Detailed explanation of the Implementation Rules for the Renewal of New Energy Vehicles: Is it more beneficial for bus companies to replace the vehicle or the battery?

![]() 08/06 2024

08/06 2024

![]() 635

635

Introduction: According to the latest policy issued by the Ministry of Transport, urban bus companies will receive a fixed subsidy for replacing old new energy city buses with new ones and for replacing their power batteries. For replacing old new energy city buses, each bus will receive an average subsidy of 80,000 yuan; for replacing power batteries, each bus will receive a subsidy of 42,000 yuan.

Replace the Bus or the Battery

After the purchase subsidy stopped being applied for in 2021, the subsidy for the "trade-in" policy is unprecedented. However, for the current bus market, taking a 10.5-meter pure electric bus as an example, the 80,000 yuan subsidy per bus accounts for approximately 10% of the purchase cost. For bus companies that mainly rely on local financial subsidies, 10% of the subsidy may be manageable, but the remaining 90% is often difficult for local governments to bear. Therefore, such a subsidy is not sufficient to drive bus companies to replace their vehicles on a large scale. Replacing power batteries is a different story.

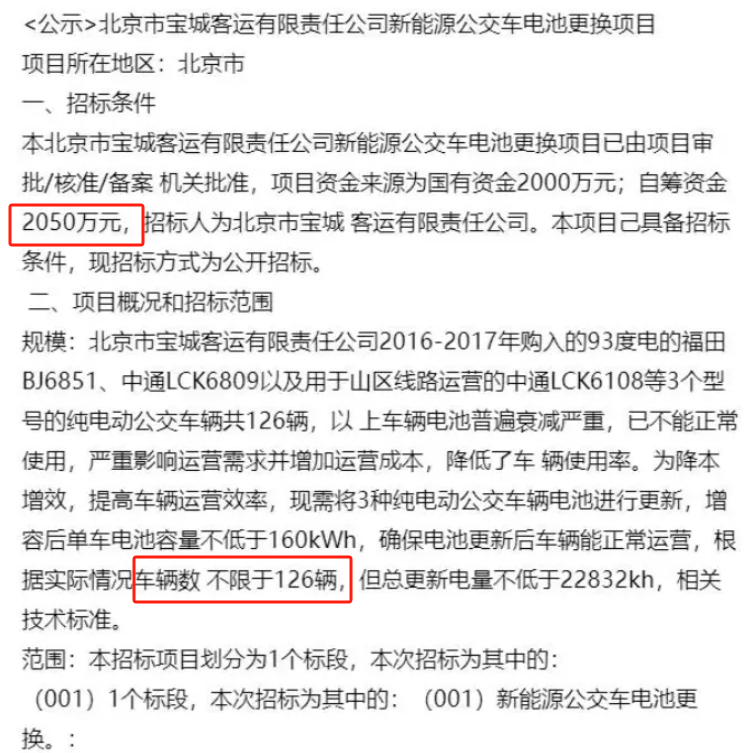

Currently, compared to replacing new batteries, vehicle manufacturers naturally prefer bus operators to replace their old buses with new ones, so they are not enthusiastic about power battery replacement services. Additionally, most mainstream domestic bus manufacturers (except BYD) do not have wholly-owned or controlled enterprises for battery cell production. Replacing power batteries requires vehicle manufacturers to set up specialized teams to purchase batteries from battery companies, and these manufacturers often handle the process under the guise of "after-sales service" or extended warranty, which can disrupt the existing battery pricing system and offer thin profit margins. Therefore, according to EV Century, most of the power battery replacement projects currently undertaken by bus operators across the country are authorized to third-party battery pack (pack) enterprises by battery (cell) manufacturers such as CATL, EVE Energy, and CALB. The reasons are as follows: First, the budget for battery replacement and the actual vehicle condition can vary, leading to different scenarios for replacing battery cells or packs. Second, there is no standard mode for the original vehicle's battery management system, high-voltage distribution module, and engineering services, all of which are project-based, making construction difficult and profits thin. Battery (cell) manufacturers, which focus mainly on mass production, lack the initiative to undertake such projects. In summary, since the beginning of this year, it has been common to see tenders for "battery extended warranty" services offered to bus companies by battery (cell) manufacturers that authorize third-party accessory or pack providers. Cities like Beijing and Yantai have issued tenders for replacing bus power batteries, each worth over ten million yuan. Jiangsu recently announced a related plan to replace 3,504 new energy city buses and 3,696 bus power batteries in 2024, with the goal of adding and replacing over 9,000 new energy city buses and 12,000 bus power batteries by 2027. Clearly, replacing power batteries has become an essential means to extend the service life of urban buses, and bus companies across the country are steadily pushing forward with related work. Taking Beijing Baocheng Passenger Transport Co., Ltd. (the bus operator in Miyun District, Beijing) as an example, the tender for its power battery replacement project issued in April this year was ultimately won by a third-party pack enterprise authorized by a battery (cell) manufacturer.

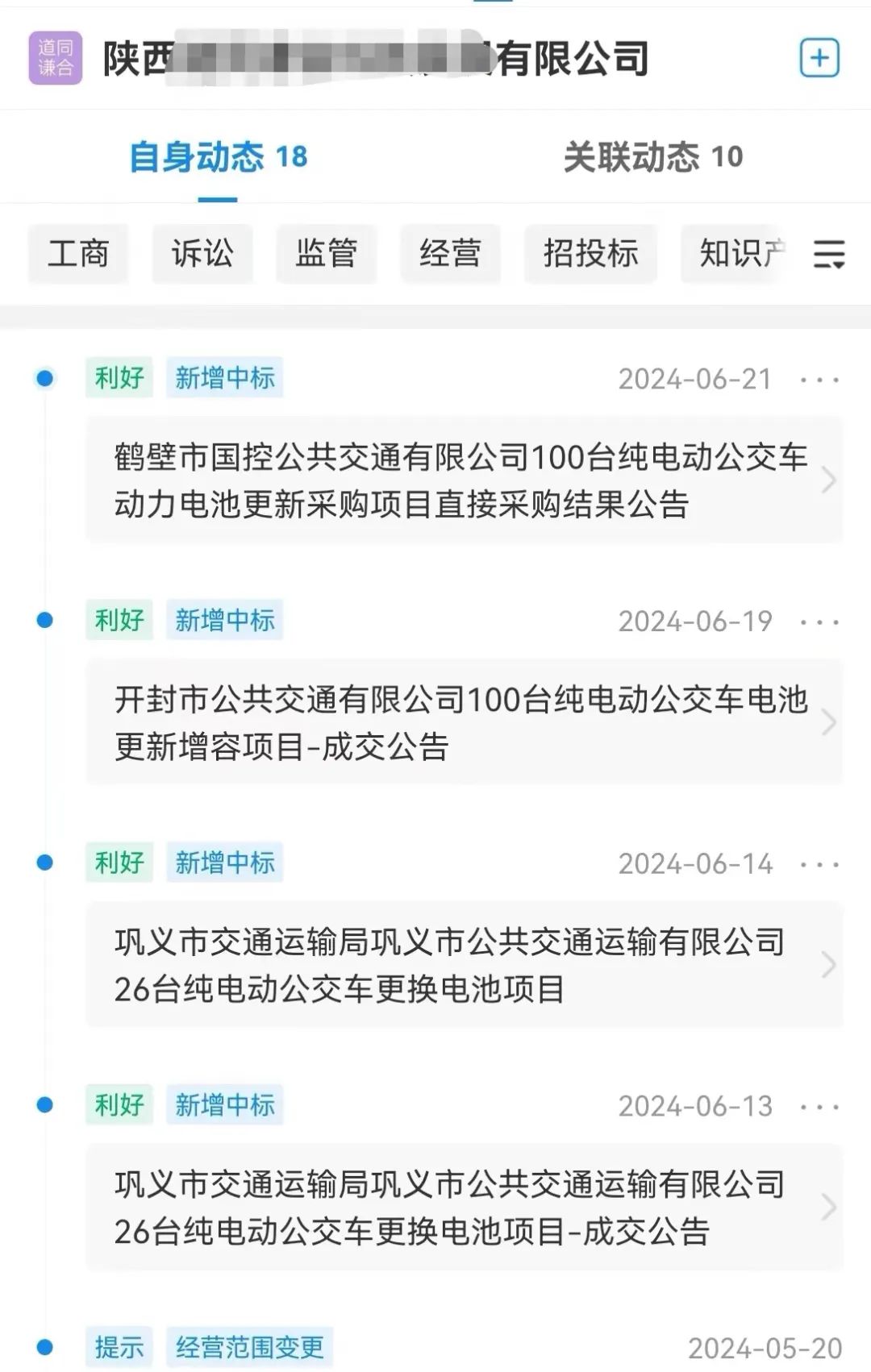

According to EV Century's verification, the battery replacement projects for three bus companies in Henan Province in 2024 were also won by a third-party pack enterprise in Shaanxi Province authorized by a battery manufacturer.

Obviously, compared to buying a new bus, which can easily cost nearly a million yuan, replacing the entire set of power batteries is more cost-effective. According to the tenders issued by Beijing and Yantai, the budget for replacing the power battery of a single bus is approximately 160,000 yuan, and the 42,000 yuan subsidy can cover over 25% of the budget. At the same time, the actual situations faced by bus companies when replacing power batteries can be broadly categorized into the following three types:

Situation 1: The original power battery is out of warranty;

Reason: The original battery manufacturer has ceased production, stopped after-sales service, or even gone bankrupt;

Situation 2: The entire bus is out of warranty;

Reason:

(1) The vehicle manufacturer has ceased production, stopped after-sales service, or even gone bankrupt;

(2) The vehicle manufacturer has failed to fulfill the original contract terms with the battery manufacturer due to commercial or payment issues;

Situation 3: Both the original bus and power battery are out of warranty;

Reason:

(1) Both the vehicle and power battery manufacturers have ceased production, stopped after-sales service, or even gone bankrupt;

(2) The bus company and vehicle manufacturer have failed to fulfill the original contract terms with the battery manufacturer due to commercial or payment issues; According to EV Century's research, similar situations mainly involve vehicles produced between December 31, 2015, and December 31, 2016. On the one hand, these vehicles have been in operation for over eight years as of 2023, and both the entire vehicle and the power battery have exceeded their warranty periods. On the other hand, after December 31, 2016, clauses advocated by CATL, such as the "8-year warranty for power batteries" and "reference to national standards for power batteries, with a charge-discharge rate ≤ 1C," have become prevalent in the bus industry and have become the standard template for bus operators and vehicle manufacturers to sign technical agreements for vehicle purchases. As a result, few new energy buses produced after January 1, 2017, have power batteries that are out of warranty. Therefore, third-party pack enterprises authorized by power battery (cell) manufacturers have embarked on a fierce market competition.

Who is the primary responsible party?

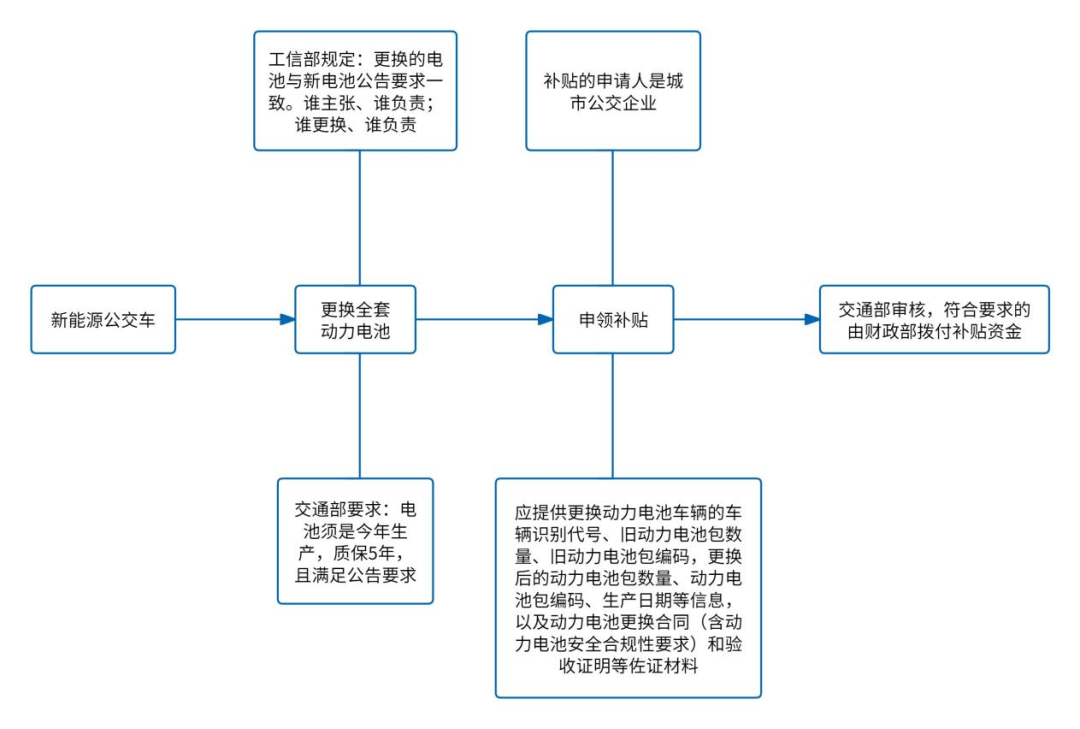

Figure: Application process and requirements for subsidies for replacing power batteries in new energy buses. The Ministry of Transport clearly states in its policy that applications for subsidies for replacing power batteries must include information such as the vehicle identification number, the number and codes of old battery packs, the number and codes of new battery packs, production dates, and a replacement contract (including safety and compliance requirements for the power batteries) along with acceptance certificates. As mentioned earlier, most power battery replacement projects currently undertaken by bus operators across the country are authorized to third-party battery pack (pack) enterprises by battery (cell) manufacturers such as CATL, EVE Energy, and CALB. To obtain the subsidy, both the new and old battery codes are required. Let's first understand what a power battery code is. The Ministry of Industry and Information Technology (MIIT) issued the "Interim Measures for the Recycling and Utilization Management of Power Batteries for New Energy Vehicles" (hereinafter referred to as the "Measures") in January 2018. The Measures state that new energy vehicles and power batteries must implement the extended producer responsibility system, with automobile manufacturers bearing the primary responsibility for the recycling of power batteries. To trace the flow of batteries, the Measures also require power battery manufacturers to collaborate with automobile manufacturers to encode the produced power batteries according to national standards and timely upload the encoding information of new energy vehicles and batteries through a traceability information system. This policy was officially implemented in August 2018.

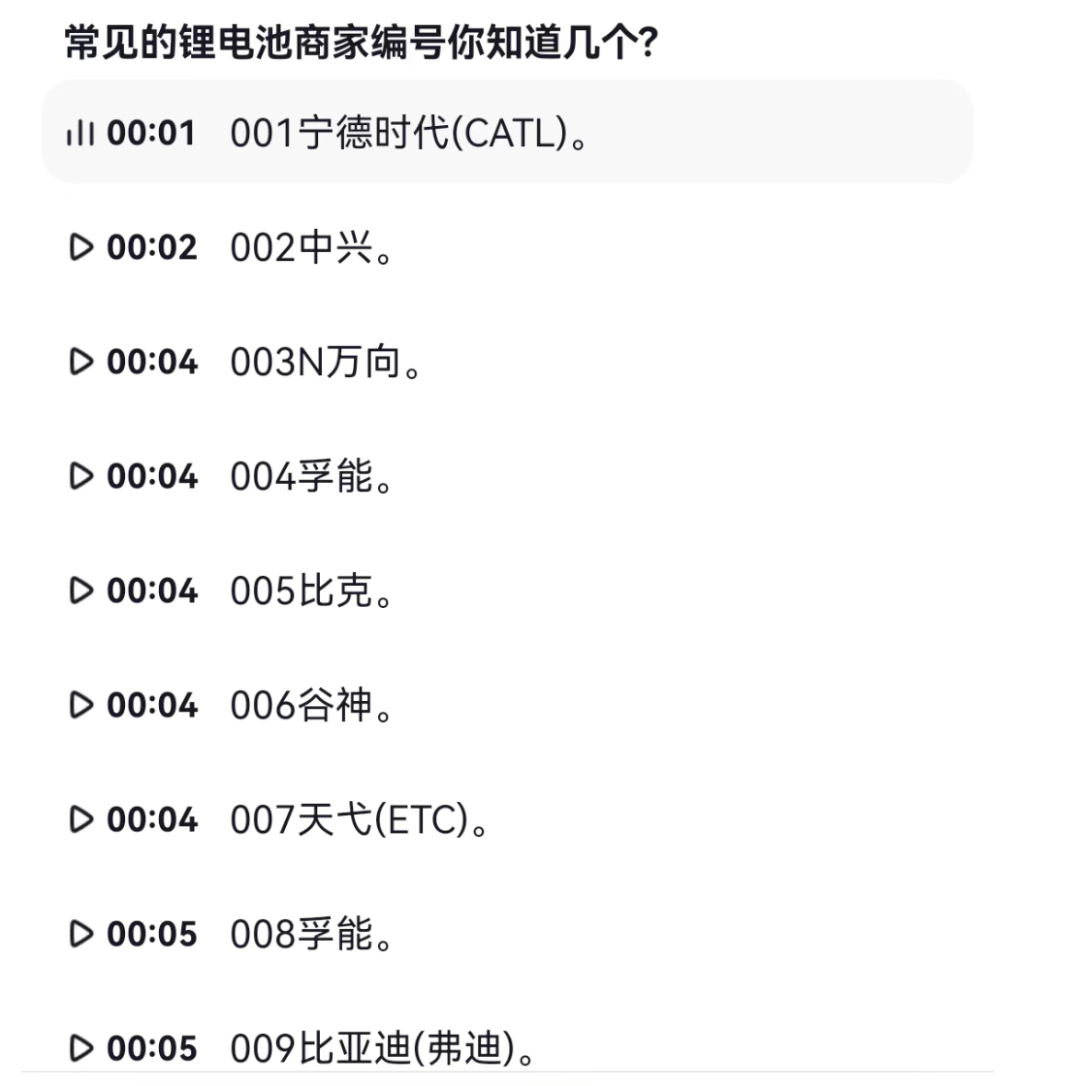

Figure: Major power battery (cell) manufacturers all have encoding systems. The power battery code ensures the traceability and uniqueness of power batteries, supporting their full lifecycle management. The basic principles of power battery encoding include uniqueness, stability, scalability, traceability, and compatibility. The structure of a power battery code typically consists of two parts: design information and production information. The design information includes the manufacturer code, product type code, battery type code, specification code, and traceability information code. The production information includes the production date code, production line code, and serial number. Specifically:

(1) Manufacturer code: Represents the battery manufacturer and is assigned by the MIIT.

(2) Product type code: Indicates the composition form of the battery, such as battery pack (P), battery module (M), or battery cell (C).

(3) Battery type code: Indicates the material used in the battery, such as lithium iron phosphate (B) or lithium nickel manganese cobalt oxide (E).

(4) Specification code: Defined by the battery manufacturer to represent the battery specifications.

(5) Traceability information code: Defined by the battery manufacturer to trace the production and usage of the battery.

(6) Production date code: Includes the year, month, and day of production.

(7) Production line code: Indicates the production line information of the battery.

(8) Serial number: Represents the order of production for that day. Since the policy started in August 2018, and the current vehicles being replaced with new power batteries and applying for subsidies were mainly produced between 2015 and 2016, it is an objective fact that these old batteries do not have codes. This has become the first issue for bus companies applying for policy subsidies. On the other hand, according to the Measures, the 24-digit power battery code includes a manufacturer code that represents the battery manufacturer. Battery manufacturers submit applications through the "Automotive Power Battery Coding Registration System," and the MIIT assigns the codes uniformly. Therefore, whether third-party pack enterprises authorized by power battery (cell) manufacturers or those using products from power battery (cell) manufacturers should submit applications through the system in their own names or use the codes assigned by the MIIT to the battery (cell) manufacturers (including manufacturer code, production line code, traceability information code, specification code, etc.) has become the second issue for bus companies applying for policy subsidies.

According to EV Century's verification, the winning bidders for the battery replacement projects in Beijing Baocheng Passenger Transport and several bus companies in Henan Province mentioned in this article do not have the codes assigned by the MIIT. In fact, based on the requirement for bus companies to provide supporting materials such as old and new battery codes when applying for subsidies, EV Century previously identified the core configurations of the corresponding vehicles, including the MIIT-registered parameters related to power battery replacement, by reviewing the past product announcements and recommended directory information of existing vehicles. This information served as supporting materials for the old power battery codes to prove their origins and identities. Meanwhile, for the new power battery codes, EV Century fully cooperated with third-party pack enterprises and bus company owners to complete the coding of new batteries in accordance with the Measures, providing critical support for the effective implementation of these Implementation Rules. However, providing codes is clearly not the ultimate goal of battery traceability. Therefore, the Measures also emphasize that the replaced power batteries should be produced after January 1, 2024, with a warranty period of no less than five years (based on the 13-year mandatory scrapping period for buses) and must meet the mandatory national standard GB38031-2020 "Safety Requirements for Traction Batteries for Electric Vehicles" and the announcement requirements of the industry regulatory authorities regarding the replacement of power batteries in new energy city buses.

Perhaps recognizing potential issues faced by bus companies in applying for subsidies, the MIIT issued the "Announcement on Matters Related to the Replacement of Power Batteries in New Energy City Buses (Draft for Comment)" (hereinafter referred to as the "Announcement") in June this year. The Announcement states that the replacement of power batteries in new energy city buses should be carried out under the premise of ensuring vehicle safety, and that new energy city bus operators and power battery replacement service providers should follow the principle of "who advocates, who is responsible; who replaces, who is responsible," strictly implementing safety responsibilities. Combining the subsidy requirements of the Ministry of Transport with the technical requirements for battery replacement from the MIIT reveals that as the procuring party for bus purchases, under the guidance of bus companies, the replacement of old power batteries in buses no longer requires direct involvement from vehicle manufacturers. The Ministry of Transport clearly states at the beginning of the Subsidy Rules that the applicant for subsidies is the urban bus company. The MIIT proposes the principle of "who advocates, who is responsible," indicating that urban bus companies will proactively propose the replacement of power batteries in out-of-warranty new energy buses due to the three situations explained in the "Replace the Bus or the Battery" section of this article.

Since most new energy buses licensed between December 31, 2015, and December 31, 2016, do not have the support of an "8-year warranty clause" for power batteries or the "30,000-kilometer subsidy application policy" (announced in June 2016), it is normal for them to be out of warranty after years of operation. Even if these vehicles are in good condition, considering the safety operation baseline of bus companies, they will never put "out-of-warranty" vehicles into operation. Since power batteries are the core element of safe vehicle operation, these challenges can only be addressed through battery replacement. Recognizing these issues, before the issuance of the Measures and Announcement, the MIIT, in its "Notice on Further Improving Safety Supervision for the Promotion and Application of New Energy Vehicles" in November 2016, required automakers to establish monitoring platforms for new energy vehicle enterprises to conduct real-time monitoring of key systems such as power batteries and interface with the national new energy vehicle supervision platform. The national supervision platform for new energy vehicles was officially established in 2017.

Since 2017, all domestically sold new energy vehicles have been connected to the platform, while some vehicles produced before that time could not be connected due to hardware limitations. From these two policies issued successively, it can be seen that the competent authorities have established a comprehensive process for the full lifecycle management of new energy buses, especially power batteries. According to EV Century's statistics, there are still over 100,000 new energy buses in operation registered before 2016, which will undoubtedly become the primary targets for this round of battery replacement or upgrade. With the support of product announcement data (all fields of registered parameters corresponding one-to-one) and vehicle sales data (where vehicles are sold and their configurations, etc.) from 2009 to the present, EV Century has also provided targeted data services focusing on power battery manufacturers, third-party pack manufacturers, and vehicle manufacturers that provide extended warranty services in response to the issuance of policies such as the Measures and Announcement.