Is Huawei making cars? The answer may lie with Thalys

![]() 08/06 2024

08/06 2024

![]() 594

594

Lead

At the beginning of July, Thalys purchased the "Wenjie" trademark from Huawei, suggesting a potential split between the two companies. However, by the end of July, Thalys announced plans to invest in Huawei's subsidiary, Yinwang, indicating a close relationship. The complex dynamics between these two enterprises make it difficult to discern whether they are growing apart or closer together. Meanwhile, Wenjie's sales continue to soar, with 41,535 new vehicles delivered in July, representing an 823% year-on-year growth.

Produced by | Heyan Yueche Studio

Written by | Chen Dejun

Edited by | Heyanzi

Total words: 3316

Reading time: 5 minutes

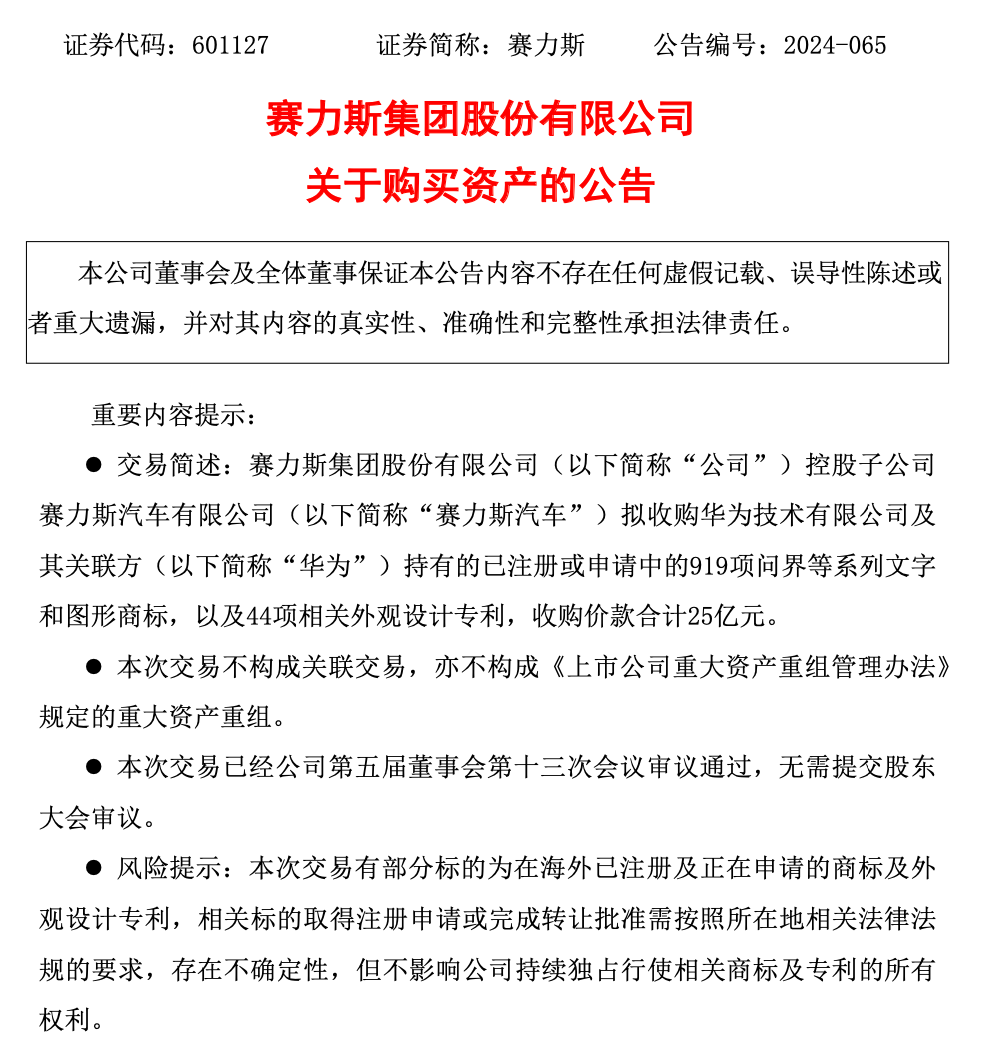

At the beginning of July, Thalys announced its intention to acquire Huawei's 919 "Wenjie" series trademarks and 44 related design patents for a total price of RMB 2.5 billion, suggesting a potential distancing between the two companies. However, by the end of July, Thalys issued an announcement about its plans to invest in Shenzhen Yinwang Intelligent Technology Co., Ltd. (hereinafter referred to as "Yinwang").

△Thalys announced its intention to acquire Wenjie series trademarks

Who is behind Huawei's Yinwang?

"Yinwang" has a significant background, as it is the entity formed after Huawei's Automotive Business Unit became independent. Established in May 2019, Huawei's Automotive Business Unit aims to provide end-to-end business solutions in the intelligent vehicle field, offering ICT components and solutions for smart cars.

The Business Unit has a rapid growth trajectory, crossing the breakeven point impressively. At the China EV100 Forum held in March, Yu Chengdong, Chairman of Huawei's Automotive Business Unit, revealed that the unit had reduced its annual losses from RMB 10 billion to RMB 8 billion and then to RMB 6 billion, with expectations of profitability this year.

Shenzhen Yinwang Intelligent Technology Co., Ltd. was incorporated in January 2024, specializing in automotive intelligent system and component solutions, including intelligent driving, smart cockpits, intelligent vehicle control, intelligent vehicle clouds, and in-vehicle optics. While Chang'an Automobile had expressed interest in investing in Yinwang, no substantial action has been taken so far. Currently, Huawei holds a 100% stake in Yinwang.

△Chang'an Automobile had expressed interest in investing in Yinwang with a stake not exceeding 40%

Now, Thalys aspires to become a shareholder in Yinwang, raising speculations about whether Yinwang's R&D focus will shift to Thalys' Wenjie models post-investment. If Yinwang leads the R&D and Thalys manufactures the vehicles, can they be considered Huawei cars?

Legally or brand-wise, they might not be considered Huawei cars, but Huawei's influence is undeniable. Even the "intelligent brain" is made by Huawei, making it difficult to argue otherwise.

The atmosphere is ripe for car manufacturing

The question of whether Huawei is manufacturing cars is divisive within the company. Yu Chengdong is widely rumored to be a firm advocate of car manufacturing.

If Huawei were to immediately start manufacturing cars, it would not come as a surprise. Through a series of Huawei-related models like Wenjie and Zhijie, Huawei has proven its capabilities in terms of technology and sales. On July 2, HarmonyOS Intelligent Driving released its mid-year report for 2024, announcing cumulative deliveries of 194,207 vehicles across its entire lineup, ranking first among new forces in China, surpassing Lixiang One and Xiaomi's cars.

Huawei has invested heavily in the automotive sector, outpacing many dedicated automakers. According to Huawei's 2023 annual report, since the establishment of its Intelligent Automotive Solutions BU, Huawei has invested over RMB 30 billion in R&D, with a team of 7,000 researchers. Huawei's research into smart cars began as early as 2012, covering electric drives, batteries, electronic controls, smart cockpits, and intelligent driving assistance systems.

The allure of the automotive market is undeniable, especially given the challenges faced by Huawei's mobile phone business in recent years. The automotive industry is undergoing a significant transformation towards intelligence and electrification, presenting an opportunity for emerging players like Huawei.

However, every gain comes at a cost. If Huawei chooses to manufacture cars, it will lose many current and potential partners, turning them into competitors. Automakers that have collaborated with Huawei include NIO, BYD, Great Wall Motors, Geely, GAC Aion, GAC Motor, SAIC Motor Passenger Vehicle, Beijing Automotive Group, Dongfeng Liuzhou Automobile, JAC Motor, SAIC MAXUS, and FAW Besturn. Facing these clients, who would willingly turn friends into foes?

△Huawei has also collaborated with BYD

Furthermore, the automotive industry is notoriously challenging, with many brands disappearing each year. While Huawei has a solid foundation, manufacturing complete vehicles entails significant costs and risks. Even if Huawei emerges victorious, the journey will undoubtedly be arduous. Moreover, some aspects of car manufacturing offer slim profit margins, making it more attractive to focus on intelligent hardware and software. In March last year, Ren Zhengfei personally issued a resolution stating that Huawei would not manufacture cars, with a validity period of five years. Huawei's Rotating Chairman Xu Zhijun later clarified that the five-year validity was standard for all Huawei documents and that Huawei would not manufacture cars within the next decade, nor would its automotive strategy change. Given Huawei's commitment to capturing the largest profit margin in intelligence, it has entrusted the "Wenjie" brand entirely to Thalys and clarified relationships with Chery and Beijing Automotive Group. Is Huawei secretly manufacturing cars?

Huawei has given "Zhijie" to Chery and "Xiangjie" to Beijing Automotive Group, without charging for either. Thalys, on the other hand, paid RMB 2.5 billion for "Wenjie," but this seems like a steal considering the brand's market value exceeds RMB 10.2 billion.

As a super vendor, Huawei offers three cooperation packages to automakers, demonstrating its sincerity in collaboration. The first is the Tier 1 model, where Huawei supplies components like battery management systems, smart cockpits, and intelligent driving solutions. The second is the Huawei Inside (HI) model, where Huawei provides a full-stack intelligent vehicle solution, including computing and communication architecture, and jointly develops with automakers. AITO and GAC Aion are notable examples under this model. The third and most favored by Huawei is the Smart Selection model, where Huawei is deeply involved in product definition, core component selection, and marketing services. Huawei's Smart Selection partners include Thalys, Chery, JAC Motor, and Beijing Automotive Group.

By offering such personalized services, automakers are willing to pay handsomely. The intelligent business is not only lucrative but also accounts for a significant portion of vehicle costs. The vice president of NIO Auto Technology (Anhui) Co., Ltd. and head of NIO Auto hardware, Bai Jian, revealed on Weibo that intelligent hardware accounts for approximately 20% of vehicle costs. Yuan Feng, former general manager of GAC Capital, estimated that 40% of future vehicle costs would be hardware, 40% software, and 20% related to services. This trend suggests that intelligence will replace or surpass the engine's core position, creating a vast and profitable market for "automotive intelligence," which aligns with Huawei's strategy.

Huawei aims to establish an intelligent ecosystem, positioning itself as a supplier of incremental components for intelligent and connected vehicles, offering both hardware, software, and intelligent vehicle solutions. This market holds immense potential and influence, unmatched by the troubled automotive industry.

Can Thalys maintain its momentum?

Wenjie's current popularity is largely attributed to Huawei's branding. If Thalys loses Huawei's support, can it maintain its charm?

The timing of the trademark transaction between the two companies suggests careful consideration. With Wenjie's substantial sales volume, any fluctuations should remain within an acceptable range.

On July 24, AITO and Huawei HarmonyOS Intelligent Driving officially announced that cumulative deliveries of the SUV Wenjie M7, jointly developed by Huawei and Thalys, exceeded 200,000 units. On July 22, AITO announced that cumulative deliveries of the new Wenjie M7 Ultra surpassed 30,000 units within 50 days of its launch.

In the first half of 2024, Wenjie sold 180,000 vehicles, marking a 639.4% year-on-year growth. Among models priced above RMB 300,000, Wenjie ranked fourth, trailing only BMW, Mercedes-Benz, and Lixiang One. It ranked second among new forces and first among high-end models priced above RMB 500,000. In July, Wenjie continued its sales surge, delivering 41,535 new vehicles, representing an 823% year-on-year growth.

△Wenjie M9 equipped with HarmonyOS cockpit

Solid sales figures provide Thalys with confidence. On July 9, Thalys disclosed its 2024 interim profit forecast, expecting revenue of RMB 63.9 billion to RMB 66 billion, representing a 479% to 498% year-on-year increase. Thalys expects to turn a profit, with net income attributable to shareholders ranging from RMB 1.39 billion to RMB 1.7 billion. Thalys has crossed the breakeven point, joining Tesla, BYD, and Lixiang One as rare profitable new energy vehicle manufacturers globally. Founded in 1986, Thalys initially produced springs and later ventured into motorcycles in 2002. It gained prominence in the automotive industry with its "Dongfeng Xiaokang" brand. In April 2020, Thalys collaborated with Huawei to launch the Thalys Huawei Smart Selection SF5, marking the beginning of a new era. While Thalys may not have the same reputation as top automakers, its nearly 40 years of experience sets it apart. This trademark transaction clarifies the brand relationship but does not affect technical cooperation. Thalys retains Huawei's technical support. If Thalys invests in Yinwang as planned, it will effectively bring intelligent component R&D in-house, strengthening its technological discourse. Moreover, distancing itself from Huawei's branding could benefit Thalys' exports. Thalys has a long history of international expansion, entering the Indonesian market in 2018. While initial sales were modest, there is potential for growth. In the first five months of this year, Thalys' Indonesian subsidiary DFSK sold only 422 units across eight models, indicating room for improvement. While Huawei maintains its stance against car manufacturing, it remains deeply involved. This benefits both Huawei and its partners. By focusing on products, Huawei and Thalys can excel in their respective fields. Commentary Long ago, Huawei stated it would not manufacture phones, yet it has since become a leading phone brand. However, the automotive industry differs. Huawei faces a choice between the intelligent industry and the automotive industry. As a supplier, Huawei has greater market potential and can better leverage its strengths. By focusing on intelligence, Huawei can drive advancements in intelligent vehicle technology. Conversely, directly manufacturing cars poses numerous challenges. (This article is originally written by Heyan Yueche and may not be reproduced without authorization.)