Smart Bands Still Thrive! Xiaomi and Huawei Witness Explosive Sales, While Keep Emerges as a Surprise Contender

![]() 11/05 2025

11/05 2025

![]() 450

450

Smart Bands Remain a Dominant Force

Who would have predicted that smart bands would experience a sales surge in the third quarter of 2025?

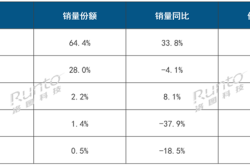

Recently, Runto Technology unveiled a report detailing China's online smart band market for Q3 2025. During this timeframe, online sales of smart bands soared to 2.969 million units, marking a 13.5% year-over-year increase. Simultaneously, sales revenue soared to 940 million yuan, reflecting a substantial 33.5% growth.

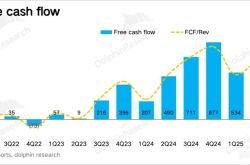

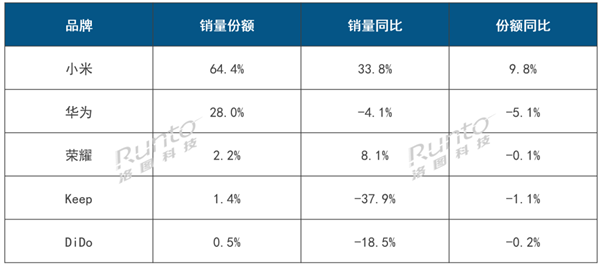

However, the third quarter witnessed an unexpected duopoly, with Xiaomi and Huawei dominating the market landscape. Data reveals that Xiaomi commanded approximately 64.4% of the market share, firmly securing the top spot, while Huawei trailed closely with around 28%. Together, they accounted for over 90% of the market. Meanwhile, other brands saw their market shares further dwindle, with niche players like Huami nearly vanishing from the rankings.

(Image Courtesy: Runto Technology)

Once celebrated as the 'gateway to mass-market smart wearables,' the smart band has now entered a highly concentrated phase. Amidst the broader trend of wearables evolving towards 'smartwatchification,' the positioning of smart bands has become more nuanced. They are neither basic pedometers nor can they compete with the rich feature sets offered by smartwatches. Yet, this sudden sales spike indicates that the smart band category remains vibrant.

How Did They Achieve Success? Xiaomi, Huawei, and Keep Each Take Unique Paths

Among the top five brands identified by Runto Technology, Xiaomi and Huawei secured the top two positions, while Honor, Keep, and DiDo occupied the remaining spots. Despite ranking third, Honor held a mere 2.2% share, significantly trailing Huawei in second place.

Xiaomi's sustained growth is closely linked to its strategic product approach. This year, the launch of the Xiaomi Band 10 continued its legacy of high cost-effectiveness, featuring a 1.72-inch AMOLED display with enhanced brightness and AOD (Always-On Display) support. Its design and user interface now closely resemble those of lightweight smartwatches, all while maintaining a price point below 300 yuan—creating a clear price gap between the Xiaomi Band, Xiaomi's REDMI Band, and Xiaomi Watch.

More importantly, the Xiaomi Band is not a standalone device but serves as the lightest entry point into Xiaomi's AIoT ecosystem. For users of Xiaomi's HyperOS, the band offers a seamless 'plug-and-play' experience, effortlessly syncing health data, activating voice assistants, and controlling smart home devices. This combination of ecosystem integration and pricing strategy has positioned the Xiaomi Band as an integral part of Xiaomi's broader ecosystem.

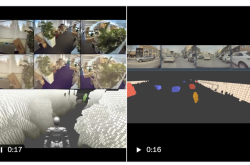

(Image Courtesy: Xiaomi)

In contrast, Huawei has adopted a professional health-centric approach with its Band 10. Unlike other smart bands that primarily cater to fitness enthusiasts, Huawei's offering incorporates features previously exclusive to smartwatches, such as sleep apnea monitoring, menstrual cycle reminders, and stress tracking. Rather than transforming the band into a miniature watch, Huawei has crafted it into a specialized, precise, and low-power health device. This positioning is ideal for users seeking continuous health monitoring without the inconvenience of daily charging or wearing a bulky watch.

(Image Courtesy: Huawei)

Notably, Keep, an internet-based fitness platform, has successfully ventured into the hardware space. Despite being a late entrant, Keep's smart bands focus on sports training, enabling them to tailor products for niche scenarios. Features like badminton and table tennis modes cater specifically to fitness enthusiasts, enhancing the overall user experience. Additionally, Keep leverages its platform to directly promote and sell these products, effectively converting fitness users into buyers. This strategy has positioned Keep as a surprise contender in the smart band market.

(Keep's App Store prominently features smart bands, Image Courtesy: Lei Technology)

Ultimately, as users transition from valuing 'feature lists' to prioritizing accuracy in health data and seamless algorithmic experiences, only brands offering a comprehensive ecosystem can maintain their market position. For price-sensitive consumers uninterested in advanced features, mainstream brands are naturally overlooked. Beyond price wars, only distinctive brands like Xiaomi, Huawei, and Keep are firmly embraced by the market.

Sales Decline, Yet the Smart Band Market Endures

A closer examination of the industry reveals a harsh yet undeniable reality: the smart band market is indeed contracting.

In recent years, smartphone brands like OPPO have largely exited the smart band segment, redirecting their resources towards smartwatches. The rationale is straightforward: watches offer higher profit margins, broader functionality, and align better with brands' aspirations for premium positioning. As smartwatch prices decline and their app ecosystems mature, the gap between bands and watches narrows, redistributing consumer attention.

This trend is evident in the data. According to Canalys, global shipments of wearable wrist devices reached approximately 193 million units in 2024, marking a mere 4% year-over-year increase—far from the 30%-plus growth witnessed in earlier years. The market has effectively plateaued.

While China remains the world's largest single market, accounting for roughly 30% of global wrist device shipments, competition among local brands has become intensely concentrated. Manufacturers outside the top two have seen their market shares further eroded. IDC data indicates that wristbands' share of the global wearable market is declining annually, signaling a shift from 'lightweight smart devices' to 'full-featured devices.'

(Image Courtesy: Huawei Official Website)

It is evident that the era of rapid expansion for smart bands has concluded.

Firstly, user expectations for 'wearables' have evolved. Bands were once perceived as entry-level smart devices, but consumers now demand more—standalone payments, navigation, comprehensive health reports, and personalized fitness planning. Bands struggle to meet these expectations due to hardware limitations in screen size, processing power, and battery life. When smartwatches become more affordable, users naturally opt for the more comprehensive option.

Secondly, manufacturers are reevaluating their product strategies, particularly phone makers focused on ecosystems. Bands initially served as gateways to brand ecosystems, but as smartphones and watches offer mature synergies, the band's role in driving user acquisition diminishes. For large firms, maintaining a low-margin, slow-updating product line becomes less cost-effective. For smaller players, lacking an ecosystem to support bands renders them nearly uncompetitive.

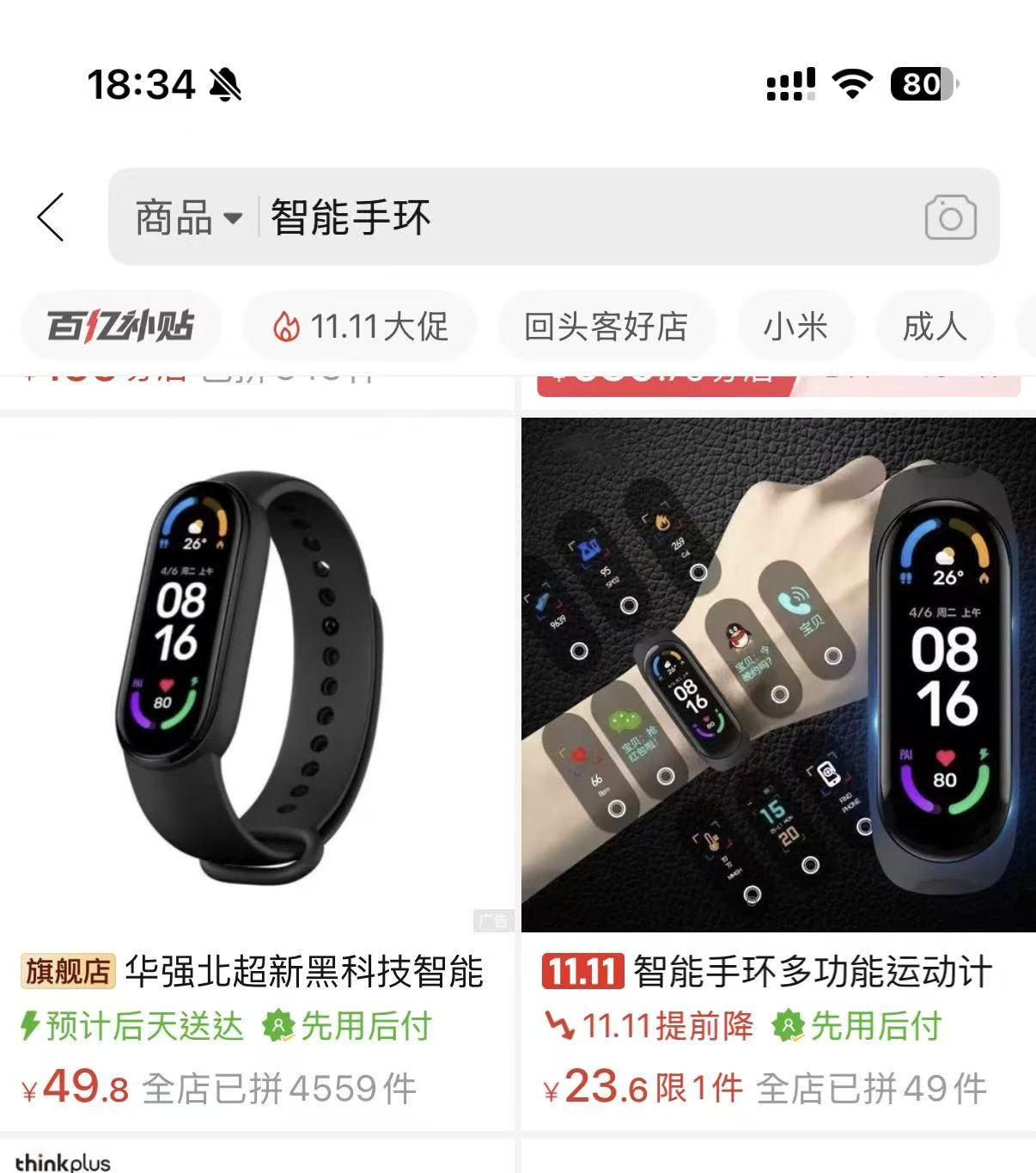

(Image Courtesy: Pinduoduo)

This creates a classic mid-market vacuum: premium users gravitate towards watches, while the low-end market is dominated by cost-effective offerings from top brands. Mid-tier players lose their footing, explaining why the top three sellers—Xiaomi, Huawei, and Honor—are all established names rather than specialized or budget-focused brands.

However, Lei Technology contends that smart bands are transitioning from scale expansion to ecosystem integration. The success of Xiaomi and Huawei demonstrates the category's continued relevance, though its value now lies in its ecosystem role rather than sales volume. Future competition will focus not on 'who has more features' but on 'who is lighter, more accurate, and better understands users.'

Thus, smart bands can leverage their strengths as lightweight wearables, emphasizing low power consumption, long battery life, and all-day wearability. They should also embrace AI, transforming from passive monitoring devices into proactive, AI-driven wearables capable of autonomous recommendations.

Moreover, smart bands could evolve into foundational sensors for AI-powered health ecosystems, providing detailed health and fitness data to other devices. Regardless, while competition may not be as fierce as in previous years, demand for smart bands remains robust, with many users eagerly awaiting innovations.

The Smart Band Will Not Be Completely Eliminated

The smart band has evolved from a 'mass-market product' to an 'efficiency-focused tool.'

Once pivotal in driving wearable adoption, it now serves as a supplementary node within broader ecosystems. The sustained growth of Xiaomi and Huawei indicates that smart bands are not disappearing but are undergoing a realignment—shifting from pure sales volume to ecosystem integration and long-term value.

As the global wrist device market enters a period of slow growth, competition has shifted from hardware specifications to algorithmic and systemic capabilities, marking a return to rationality in the industry.

(Image Courtesy: Xiaomi)

The domestic market landscape is largely settled, with future growth driven by health management and AI-driven data services. Overseas markets will remain focused on affordability and mass adoption, though premium opportunities are limited. For manufacturers, the key is no longer launching new products but maintaining connection stability and data accuracy within existing ecosystems.

The smart band's future lies not in elimination but in redefinition. It will no longer be synonymous with smart wearables but will serve as a foundational component of AI-powered health ecosystems—a stable, reliable, and sustainable data node. As the market transitions from 'scale expansion' to 'technological refinement,' surviving manufacturers must provide compelling reasons for users to continue wearing their bands.