2025上半年欧洲电车榜:自主大变天!比亚迪成第一、小鹏竟第三 | 明镜pro

![]() 07/17 2025

07/17 2025

![]() 591

591

After recovering in the second quarter, electric vehicle sales in Europe still maintained a growth trend in the first half of the year. According to comprehensive statistics from multiple European institutions, in the first half of this year, electric vehicle sales in the core 14 European countries (including the UK, Norway, the Netherlands, Spain, Sweden, Denmark, Germany, Italy, Switzerland, Ireland, Finland, Austria, Portugal, and France) reached 927,966 units, an increase of 5.93% year-on-year.

At the same time, the sales of Chinese brand electric vehicles in the European market also recovered. According to statistics from European institutions, in the first half of this year, the sales of Chinese electric vehicle brands in Europe reached 74,296 units, an increase of nearly 20% year-on-year, with a market share of about 8%. Including Volvo, Lotus, and Polestar, the sales of Chinese electric vehicle brands in the first half of this year reached 133,549 units, with a market share of about 14.39%.

In April this year, the European Union abolished the previous punitive tariff of up to 45.3% on Chinese electric vehicles and introduced a new "minimum import price" policy, stipulating that the selling price of Chinese electric vehicles must not be less than 35,000 euros. This also gave Chinese electric vehicle brands an opportunity to expand in the European market.

01 BYD and ZERO EV soar

Some notable changes have occurred within these Chinese brands selling electric vehicles to Europe. For example, BYD has risen rapidly, and its sales in the first half of the year have surpassed MG to rank first; MG, affected by tariffs in the first quarter, saw a significant decline in sales, but fortunately recovered in the second quarter. In addition, new forces such as XPeng and ZERO EV have also accelerated their expansion in Europe, especially ZERO EV, which has achieved the height of other brands' multi-year layout in less than a year.

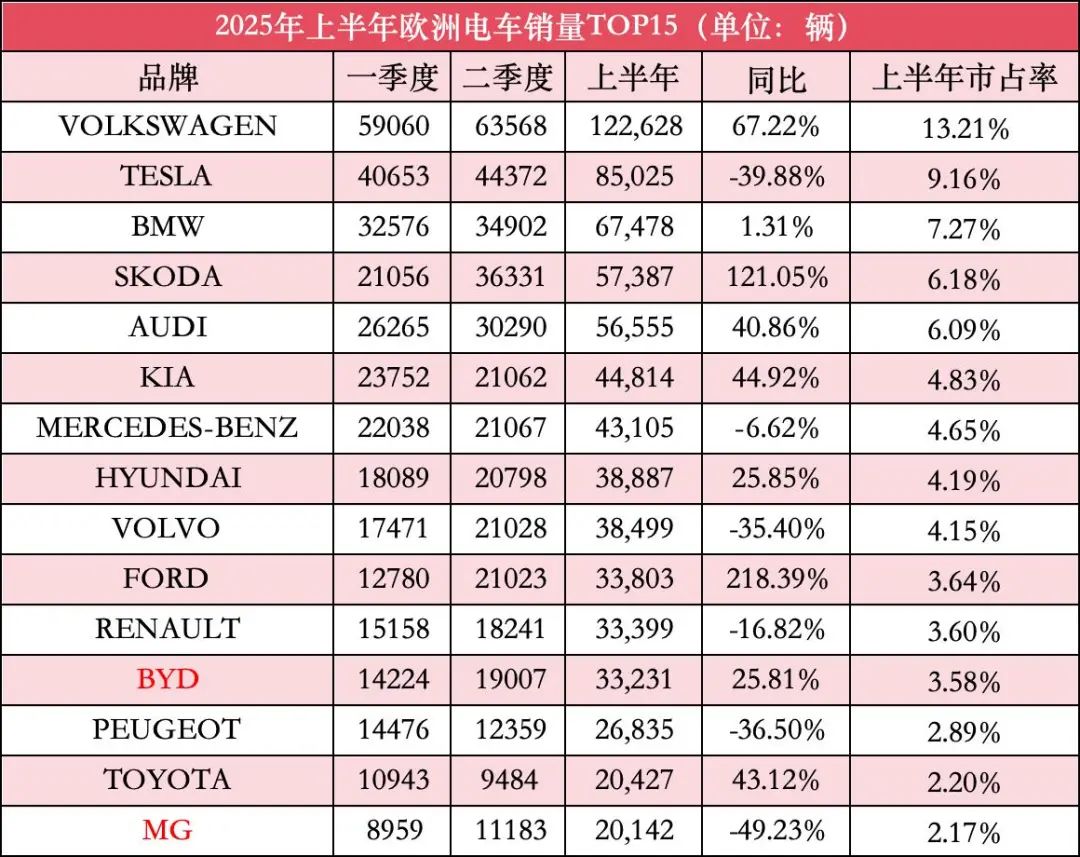

First, let's take a look at BYD. In the first half of this year, BYD's cumulative sales reached 33,231 units, an increase of nearly 140% year-on-year. However, BYD failed to enter the TOP 10 this time and ranked 12th, which is already BYD's highest ranking in terms of sales in the European market. Nevertheless, BYD's offensive is very fierce, and if BYD can maintain this growth rate, it will only be a matter of time before it enters the TOP 10 of electric vehicles in Europe.

MG follows closely behind BYD. The brand sold 20,142 electric vehicles in Europe in the first half of this year, a year-on-year decline of nearly 50%, and its ranking also slipped directly to 15th. Prior to this, MG had been the best-performing Chinese brand in terms of sales in Europe, and last year, MG was the only Chinese brand to enter the TOP 10 of electric vehicle sales in Europe. BYD and MG are the only two Chinese electric vehicle brands with cumulative sales exceeding 20,000 units in the first half of this year.

In addition to BYD, XPeng and ZERO EV have also seen significant growth in sales in the European market. Among them, XPeng sold 6,063 units in the first half of the year, an increase of over 170% year-on-year, ranking 27th. Relying on the channel advantages of the Stellantis Group in Europe, ZERO EV sold 5,124 units in the first half of the year. It should be noted that ZERO EV only started selling in Europe in September last year, and its sales growth rate is very fast. It is reported that ZERO EV also plans to start localized production in Europe next year, and its potential in the European market is still very large.

In addition, in the first half of the year, Chery Omoda sold 2,763 units, ranking 31st; Zeekr sold 1,653 units, ranking 33rd; Maxus sold 1,574 units, ranking 35th; Great Wall sold 1,039 units, ranking 36th. Apart from the above-mentioned brands, the sales of other Chinese brands in Europe in the first half of the year were all below 1,000 units. Among them, Lynk & Co sold 437 units, NIO sold 380 units; Thalys sold 264 units; Hozon Auto sold 201 units; AITO sold 70 units; Ora sold 64 units; Dongfeng Xiaokang sold 39 units; Nezha and Zhidou each sold 1 unit.

If we look at the models, the best-selling Chinese brand electric vehicle in the European market is still MG's MG4. This model sold a total of 10,878 units in the first half of this year, a year-on-year decline of about 60%, ranking 23rd in terms of sales of a single model of electric vehicles in Europe. Followed by BYD's SEAL, DOLPHIN, and ATTO 3, with sales of 8,363 units, 5,188 units, and 5,101 units, respectively. These three models accounted for half of BYD's sales in Europe. In addition to these three models, BYD has also launched SEALION, DOLPHIN SURF, ATTO 2, TANG, and other models in Europe. Its rapid sales growth in Europe is related to its rich product layout.

Currently, ZERO EV's main sales model in Europe is the pure electric car T03, with sales of 3,998 units in the first half of the year. The sedan C10 has also started delivery, with sales of 617 units in the second quarter. XPeng's sales are mainly driven by the G6 and G9 models, with sales of 3,770 units and 1,718 units in the first half of the year, respectively.

The sales of other brands' models in the first half of the year were all below 1,000 units, such as Zeekr X and 7X, which sold 701 units and 583 units, respectively. Although NIO has also launched multiple models in Europe, the sales of each model are not high. Among them, NIO EL6 is the best-selling model, with sales of only 130 units in the first half of the year. In addition, if Volvo is included, EX30 sold 16,981 units in the first half of the year, a halving compared to the same period last year, and its ranking also slipped from fourth place last year to 13th place this year.

Although Chinese brands are vigorously attacking the European market and sales have resumed growth, their overall market share is not high at this stage, with all brands combined accounting for about 8%. The market share of Tesla (13.2%) and Volkswagen (9.16%) alone is higher than that of all Chinese brands combined. Therefore, it is not an easy task for Chinese electric vehicles to capture the "automotive stronghold" of Europe.

02 Volkswagen Wins Big

In addition to Chinese brands, there have also been some interesting changes in the European electric vehicle market. Since 2022, the top three electric vehicle sales in Europe have been dominated by Tesla, Volkswagen, and BMW, and the same was true in the first half of this year. However, this time Volkswagen's electric vehicle sales surpassed Tesla by a large margin, taking the top spot in electric vehicle sales in the European market for the first half of the year.

In the first half of this year, Volkswagen sold 122,628 units, an increase of 67.22% year-on-year, with a market share of 13.21%, up from 8.37% in the same period last year, an increase of 4.84 percentage points. Tesla slipped to second place. In the first half of this year, Tesla sold 85,025 units, a year-on-year decline of 39.88%, with a market share decline of 6.98 percentage points. The same is true in the Chinese market, where Tesla's sales have also declined under the fierce competition from Chinese brands. It can be seen that Tesla is facing considerable sales pressure.

Third place went to BMW. In the first half of this year, BMW sold 67,478 electric vehicles, an increase of 1.31% year-on-year, with a market share of 7.27%, performing moderately overall. Škoda, another brand under the Volkswagen Group, has also seen rapid sales growth this year, ranking fourth. In the first half of this year, Škoda sold 57,387 units, an increase of 121.05% year-on-year, with a market share of 6.18%, compared to 2.96% in the same period last year. Audi followed closely behind Škoda with sales of 56,555 units and a market share of 6.05%.

From sixth place onward, sales in the first half of the year were all below 50,000 units. Among them, Kia ranked sixth with sales of 44,814 units, an increase of 44.92% year-on-year, and a market share of 4.83%; Mercedes-Benz ranked seventh with sales of 43,105 units, a year-on-year decline of 6.62%, and a market share of 4.65%; Hyundai ranked eighth with sales of 38,887 units, an increase of 25.85% year-on-year, and a market share of 4.19%; Volvo ranked ninth with sales of 38,499 units, a year-on-year decline of 35.40%. Ford, ranking tenth, increased its sales to 33,803 units in the first half of this year, an increase of 218% year-on-year, making it the fastest-growing among all TOP 10 companies. Its market share also increased from 1.21% in the same period last year to 3.64% this year.

However, from the ranking of single models of electric vehicles in Europe, the Model Y still ranks first with sales of 46,888 units, a year-on-year decline of 44.81%; the second and third places are occupied by Volkswagen ID.7 and ID.3 with sales of 36,565 units and 28,772 units, respectively. Apart from these two models, Volkswagen's ID.4, ID.BUZZ, and other models also performed well in sales. Among the TOP 15 single models, Volkswagen occupied five spots.

Škoda ENYAQ ranked fourth with sales of 28,693 units, an increase of 14.46% year-on-year; Model 3 slipped to fifth place with sales of 27,084 units, a year-on-year decline of 39.77%; Kia EV3 sold 25,845 units, a year-on-year decline of 1.44%; Škoda's new model ELROQ sold 24,365 units in the first half of the year, and the launch and delivery of this model have contributed to Škoda's rapid sales growth this year. In addition, Audi Q4 e-tron and Q6 e-tron also performed well in sales, with sales of 20,356 units and 17,349 units in the first half of the year, respectively.