7 Billion Valuation: Kayou Flunks Second IPO Bid

![]() 11/11 2025

11/11 2025

![]() 452

452

Author: Vincent

Editor: Jiajia

Recently, the official website of the Hong Kong Stock Exchange disclosed that after a six-month wait, the prospectus of Kayou has lapsed. This represents the second failed attempt at an initial public offering (IPO), following the initial failure in January 2024.

Unlike other companies that fail to go public due to financial issues such as revenue, Kayou is a highly profitable enterprise. It commands market shares of 71.1% and 24.3%, respectively, in the trading card game (TCG) sector and the pan-entertainment stationery industry, ranking first in both categories. In 2024, its revenue and profit reached 10.057 billion and 4.466 billion yuan, respectively.

Given its outstanding performance, Kayou has earned the moniker of the "TCG leader," with a valuation nearing 7 billion yuan. However, behind its high profitability and growth lies public criticism of its "gambling-like" business model. Sina Finance's Listed Company Research Institute even labeled it as a "primary school student harvester" with a "gambling-like" business model.

【1】Super Profitable Kayou

How profitable can trading cards featuring licensed intellectual properties (IPs) like Ultraman, Naruto, and Digimon be? Their profit margins exceed imagination.

According to prospectus data, in 2022, Kayou's revenue was 4.131 billion yuan with a net profit of 1.62 billion yuan. By 2024, these figures had grown to 10.057 billion yuan and 4.466 billion yuan, respectively. Over two years, revenue and profit growth reached 99.57% and 176%, respectively.

Over the past five years, China's TCG market has experienced a compound annual growth rate exceeding 50%. CITIC Securities predicts that by 2027, China's TCG market size will reach 35.1 billion yuan. Competitors include Card Club, Hitcard, and even trendy toy competitors like Pop Mart.

But why does Kayou stand out? The reason lies in its IP matrix and channel capabilities:

Currently, IPs such as Ultraman, My Little Pony, Eggy Party, Naruto, Detective Conan, and Harry Potter are extremely popular among primary school students. For them, these Ultraman cards are akin to adult collectibles of the "One Piece" series or Pop Mart's Labubu figures—essential in daily life.

(Source: Internet)

(Source: Internet)

However, primary school students' love for a single product cannot sustain Kayou's revenue exceeding 10 billion yuan. Kayou achieves strong repurchase rates through a diverse product system.

This diversity refers not only to Kayou's portfolio of 69 licensed IPs and one proprietary IP but also to the extreme commercialization of each IP.

Take Ultraman cards as an example. Kayou features over 50 Ultraman characters, but its derived products include 320 TCG series and 42 stationery series. My Little Pony cards have 20 levels from N to SC, along with series like Fun Shadow Packs, Rainbow Packs, Glorious Moon Packs, and Twilight Packs.

In essence, Kayou develops N series for a single IP character, maximizing its commercial value.

Additionally, Kayou vigorously expands its offline channels, covering 217 distributors across 31 provinces and 32 self-operated flagship stores. These distributors further distribute products to stationery stores and convenience stores near school gates.

According to its prospectus, in 2024, revenue from national distribution channels still accounted for over 80%, indicating strong offline sales network penetration.

China Report points out that a strong IP matrix and offline channels have formed a certain moat for Kayou in the domestic youth TCG market.

While sales are growing, Kayou's profits are even more crucial. Data shows that in 2024, Kayou sold 4.8 billion packs of TCGs with direct material costs of 1.938 billion yuan.

This calculates to a production cost of 0.4 yuan per pack. Correspondingly, terminal prices range from 2 to 30 yuan per pack, depending on the IP.

Even considering IP licensing costs, Kayou's profit margins are astonishingly high.

In 2024, Kayou's gross profit margin was 67.3%, with the core TCG segment reaching 71.3%. In comparison, the popular Pop Mart had a gross profit margin of only 66.79% that year.

Due to its exceptional profitability, Kayou ranked 66th on Hurun Research Institute's "2025 Global Unicorn List" with a valuation of 6.95 billion yuan, becoming a dark horse among unicorns.

【2】Kayou's Gambling-Like Business Model

Despite impressive financial performance and market leadership in TCGs and pan-entertainment stationery, Kayou has faced setbacks in its IPO attempts.

Curiously, why has Kayou failed in two IPO attempts?

In January 2024, Kayou submitted its prospectus to the Hong Kong Stock Exchange. Subsequently, the China Securities Regulatory Commission (CSRC) requested Kayou to prove it had established effective data security management systems and protection measures in compliance with the "Data Security Law of the People's Republic of China," "Measures for the Security Assessment of Data Exits," "Measures for the Security Management of Data in the Industrial and Information Technology Sector (Trial)," and "Provisions on the Online Protection of Children's Personal Information."

In April 2025, Kayou submitted its prospectus again. However, six months after the deadline, its IPO application lapsed.

Media outlets like Sina Finance's Listed Company Research Institute and Shenzhen Economic Daily pointed out that Kayou's IPO failures may stem from its "gambling-like" or "junior gambling" business model.

Kayou's "gambling-like" or "junior gambling" business model is not an exaggeration:

Firstly, Kayou artificially controls the appearance probabilities of different card types to determine the rarity of various character types across series.

Take Kayou's My Little Pony Glorious Moon Pack – Series 5 as an example. According to Cover News, the probability of obtaining the "rarest" card is 1 in 216, meaning one rare card appears in every 216 packs. With over 10,000 boxes distributed in Shanghai, nearly 50 rare cards are in circulation.

Secondly, Kayou exploits primary school students' immature competitive psychology by designing blind boxes.

According to Yangcheng Evening News, over 90% of consumers in China's TCG market are under 15 years old. Kayou holds a 71.1% market share in TCG sales, indicating its primary user base is primary school students.

Unlike rational adults, primary school students lack a concept of money and often fall into consumption blind spots. Kayou's blind box design traps young people in a "Skinner Box": random rewards create anticipation, stimulating dopamine secretion in the brain and encouraging repeated purchases.

This phenomenon is reflected in Kayou's financial reports.

According to its prospectus, in 2024, Kayou sold a total of 4.8 billion card packs. Assuming a conservative estimate that 90% of users are under 15, approximately 4.32 billion packs were purchased by primary school students.

Given that there were 106 million primary school students in China in 2024, this averages to 40.8 packs per student per year, suggesting addictive tendencies in Kayou's blind box card design.

Last July, CCTV Finance's investigative program even called out Kayou for attracting minors to spend wildly on cards through blind pack rarity tiers.

(Source: China Report)

(Source: China Report)

Therefore, on its prospectus, Kayou lists minors as a significant risk factor, warning that inadequate protection of minors could harm its brand reputation.

【3】Betting Agreement After IPO Failure

Kayou's card designs are addictive to minors, and its founder, Li Qibin, is even more "gambling-oriented."

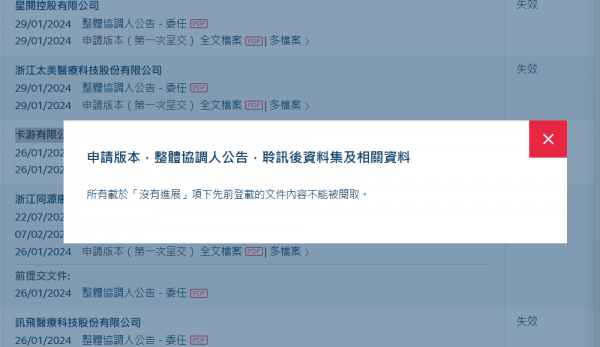

Riding on the Ultraman IP boom, Kayou urgently needed funds for further expansion. In late 2021, Sequoia Capital and Tencent invested $105 million and $30 million, respectively, through their subsidiary Grand Hematite Limited, totaling $136 million to support its business development.

Unlike investments without specific IPO timelines, this funding round for Kayou was a betting agreement: If Kayou fails to go public before June 2026, investors have the right to demand redemption of all or part of the issued preferred shares at an 8% annual interest rate.

(Source: Hong Kong Stock Exchange)

(Source: Hong Kong Stock Exchange)

After two failed IPO attempts, Li Qibin has only seven months left. The Hong Kong Stock Exchange's listing cycle typically takes 3-6 months. Calculating at the maximum six months, if Kayou fails to pass regulatory hearings within six months, it will have almost no time left and may be forced to repurchase shares at a high interest rate.

According to estimates, if Kayou fails to go public before June next year, Li Qibin and Kayou will need to spend $190 million (approximately 1.35 billion yuan) on repurchases. Many believe this will impose significant financial pressure on Kayou.

However, after examining Kayou's cash reserves, Treasury Finance found that Li Qibin may not care about going public before June next year, as Kayou can fully afford the betting agreement compensation.

Data shows that from 2022 to 2024, Kayou's net profits were 1.62 billion, 934 million, and 4.466 billion yuan, respectively, totaling 7.02 billion yuan over three years. Paying 1.35 billion yuan in betting compensation poses no pressure.

More suspiciously, does Kayou even need to go public? Is Li Qibin truly willing to take Kayou public?

Going public is to raise funds for business development, but it requires disclosing all corporate information and sacrificing some founder equity.

However, Kayou is different from companies eager to go public. It is highly profitable and not short of cash. Why should Li Qibin and his wife, who hold over 80% of the equity, relinquish shares in this "cash cow"? From a founder's perspective, isn't this family-owned cultural and creative enterprise preferable?

Despite two failed IPO attempts, Kayou remains rooted as the "TCG leader." It is still an incredibly profitable and cash-rich company, easily capable of handling potential "betting crises."

However, its business model's inherent "gambling-like" elements, especially its precise manipulation of minors' consumption psychology, have become the biggest obstacle to its capital market ambitions.

With increasing regulatory focus on data security and minor protection, Kayou must not only prove its "profitability" but also answer a more fundamental question: How to find a truly sustainable balance between commercial success and social responsibility.

END