Radical capex scared away the God of Stocks

![]() 08/09 2024

08/09 2024

![]() 573

573

In recent days, besides the yen carry trade, the second major event was Warren Buffett significantly reducing his stake in Apple. When he sold 11% of his Apple shares in the first quarter of this year, the God of Stocks said it was due to high taxes. However, to the market's surprise, Buffett sold another 400 million shares in the second quarter, reducing his holdings from 789 million shares to about 400 million shares, halving his Apple stake. The original tax issue likely was not the reason for the sale, but rather other factors.

Regarding the reasons, there are many speculations in the market. Duan Yongping believes that Warren Buffett's actions are not surprising, as it could mean that the current valuation is too high or that Buffett has better opportunities elsewhere.

Putting aside conspiracy theories, the reason might be that Apple has reached Buffett's psychological price level. The upcoming AI wave story may be beyond Buffett's 'circle of competence,' as major tech companies are increasing their capex, and Apple, though not spending much among the FAANG+ companies, may also have to increase its capex in the future. The profitability of these investments is uncertain, combined with Apple's recent surge in share price. When the mid-term logic changes, Buffett may choose to reduce his holdings.

Another speculation in the market is that Buffett believes current tech stock valuations are too high, and he is also reducing his stake in Bank of America. This has resulted in Berkshire Hathaway's cash reserves reaching $276.9 billion, leading the market to speculate that Buffett is preparing for interest rate cuts and tech stock corrections. Is he hoarding cash to buy at the bottom?

Selling at the peak of enthusiasm is indeed interesting. Combining recent news, we can guess what Buffett might be thinking.

1. The grand cycle of tech stock capex

Duan Yongping said that Buffett's statement that Apple will likely remain his largest holding by the end of the year implies he intends to continue selling but will not sell out entirely for fear of market crashes. Apple's share price surge since May could be considered a special reason for Buffett to sell. If there is a significant market downturn, he would sell to protect himself. Alternatively, if market sentiment is good, Buffett's large sales will not significantly impact the market.

Indeed, looking back at Apple's share price movement in the second quarter, who would have expected its largest buyer in recent years to be significantly reducing its stake?

The primary reason for Apple's share price surge since May is its increased capex investment in AI to accelerate Apple Intelligence. Over the past year, both Apple and Tesla have faced criticism for insufficient AI investments, making them the slowest among the FAANG+ companies in AI deployment. Consequently, their share prices lagged behind the other five companies. In the first quarter of this year, both Apple and Tesla underperformed the S&P 500, a first since 2020.

When Apple increases its capex investment in AI, it signals a change in its growth narrative.

As we know, Buffett rarely invests in tech companies, especially in the early stages of new technologies. AI is clearly in its infancy. While Apple has a strong moat in hardware, the future of AI and Apple's success in it are uncertain.

In other words, based on Buffett's 'circle of competence' investment philosophy, if Apple were to increase its capex year after year, it is uncertain when AI would generate returns.

If AI becomes a new growth driver, profitability is difficult to predict. Importantly, Buffett values Apple's cash flow. While Apple's revenue growth has not been the fastest among the FAANG+ companies in recent years, it has been the best-performing tech stock from 2019 to 2024 due to its increasing buybacks.

So, how many years will this AI capex cycle last? How likely is Apple to succeed? Clearly, the logic for the next few years begins to deviate from Buffett's investment philosophy. For Buffett, taking a large position in an uncertain future with Apple re-entering a capex cycle is not in line with his style.

As Duan Yongping said, if Apple's share price remains strong, Buffett will likely sell as much as he can, as this is not his comfort zone. The current PE ratio has risen due to the uncertainty of AI, from an average of 25-30x PE in the past three years to 35x PE. Coupled with potentially attractive assets, Buffett may have sold due to these factors when the logic shifted and the current valuation was appropriate.

Regarding potential stock assets, Buffett has not made any new moves yet. He has been reducing his long-term holdings in Apple and Bank of America. Berkshire Hathaway's US Treasury bond holdings have increased from $97 billion a year ago to $234 billion, exceeding the Fed's holdings of $195 billion. Combined with the $276.9 billion in cash, this has sparked much speculation in the market.

2. When will tech giants' capex become profitable?

Buffett and many investors are concerned about how long AI giants' capex will continue and when they will become profitable. Recent foreign bank reports provide some comparisons and analysis, offering valuable insights.

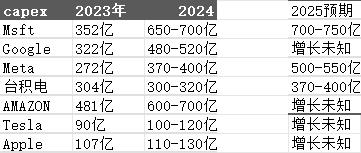

Looking at the current capex changes among tech giants, Apple's investment is relatively modest. In 2023, Apple's capex was $10.7 billion, with foreign banks estimating it to be around $11-13 billion this year, with little change. Tim Cook did not disclose much about AI spending during the earnings call.

It can be seen that Apple is relatively conservative in AI investments, as $10 billion is not a significant amount for the company. Other tech giants have increased their capex by 50% or even doubled, while Apple controls its capex through partnerships and in-house chip development, such as Apple Intelligence's collaboration with OpenAI.

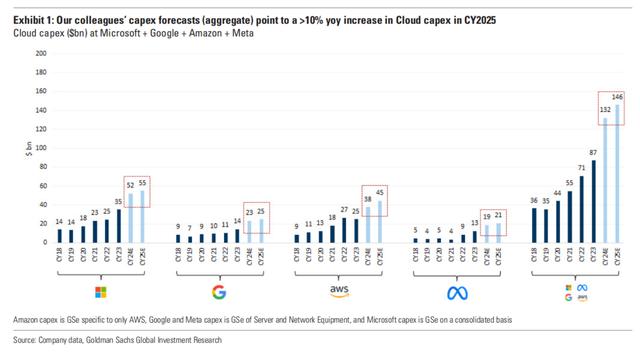

According to foreign bank forecasts, Microsoft's capex is expected to reach $70-75 billion next year, Meta may rise to $50-55 billion, and TSMC to $37-40 billion. While Google, Apple, Tesla, and Amazon are not specifically forecasted, the overall trend is that tech giants will continue to increase their capex next year.

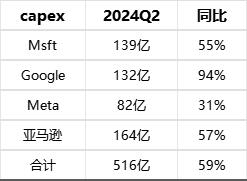

In the second quarter of this year, Microsoft's capex reached $13.9 billion, Google's increased to $13.2 billion, Meta's to $8.2 billion, and Amazon's to $16.4 billion, totaling $51.6 billion, up 59% year-on-year.

This has led many investors to wonder if investing so much money in AI is worthwhile, especially since, apart from Microsoft's Copilot and ChatGPT, there have been no significant new applications recently.

According to Goldman Sachs's communication with NVIDIA, NVIDIA prioritizes its customers' ROI, and current capex by major customers is sustainable. NVIDIA may announce the ROI levels provided by its customers during the next earnings call.

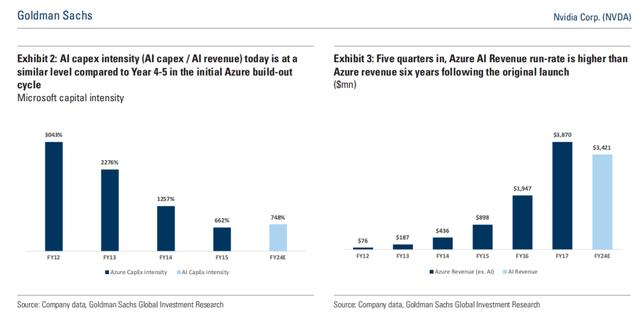

Goldman Sachs stated that Microsoft's capital expenditure efficiency is equivalent to 4-5 years in the cloud computing cycle. Microsoft's Azure AI has generated more revenue in the last five quarters than Azure did in its first six years after launch. In other words, Microsoft's AI investments have higher returns and cost-effectiveness than cloud services.

The report mentions that according to data shared by Meta with NVIDIA, LIama3's API providers can earn $7 for every $1 spent on servers over four years. From the perspective of major tech companies, investing in AI can be profitable, especially cloud-based AI services.

Goldman Sachs predicts that Google, Microsoft, Amazon, and Meta will continue to increase their investments in AI cloud services in 2024-2025.

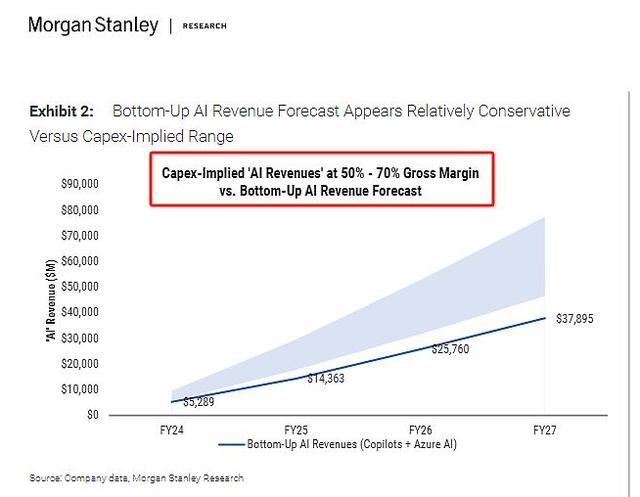

Additionally, Morgan Stanley predicts that AI capex will generate potential revenue of $5.8-9.6 billion in fiscal year 2024, with potential AI business revenue reaching $45.6-77.4 billion in fiscal year 2027, with a gross margin of approximately 50-70%.

The significant difference in the middle range is due to the speed and efficiency of AI investments. Regarding when the first tech stock may scale back its AI investments, Barclays predicts it could happen in 2026. However, it emphasizes that it took five years for the iPhone to launch its first groundbreaking app, while AI has only just started 20 months ago. Undoubtedly, AI is still in its early stages, and long-term investments are crucial.

3. Conclusion

Currently, there is a consensus among tech stocks regarding capex growth, referred to by foreign investors as 'Fear of Missing Out' (FOMO). Even though the burn rate affects short-term cash flow, it does not impact long-term cash flow. This is akin to insurance that tech companies must purchase during the development of new technologies.

Therefore, as companies increase their capex, even though Apple's investment is currently the smallest, will it be forced to increase its capex defensively in the future? This is uncertain, and Buffett's avoidance of early-stage tech stocks may be a significant factor in his recent sales.