Hygon and Sugon's RMB 400 Billion Merger: A Turning Point in AI and Internet Power Dynamics

![]() 06/04 2025

06/04 2025

![]() 648

648

This article is based on publicly available information and is intended solely for information exchange, not as investment advice.

In the Huayuan Industrial Park of Nankai District, Tianjin, two main roads, Haitai Avenue running north-south and Huake Street running east-west, form the park's traffic backbone. Recently, a significant event has stirred up these two streets: two leading domestic computing power enterprises, situated less than a kilometer apart, have become the talk of the town in the A-share market and the entire Chinese chip industry in the summer of 2025 through an announced share swap merger. Hygon, the up-and-coming AI chipmaker located on Haitai Avenue, has declared its intention to acquire Sugon, the server manufacturer headquartered on Huake Street. Notably, Sugon was originally Hygon's largest shareholder, holding a 27.96% stake. With Hygon's current market value at RMB 316.4 billion and Sugon's at RMB 90.5 billion, Hygon is now poised to consume the entity that nurtured it. How should we interpret this strategic move?

01

Three Levels of Interest Intertwining

Metaphorically, the proximity of Hygon and Sugon's registered addresses, less than a kilometer apart, signifies their complex and intertwined interests as upstream and downstream players in the semiconductor computing industry:

Surface Level: As Hygon's largest shareholder with a 27.96% stake, Sugon contributes a quarter of its profits to Hygon.

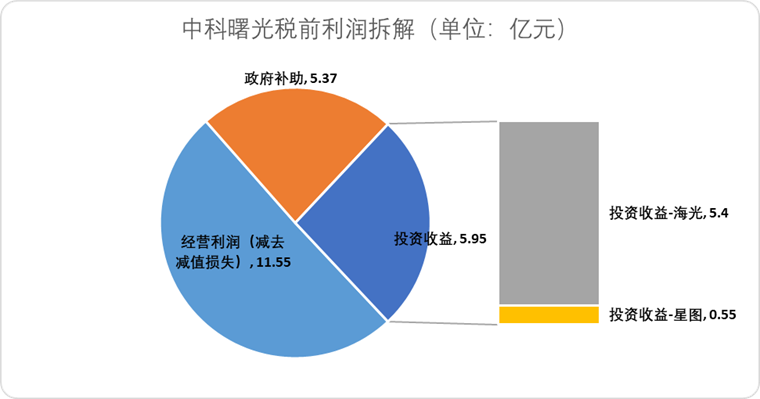

Taking the 2024 annual report as an example, Sugon recorded a pre-tax profit of RMB 2.291 billion, of which only RMB 1.413 billion was operating profit, further reduced to RMB 1.179 billion after deducting impairment losses. The difference in pre-tax profit mainly stems from other income of RMB 544 million and investment income of RMB 563 million.

Among the other income, a government subsidy of RMB 537 million, apart from a small amount of tax relief, constitutes non-operating income, contributing roughly a quarter of Sugon's profit.

Regarding investment income, excluding minor losses under the equity method, the main contributions come from two listed companies in which Sugon holds shares: Sinomap (SH:688568), contributing RMB 55 million, and Hygon, contributing RMB 540 million.

Figure: Breakdown of Sugon's pre-tax profit, source: corporate financial report, compiled by Jinduan Research Institute

In other words, government subsidies and Hygon contributed nearly half of Sugon's profit in 2024.

Stratosphere: As a potential largest customer, Hygon's performance is also closely tied to Sugon.

Considering the Hygon-Sugon merger solely from a shareholding perspective fails to capture the full picture. Beneath the surface of shareholding control, the two companies are intricately linked through specific business operations.

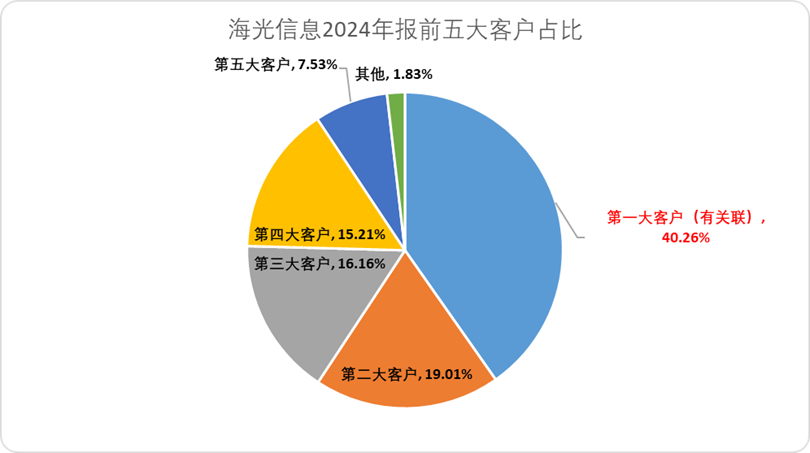

Hygon's financial report for 2024 shows a revenue of RMB 9.162 billion, slightly less than Sugon's, but with an operating profit of RMB 2.675 billion, indicating a significantly better operating profit margin. However, 98.16% of Hygon's sales in 2024 went to its top five customers, with the largest customer accounting for 40.26% of sales.

While high customer concentration in chip factory sales is not uncommon during the initial product phase (Cambrian Innovation's sales to its largest customer accounted for nearly 80% in 2024), Hygon disclosed that its largest customer is related to a listed company, implying an equity relationship with Hygon's listed entity.

Figure: Proportion and annotations of Hygon's top five customers in 2024, source: corporate financial report, compiled by Jinduan Research Institute

To determine the relationship, two criteria are applied: a narrow definition considers related enterprises holding more than 25% of shares, while a broad definition (referencing Hygon's share reduction commitment) considers at least 5% shareholding. Among Hygon's shareholders holding more than 5%, Sugon, Haifutianding, Lanhaiqingzhou, Chengdu Industry Investment, and Chengdu High-tech Investment stand out. However, Haifutianding and Lanhaiqingzhou are investment enterprises with no specific business ties, and Chengdu Industry Investment and Chengdu High-tech Investment are also investment firms. The only entity closely related to Hygon's operations is Sugon, fitting the narrow definition with over 25% shareholding.

Therefore, it is highly probable that Sugon is Hygon's largest customer. Proportionally, of Hygon's gross profit of RMB 5.838 billion, RMB 2.35 billion likely originated from Sugon, with Hygon subsequently distributing a final profit of RMB 540 million to Sugon. This interdependency raises questions about who is supporting whom.

Atmosphere: The two parties are also intertwined in personnel and daily operations.

Beyond financial statements, Hygon and Sugon are deeply connected in various aspects. Sha Chaoqun, the current director and general manager of Hygon, held senior positions such as technical vice president at Sugon for a long time. Li Jun, the president and acting chairman of Sugon, is also a director at Hygon.

Moreover, Hygon's disclosed related-party transactions reveal sales of goods worth RMB 3.68 billion to "Company A" in 2024, which coincides with sales to its largest customer and related party "Customer A". Assuming "Customer A" and "Company A" are the same entity (i.e., Sugon), Hygon also purchased technical service fees exceeding RMB 60 million and products/processing fees amounting to millions (possibly servers for R&D) from Sugon in 2024.

Furthermore, Hygon currently has RMB 1.64 billion in accounts receivable and RMB 890 million in contract liabilities from Customer A. The intricate business entanglements between Hygon and Sugon lead some commentators to believe that the merger aims to resolve horizontal competition issues, a reasonable assumption.

02

Power Transfer

The day after Hygon and Sugon announced their major restructuring, Sha Chaoqun, Hygon's director and general manager, stated at the performance meeting that the strategic merger would optimize the industrial layout from chips to software and systems, realizing the "strengthening, supplementing, and extending" of the industrial chain with significant technological synergies.

Market reactions are divided. Most commentators recognize the "from chip to cloud" industrial layout, emphasizing the need for concentrated efforts to achieve breakthroughs in semiconductor development.

Others cite examples like chip factories acquiring board card factories, arguing that downstream mergers can lead to potential customer loss for chip factories (similar to Bosch's strategy of being only a Tier 1 supplier) and use the case of 3DFX acquiring STB, ultimately benefiting NVIDIA, as a cautionary tale.

However, we tend to be optimistic about this merger for two practical reasons:

First, the comparison between 3DFX's acquisition of STB and Hygon's acquisition of Sugon is inherently flawed.

Before 3DFX acquired STB, STB's main shipped products were from N-factory, effectively cutting off some capacity and market investment in STB to compete for board card factory channels. This meant that with limited capacity, other board card factories lost purchasing power and market share.

However, the relationship between Hygon and Sugon is different. Before the merger, Sugon was already Hygon's largest customer. The merger will not alter Hygon's product direction or the product landscape of integrators and server manufacturers, rendering the comparison invalid.

Second, Hygon's acquisition of Sugon addresses current practical issues.

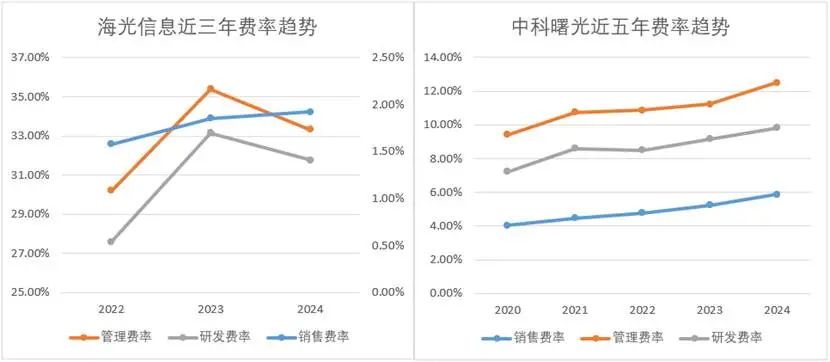

Firstly, there are complex financial intersections and horizontal competition issues that are difficult to resolve short-term. More importantly, there are numerous accounting figures within the two entities that can be optimized. Hygon's period expense ratio has cumulatively increased by 7.62 percentage points over the past three years, while Sugon's has risen by 7.55 percentage points over the past five years, with concurrent growth in management, sales, and R&D expenses.

Figure: Trend of period expense ratios of Hygon and Sugon, source: Choice Financial Client

As mentioned, Sugon is Hygon's primary customer. Post-merger, sales channel expenses are expected to decrease significantly, management scale will be streamlined, and there will be synergy at the R&D level, eliminating duplicate R&D investments and reducing the period expense ratio, thereby improving operating profit.

Even if correcting the period expense ratio takes time, at least the step of Hygon distributing after-tax dividends to Sugon can be omitted, further reducing duplicate tax expenditures. Why waste financial costs when already on the same team?

Secondly, there is the issue of industrial narrative. The failed case of 3DFX acquiring STB is a narrative from over 20 years ago. Since the accelerated development of AI, NVIDIA's rise to dominance is inseparable from its nearly 25-year downstream industrial chain layout. From acquiring Mellanox for USD 6.9 billion to this year's rumored acquisition of Lepton AI, a leading server leasing company, NVIDIA aims to provide full-stack data center services.

End-to-end computing power solutions have always been the focus of AI-era industry development. The merger of Hygon and Sugon indeed benefits chip products and computing power adaptation, offering more competitive products. Why not seize this opportunity?

Lastly, there is the current state of semiconductor development. The objective law of industrial development points towards marketization. Currently, China's leading semiconductor design industry has grown under the nurturing of the "Chinese Academy of Sciences system."

However, we believe that this merger goes beyond resolving accounting issues and holds deeper logical implications:

Each era has its technological leaders, from CPUs to GPUs, from Intel to NVIDIA. The rise and iteration of technologies and enterprises are objective expressions of industrial development cycles and concrete market demands. From Sugon to Hygon, and now this "reverse" merger, the underlying logic remains the same.

This further signifies that the merger of Hygon and Sugon is not merely a financial statement addition but a time-sensitive event:

It marks the transfer of power in China's semiconductor technology – the era of serial computing belonging to the internet is past, and the AI era of parallel computing is being solidified through real-money transactions worth hundreds of billions of dollars.

Those who embrace this change will thrive; those who resist will perish. Technology is silent but always acts accordingly.