TikTok Shop: Aggressiveness has limits, but competitors are limitless

![]() 08/09 2024

08/09 2024

![]() 489

489

Source | bohuFN

Rivers change their course every thirty years.

In October last year, TikTok's e-commerce was banned in Indonesia, and Malaysia also announced plans to follow suit, raising concerns about TikTok Shop's future development. Two months later, TikTok made a comeback, announcing a strategic partnership with Indonesia's technology group GoTo. Since then, TikTok Shop has gained momentum, reshaping the e-commerce landscape in Southeast Asia.

According to a recent report by Momentum Works, a Singapore-based venture capital firm, titled "Southeast Asia E-commerce Report 2024," the total gross merchandise value (GMV) of e-commerce platforms in Southeast Asia reached US$114.6 billion last year. Shopee led with a 48% market share, followed by Lazada with 16.4%, and TikTok and Tokopedia tied for third place with 14.2% each.

However, considering that TikTok acquired a majority stake in Indonesia's largest e-commerce platform, Tokopedia, last year, their combined market share reached 28.4%. It can be said that TikTok Shop has emerged as the second-largest player in Southeast Asia.

TikTok Shop's GMV nearly quadrupled from 2022 to 2023, making it the fastest-growing e-commerce platform in the region.

Meanwhile, TikTok Shop launched in the US in August last year, almost a year after Temu. It has set a goal for this year: to achieve a GMV of US$50 billion, a year-over-year growth of 150%, with the US market contributing at least US$17.5 billion. Notably, this is ten times the previous year's figure.

Currently, Southeast Asia and the US serve as TikTok Shop's two most critical markets, carrying all its hopes for success.

But can it succeed?

01 Overtaking in Southeast Asia

TikTok Shop's journey in Southeast Asia began in 2021.

In February 2021, TikTok Shop launched in the UK and Indonesia, generating approximately US$1 billion in GMV, with Indonesia contributing 70% of sales. This successful pilot in Indonesia gave TikTok Shop the confidence to expand into other Southeast Asian markets such as Thailand, Vietnam, the Philippines, Malaysia, and Singapore. Data shows that TikTok's e-commerce GMV in Southeast Asia grew more than threefold in 2022, reaching US$4.4 billion.

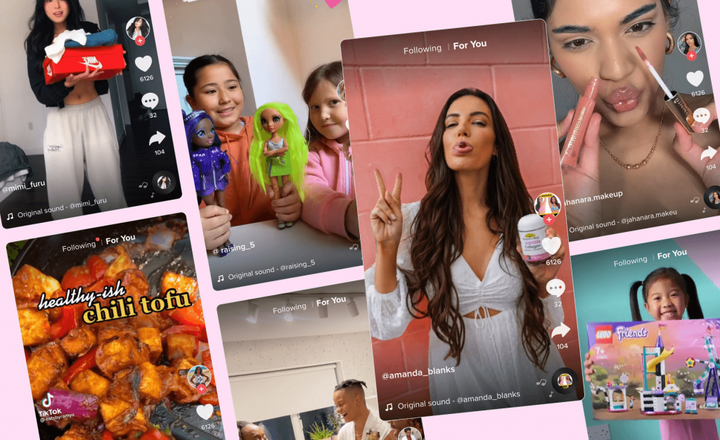

Like its domestic counterpart Douyin, TikTok Shop follows the "interest-based e-commerce" model in Southeast Asia, which is crucial to its rapid growth. Live streaming e-commerce is an essential component of this strategy.

On the one hand, TikTok Shop is a derivative product of the TikTok short video platform, which boasts a huge user base in Southeast Asia. According to TikTok's official data, the total monthly active users in Southeast Asia reached 325 million by mid-2023.

On the other hand, Southeast Asia's population is relatively young, with over 50% of its nearly 700 million people under 30 years old. It is projected that by 2030, millennials and Gen Z will account for 75% of ASEAN consumers.

In other words, TikTok Shop has access to a vast pool of young, active users who enjoy watching short videos and are open to new things, making it an attractive platform for e-commerce.

As TikTok Shop gains traction, live streaming e-commerce has gradually become a popular shopping format among Southeast Asian consumers. According to a survey by Milieu Insight, 82% of respondents in Southeast Asia have entered live streaming rooms, with 48% visiting at least once a week and 63% having made purchases. To further enhance its e-commerce ecosystem, TikTok Shop also introduced a traditional e-commerce model where customers search for products last year, entering a phase of dual-track growth.

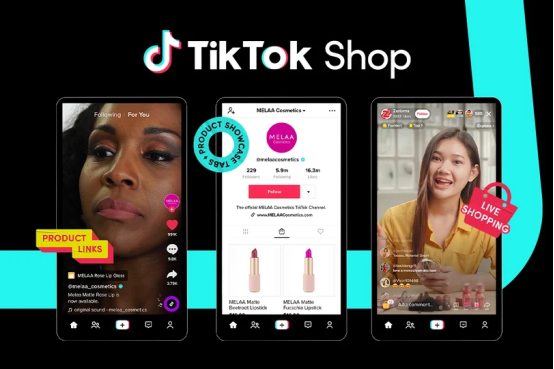

TikTok Shop leverages a combination of short videos, live streams, product showcases, and online malls to create a seamless "people-product-place" ecosystem in Southeast Asia. Similar to Douyin, TikTok Shop uses short videos for content marketing, live streams to stimulate impulse purchases, and online malls to showcase products, achieving a seamless transition from video watching to product discovery and purchase.

TikTok Shop also invests heavily in marketing, surpassing its competitors. Analysts estimate that TikTok Shop spends between US$600 million and US$800 million annually on incentives. In 2024, TikTok Shop increased its localization efforts in Southeast Asia, setting up operational centers in key markets like Vietnam, Thailand, and Indonesia and collaborating with local influencers to launch culturally relevant marketing campaigns.

These efforts have paid off, with official data showing that the number of cross-border active products in Southeast Asia grew by over 19 times year-over-year, and the number of cross-border merchants increased nearly fivefold.

However, while live streaming e-commerce has proven successful in China and Southeast Asia, its adoption in the US has been less smooth.

02 The Unavoidable US Market

TikTok boasts explosive growth and a vast user base in the US, with over 150 million users. The success stories of Temu and Shein in the US are also compelling. In 2023, Shein achieved US$45 billion in sales, surpassing Inditex Group, the parent company of Zara, for the first time. Despite fierce competition, Shein still generated over US$2 billion in net profit, up more than 180% year-over-year. Temu, which launched in the US in September 2022, achieved a daily GMV of over US$1.5 million within just over a month and completed approximately US$18 billion in GMV for the year.

TikTok Shop finally launched in the US in August last year.

Live streaming e-commerce has been highly successful in China and Southeast Asia, but what about the US? Last year, live streaming e-commerce transactions in the US were less than US$500 million, accounting for less than 20% of the total.

According to LatePost, TikTok opened live streaming studios in the US this year. TikTok mobilized service providers to rent multiple office buildings in the US, where merchants could send samples for multiple anchors to broadcast. Service providers provided professional guidance to increase anchor rewards. Additionally, TikTok's US merchant operations team has changed its customer classification from size-based to industry-based to deepen industry penetration.

According to the 2024 TikTok Ecosystem Development White Paper released by FastMoss, TikTok live streaming saw robust growth in the first half of the year. From January to June, there were 140 live streams in the US with GMV exceeding US$100,000 per session. Notably, influencers like Jeffree Star, SimplyMandys, and iamstormisteele set new GMV records, with iamstormisteele achieving a "million-dollar session" in June.

However, data from Tabcut shows that TikTok's total closed-loop GMV in the US was less than US$2 billion from January to May 2024, achieving only 11% of its annual target after five months. TikTok must now intensify its efforts to achieve its e-commerce goals for the second half of the year, explaining the surge in million-dollar live streaming sessions in June and July.

However, compared to Temu, TikTok faces significant compliance challenges. After three years, TikTok Shop covers only nine countries: six in Southeast Asia, the US, the UK, and Saudi Arabia, while Temu covers 56 countries in just one and a half years.

A TikTok insider attributed Temu's rapid expansion to its "get on the train first, buy the ticket later" strategy, establishing logistics and payment partnerships in advance before entering a new market and addressing compliance issues as it expands.

In contrast, TikTok has been cautious due to past bans in Indonesia and ongoing legal issues in North America. Firstly, TikTok allocates about 2% of its content feed to e-commerce, compared to 10% in Southeast Asia. Secondly, the review threshold for TikTok Shop's US-based stores remains high, requiring merchants to have a US social security number or annual sales exceeding US$2 million on Amazon. While this threshold was lifted in July, the entry barriers are still much higher than those for Temu.

In contrast, Temu's semi-managed review standard only requires a business license.

Moreover, TikTok Shop must compete not only with Temu, AliExpress, and Shein but also with Amazon, the dominant player in the US.

Over the past two years, Temu and Shein have successfully penetrated the US e-commerce market with low-cost, efficient Chinese products, challenging Amazon's dominance.

However, it's crucial to note that Temu and Shein combined hold only a 2% market share in the US e-commerce market, while Amazon holds 36%. Furthermore, nearly 60% of Amazon Prime orders in the first quarter of this year were delivered on the same or next day, a result of Amazon's US$100 billion investment over 18 years to establish 185 fulfillment centers worldwide.

Additionally, several European and American countries have raised tariffs on cross-border small parcels in response to the influx of Chinese cross-border e-commerce. While parcels valued under US$800 were previously duty-free in the US and under €150 in the EU, the US Department of Homeland Security announced in April that it would strengthen inspections of low-value parcels shipped directly to the US, and Europe is also considering imposing tariffs on cheap goods.

This means that the preferential policies for cross-border direct mail parcels may be revoked, weakening the price advantage of fully managed sales products. In contrast, semi-managed models allow merchants to declare and import goods themselves, unaffected by these changes.

In fact, Chinese e-commerce platforms have already adopted semi-managed models, targeting approximately 400,000 Amazon sellers and independent station sellers in China. This poses a severe challenge for TikTok Shop, which is still exploring the US market.

References:

1. FastMoss: 2024 TikTok Ecosystem Development White Paper

2. LatePost: Exclusive: A Race Among Four Rising E-commerce Stars: Doubling Growth at All Costs

*The cover image and accompanying images belong to their respective copyright owners. If any copyright owner believes that their work is not suitable for public viewing or should not be used free of charge, please contact us promptly, and we will immediately take corrective action.