Apple's revenue increased by 5% in the third fiscal quarter, while revenue in Greater China declined, continuing to invest in AI

![]() 08/06 2024

08/06 2024

![]() 540

540

Bianniushi Today's Report

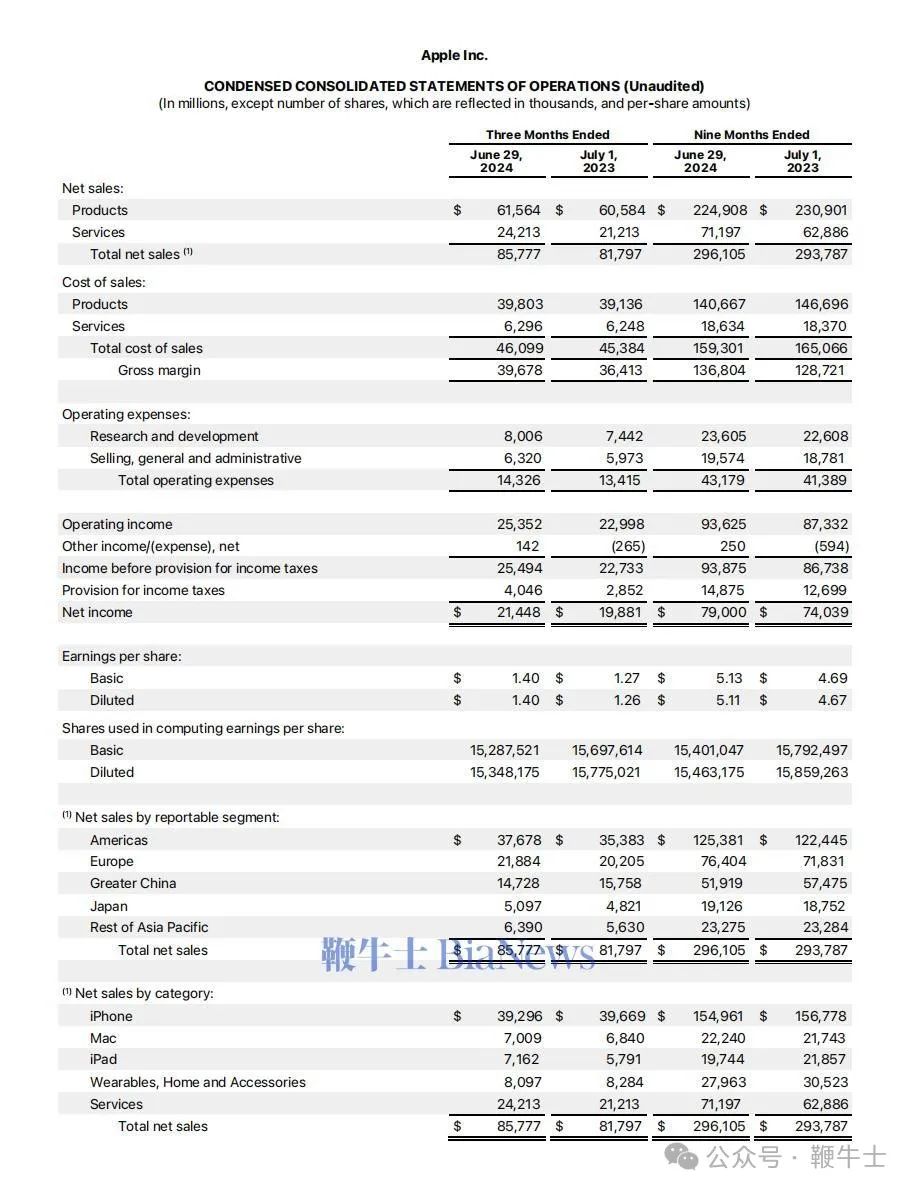

Apple released its fiscal third-quarter (ending June 29) earnings report for fiscal year 2024 after the US market close on August 2, Beijing time.

The earnings report showed that Apple generated $85.8 billion in revenue for the quarter, a year-over-year increase of 5%, faster than expected growth and shaking off the previous sales downturn.

Multiple investment banks also raised their target prices for Apple around the earnings report release. JPMorgan Chase increased its price target for Apple from $245 to $265 and maintained its “Overweight” rating.

Investment bank D.A. Davidson raised its target price for Apple from $230 to $260 after the earnings release, while Citigroup raised its target price from $210 to $255.

During the investor conference call, Tim Cook excitedly emphasized that “Apple set new quarterly records in many regions around the world.”

Specifically:

Earnings per share: $1.40 vs. expected $1.35

Revenue: $85.78 billion vs. expected $84.53 billion

iPhone revenue: $39.3 billion vs. expected $38.81 billion

Mac revenue: $7.01 billion vs. expected $7.02 billion

iPad revenue: $7.16 billion vs. expected $6.61 billion

Wearables, Home, and Accessories revenue: $8.1 billion vs. expected $7.79 billion

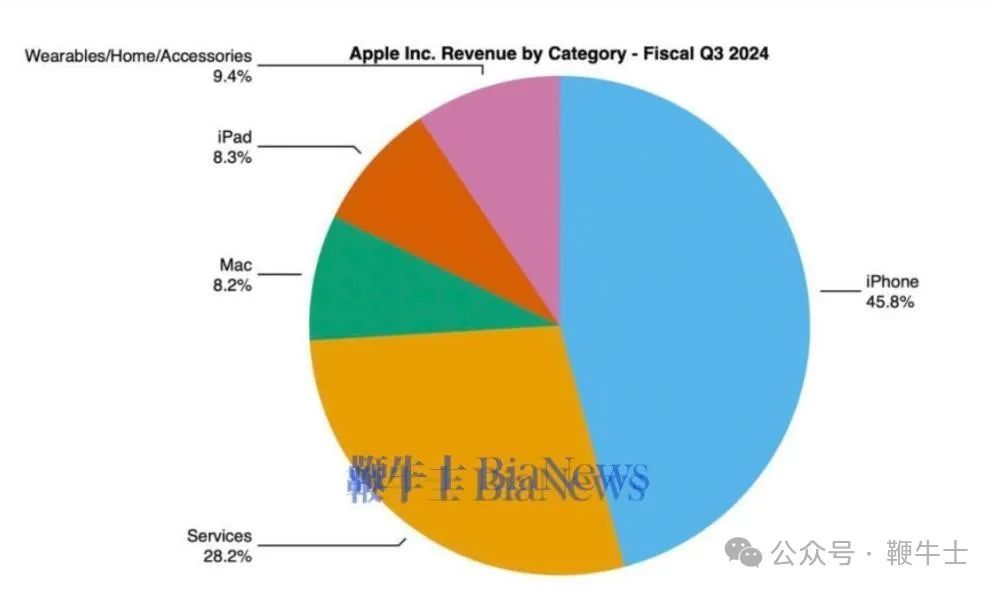

Services revenue: $24.21 billion vs. expected $24.01 billion

Gross margin: 46.3% vs. expected 46.1%

Among them, Apple's iPad division showed the strongest growth, with sales increasing by nearly 24% year-over-year to $7.16 billion.

In May this year, Apple relaunched the new iPad Air, iPad Pro, Apple Pencil, and Magic Keyboard accessories after a hiatus in 2023. According to DigiTimes, shipments of the 2024 iPad Pro are targeted to exceed 9 million units.

Cook mentioned during the call that 50% of iPad buyers are first-time purchasers, indicating that the tablet market is not yet saturated.

Regarding its primary business, the iPhone, Apple's performance appears less impressive, with iPhone revenue declining for two consecutive quarters. Revenue for the fiscal quarter was $39.296 billion, a 0.9% year-over-year decrease but above market expectations of $38.95 billion. In the previous quarter, Apple's iPhone revenue was $45.96 billion, down from $51.33 billion in the same period last year.

According to foreign media reports, the iPhone accounted for approximately 46% of the company's total sales in this fiscal quarter, and the decline in iPhone sales was a significant factor contributing to the overall revenue decline.

Additionally, the only declining revenue in Greater China has become a thorn in Apple's side.

Apple's revenue in Greater China for the quarter was $14.7 billion, down 6.5% year-over-year, an improvement from the previous quarter's 8.1% decline but still below analysts' expectations of $15.3 billion.

According to data released by an institution on smartphone shipments in mainland China in the second quarter of 2024, Apple has dropped to sixth place in China's smartphone shipments.

Improving iPhone sales has become an urgent issue.

Currently, it appears that Apple has adopted a more aggressive pricing strategy. On the evening of May 31, JD.com announced increased discounts for Apple products during the 618 promotion, with up to RMB 2,350 off the iPhone 15 Pro Max and discounts starting from RMB 2,000 for the iPhone 15 Pro in JD.com's self-operated Apple flagship store.

In terms of boosting sales, Cook mentioned during the call that Apple's intelligence would be the biggest factor influencing users' decisions to upgrade their iPhones in the future.

Cook stated that while he could not yet discuss the positive impact of Apple Intelligence services on sales, the company has increased spending to prepare for the service's launch.

Regarding the unavailability of iOS 18 AI features in China, Cook also promised to introduce them as soon as possible.

It is worth mentioning that shortly before the earnings report release, Apple released the iOS 18.1 Beta version for paid developers, marking the debut of Apple Intelligence on end-user devices.

However, a comprehensive evaluation reveals that the current beta version's functions mainly revolve around writing tools, Siri, photo albums, etc. Bloomberg Tech journalist Mark Gurman also stated, "So far, Apple Intelligence has very few functions, with only writing tools and call logs standing out, and there haven't been significant changes in other areas."

With the 'racing' iPad, the 'sluggish' iPhone, and the 'unknown' Apple Intelligence, Apple still faces multiple challenges overall. However, compared to the uncertainties of the previous quarter, Apple's bet on AI and its development in this area have confirmed its development direction, potentially leading to further progress.