Blaming the sponsor for failed IPO, Xunzhong shares' executives arbitrage shares before IPO

![]() 08/06 2024

08/06 2024

![]() 520

520

The full text is 5,736 words and will take about 19 minutes to read

By Rui Finance Sun Subo

Listed on the NEEQ, failed sale to an A-share listed company, failed listing on Beijing Stock Exchange... These years, Beijing Xunzhong Communications Technology Co., Ltd. (hereinafter referred to as "Xunzhong shares") has not stopped stirring up the capital market.

On July 26, the capital market once again received news about Xunzhong shares. This time, it aimed to list on the Hong Kong Stock Exchange. The IPO two years later reminds people of the inquiry letter from the Beijing Stock Exchange that was ignored by Xunzhong shares. The issues mentioned in it, such as the stability of the actual controller's control rights and the legality and compliance of operations, remain to be answered.

Founded in 2008, Xunzhong shares is a cloud communication service company that once claimed to have near-monopolistic voice line resources.

Six years ago, Xunzhong shares almost sold itself to Dahua Intelligence (002512.SZ) for 1.2 billion yuan. After the failed acquisition, it decided to go public independently, at which time a strategic investor proposed to withdraw its shares, while two new investors expressed interest in joining.

Taking advantage of the gap between the withdrawal of old shareholders and the addition of new shareholders, the general manager of the administration department of Xunzhong shares took the opportunity to resell shares and made nearly 6 million yuan in profits.

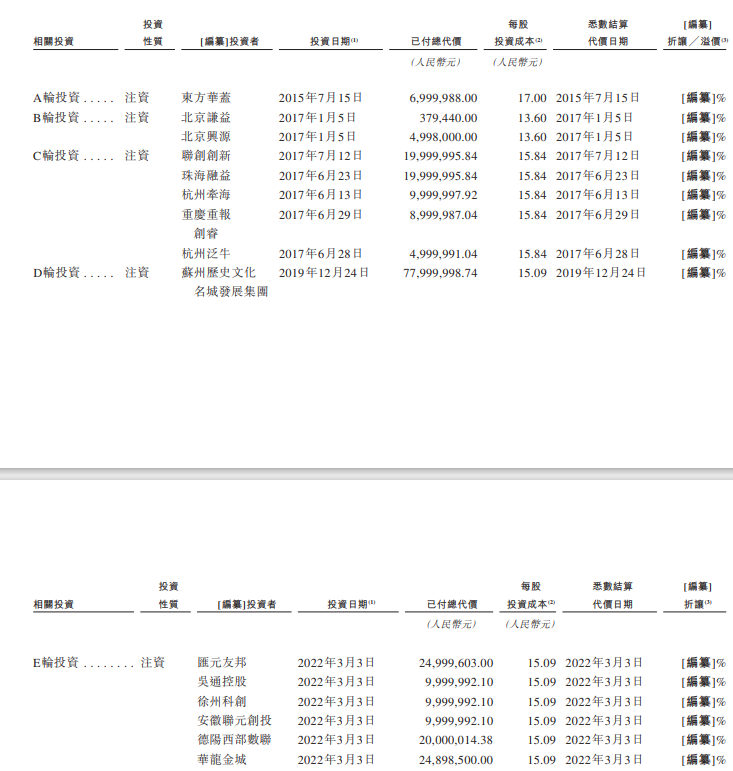

From the prospectus submitted this time, it can be learned that from 2015 when Xunzhong shares were listed on the NEEQ to 2022 before submitting an application to the Beijing Stock Exchange, Xunzhong shares obtained a total of 254 million yuan in financing. However, in the two years after its listing plan on the Beijing Stock Exchange was terminated, it did not receive any further capital favor.

01

Founder crosses over from antivirus software to cloud communication

Once concealed proxy holding and listed on the NEEQ

In December 1998, Sina.com emerged. This website, merged from Sitong Lifang Online and Huayuan Information, caused a sensation at that time.

Before Sina.com, Pu Shenggen joined Sitong Lifang Online, the predecessor of Sina.com, as Sales Manager in February 1998. It can be said that he was the first generation of employees of Sina.com.

In December 1999, Pu Shenggen left Sina.com and joined Jiaoda Mingtai as Vice President. It is worth mentioning that five months after Pu Shenggen left Sina, Sina was listed on NASDAQ. This was also the first time in Pu Shenggen's career that he narrowly missed the capital market.

After joining Jiaoda Mingtai, Pu Shenggen went through the entire process of the company's startup to Hong Kong listing, and organized the research, development, and promotion of the translation software "Oriental Express" and the playback software "Oriental Cinema".

In March 2004, the 33-year-old Pu Shenggen had his first company, Shengshi Changjie Information Technology Co., Ltd., in Zhucheng Building, Zhongguancun, Beijing.

For his first startup, Pu Shenggen focused on the field of antivirus software, developing and promoting "Oriental Guardian", the first online antivirus software profit model in China.

In 2007, 360 disrupted the business model of antivirus software, triggering a price war. The end of the era of paid antivirus software also marked the end of Pu Shenggen's first startup.

In 2008, the 3G era was about to arrive! At the same time, 4G research and development was also put on the agenda. Pu Shenggen set his second startup goal on the telecommunications industry. At that time, Pu Shenggen met investor Chen Xiaoqiong through a friend's introduction.

In November 2008, Chen Xiaoqiong and Guan Peiyi, a relative of Pu Shenggen's wife, jointly invested 10 million yuan to establish the predecessor of Xunzhong shares, "Beijing Xunzhong Communications Technology Co., Ltd." (hereinafter referred to as "Xunzhong Limited"), with each holding 50% of the shares. Among them, the 50% shares held by Guan Peiyi were held on behalf of Pu Shenggen.

In the year following the establishment of the company, Chen Xiaoqiong decided to permanently emigrate overseas and transferred 50% of his shares in Xunzhong Limited to Pu Shenggen's wife Rao Fang.

In November 2011, Guan Peiyi decided to retire, so Pu Shenggen terminated the shareholding arrangement between them. At the same time, Rao Fang also transferred 50% of her shares in Xunzhong Limited to Pu Shenggen. Since then, Xunzhong Limited has been wholly owned by Pu Shenggen.

It is worth noting that Xunzhong shares did not disclose the previous proxy relationship between Pu Shenggen and Guan Peiyi when submitting the public transfer prospectus to the National Equities Exchange and Quotations (NEEQ).

After Xunzhong shares submitted its prospectus to the Beijing Stock Exchange in June 2022, the exchange questioned them about the reasons for Guan Peiyi's proxy holding of Xunzhong shares on behalf of Pu Shenggen, whether there were issues such as not being allowed to serve as a shareholder due to employment status, not meeting shareholder eligibility criteria, or other issues that circumvented relevant laws and regulations.

However, Xunzhong shares withdrew their listing application voluntarily without responding to the inquiry letter. This time, in the prospectus submitted to the Hong Kong Stock Exchange, Xunzhong shares explained that when the company was established, Pu Shenggen wanted to focus on initial business development and operations and SaaS technology development, so he decided to hold his equity interests through Guan Peiyi for administrative convenience.

This explanation is even more confusing. What is the conflict between holding company shares and "focusing on initial business development and operations"?

02

Failed listing on Beijing Stock Exchange, blaming the sponsor

Compliance of debt collection business questioned by regulators

After Pu Shenggen wholly owned Xunzhong Limited, in November 2013, he transferred a total of 20% of his shares to eight company employees: Yue Duanpu, Niu Jie, Zhao Junjie, Chen Limei, Gang Jirigetu, Wang Peide, Xu Pang, and Jia Qi.

Rui Finance "Pre-IPO Review" found that among these eight employees, only Wang Peide and Yue Duanpu are still employed at Xunzhong shares. Among them, Wang Peide is the company's executive director and is responsible for the expansion and management of the group's PaaS business; Yue Duanpu is the company's executive director and deputy general manager, responsible for the management and operation of the group's intelligent communication solutions business.

To prepare for the application to list on the NEEQ, on October 11, 2014, Xunzhong Limited was transformed into a joint-stock limited company, and the company name was changed to "Beijing Xunzhong Communications Technology Co., Ltd.".

The following year, on June 16, Xunzhong shares were officially listed and publicly traded on the NEEQ. Before the listing, Pu Shenggen was the legal representative of the company, serving concurrently as Chairman and General Manager, able to actually control the company's business decisions, and holding 80% of the company's shares, making him the actual controller of the company.

After listing on the NEEQ, from July 2015 to March 2022, Xunzhong shares raised a total of approximately 254 million yuan in five rounds of financing, with its valuation increasing from 199 million yuan to 1.378 billion yuan.

In June 2022, seven years after listing on the NEEQ, Xunzhong shares submitted a listing application to the Beijing Stock Exchange. Just half a month later, the Beijing Stock Exchange issued an inquiry letter. In the inquiry, the exchange questioned the stability of the control rights of Pu Shenggen, the actual controller of Xunzhong shares.

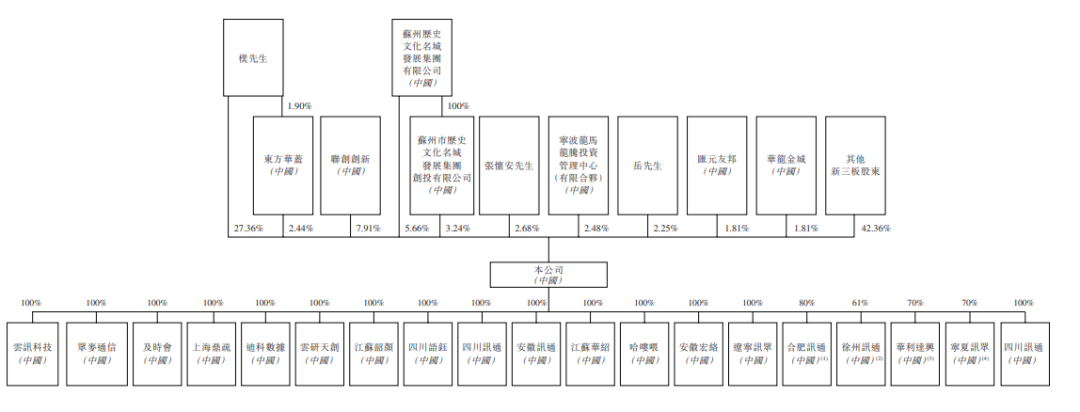

According to Rui Finance "Pre-IPO Review", after the final round of financing in March 2022, the number of shareholders of Xunzhong shares reached 586. Before submitting the application to the Beijing Stock Exchange, Pu Shenggen held a 27.36% stake, which would decrease to 21.30% after the issuance, and no single shareholder other than Pu Shenggen held a direct stake exceeding 7%.

In addition to questioning the stability of the control rights of Xunzhong shares' actual controller, the Beijing Stock Exchange also inquired about the legality and compliance of Xunzhong shares' operations.

According to the disclosure of Xunzhong shares, its cloud communication business connects upstream with basic telecom operators and downstream with end customers, involving multiple aspects and a long chain, while some regulatory policies are still unclear.

Furthermore, Xunzhong shares' call center operation services can provide customer services to the financial industry, such as credit card activation, information verification, credit card collection, and credit card billing installment marketing. The Beijing Stock Exchange questioned whether these services comply with relevant laws and regulations, whether they meet the requirements of relevant industry policies, and whether there are major violations of laws and regulations or potential litigation risks.

Xunzhong shares did not respond to the many questions raised by the Beijing Stock Exchange. On September 23, 2022, Xunzhong shares voluntarily withdrew its listing application from the Beijing Stock Exchange.

Interestingly, in June 2023, Xunzhong shares once again initiated plans for an A-share listing on the Beijing Stock Exchange and submitted a listing Tutoring registration to the Beijing Regulatory Bureau of the China Securities Regulatory Commission in July 2023. However, now, one year later, its presence has emerged in the Hong Kong stock market.

Regarding the termination of the IPO on the Beijing Stock Exchange in 2022, Xunzhong shares stated in the prospectus submitted to the Hong Kong Stock Exchange that at that time, the sponsor had previously sponsored another listed company (unrelated to Xunzhong shares, hereinafter referred to as "unrelated listed company") that was subject to a follow-up procedure initiated by the competent authority. In view of the uncertainty regarding the outcome, duration, and impact of the follow-up procedure on the unrelated listed company and the sponsor, the company voluntarily decided to terminate its listing application.

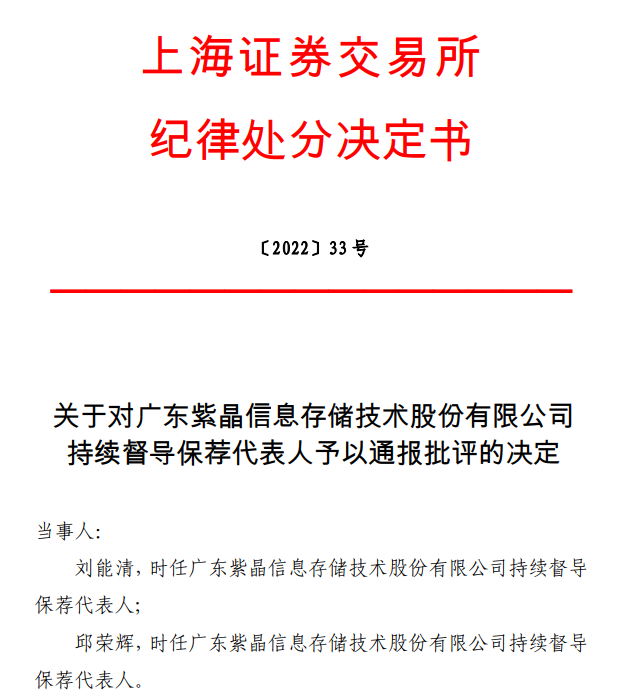

According to Rui Finance "Pre-IPO Review", when Xunzhong shares applied for listing on the Beijing Stock Exchange in June 2022, its sponsor was China Securities Co., Ltd.

Although Xunzhong shares did not disclose why China Securities was subject to a follow-up procedure by the competent authority in 2022, Rui Finance "Pre-IPO Review" found that China Securities was involved in the "first case of fraudulent issuance under the registration-based IPO system" that year.

It is reported that in February 2022, Guangdong Zijing Information Storage Technology Co., Ltd. (hereinafter referred to as "Zijing Storage"), which was once listed on the STAR Market, was placed under investigation for suspected violations of information disclosure laws and regulations.

According to the China Securities Regulatory Commission's "Administrative Penalty and Market Entry Prohibition Advance Notice" and the Shanghai Stock Exchange's regulatory letter, during the IPO process, Zijing Storage was suspected of inflating its operating revenue and profits by falsifying sales contracts, forging logistics and acceptance documents, arranging for fund repayments, and recognizing revenues in advance. From 2017 to 2019, the inflated profits accounted for 35.82%, 32.59%, and 137.33% of the total profits for those years, respectively. After going public, Zijing Storage continued to inflate its operating revenue and profits through the aforementioned financial fraud methods, with inflated profits accounting for 94.55% and 151.1% of total profits in 2019 and 2020, respectively.

As the IPO sponsor and lead underwriter of Zijing Storage, the Shanghai Stock Exchange issued a criticism notice to China Securities's continuing supervision representatives Liu Nengqing and Qiu Ronghui in April 2022.

In addition to the Zijing Storage project, in November 2022, due to insufficient diligence during the sponsorship of Liyuan Jingzhi's (002501.SZ) 2017 private placement of shares, inadequate implementation of internal control mechanisms, and failure to fulfill ongoing supervision obligations as required, China Securities and its two representatives, as well as the then-head of the internal review committee, were issued warning letters by the Jilin Regulatory Bureau.

Before this submission, Xunzhong shares' major shareholders included Pu Shenggen, Lianchuang Innovation (Chengdu) Equity Investment Fund Partnership (Limited Partnership) (hereinafter referred to as "Lianchuang Innovation"), and Suzhou Historical and Cultural City Development Group Co., Ltd. (hereinafter referred to as "Suzhou Historical and Cultural City"), with direct shareholding percentages of 27.36%, 7.91%, and 5.66%, respectively.

Behind Lianchuang Innovation, not only can one find China Unicom, one of the three major operators, but also the founder of Fanbook and former CCTV anchor Fan Deng.

03

Failed 1.2 billion sale

Administration manager resells shares for 5.94 million yuan

In fact, before attempting to enter the A-share market on its own, Xunzhong shares almost sold itself to an A-share listed company for 1.2 billion yuan.

In June 2018, Dahua Intelligence announced that it planned to acquire Xunzhong shares through the issuance of shares, hoping to quickly enter the cloud communication business through this acquisition.

According to Rui Finance "Pre-IPO Review", Dahua Intelligence's main business is "One Network, One Screen," involving satellite internet and internet TV industries.

Three months later, Dahua Intelligence disclosed the "Issuance of Shares and Payment of Cash for Asset Acquisition Plan." The plan showed that as of March 31, 2018, Xunzhong shares' audited net assets were 222 million yuan, and the pre-estimated value of its 100% equity was 1.225 billion yuan. The parties to the transaction negotiated and determined the total transaction amount to be 1.225 billion yuan, representing a 450.61% premium over the net assets.

Two months later, however, Dahua Intelligence announced that since the target asset belonged to an NEEQ-listed company with numerous shareholders, the interests and demands of various parties were diverse, and some shareholders were state-owned, making the procedures for the company to issue shares to them complex. The parties could not reach an agreement on core terms such as the transaction method for the target asset, so the acquisition was changed to a cash payment method.

According to Dahua Intelligence's announcement, the funds for this transaction mainly came from two sources. On the one hand, by selling various financial assets, including Runxing Finance Leasing Co., Ltd., a large amount of funds could be recouped to pay part of the transaction consideration. On the other hand, Fujian Strait Bank Co., Ltd. Fuzhou Liming Sub-branch planned to grant the company a credit line of 1.3 billion yuan, which could also be used to pay part of the consideration for this transaction if successfully disbursed.

On December 17, 2018, Xunzhong shares announced that as of that date, the acquisition funds from Dahua Intelligence had not yet been secured, and the acquisition could not be implemented in real-time. Since then, neither Xunzhong shares nor Dahua Intelligence has disclosed any further information about the transaction.

The Beijing Stock Exchange had previously inquired about the reason for the termination of the acquisition transaction between Xunzhong shares and Dahua Intelligence during the inquiry process, but Xunzhong shares did not respond.

In this prospectus submitted to the Hong Kong Stock Exchange, Xunzhong shares still did not directly address its transaction with Dahua Intelligence.

At the end of 2019, Xunzhong shares decided to go public independently, but at that time, shareholder Jingning Guangda Ziyu Equity Investment Fund Management Center (Limited Partnership) intended to withdraw.

In September 2017, Guangda Ziyu subscribed for 1,641,414 shares of Xunzhong shares at a price of 15.84 yuan per share, for a total cost of approximately 25.9999 million yuan. Nine months after it became a shareholder of Xunzhong shares, Dahua Intelligence officially announced its acquisition of Xunzhong shares.

As Guangda Ziyu intended to withdraw, Xunzhong shares was also looking for new investors for its A-share listing, and at that time, Suzhou Historical and Cultural City and Zhang Huai'an came into view.

Meanwhile, Hu Jiali, the General Manager of the Administrative Department and shareholder of Xunzhong shares, became aware of Everbright Ziyu's intention to withdraw from the company and the investment intention of new potential investors through discussions at several administrative meetings of the company.

Therefore, Hu Jiali decided to acquire Everbright Ziyu's shareholding and resell it to new investors, making a profit from the price difference.

Ultimately, Everbright Ziyu transferred 2,954,500 shares of Xunzhong shares to Hu Jiali for RMB 31.62 million. Subsequently, Hu Jiali transferred 1,350,000 shares of Xunzhong shares to Suzhou City's Historical and Cultural City for RMB 20 million and 1,600,000 shares to Zhang Huai'an for RMB 17.56 million.

In other words, the General Manager of Xunzhong's Administrative Department capitalized on the gap between strategic investors exiting and new investors joining the company, earning RMB 5.94 million.

It should be noted that when Hu Jiali acquired Everbright Ziyu's shares, Piao Shenggen provided financial assistance and asked the company's Investor Relations Manager Luo Jianbo to arrange meetings between the buyer and seller. However, Hu Jiali stated that she retained all realized investment returns and repaid the financial assistance to Piao Shenggen.

04

Seeking a Former Creditor Affiliate as IPO Sponsor

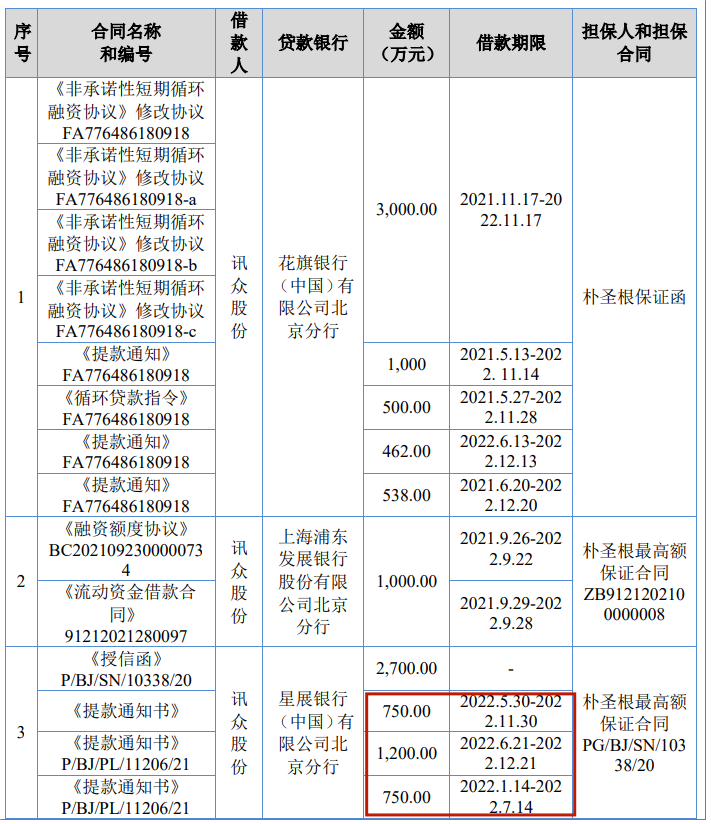

For this Hong Kong Stock Exchange IPO, Xunzhong shares' sponsor was DBS Asia Capital Limited (hereinafter referred to as "DBS Asia"). According to Rui Finance's "Pre-IPO Review," Xunzhong shares had previously borrowed from DBS Bank (China) Limited Beijing Branch (hereinafter referred to as "DBS Beijing Branch"), an affiliate of DBS Asia.

According to DBS Group's official website, DBS Group currently operates in 19 markets globally, including DBS Asia and DBS Bank (China) Limited, the parent company of DBS Beijing Branch.

On May 30, 2022, June 21, 2022, and January 14, 2022, DBS Beijing Branch issued loans of RMB 7.5 million, RMB 12 million, and RMB 7.5 million to Xunzhong shares, respectively.

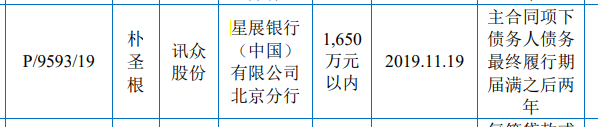

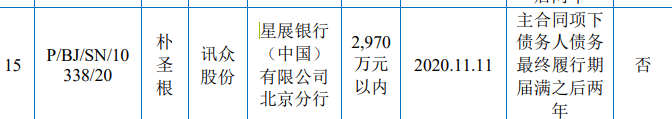

On November 19, 2019, and November 11, 2020, Piao Shenggen provided guarantees for the loans provided by DBS Beijing Branch to Xunzhong shares, with guaranteed amounts of up to RMB 16.5 million and up to RMB 29.7 million, respectively.

Furthermore, DBS Beijing Branch was also the deposit bank for Xunzhong shares' private placement of funds in 2021 and 2022.

Surprisingly, Xunzhong shares also engaged in "bank refinancing" through suppliers using the entrusted payment method with DBS Bank. After receiving the funds, the supplier transferred them back to Xunzhong shares' account within a short period, and all principal and interest related to this refinancing were repaid on schedule.

05

Net Profit Halved Before Listing Application

Short-term Debt Gap Exceeds RMB 200 Million

The prospectus shows that Xunzhong shares' primary businesses include cloud communication services, intelligent communication solutions, other communication solutions, and accessories. Among them, Communication Platform as a Service (CPaaS) is the core of its operations.

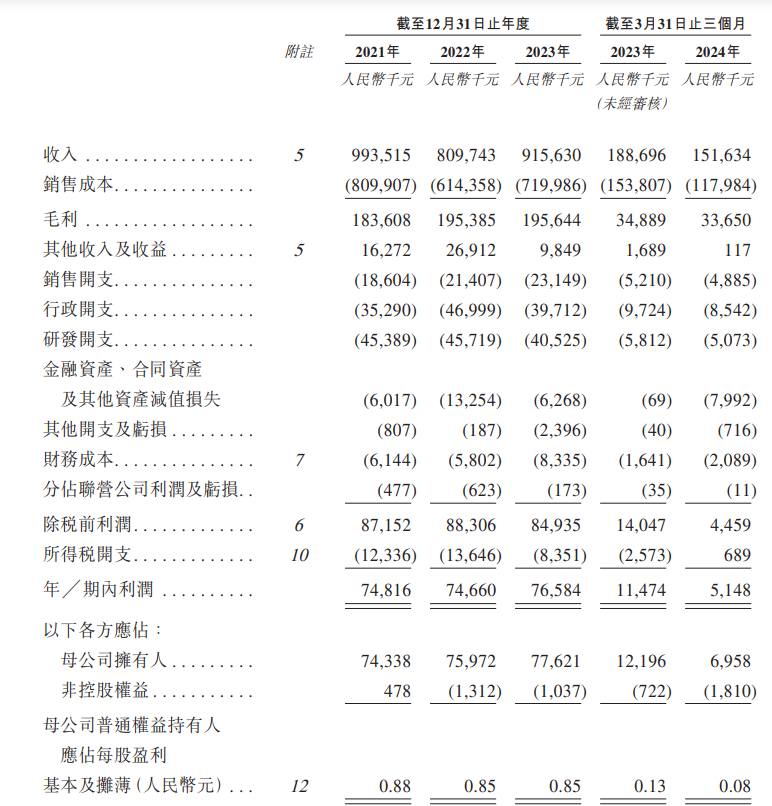

In 2021, 2022, and 2023 (hereinafter referred to as the "reporting period"), Xunzhong shares' revenues were RMB 994 million, RMB 810 million, and RMB 916 million, respectively, with net profits of RMB 74.816 million, RMB 74.66 million, and RMB 76.584 million.

Rui Finance's "Pre-IPO Review" found that during the reporting period, Xunzhong shares' revenue growth rates were 2.85%, -18.5%, and 13.08%, respectively, while net profit growth rates were 18.95%, -0.21%, and 2.58%, respectively.

It can be seen that during the reporting period, Xunzhong shares' revenue fluctuated, and net profit growth also weakened. In the first quarter of 2024, Xunzhong shares' revenue decreased by 20.6% year-on-year, and net profit declined by 55.1% year-on-year.

In fact, Xunzhong shares' performance has fluctuated since 2019, with a slowing growth rate. By 2023 revenue, Xunzhong shares ranked fourth in China's cloud communication service market with a mere 1.8% market share, while the top three players held 9.9%, 5.6%, and 2.1% market shares, respectively.

Regarding the decline in the company's performance in the first quarter of this year, Xunzhong shares attributed it mainly to the decision to terminate low-profit customer relationships and weakened demand for CPaaS voice services from customers.

Currently, Xunzhong shares may be more concerned about its cash flow situation.

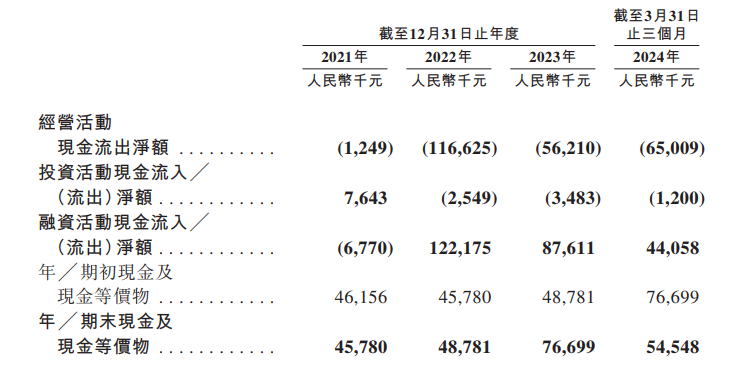

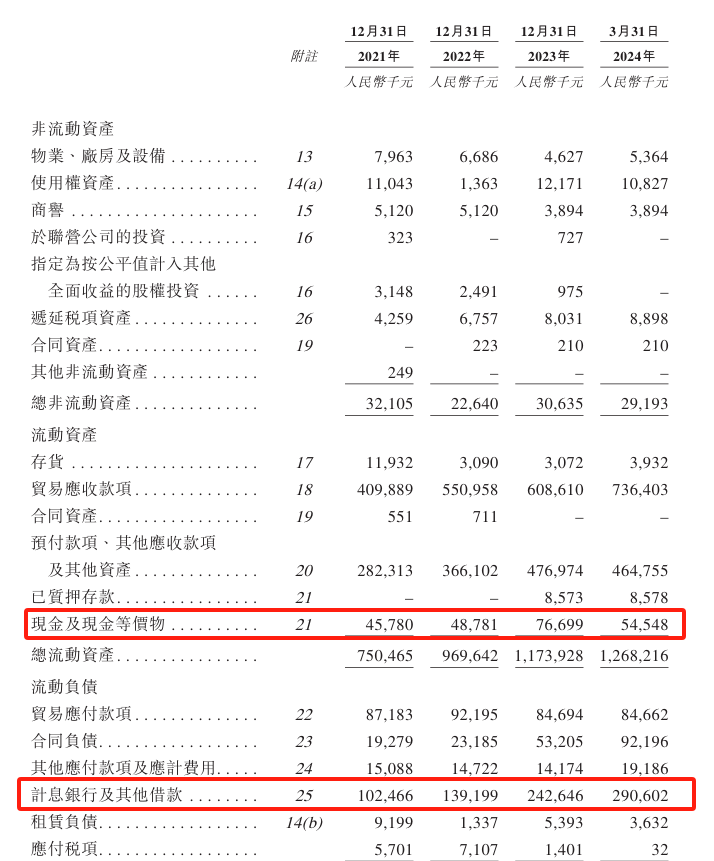

As of December 31, 2021, December 31, 2022, December 31, 2023, and March 31, 2024, Xunzhong shares' net cash flow from operating activities was consistently negative, with net outflows of RMB 1.249 million, RMB 117 million, RMB 56.21 million, and RMB 65.01 million, respectively.

During the period, the main operating capital changes adversely affecting Xunzhong shares' cash flow included extended billing and settlement processes for post-paid customers amid economic slowdown, leading to increased trade receivables, as well as increased prepayments, deposits, and other receivables.

As of March 31, 2024, Xunzhong shares had cash and cash equivalents of RMB 54.548 million and interest-bearing loans due within one year of RMB 290 million. In other words, Xunzhong shares had a short-term debt gap of approximately RMB 235 million.

Attachment: List of Intermediaries for Xunzhong Shares' IPO

Sole Sponsor: DBS Asia Capital Limited

Legal Advisor: King & Wood Mallesons

Auditor and Reporting Accountant: Ernst & Young