid growth. Currently, commercial conference display devices are evolving towards specialization and intelligence, and video conference systems, with their mature technology and cost-effectiveness, remain the preferred choice for basic meeting scenarios in enterprises. Looking ahead, video conference system products equipped with full-chain solutions and scene adaptation capabilities will further dominate the market, driving the upgradation of traditional display devices.