Hygon Merges with Sugon: Can This Domestic Computing Powerhouse Achieve Breakthroughs?

![]() 05/27 2025

05/27 2025

![]() 681

681

Article | Hengxin

Source | Bowang Finance

The union of Hygon, the "new aristocrat of chips" on the STAR Market, and Sugon, the "leader of supercomputing" on the main board, has garnered immense attention.

This capital operation, with a combined market value exceeding 400 billion yuan, marks not only the "first ice-breaking order" following the implementation of new reorganization regulations but is also viewed by the market as a landmark event in the consolidation of the domestic computing power industry chain. While it appears that Hygon, with a market value of 316.4 billion yuan, has "swallowed" Sugon, valued at 90.6 billion yuan, in reality, it embodies a dual logic of technological complementarity and policy dividends.

However, whether this merger and acquisition can truly achieve "1+1>2" necessitates piercing through the veil of capital and examining potential issues such as industrial chain coordination, cultural conflicts, and market risks.

01

Hygon and Sugon Strategically Reorganize to Capitalize on New Opportunities in Domestic Chips

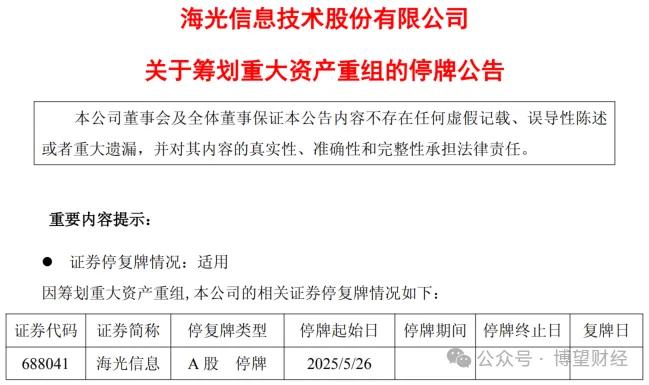

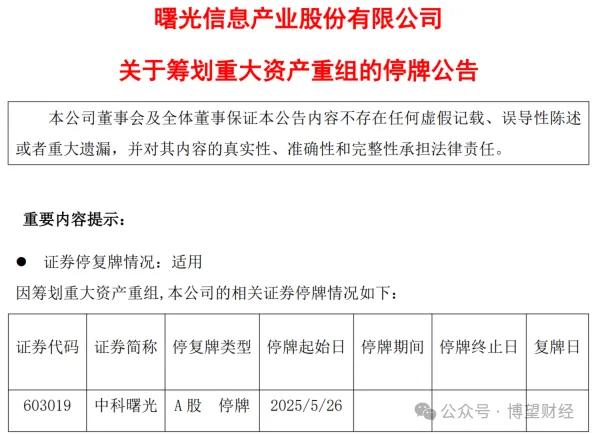

On the evening of May 25, 2025, both Hygon and Sugon announced their strategic reorganization plan aimed at seizing new opportunities in the information technology industry and fostering industrial chain integration and high-quality development. Hygon will issue A-shares to all Sugon's A-share shareholders in exchange for shares, absorbing and merging Sugon, and raising supporting funds. Trading in both companies will be suspended from May 26th, with the expected suspension period not exceeding 10 trading days due to the complexity of the reorganization.

Who are these two companies, and why have they caused such a stir?

Public information reveals that Hygon, a leading domestic enterprise in CPU processor chip design, was registered and established in 2014. In 2016, it formed a joint venture with American chip giant AMD in Chengdu, China, securing permanent authorization for AMD's high-end CPU processor-related technology and the x86 instruction set. Listed on the STAR Market in August 2022, its current offerings include x86 instruction set-compatible general-purpose processors (CPUs) and GPGPU architecture-based coprocessors (DCUs), primarily used in data center infrastructure equipment like servers and workstations.

Sugon, on the other hand, is a listed enterprise under the Institute of Computing Technology of the Chinese Academy of Sciences, founded in 2006 and listed on the Shanghai Stock Exchange in 2013. Its product portfolio includes data center rack servers, all-in-one machines, and other solutions related to data center (IDC) integration services. According to the 2024 China Server Vendor Market Share Report by IDC, Sugon holds approximately 10% market share.

Tianyancha data shows that Sugon's largest shareholder is Beijing Zhongke Suanyuan Asset Management Co., Ltd., with the Chinese Academy of Sciences' Institute of Computing Technology as the ultimate controller. Meanwhile, Hygon's largest shareholder is Sugon Information Industry Co., Ltd., indicating both are high-quality assets under the Chinese Academy of Sciences' Institute of Computing Technology.

02

A Merger with Both "Strengthening and Complementing the Industrial Chain" Logic and Concerns Over High Valuation Integration and Cultural Conflicts

The Hygon-Sugon merger essentially represents a vertical integration of "chip design + server + cloud computing services".

Hygon specializes in domestic CPUs and DCUs, with products compatible with the x86 architecture and technology licensed from AMD, yet it has evolved to the independently controllable Deep Computing III. Sugon, with expertise in supercomputing, storage, and cloud computing, holds the domestic DeepSeek hyper-converged all-in-one machine. Post-merger, the two can offer a full-stack solution of "domestic CPU + DCU + server," potentially rivaling the NVIDIA + Dell ecosystem. This synergy is crucial in the AI computing power race, where Hygon's DCU boasts a single-card computing power of 10.8 TFlops, while Sugon possesses supercomputing system integration capabilities. Together, they aim to break Intel and AMD's patent barriers and seize domestic computing power market dominance.

Policy dividends further enhance the strategic significance of this merger. Coinciding with the revision and implementation of the "Measures for the Administration of Major Asset Reorganizations of Listed Companies," which explicitly encourages leading enterprises to integrate industrial chain resources through mergers and acquisitions, the Hygon-Sugon merger aligns with the "strengthening and complementing the industrial chain" strategy and is poised to receive expedited approval. Additionally, the new "Nine National Policies" have increased the valuation inclusivity of technology enterprise mergers and acquisitions (e.g., allowing high-price-to-earnings ratio targets to be diluted through additional issuances), providing policy support for this "high-valuation swallowing low-valuation" transaction. Broader implications include strengthening domestic chips' penetration in key industries like government and finance, aligning with "Digital China" strategic needs.

The direct benefit of the merger is enhanced market competitiveness. The new company's revenue will exceed 22.3 billion yuan (9.16 billion yuan from Hygon and 13.15 billion yuan from Sugon in 2024), with combined R&D expenses surpassing 4 billion yuan, significantly accelerating technological iteration. Additionally, shared customer resources reduce market expansion costs. More importantly, the merger forms an "chips - systems - cloud services" ecological closed loop, attracting more developers to the Hygon ecosystem, fostering a software and hardware synergy akin to Apple's. This vertical integration model not only reduces industrial chain transaction costs but also shortens product time-to-market through technology sharing, offering domestic computing power enterprises a chance to "overtake on curves".

Strategically, the underlying value lies in resolving domestic chips' "choking" dilemma through resource integration. Technological complementarity addresses single enterprises' fragmented ecosystems, policy dividends lower integration costs, and economies of scale bolster market influence.

However, the high valuation pressure resulting from the merger may raise market skepticism.

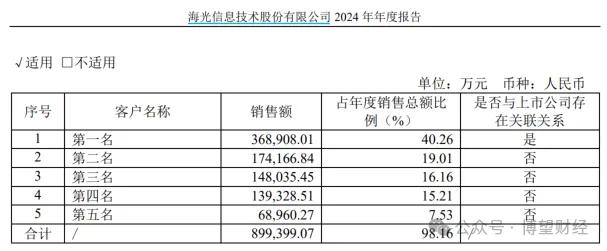

Prior to trading suspension, Hygon's price-to-earnings ratio was significantly higher than Sugon's, with the valuation gap potentially seen as "interest transfer" or overly optimistic expectations. While post-reorganization economies of scale can boost profits, if expected synergies fail to materialize, the high valuation may be unsustainable. Additionally, Hygon's high customer concentration (reliant on Sugon) could expose growth ceilings if it fails to expand into internet giants post-merger.

Cultural conflicts and integration challenges may diminish synergies. As a STAR Market enterprise with strong marketization genes, Hygon is known for "rapid iteration and high-profile actions," while Sugon, with a strong state-owned asset background, follows a more conservative decision-making process. Differences in R&D investment directions (Hygon focuses on chips, Sugon on cloud computing) and management styles (Hygon's flat structure vs. Sugon's hierarchical structure) may lead to internal friction.

In summary, the core challenges lie in supporting high valuation with high growth performance, while cultural and management differences may hinder integration progress. If these contradictions are not properly addressed, the strategic synergy may transform into a "strategic burden".

03

Industry Implications: A "Paradigm Revolution" in Domestic Computing Power Integration

Regardless, the Hygon-Sugon merger marks a shift from "single-point breakthroughs" to "ecological reconstruction" for domestic chip enterprises, offering a vertical integration breakthrough paradigm for the industry.

The new reorganization regulations signify a significant policy shift, easing restrictions on mergers and acquisitions of heavy-asset technology enterprises. The Hygon case underscores policies' preference for "strengthening and complementing the industrial chain" over "market value management," urging enterprises to transition from "storytelling" to "competing on hard power." Investors must assess whether mergers and acquisitions align with the "technological autonomy + market demand" dual-drive logic rather than mere conceptual speculation. For instance, a company's decreased R&D investment ratio or stagnant customer expansion post-merger may trigger a valuation correction.

For the industry, this merger serves as a warning against the "pseudo-synergy" trap. Synergies must be validated through R&D, market, and management synergy, not just conceptual packaging. Investors should focus on merging parties' technical complementarity, customer overlap, and management compatibility. Regulators must be vigilant against capital market bubbles arising from high-valuation mergers and acquisitions, preventing "policy arbitrage" from distorting resource allocation efficiency.

In essence, the industry's core implication is that domestic chips' breakthrough requires a shift from "single combat" to "group combat," yet integration success hinges on the triple test of technological autonomy, ecological synergy, and management compatibility. This case not only provides a replicable integration path for the industry but also exposes the domestic chip industry chain's deep-seated shortcomings, necessitating a balance between policy support and market mechanisms.

The Hygon-Sugon merger is both a monumental self-rescue for the domestic chip industry chain and a high-risk strategic experiment. Time will tell the outcome, and we eagerly await the results.