AI: The Global Passport for Chinese Cloud Providers

![]() 08/08 2025

08/08 2025

![]() 731

731

The position of Chinese cloud providers in the global market is quietly evolving.

After eight months of preparation and a seamless transition lasting four hours and 54 minutes, Indonesia's largest tech company, GoTo Group, successfully migrated its instant transportation and delivery service, Gojek, to Tencent Cloud in June of this year.

Shortly thereafter, GoTo announced the deployment of its financial services business, GoTo Financial, on Alibaba Cloud. In the future, Alibaba Cloud will support Indonesia's national-level digital wallet, GoPay, serving over 20 million users.

As one of the largest internet tech companies in the Southeast Asian market, GoTo's decision to split its two core businesses between Chinese cloud providers underscores the rising prominence of Chinese cloud providers in the global market. This is merely a microcosm of cloud providers' overseas expansion efforts.

(In October 2024, at the China-Indonesia Business Forum, the President of Indonesia witnessed the official signing between GoTo Group and Tencent Cloud, Alibaba Cloud. Source: Internet)

In recent years, cloud providers have increasingly ventured overseas, primarily driven by the need for their own or Chinese enterprises' international expansion. However, since last year, there has been a notable shift: overseas expansion has been elevated to a corporate strategic level.

"We truly began treating overseas expansion as an independent endeavor last year," said Han Hongyuan, Vice President of Alibaba Cloud Intelligence and Chief Architect of the Public Cloud Business Unit, in May of this year. While overseas expansion has always been on the agenda, it has garnered more attention this year.

At Alibaba Cloud's China Enterprise Going Overseas Conference in Hangzhou in 2025, Wu Yongming, CEO of Alibaba Group, directly stated that Alibaba Cloud is investing at a strategic level to assist Chinese enterprises in their international expansion.

In September of last year, Tencent Cloud also clearly outlined three main growth avenues at its Industry Partner Summit: AI, overseas expansion, and fusion innovation. In April of this year, Li Qiang, Vice President of Tencent Group and President of Tencent Cloud's Government and Enterprise Business, stated that the company would continue to increase investment overseas this year.

Why has the overseas expansion of cloud providers significantly accelerated?

While seeking incremental markets is a well-known reason, the advent of the AI era has introduced a new dimension to cloud providers' overseas strategies. AI+cloud is poised to become a new breakthrough for cloud providers in international markets.

"AI is no longer a loosely coupled cloud service but has become the design principle for all cloud services," said Dai Kun, Vice President and Principal Analyst at market research firm Forrester.

Thus, by leveraging their early deployment of cloud infrastructure and serving overseas and local enterprises, Chinese cloud providers are strategically expanding into the global AI cloud market, particularly in emerging regions such as Hong Kong, Southeast Asia, the Middle East, and the Belt and Road Initiative, to explore new growth opportunities.

In the global cloud market, AWS, Google Cloud, and Microsoft Cloud have established a first-mover advantage based on "general technology standardization." As latecomers, Chinese cloud providers have traditionally followed suit. However, now, AI+localized scenario customization may become the breakthrough point for Chinese cloud providers.

This year, cloud providers' overseas expansion is not merely about expanding infrastructure but also about engaging in a deeper game of AI+ecosystems. Chinese cloud providers are transforming from "followers" to "rule co-constructors" in the global AI cloud market.

The crux of this transformation lies in the deep integration of AI technology with localized scenarios.

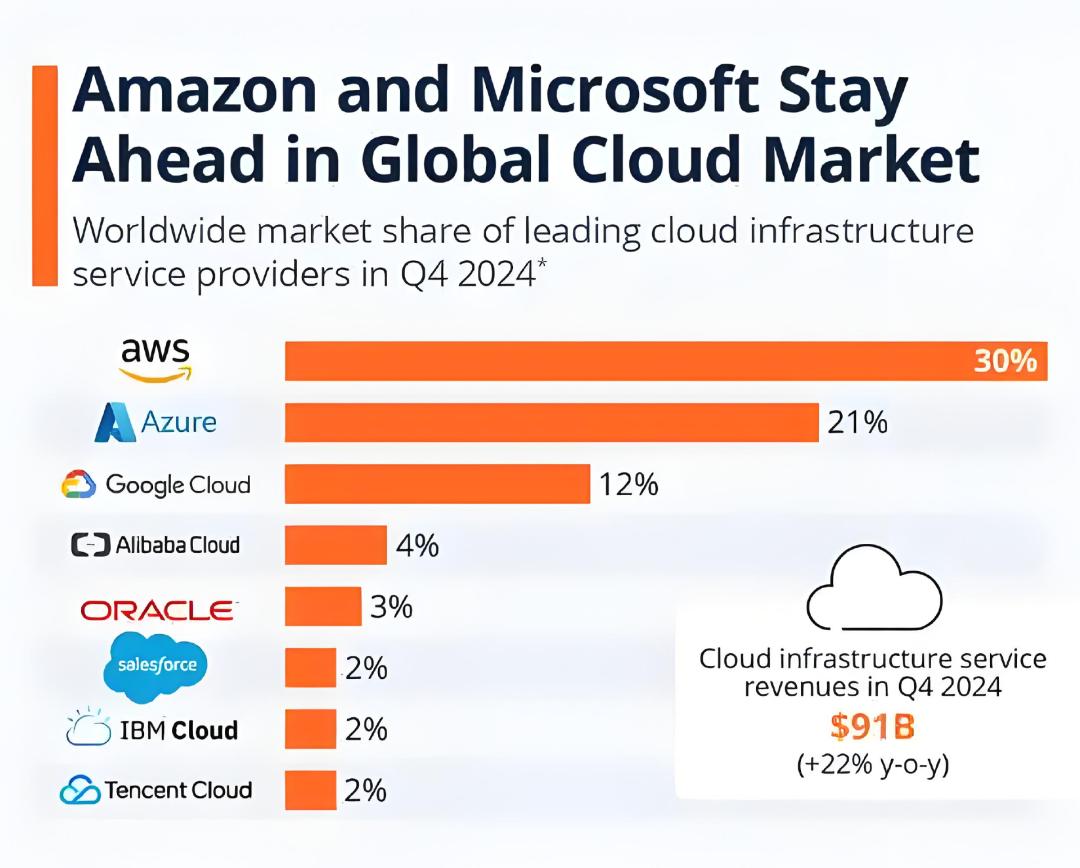

In the global cloud market, Chinese cloud providers have been catching up with leading international players.

In the global IaaS rankings, AWS, Microsoft Azure, and Google Cloud firmly occupy the top three positions, while Alibaba Cloud ranks fourth, being the only Chinese cloud provider among the global top five.

Relevant data shows that in 2024, Amazon AWS accounted for 30% of the global market share, followed closely by Microsoft Azure with 21%. Google Cloud successfully increased its market share to 12% due to its breakthroughs in the AI field. Alibaba Cloud holds a 4% global market share, while Tencent Cloud ranks eighth globally with a 2% market share.

It is evident that Chinese cloud providers face strong competitive pressure in the global market.

However, comparatively, the growth rate of Chinese cloud providers in the global market is impressive. Taking Alibaba Cloud as an example, its market size has increased by over 20 times in five years. According to Gartner data, Alibaba Cloud is the largest cloud service provider in Asia-Pacific and China. Huawei Cloud's overseas revenue increased by over 50% annually, with revenue growing by 18% year-on-year. Tencent Cloud's international business has achieved double-digit growth for three consecutive years.

However, for Chinese cloud providers to achieve further breakthroughs in the global market, relying solely on selling cloud services is unrealistic. Hence, AI has become the "passport" for Chinese cloud providers to go global and the key turning point in their global competition.

Why is AI so crucial for cloud providers?

On one hand, the era of large AI models is sparking a new wave of enterprise application demand, which in turn fuels the growth of AI cloud. AI is also bringing tangible revenue growth to global cloud providers.

According to Microsoft's fiscal third-quarter 2025 earnings report, Microsoft Azure grew at a year-on-year rate of 33%, with AI services contributing 16 percentage points, up from single-digit percentages in the previous quarter.

This indicates that a significant portion of new cloud demand is directly driven by AI workloads. It suggests that enterprise customers are not merely "trying out" AI but are beginning to migrate and deploy it on the cloud as a core business workload.

Furthermore, Satya Nadella, CEO of Microsoft, revealed a key data point during the earnings call: the annualized revenue run rate (ARR) of the AI business has exceeded $13 billion, a year-on-year surge of 175%.

These $13 billion are not distant promises but are real, ongoing revenues.

Google Cloud's growth rate was 31% in Q1 2025, with Gemini API calls surging 200% in half a year. Seventy percent of generative AI unicorns use its services, and it is precisely through its investment in AI that Google Cloud has increased its global market share to 12%.

Domestically, relevant data shows that Alibaba Cloud, Baidu Intelligent Cloud, and others have achieved revenue growth reversals due to their investment in AI, returning to growth.

For instance, Alibaba's fiscal 2025 annual report reveals that driven by AI demand, Alibaba Cloud's fiscal year revenue exceeded double-digit growth, and AI-related product revenue achieved triple-digit year-on-year growth for seven consecutive quarters.

It is clear that the wave brought by generative AI is sweeping the globe, with more and more enterprises integrating it into their business systems, which in turn drives their demand for cloud computing.

Similarly, the Chinese market is also experiencing a wave of large-scale AI model deployment applications. More importantly, more and more enterprises are also beginning to export AI technology capabilities to overseas markets.

Currently, Chinese enterprises going overseas are shifting from digitalization and industrial expansion to intelligence and industrial expansion.

At the 2025 Alibaba Cloud China Enterprise Going Overseas Summit in Shenzhen, Liu Weiguang, Senior Vice President of Alibaba Cloud Intelligence Group and President of the Public Cloud Business Unit, pointed out that in the decade starting from 2024, it is imperative for Chinese enterprises to go overseas with AI capabilities.

"Over the past year, I have visited almost all domestic OEMs and found that from 2025 onwards, every Chinese car going overseas will be equipped with intelligence or even autonomous driving capabilities, every mobile phone will have AI capabilities, and smart wearables, drones, etc., are also powerful AI product forms," said Liu Weiguang. The combination of cloud and AI is no longer just underlying infrastructure but plays a crucial supporting role.

Based on this, it is evident that in the face of strong competitive pressure in the global cloud market, AI offers cloud providers a second growth curve. Moreover, AI is still in its nascent stages, with even greater growth potential in the future. This is undoubtedly a new opportunity for Chinese cloud providers.

"From an overall trend perspective, 78% of global enterprises will embrace AI. If the past decade was about the transformation of digitalization and cloud computing, the next decade will be about the challenges and opportunities of cloud+AI," said Yuan Qian, Vice President of Alibaba Group and President of Alibaba Cloud's International Business Unit.

From the global AI wave to the intelligent overseas expansion of Chinese enterprises, the overseas expansion of Chinese cloud providers must also be integrated with AI. So, how can Chinese cloud providers leverage AI to capture a larger share of the global cloud computing market?

In the global cloud computing market, Microsoft Azure, Google Cloud, and Amazon AWS are still growing at a rapid pace. For Chinese cloud providers, if they do not proactively seize the market, these shares will flow to these international cloud providers.

The first step in capturing territory is, of course, to lay a solid foundation.

Currently, when serving the overseas market, Chinese cloud providers primarily serve Chinese enterprises going overseas. These customers generally have a dual-architecture system with one cloud in China and one cloud abroad, making it challenging to achieve coordinated development at home and abroad.

LiblibAI, the first domestic AI original image community, has invested in overseas model ecosystem construction since last year and created a multimodal content toolset. For the overseas market, it faces issues such as compliance, consistent global access, rapid business iteration, and concurrent multi-model invocation.

In fact, in addition to LiblibAI, large model vendors such as Shengshu Technology and Minimax are also deploying in overseas markets, and these enterprises face the same issues abroad.

To address these challenges, a global network is essential, and this network must also possess out-of-the-box AI capabilities.

From last year to the present, cloud providers including Alibaba Cloud, Tencent Cloud, Huawei Cloud, and others have accelerated their investment in overseas cloud infrastructure construction and deeply integrated AI capabilities into cloud infrastructure.

In May of this year, Wu Yongming stated, "Alibaba Cloud will accelerate the construction of a global cloud computing network covering China, Japan, Korea, Southeast Asia, the Middle East, Europe, and the Americas. This year, we will open seven new data centers: in the United Arab Emirates, Thailand, Malaysia, the Philippines, South Korea, Japan, and Mexico."

It is reported that in each data center across 29 regions and 87 availability zones globally, Alibaba Cloud pre-installs Tongyi Large Model, Bailian Inference Engine (supporting GPU second-level startup), and PAI Training Platform, enabling an "out-of-the-box" AI environment.

This year, Tencent Cloud will also continue to increase its overseas investment, planning to invest $150 million in the Middle East to establish its first data center in Saudi Arabia, which will be operational within the year. At the same time, Tencent Cloud also announced the construction of a new availability zone in Osaka, Japan, making it the third data center in Japan after the two availability zones in Tokyo.

Currently, its infrastructure spans 21 regions on five continents, operates 56 availability zones, and deploys over 3,200 acceleration nodes with 200T bandwidth reserves, meeting the global business expansion needs of enterprises. Data shows that Tencent Cloud's international business has maintained double-digit growth over the past three years, serving over 10,000 overseas customers across more than 80 countries and regions.

At the same time, Tencent Cloud's overseas infrastructure has undergone an AI upgrade, shifting from mere "computing power expansion" to "AI-native architecture." Through the integration of cloud intelligence computing, edge network real-time optimization, and localized data center compliance support, it has formed an overseas AI infrastructure matrix covering the entire "training - inference - application" chain.

For example, in Saudi Arabia, its dual availability zones not only support large model inference but also enable AI barrage interactions for esports live streaming through edge clouds. In Southeast Asia, edge intelligence computing nodes are directly embedded in automaker production lines, enabling "zero-time-lag" AI quality inspection.

Furthermore, Huawei Cloud's overseas data center expansion plan also takes "a global network" as its core strategy, accelerating its layout in emerging markets such as Africa, Southeast Asia, the Middle East, and Latin America through localized deployment and ecological cooperation.

In the past two years, it has continuously expanded into the Middle East and North Africa, successively opening nodes in Riyadh, Saudi Arabia, and Egypt. Its Egyptian node is the first public cloud in North Africa. In February of this year, Huawei Cloud opened a node in Nigeria, which is also the first local cloud in West Africa.

From last year to this year, Chinese cloud vendors have been continuously expanding their overseas infrastructure, particularly in basic disk capacity. Initially dominant in the Asia-Pacific region, they are now progressively venturing into emerging markets such as the Middle East, North Africa, and West Africa.

Furthermore, this expansion is accompanied by an upgrade of their overseas infrastructure, which not only enhances the efficiency of AI deployment globally but also positions cloud vendors as not just providers of computing power, but co-creators of AI scenarios through technological innovation.

With Alibaba Cloud operating 89 availability zones across 30 regions, firmly leading in the Asia-Pacific, and Huawei Cloud's 384 super-node surpassing NVIDIA in single-node inference performance, the gap between Chinese and international cloud vendors in computing power infrastructure is narrowing. The true breakthrough lies in the localized cultivation of AI applications.

This echoes a previous statement by Yu Kai, CEO of Horizon Robotics: "to compete where there is no competition."

In recent years, emerging regions like the Middle East and Latin America have shown strong demand for digital transformation. Saudi Arabia's Vision 2030 plan, for instance, prioritizes "digitalization" and "new energy." Meanwhile, data indicates that cloud computing usage in Latin America will increase by 25% over the next five years, with analysts predicting the Latin American cloud market to reach $22 billion by 2025.

Moreover, amidst the current wave of large AI model development, there is a demand for AI application deployment in both Southeast Asia and these emerging regions. Crucially, these areas are not at the forefront of large AI model technology development and need to leverage advanced models to catch up.

"Indonesia is the third-largest AI market globally and is advancing rapidly in AI deployment," said William Xiong, CTO of GoTo Group. "For GoTo Group, open-source models are highly beneficial."

It's evident that these untapped "no man's lands" offer immense opportunities. For Chinese cloud vendors to establish a foothold, they must integrate their capabilities, especially in AI, rather than merely selling products.

From the perspective of large model technology, China's open-source models have consistently maintained a leading position in the global market. As of July 31, according to the latest trend hotlist from Hugging-Face, nine out of the top ten models are domestic. Zhipu's newly released flagship model GLM-4.5 tops the list, followed by Alibaba's Tongyi Qianwen model Qwen3 in second, and Tencent's Hunyuan's latest 3D model in third.

Unlike closed models, open-source models can be downloaded, deployed, and used by anyone. Thus, China's open-source models serve as seeds that can be disseminated, rooted, and sprouted globally, allowing developers to retrain or deploy them.

Some enterprises prefer to run on Chinese cloud vendors' full-stack AI infrastructure when going abroad due to the use of Chinese large models.

William Xiong also believes that, considering both cost and performance, China's open-source models offer significant advantages and are more suited to the needs of developing country markets.

Currently, in addition to Alibaba, major Chinese internet companies such as Tencent, Huawei, and Baidu have all open-sourced their large model products, which will undoubtedly propel the growth of their cloud computing businesses in overseas markets.

While Chinese cloud vendors lead in open-source large model technology, achieving good implementation results necessitates combining these models with specific localized scenarios.

For Chinese cloud vendors, localized in-depth cultivation involves more than simple translation or adaptation; it requires AI capabilities to grow in tandem with local markets.

Language is the first hurdle. Alibaba Cloud's Tongyi Qianwen series of open-source models support 119 languages, covering southeast Asian, Middle Eastern, and other minority language markets. On Indonesian e-commerce platforms, merchants use it to generate Indonesian product descriptions, improving efficiency by 60%. This makes AI tools affordable even for small businesses.

"BYD's employees and global upstream and downstream channel partners use Tencent Meeting for global collaboration, connecting over 30 industrial zones across six continents. They hold over 10,000 cross-border meetings on Tencent Meeting every month. Tencent Meeting's 17-language translation capability significantly enhances communication efficiency across borders and languages," said Li Qiang.

Additionally, Tencent Cloud has embedded the Hunyuan large model into products like WeChat Work and Tencent Meeting, forming a "large model suite." Overseas cross-border e-commerce businesses utilize it to build AI customer service systems, improving response speed by 40%, essentially replicating proven solutions from the Chinese market.

Previously, Tan Weihua, Vice President of Xiaopeng Motors and head of global infrastructure, also stated that Xiaopeng Motors now offers more than just automotive products; the company's business also includes flying cars and AI robots. All three heavily rely on AI infrastructure and localized computing power.

To address these challenges, Xiaopeng Motors and Alibaba Cloud have jointly built domestic and overseas technical frameworks. Tan Weihua explained, "The technical architectures of the two are integrated, allowing us to quickly replicate domestic R&D teams globally."

In fact, Chinese cloud vendors have also set their sights on more nuanced battlegrounds. For example, Tencent Cloud created a digital avatar named "Khalifa" for Abu Dhabi's Department of Culture and Tourism using digital human technology, while Alibaba Cloud optimized the recommendation engine for miHoYo's "Genshin Impact" overseas service.

These seemingly fragmented local scenarios constitute a unique advantage for Chinese cloud vendors—rather than confronting global giants head-on, they establish barriers with localized AI solutions in areas where these giants have not yet deeply cultivated.

"In the next 3 to 5 years, or even longer, we will definitely focus on AI, expanding capabilities based on AI strategies and overseas data centers. We need to consider how to build more competitive products, technologies, and service capabilities overseas," said Yuan Qian. "We will continue to increase investment in infrastructure, AI capabilities, and local service systems, aiming to establish a globally competitive cloud computing network."

Behind the in-depth localization of AI scenarios lies a strategic shift for Chinese cloud vendors, transitioning from "selling clouds" to co-constructing ecosystems with local enterprises.

For instance, Alibaba Cloud established its first AI Global Competency Center in Singapore, aiming to attract over 1,000 enterprises and startups to participate in developing new-generation AI solutions. Tencent Cloud has forged strategic partnerships with enterprises like YZ-Intelligence and MiniGame under Saudi Arabia's "Vision 2030" plan. Huawei Cloud, on the other hand, launched the "Spark Program for Developers" in Southeast Asia, training over 5,000 local AI developers and collaborating with universities to offer AI courses.

Undoubtedly, the large model ecosystem of Chinese cloud vendors is essentially a global experiment in "technology spillover + ecosystem replication." However, ultimately, finding a balance between compliance, cost, and scenarios will determine whether Chinese cloud vendors can transition from "followers" to "rule makers".