Xiaomi Robotics, which enterprise has the strongest profitability?

![]() 03/10 2025

03/10 2025

![]() 517

517

It is reported that Xiaomi's first full-size humanoid bionic robot, CyberOne (Tie Da), is expected to showcase its latest progress in Yizhuang, Beijing, from March to April.

The robot stands at 177cm, has emotional perception capabilities, can identify 85 environmental semantics and 45 human emotions, and its technical path may continue Xiaomi's "latecomer first" strategy for its automotive business.

Additionally, Beijing Xiaomi Robotics Technology Co., Ltd., a subsidiary of Xiaomi, obtained a patent for "Motion Trajectory Generation Method" on March 4, 2025, which helps improve the robot's motion control capabilities.

On August 11, 2022, Xiaomi Group officially launched its first full-size humanoid bionic robot, CyberOne (Tie Da). In February 2025, Xiaomi advanced the phased implementation of its CyberOne (Tie Da) on its own manufacturing production line.

Sorting out various links in Xiaomi's robotics industrial chain

Upstream

Sensors: Kunwei Technology focuses on the research and development of six-dimensional force sensors, with Xiaomi participating in its Series B funding round. Hanwei Technology's subsidiary, Neng Sida, collaborates with Xiaomi in the research and development of flexible bionic electronic skin.

Chips: Allwinner Technology provides the Allwinner MR813 chip for Xiaomi's bionic quadruped robot, "Tie Dan".

Other Components: Zhaowei Electromechanical provides micro drive systems. Jiangsu Leili provides micro motors and drive systems. Leadshine provides dedicated reducers for humanoid robots.

Midstream

Manufacturing: Xiaomi is one of the midstream manufacturers of humanoid robots, with layouts in the design, manufacturing, and testing of its humanoid robot products.

Integration and Assembly: Lens Technology participates in the module and complete machine assembly of humanoid robots. Foxconn may participate in the large-scale production of Xiaomi's robot-related products.

Downstream

Home Service Sector: Collaborates with Xiaomi's ecological chain enterprises such as Roborock Technology. For instance, Roborock's smart sweeping robots use AI path planning technology, collaborating with Xiaomi robots to build a smart home ecosystem.

Industrial Sector: Xiaomi collaborates with Estun Automation and Luoshi Robotics in the field of industrial robots, exploring advanced technologies and promoting the application of robots in industrial scenarios.

Other Potential Application Scenarios: Explores the application of robots in more fields such as industrial sorting through cross-border collaborations with automakers.

Profitability of Enterprises in Xiaomi's Robotics Industrial Chain

Corporate profitability is usually manifested in the amount of corporate earnings and their level over a certain period. The analysis of profitability is an in-depth analysis of a company's profit rate.

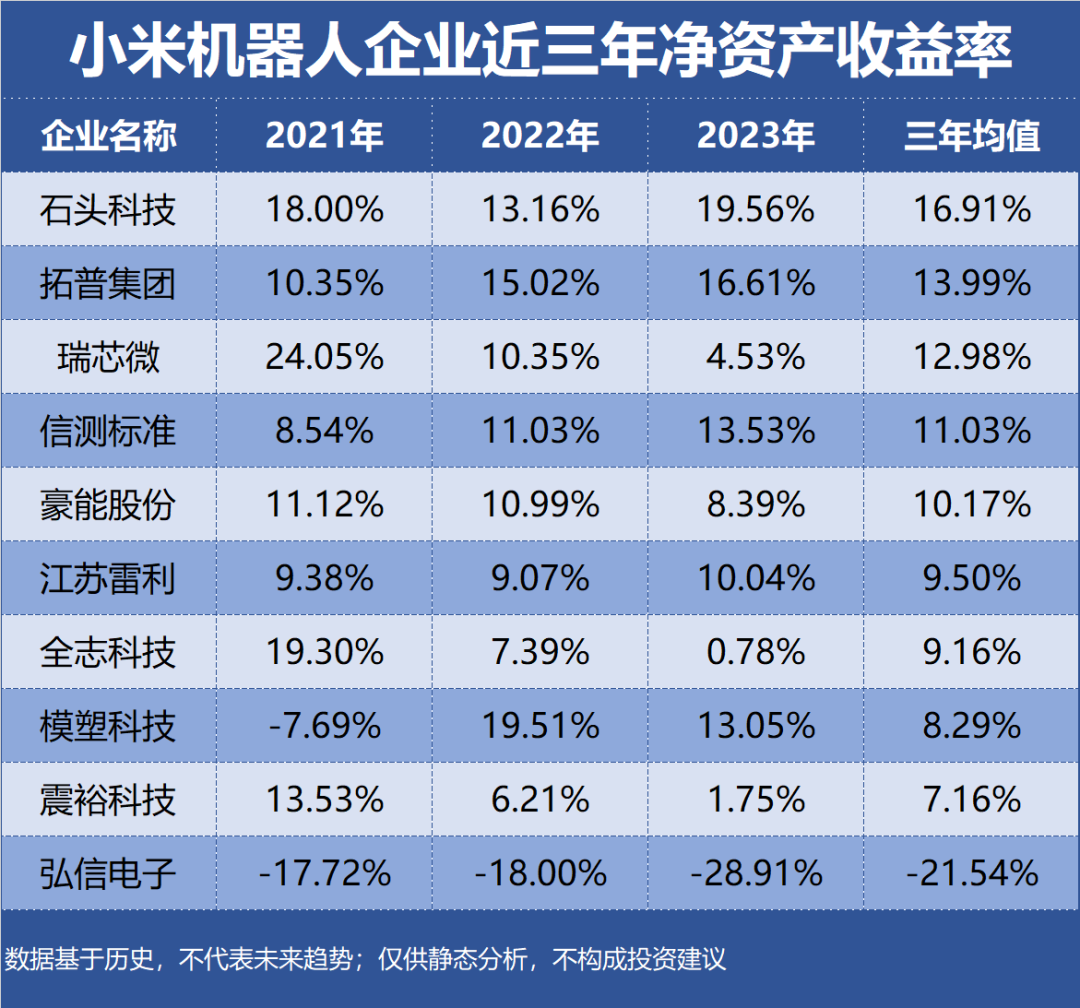

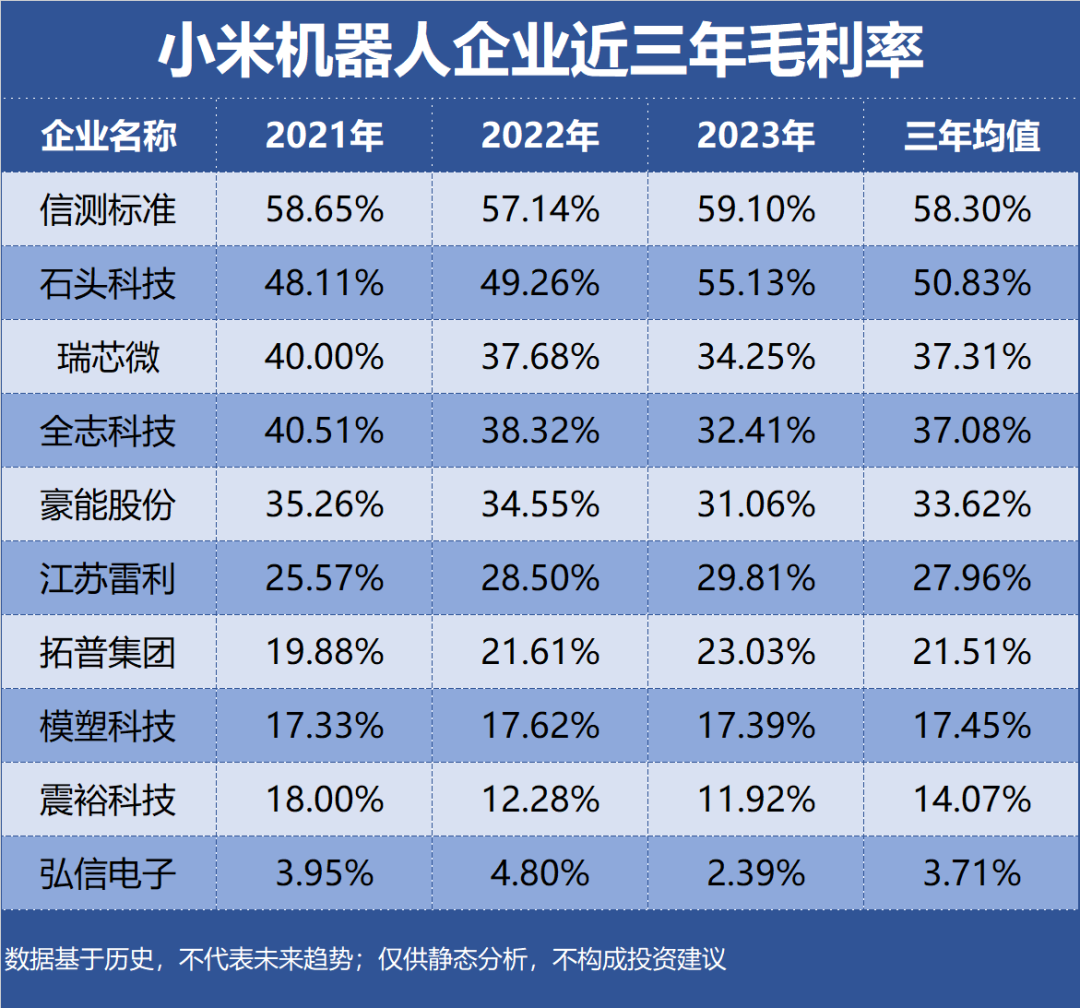

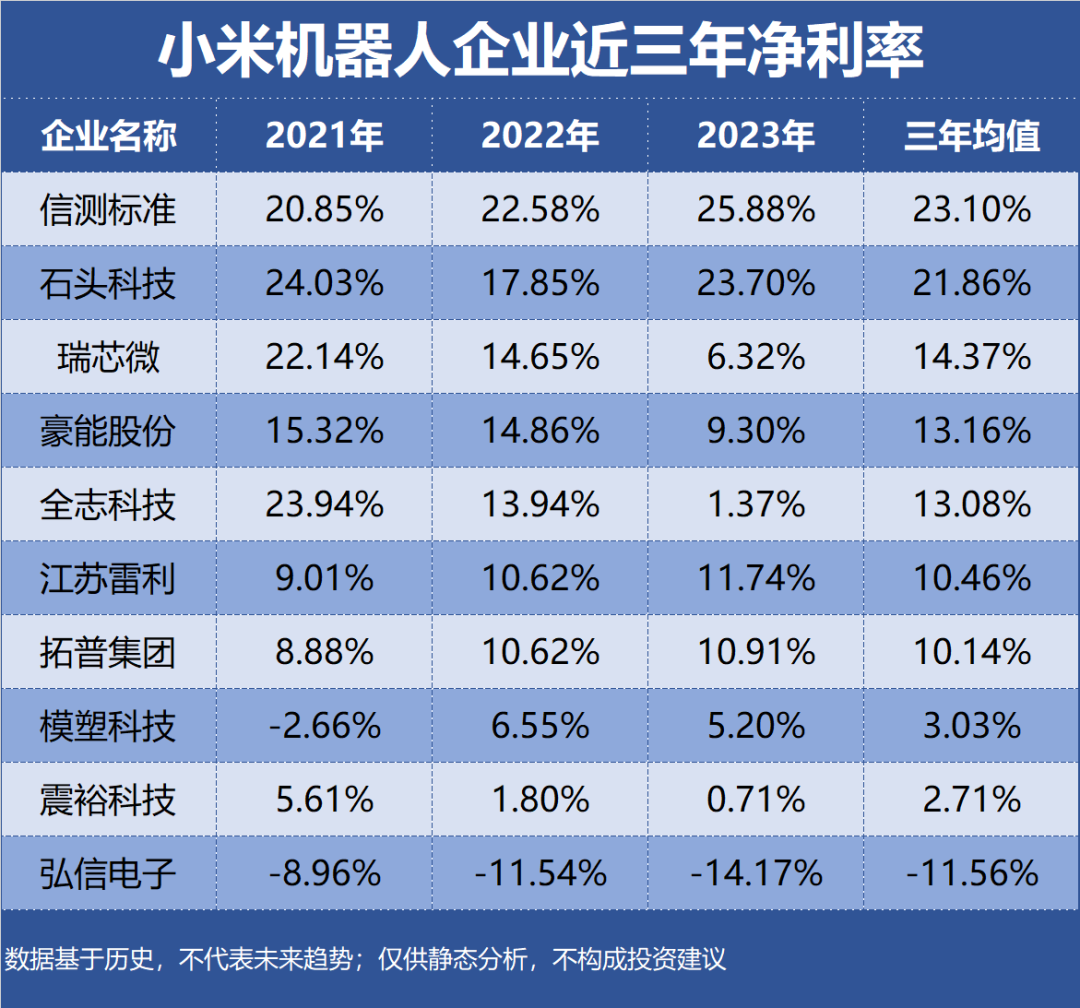

This article is the "Profitability" section of the Corporate Value series, selecting a total of 23 enterprises in the Xiaomi Robotics industrial chain as research samples, with return on equity (ROE), gross profit margin, net profit margin, etc., as evaluation indicators.

Data is based on history and does not represent future trends; it is for static analysis only and does not constitute investment advice.

No. 10 Allwinner Technology

Industry Segment: Digital chip design

Profitability: ROE of 9.16%, gross profit margin of 37.08%, net profit margin of 13.08%

Performance Forecast: The highest ROE in the past three years was 19.30%, with the latest forecast average of 7.04%

Main Products: Smart terminal application processor chips are the primary source of income, accounting for 85.75% of revenue, with a gross profit margin of 32.10%

Company Highlights: Xiaomi's bionic quadruped robot, Tie Dan, uses chips from Allwinner Technology.

No. 9 Jiangsu Leili

Industry Segment: Motors

Profitability: ROE of 9.50%, gross profit margin of 27.96%, net profit margin of 10.46%

Performance Forecast: ROE has fluctuated between 9%-11% in the past three years, with the latest forecast average of 9.88%

Main Products: Stepper motors are the primary source of income, accounting for 37.21% of revenue, with a gross profit margin of 31.98%

Company Highlights: Jiangsu Leili's subsidiary, Dingzhi Technology, has sent samples of some linear transmission products for use in the field of humanoid robots and obtained phased customer approval; the company has products applied to Xiaomi-related home appliances.

No. 8 Zhenyu Technology

Industry Segment: Lithium batteries

Profitability: ROE of 7.16%, gross profit margin of 14.07%, net profit margin of 2.71%

Performance Forecast: ROE has continuously declined to 1.75% in the past three years, with the latest forecast average of 9.04%

Main Products: The precision structural components business is the primary source of income, accounting for 79.43% of revenue, with a gross profit margin of 13.21%

Company Highlights: Zhenyu Technology's wholly-owned subsidiary, Suzhou Fanster, jointly developed a frameless torque motor with Inovance Technology, which is applied to humanoid robot actuators; the company entered Xiaomi's automotive supply chain in collaboration with Inovance Technology, providing drive motor cores for Xiaomi's automobiles.

No. 7 CTI

Industry Segment: Testing services

Profitability: ROE of 11.03%, gross profit margin of 58.30%, net profit margin of 23.10%

Performance Forecast: ROE has continuously risen to 13.53% in the past three years, with the latest forecast average of 12.70%

Main Products: Testing in the automotive field is the primary source of income, accounting for 39.97% of revenue, with a gross profit margin of 71.68%

Company Highlights: CTI possesses capabilities and qualifications for EMC testing, safety testing, environmental reliability testing, etc., for robots; the company provides product safety, electromagnetic compatibility, reliability testing, chemical testing, and international certification for Xiaomi's products.

No. 6 Hongxin Electronics

Industry Segment: Printed circuit boards

Profitability: ROE of -21.54%, gross profit margin of 3.71%, net profit margin of -11.56%

Performance Forecast: ROE has been negative in the past three years, with the latest forecast average of 5.03%

Main Products: Printed circuit boards are the primary source of income, accounting for 49.98% of revenue, with a gross profit margin of 1.51%

Company Highlights: Hongxin Electronics has accumulated a large number of patented technologies in the field of flexible electronics and successfully provided a complete set of circuit board solutions exclusively for Xiaomi's Tie Dan robot.

No. 5 Haoneng Co., Ltd.

Industry Segment: Chassis and engine systems

Profitability: ROE of 10.17%, gross profit margin of 33.62%, net profit margin of 13.16%

Performance Forecast: ROE has continuously declined to 8.39% in the past three years, with the latest forecast average of 12.66%

Main Products: Synchronizers are the primary source of income, accounting for 41.67% of revenue, with a gross profit margin of 31.34%

Company Highlights: Haoneng Co., Ltd.'s subsidiary, Chongqing Haoneng, has a project for precision electric drive planetary reduction mechanisms for new energy vehicles, and precision planetary reducers can be applied in the field of robots; the company's products indirectly support Xiaomi's automobiles.

No. 4 Mould King Technology

Industry Segment: Body accessories and trim parts

Profitability: ROE of 8.29%, gross profit margin of 17.45%, net profit margin of 3.03%

Performance Forecast: The highest ROE in the past three years was 19.51%, with the latest forecast average of 15.65%

Main Products: Plasticized automotive trim parts are the primary source of income, accounting for 86.23% of revenue, with a gross profit margin of 18.58%

Company Highlights: Mould King Technology's subsidiary provides precision plastic molds and injection molding products for Xiaomi's sweeping robots.

No. 3 Roborock Technology

Industry Segment: Cleaning small appliances

Profitability: ROE of 16.91%, gross profit margin of 50.83%, net profit margin of 21.86%

Performance Forecast: ROE has fluctuated between 13%-20% in the past three years, with the latest forecast average of 15.89%

Main Products: Smart cleaning products and accessories are the primary source of income, accounting for 99.83% of revenue, with a gross profit margin of 53.97%

Company Highlights: Mijia sweeping robots are the main products of Roborock Technology.

No. 2 Top Group

Industry Segment: Chassis and engine systems

Profitability: ROE of 13.99%, gross profit margin of 21.51%, net profit margin of 10.14%

Performance Forecast: ROE has continuously risen to 16.61% in the past three years, with the latest forecast average of 16.59%

Main Products: Interior functional parts are the primary source of income, accounting for 31.98% of revenue, with a gross profit margin of 17.08%

Company Highlights: Top Group has existing robot actuator products; the company's IBS, EPS, air suspension, thermal management, and smart cockpit projects have received designations from Xiaomi.

No. 1 Rockchip

Industry Segment: Digital chip design

Profitability: ROE of 12.98%, gross profit margin of 37.31%, net profit margin of 14.37%

Performance Forecast: ROE has continuously declined to 4.53% in the past three years, with the latest forecast average of 15.09%

Main Products: Integrated circuits are the primary source of income, accounting for 99.11% of revenue, with a gross profit margin of 34.00%

Company Highlights: Rockchip collaborates with multiple well-known domestic consumer electronics brands to launch smart speakers, sweeping robots, and other smart home appliances, as well as mobile phone adapters. Xiaomi is one of its partners.

Top 10 enterprises with the strongest profitability in Xiaomi's robotics industrial chain, ROE, gross profit margin, and net profit margin for the past three years: