Avoiding sales figures, how will NIO compete in the second half of the game?

![]() 08/06 2024

08/06 2024

![]() 510

510

Source: NIO's official Weibo account

Technological innovation becomes the new focal point

Written by: Meng Huiyuan

Edited by: Chen Dengxin

Typeset by: Annalee

Unexpectedly, weekly sales figures of new energy vehicles have become a taboo topic in the industry.

Recently, first, He Xiaopeng made a comment at the Xpeng AI Autonomous Driving Technology Conference that after returning to China, he found people arguing about weekly sales rankings online, implying criticism of Li Auto, which releases weekly sales rankings.

Subsequently, several NIO executives directly expressed their opposition to weekly auto sales rankings. Qin Lihong, co-founder and president of NIO, stated, "Our brand has not authorized anyone to use our brand to release weekly rankings. Can you please remove our brand?" Ma Lin, vice president of NIO Brand and Communications, also tweeted at Li Xiang, CEO of Li Auto, saying, "The top management has set the tone: no low-level internal competition. Weekly rankings somewhat imply low-level internal competition. Brother Li, please stop. The mission of Chinese automakers now is to achieve technological breakthroughs through research and development, isn't it? Let's all charge up together!"

Even NIO's move received support from Geely – Yang Xueliang, senior vice president of Geely Holding Group, retweeted Ma Lin's post and added, "I also oppose weekly rankings."

For a long time, sales rankings have been a key indicator for measuring market competition, attracting significant attention from automakers and consumers alike. Despite intense price competition among brands since last year, some manufacturers' sales figures remain underwhelming. Based on sales performance in the first half of the year, traditional brands have outperformed new forces in terms of achieving their annual sales targets. Geely has achieved 50.3% of its annual sales target, while BYD has reached 44.7%, leading other brands. Li Auto, NIO, and Zeekr have all surpassed 30% of their annual sales targets in the first half of the year.

Given the intense market competition and evolving strategies of automakers, the dissatisfaction expressed by new energy vehicle brands over weekly rankings may reflect a shift in focus beyond sales competition, with technological innovation and product quality gradually becoming new focal points for industry competition.

Why executives collectively spoke out

In this alternative industry-wide initiative to boycott “ Ideal Weekly Ranking ”, NIO, which repeatedly voiced its opposition, may seem overreacted but has its own reasons.

"Weekly sales rankings" that sparked discontent among peers

When discussing NIO, it's impossible to ignore its persistent "loss" curse. Relevant data shows that in 2023, NIO generated revenue of 55.6 billion yuan, with a net loss (adjusted) of 18.35 billion yuan, a 51% increase from the previous year. Last year, NIO delivered 160,000 vehicles, incurring a loss of approximately 115,000 yuan per vehicle sold.

Regarding where NIO's money is lost, Li Bin responded at the 2024 China Automotive Chongqing Forum: "It's very simple – in research and development and infrastructure investments." Financial reports indicate that NIO invested 13.43 billion yuan in R&D in 2023, exceeding 10 billion yuan for the second consecutive year. In the first quarter of this year, NIO's R&D expenses were 2.8642 billion yuan, down 6.9% from the first quarter of 2023 and 27.9% from the fourth quarter of 2023. From the first quarter of 2022 to the first quarter of this year, NIO's cumulative R&D investment exceeded 27.1 billion yuan.

Of course, NIO's heavy investment in self-developed technology is no longer just numbers on paper.

On July 27, at NIO's second NIO IN Innovation Technology Day, Li Bin and his R&D team shared updates on the company's smart vehicle architecture, smart cockpit, and autonomous driving capabilities. After four years of development, NIO's self-developed chip, Shenji NX9031, successfully taped out, and its vehicle-wide operating system, SkyOS·Tianshu, was officially launched. NIO's second-generation phone also underwent a refresh.

SkyOS·Tianshu, as the world's first "AI-oriented vehicle-wide operating system," received significant attention from NIO.

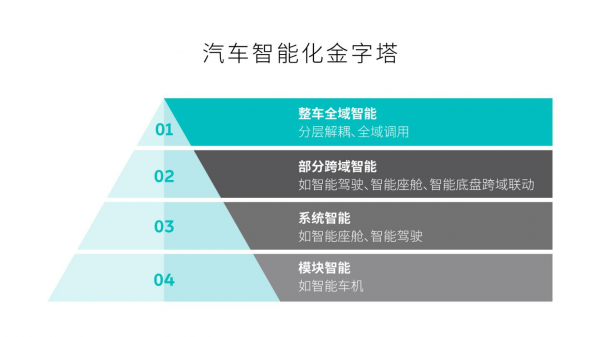

In simpler terms, SkyOS·Tianshu integrates various functions of smart electric vehicles, including telematics, control, autonomous driving, and digital cockpits, enabling unified management and coordination of applications. This contrasts sharply with the past practice of having separate operating systems for each core component, akin to the relationship between Apple's iOS and iPhone or Huawei's HarmonyOS and its smartphones.

"We've accomplished some industry-breaking achievements, and I believe we should let people know." Although Li Bin is confident, and NIO's self-developed technology showcases the company's ambition for future development and pursuit of technological leadership, the significant investments in basic technologies like chips and operating systems are unlikely to yield immediate returns in the short term and have become a major obstacle to NIO's self-sufficiency.

However, since the third quarter of last year, NIO's vehicle gross margin has consistently exceeded 10%. Some analysts believe this indicates that NIO's R&D investments are starting to bear fruit. Moreover, the surge in NIO's second-quarter sales has bolstered Li Bin's confidence. In Q2, NIO delivered a total of 57,373 vehicles, exceeding delivery guidance and growing 143.9% year-on-year.

It's worth noting that both NIO and Li Bin faced widespread skepticism over the past year, with first-quarter sales remaining low at 30,053 vehicles, a 3.2% decrease year-on-year, and an adjusted net loss of 4.9032 billion yuan, up 18.1% year-on-year.

NIO executives tweet against weekly rankings

In the public discourse, the dominant "Li Auto Weekly Rankings" may have varying degrees of negative impact on other automakers. However, for NIO, the key lies in its long-standing profitability pressures.

Ledao L60 Holds High Expectations

Reviewing NIO's activities over the past year, from partnering with Chang'an, Geely, Chery, GAC, China Southern Power Grid, and others to establish a battery swapping alliance, to the unveiling of the first model under the new Ledao brand, to announcing the successful tape-out of the self-developed Shenji NX9031 in-vehicle chip and the vehicle-wide operating system SkyOS·Tianshu, NIO appears to be making progress on multiple fronts, but each requires time to break through.

NIO releases the first "AI-oriented vehicle-wide operating system"

In a sense, battery swapping is a significant advantage for NIO, differentiating it from other automakers. According to Shen Fei, senior vice president of NIO Power, the break-even point for battery swapping stations is 60 swaps per day per station, covering operating and depreciation costs including service and electricity fees. However, only 20% of NIO's stations currently exceed this break-even point.

In other words, the battery swapping alliance serving NIO cannot generate economic benefits in the short term and represents a more long-term goal. Some argue that the direct beneficiary of the alliance is Ledao, NIO's flagship brand poised for significant sales growth.

At the Ledao new car launch event, Li Bin expressed high expectations for the Ledao L60, repeatedly comparing it to the widely recognized "sales king" of pure electric vehicles, the Model Y. Nomura Securities believes that the L60's price range requires a vehicle without shortcomings in space, energy replenishment, and price. In the past, pure electric vehicles have not held a strong position in this market segment due to energy replenishment time issues. Battery swapping may significantly benefit the Ledao brand, but its actual performance post-launch remains to be seen.

Regarding NIO's self-developed in-vehicle chip and vehicle operating system, which have just been unveiled, as the technological foundation for intelligent driving, Li Bin unequivocally stated that NIO is an AI company. "A successful smart electric vehicle company must also be a successful AI company," he said.

However, in the AI realm, NIO faces competition not only from peer automakers but also from players across the broader AI landscape. Even though models like GPT and Sora may not be directly applicable to autonomous driving tasks, their representation of the AGI (Artificial General Intelligence) paradigm can still be applied, meaning that major domestic and international players like OpenAI, Google, NVIDIA, Tencent, Alibaba, and Baidu could potentially compete in intelligent development.

Source: NIO's official Weibo account

Under these circumstances, NIO's aspiration to maintain its high R&D investment advantage in the automotive sector and achieve long-term success necessitates enduring significant financial pressure and continuous market testing.

Betting on AI: Can NIO Break Through?

"Our foundation is technology and R&D." Nowadays, whenever NIO makes a significant move, the most common narrative revolves around taking a long-term perspective.

This is indeed appropriate. As the competition in the new energy vehicle sector progresses from the first half of electrification to the second half of intelligence, the new forces still in the game tend to look further ahead to better cater to evolving consumer preferences.

Given the thriving new energy vehicle market and product diversity, consumers' purchase decisions are no longer solely based on sales rankings but also consider factors like product performance, price, and brand reputation, with some even referring to cars as their "third space" beyond work and home. Relevant survey results show that 84.5% of consumers indicate that intelligent vehicle features significantly influence their purchase decisions.

For NIO, which has fallen behind, failing to take proactive action early in the second half of the competition may lead to a continuous slowdown and risk of elimination. Therefore, NIO has frequently extended its tentacles to seek optimal solutions from multiple angles.

Source: NIO's official Weibo account

However, from a broader perspective, competitors are not lagging behind.

Xpeng, in a similar predicament as NIO, also announced at the end of July that it would roll out the AI-powered Tianji System XOS 5.2.0 version to all global users. This system is officially upgraded from "usable nationwide" to "optimal nationwide," offering unlimited access across cities, routes, and driving conditions.

Meanwhile, established automakers like Geely Holding are actively pursuing technological innovation and product upgrades by increasing R&D investments, attracting high-end talent, and deepening industry-academia-research cooperation to enhance their technological capabilities and innovation potential.

Even Baidu, which was initially on the sidelines, has been active lately, reportedly integrating its AI research achievements into its invested Jiyue brand. Furthermore, Huawei's Vehicle BU, which has invested over 10 billion yuan in R&D, has officially spun off and chosen to focus on empowering HarmonyOS smart vehicle partners.

"We invest around 3 billion yuan in R&D each quarter, totaling over 10 billion yuan annually, with 60% to 70% allocated to basic research. Based on such investments and efficient execution," Li Bin firmly believes that NIO is well-prepared to participate in the intelligence race and deserves a spot in the finals. However, regardless of whether NIO can compete with other players in R&D investment and output, it must first address its profitability concerns and uncertain financing sources, which underpin its massive technology development funding requirements.

And this is the key to whether NIO can get a ticket to the finals.