Production and sales exceed 30 million vehicles, where is the next battleground for new energy vehicles?

![]() 08/06 2024

08/06 2024

![]() 641

641

Written by Jiucai

"In the face of time, all technical obstacles are paper tigers." A decade ago, new energy vehicles were still a novel concept, but today, they are ubiquitous on the streets. What will happen in another ten years? It's truly worth looking forward to.

In the development journey of new energy vehicles, the first half of 2024 is destined to leave an indelible mark.

According to the latest data released by the China Association of Automobile Manufacturers, by the end of June this year, the cumulative production and sales of domestically produced new energy vehicles had officially surpassed the 30 million mark. Specifically, from January to June this year, the cumulative production and sales of domestic new energy vehicles reached 4.929 million and 4.944 million units, respectively, representing year-on-year growth of 30.1% and 32%, with a market share of 35.2%. In July, the monthly retail sales of new energy vehicles are expected to reach 860,000 units.

This trend is accelerating. Specifically, in June alone, the production and sales of new energy vehicles reached 1.003 million and 1.049 million units, respectively, with a market share of 41.1%. It is not difficult to foresee that the market share of new energy vehicles will continue to rise in the future.

So, looking back at the first half of 2024, what are the notable development trends behind the rapid growth of new energy vehicles?

01 Market share surges, while gasoline-powered vehicles decline?

Corresponding to the rapid expansion of the new energy vehicle market is the gradual retreat of the traditional gasoline-powered vehicle market, a trend that is almost inevitable. Data shows that from January to June this year, retail sales of conventional gasoline-powered vehicles totaled 5.73 million units, a year-on-year decrease of 13%.

The rapid decline of gasoline-powered vehicles has surpassed many people's expectations.

From Jie Dian Cai Jing's perspective, the reason for the increasing annual sales of new energy vehicles lies primarily in their advantages that gasoline-powered vehicles cannot match, such as the innovative smart technology and driving experience offered by electric vehicles, which far surpass those of traditional gasoline-powered vehicles. A smart electric vehicle costing two or three hundred thousand yuan can provide a driving experience that may not even be achievable in a million-yuan gasoline-powered vehicle, prompting a large number of former gasoline-powered vehicle users to switch.

Moreover, in the race for new energy vehicles, major brands are all stepping up their efforts, with new products launching rapidly. In contrast, the traditional gasoline-powered vehicle sector appears to be lacking in momentum.

The latest data from the China Passenger Car Association shows that only 11 gasoline-powered vehicles were launched in the first half of this year, 31 fewer than in the same period in 2018, while 60 new models of new energy vehicles were launched, almost six times as many as gasoline-powered vehicles.

Furthermore, the lack of new product launches has put gasoline-powered vehicles at a disadvantage in the "price war."

In the "price war" that began earlier this year, gasoline-powered vehicles were also involved. However, new energy vehicles were able to offset some of the negative effects of price declines by relying on a large number of newly launched products. In contrast, gasoline-powered vehicles struggled to maintain price stability due to the significant reduction in new products, facing greater pressure.

Currently, after large-scale price cuts earlier this year, many new energy vehicle brands have reduced their promotional efforts compared to before, but the promotional efforts of gasoline-powered vehicles have increased, as they have no choice but to reduce prices.

However, even so, it may be difficult for gasoline-powered vehicles to reverse their declining trend. In the second half of this year, policies such as trade-ins and the promotion of new energy vehicles in rural areas will continue to be implemented, and new models of new energy vehicles will also be Intensive listing , making it highly likely that sales will further increase. Industry insiders predict that the production and sales scale of new energy vehicles this year is expected to reach 11.5 million units.

Such a market size provides ample room for development for domestic new energy vehicle brands. So, how have new energy vehicle brands performed in the past six months?

02 The pattern of independent brands, "Wei Xiao Li" no longer exists

According to Jie Dian Cai Jing's understanding, from the perspective of the overall automobile market, the market share of independent brand passenger vehicles continues to increase. This is due, on the one hand, to the rapid growth in sales of new energy vehicles, during which independent brands have transitioned more quickly than joint venture brands in terms of electrification and intelligence; on the other hand, it is due to the rapid growth in automobile exports, which are primarily dominated by independent brands.

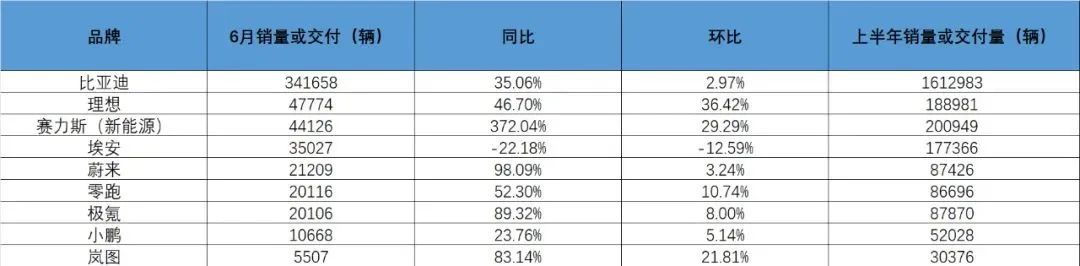

Specifically, BYD's sales remain in the lead. Data shows that BYD sold 340,000 new energy vehicles in June, an increase of 30.6% year-on-year; cumulative sales for the first seven months of this year totaled approximately 1.96 million units, an increase of 28.83% year-on-year.

Beyond BYD, several new automotive forces have also performed well in the first half of the year. In the first tier, NIO encountered a brief downturn in the first half of the year but rebounded strongly, taking the sales crown in July with approximately 51,000 deliveries, a record monthly delivery and a year-on-year increase of 49.4%. For the first seven months of this year, it delivered approximately 240,000 vehicles.

However, at the beginning of this year, NIO set a full-year delivery target of 480,000 vehicles. In contrast, NIO will need to work harder in the second half of the year to achieve its annual target.

Beyond NIO, Seres is a formidable competitor. Data shows that Seres sold 42,200 new energy vehicles in July, a year-on-year increase of 508.25%. Total vehicle sales in the first seven months were 282,600 units, a year-on-year increase of 171.19%.

Seres' sales are primarily composed of its AITO brand, which is also the main force behind HarmonyOS SmartRide. In the first seven months of this year, HarmonyOS SmartRide delivered a cumulative total of 238,300 vehicles.

In the second tier of new forces, Xpeng is gradually emerging from its low point. In July, it delivered a total of 20,500 new vehicles, marking the third consecutive month of deliveries exceeding 20,000 units. In the first seven months of this year, Xpeng delivered a total of 108,000 new vehicles, an increase of 43.85% year-on-year.

It is worth noting that in the entire second quarter, Xpeng delivered a total of 57,400 new vehicles, a significant increase of 143.9% and far exceeding market expectations. Therefore, Xpeng's performance in the second half of the year is likely to be even stronger.

Also breaking through the 20,000-unit mark in July was Leapmotor, which delivered 22,100 units in July alone, a year-on-year increase of 54.1%, setting a new record. Close behind Xpeng is Zeekr, which delivered 15,700 new vehicles in July, a year-on-year increase of over 30%.

In contrast, Xpeng, once part of the "Wei Xiao Li" trio, lags significantly. In July this year, it delivered approximately 11,100 vehicles, and in the first seven months of this year, it delivered 63,100 vehicles, a year-on-year increase of 20%.

Finally, it is essential to mention Xiaomi Automobile, the top performer in the automotive industry in the first half of the year. In June and July, Xiaomi SU7 deliveries exceeded 10,000 units. Xiaomi Automobile stated that deliveries in August would continue to exceed 10,000 units and that it expects to complete its annual delivery target of 100,000 units ahead of schedule in November.

Based on the sales performance of new energy vehicles in the first half of the year, BYD remains in a league of its own in terms of scale. NIO and Seres are at the forefront of the new forces, while Xpeng, Geely's Zeekr, and Leapmotor are in the second tier. Xiaomi's performance still needs to be observed, and Xpeng risks falling behind the "Wei Xiao Li" trio.

Compared to previous years, the landscape of the entire new energy vehicle market is undergoing significant changes.

03 The next three years: the decisive battle for intelligent driving in new energy vehicles

On the one hand, the rapid expansion of the market size also implies intensifying competition. This is not only reflected in the competition between gasoline-powered and electric vehicles but also in the "internal competition" among electric vehicle brands. The "price war" that began earlier this year exemplifies this intense competition.

Not long ago, FAW Toyota wrote in its official WeChat account, "From January to June this year, the most influential, longest-lasting, and widest-reaching keyword in the automotive market is still the price war."

In this regard, Wang Chuanfu, Chairman of BYD, offers a more representative view. He believes that the new energy vehicle industry has entered a knockout round, with 2024 to 2026 being decisive years for scale, cost, and technology.

"As Chinese automakers accelerate the launch of new energy products, they will erode the market share of joint venture brands. In the next 3 to 5 years, the market share of joint venture brands will drop from 40% to 10%, with 30% of that decline representing future growth opportunities for Chinese brands," Wang said.

Wang Chuanfu's perspective will be borne out in the next three years.

In the short term, Jie Dian Cai Jing observes that the raging "price war" has had a significant impact on the terminal market. The continuous and substantial promotions in the first half of the year, while driving sales, may have led to an overextension of consumption among car buyers in the second half of the year, potentially weakening the effectiveness of the "price-for-volume" strategy in July, and the ability to maintain the momentum of production and sales in the second half of the year remains to be seen.

Of course, as Chinese new energy vehicle brands expand their presence in the global market, new growth drivers are emerging.

Currently, for core export regions such as Southeast Asia and Central Asia, exports of independent brands continue to grow at a high rate. For markets with strong local brands, such as Europe, independent brands are beginning to explore new joint venture models centered on technology exports. For countries with low spending power, such as Africa, independent brands have a lower market penetration and still rely primarily on direct exports.

According to the latest report by AlixPartners, by 2030, Chinese brand automobiles are expected to sell 9 million units outside of China, with market share growing to 13%. The development prospects of Chinese new energy vehicles remain promising.

Jie Dian Cai Jing observes that the decisive battle for new energy vehicles in the future will center on intelligent driving technology.

Just a few days ago, during Tesla's earnings call, Elon Musk stated that Full Self-Driving (FSD) has made significant progress and is expected to enter the Chinese market by the end of this year. Furthermore, he announced that Tesla will launch Robotaxi on October 10, with the goal of having it operational globally by the end of this year.

With Tesla, the "catfish" in the industry, coming in full force, it is not difficult to predict that autonomous driving will become the new battlefield for global technological strength and comprehensive national strength. Time waits for no one, and it remains to be seen who will emerge victorious in the end. "*The featured image is generated by AI"