The mobile phone industry is out of the doldrums, and domestic manufacturers are poised to win big again?

![]() 08/06 2024

08/06 2024

![]() 613

613

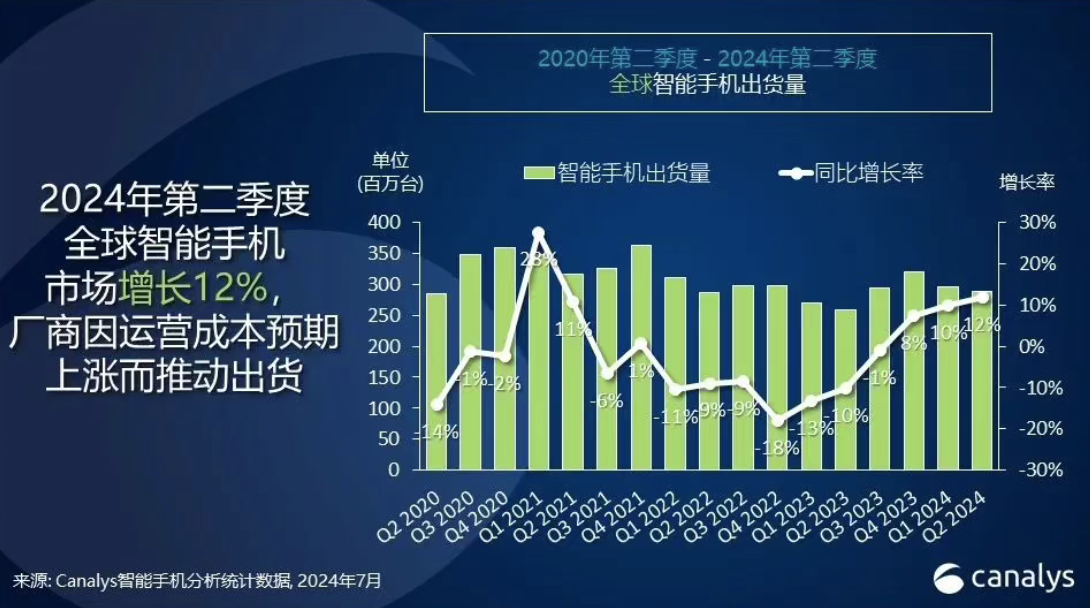

After years of decline, the smartphone industry finally returned to growth in 2024.

(Image source: Canalys)

According to the latest report from market research firm Canalys, global smartphone shipments reached 288.9 million units in the second quarter of 2024, a year-on-year increase of 12%. Three consecutive quarters of growth in the smartphone industry have brought significant relief to phone manufacturers, signaling a shift from decline to growth.

For example, the market has more room for niche categories, including foldable phones and other specialized segments, which have more promising prospects. Manufacturers can finally stop the meaningless "internal competition" and invest more energy and resources into technological research and development beyond price competition.

Given the current social and technological environment, the return to growth in the global smartphone market also seems to indicate the correctness of the "AI phone" segment, and the role played by Chinese phone manufacturers in this cannot be ignored.

More Opportunities, More Variables

In terms of market share, Samsung remains the undisputed leader. Although it is considered "Others" in the domestic market, Samsung's brand appeal is still top-notch globally, forming its core competency. However, a 3% decline in its 18% market share compared to last year indicates that Samsung cannot afford to be complacent. Apple ranks second with a 16% market share, closely followed by Xiaomi with 15%. Vivo and Transsion hold the fourth and fifth positions, respectively.

(Image source: Omdia)

To my surprise, OPPO fell out of the top five and became "Others," while Transsion, another domestic brand, ranked fifth globally based on its success in Africa. With Honor and Huawei having released several highly competitive products in 2024, the ranking list may change again in the second half of the year.

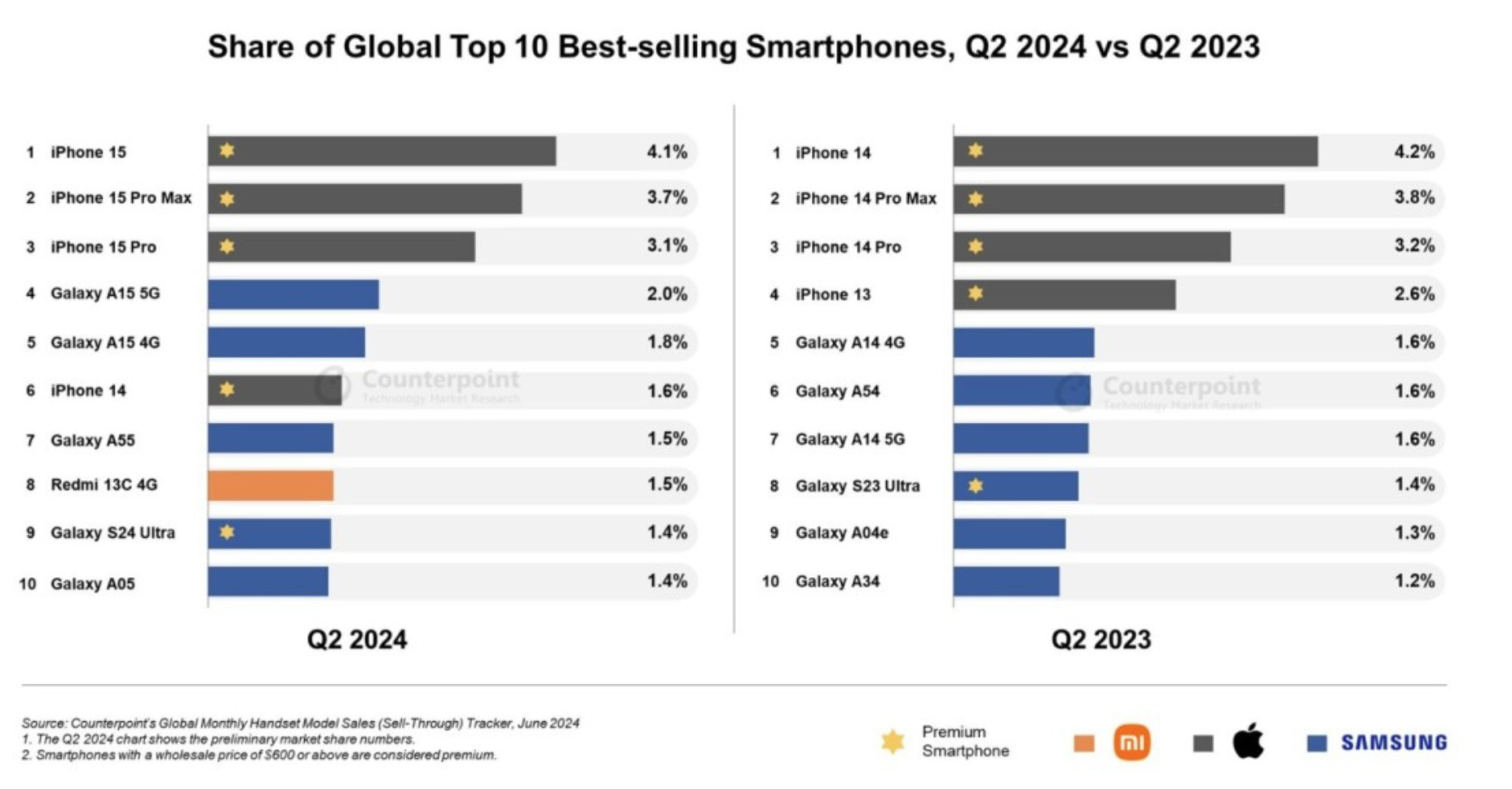

Specifically looking at products, Samsung leads the way, with the Galaxy A15 5G (4th), Galaxy A15 4G (5th), Galaxy A55 (7th), Galaxy S24 Ultra (9th), and Galaxy A05 (10th) occupying five spots on Counterpoint's list of the world's best-selling smartphones in Q2 2024.

Samsung's achievements speak for themselves. Despite its limited presence in the Chinese market, Samsung's global top ranking reflects market recognition. Overseas users choose Samsung not necessarily for its product capabilities or cost-effectiveness but because they trust the brand. In other words, Samsung's brand influence is sufficient, and choosing Samsung may not always be the best option, but it is never wrong.

Apple ranks second, with the iPhone 15, iPhone 15 Pro Max, iPhone 15 Pro, and iPhone 14 occupying the top four spots on the list.

(Image source: Counterpoint)

From these lists, it's evident that all manufacturers except Apple rely on low-end phones to boost shipments. Manufacturers' true sales drivers are low-cost models like Samsung's A series, Xiaomi's Redmi series, and Vivo's Y series.

Apple's success baffles me. Despite the criticism surrounding the iPhone 15 series last year, people still bought them, unaffected by the backlash. Apple's brand loyalty is impressive, but its price cuts in the Chinese market during the 618 shopping festival also contributed significantly to sales.

(Image source: Apple)

These substantial price cuts attracted many buyers, including some of my friends who purchased during the 618 sale. No wonder iPhone sales surged in Q2.

The only domestic phone on the list is Xiaomi's Redmi 13C 4G, which doesn't surprise me as Xiaomi has previously relied on affordable 4G phones to make the list. However, this achievement shows that Xiaomi can compete with Samsung in the low-end market.

Xiaomi's Sales Surge, Transsion's Surprise

Xiaomi recorded the fastest growth among the top five phone manufacturers, with a staggering 27.4% increase. Strong sales in the Chinese market fueled Xiaomi's global growth, with the Xiaomi 13 and Xiaomi 14 achieving million-unit sales domestically, making them Xiaomi's best-selling flagship phones in recent years. According to recent reports, Xiaomi surpassed competitors like Vivo and Huawei to top the sales chart with a 18.6% market share from July 22 to 28.

(Image source: Xiaomi's official website)

To maintain its global lead, Xiaomi must face fierce competition from international giants like Samsung and Apple. This is not just a battle of technology and innovation but also a game of brand influence and market strategy.

Vivo, which dominates the domestic market, also performed well. Though its current market share is 9%, a 6% difference from Xiaomi, its 16.6% year-on-year growth demonstrates Vivo's potential. According to IDC, Vivo ranked first in China's smartphone market in Q2.

(Image source: Leitech)

Vivo's sub-brand iQOO holds 5.5% of the overall market share, making it the most successful sub-brand among many. If Vivo can better expand overseas and leverage iQOO as an "X factor," the market landscape could significantly change.

Transsion's fifth-place ranking surprised me. Barely known in the Chinese market, Transsion's achievements stem from its overseas markets. Its complete overseas layout and brand influence make it the most successful Chinese phone brand globally. According to Transsion's financial report, it shipped 194 million phones in 2023, a 24.23% year-on-year increase. With revenue of 62.295 billion yuan and net profit of 5.537 billion yuan, up 33.69% and 122.93%, respectively, Transsion is known as the "King of Africa."

(Image source: Leitech)

But Transsion's ambitions extend beyond Africa. It has made significant inroads in emerging markets like the Middle East, Latin America, South Asia, and Southeast Asia. According to Canalys, Transsion's growth rate in Saudi Arabia reached 230% in Q1 2024, with a 25% market share, ranking first. In Southeast and South Asia, Transsion held a 18% market share and a 197% year-on-year growth rate, ranking second in Southeast Asia. In Indonesia and the Philippines, Transsion remains the king of the sub-$100 phone market.

Notably, Transsion is no longer limited to low-end and feature phones. It has launched high-end foldable phones like the Phantom V Fold and V Flip in India, positioning itself as a potential dark horse, albeit still unable to compete with Xiaomi in the short term.

Huawei, though ranked tenth, recorded a 40% year-on-year increase. If this growth rate persists, Huawei could climb to the top in Q3.

Evidently, sales rankings alone do not reflect product capabilities across brands. Domestic phones now excel in batteries, charging, cameras, AI, and networks, outperforming Samsung and Apple at similar price points. Yet, why can't they defeat Samsung and Apple head-on?

(Image source: Leitech)

In my opinion, besides innovation, domestic manufacturers should slow down the pace of phone iterations. They've accelerated product launches compared to previous years, releasing new models almost monthly. However, as non-essential consumer goods, excessive model proliferation can backfire.

Therefore, domestic manufacturers should streamline their product lines to cater to diverse consumer needs rather than flooding the market with similar models, blurring internal product positioning and creating a negative industry atmosphere.

Finding a balance between maintaining market presence through model proliferation and ensuring sales and profits is a challenge manufacturers must address.

Global Growth Benefits Domestic Phones

As mentioned, growth brings variables. Samsung and Apple lead the smartphone industry, but this may not last. The global smartphone sales growth will ultimately benefit Chinese manufacturers.

This is due to two main reasons: China's smartphones' core competitiveness and the surge in sales of new categories like foldable and AI phones, tilting the scales in favor of Chinese brands.

(Image source: Leitech)

Core competencies include performance, camera quality, and battery life. While all use top-tier chips, Chinese manufacturers excel in performance optimization, camera performance, and battery endurance, especially fast charging. As the global market recovers, manufacturers will invest more to consolidate their lead and enter new markets, showcasing China's smartphone experience to overseas consumers.

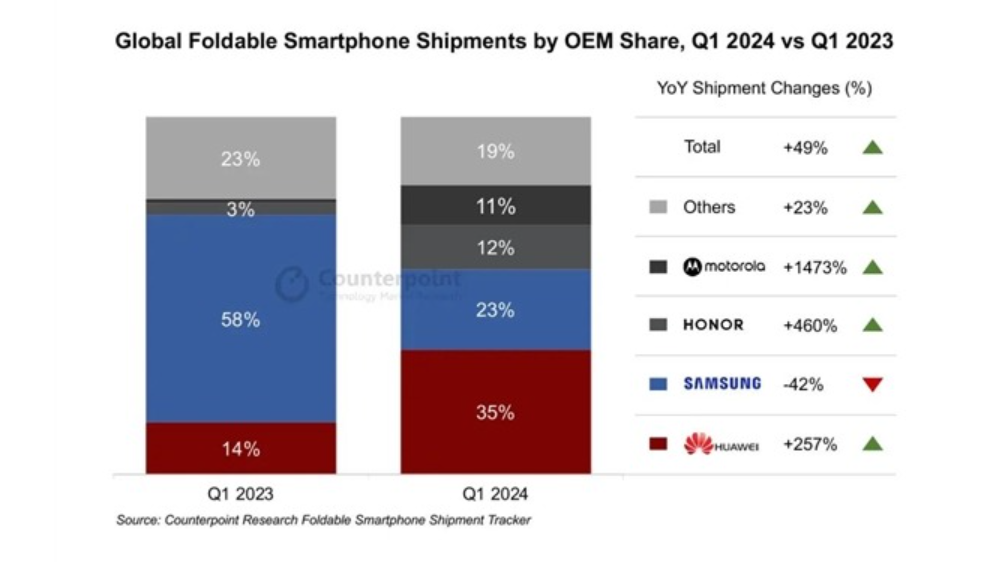

In foldable phones, Counterpoint data shows a 49% growth rate in Q1 2024, the highest in six quarters. Notably, three of the top four brands are Chinese (Motorola, Huawei, Honor), with Huawei surpassing Samsung in global foldable phone sales.

(Image source: CounterPoint)

For AI phones, while no specific statistics are available, Chinese products have popularized AI assistants and AI call summaries. In contrast, Apple's AI assistant has stringent usage conditions (strictly in internal testing), and Samsung's performance is not outstanding.

Overall, Chinese manufacturers excel in AI phone popularity, playability, and practicality. If AI phones grow as rapidly as foldable phones, Chinese manufacturers will be well-positioned.

(Image source: Huawei's official website)

In this stable market, manufacturers should focus on building lasting relationships with users through quality products rather than market share rankings. Chinese manufacturers, battle-hardened from ups and downs, must have long-term strategic vision, resilience, and a commitment to building core competencies for future success.

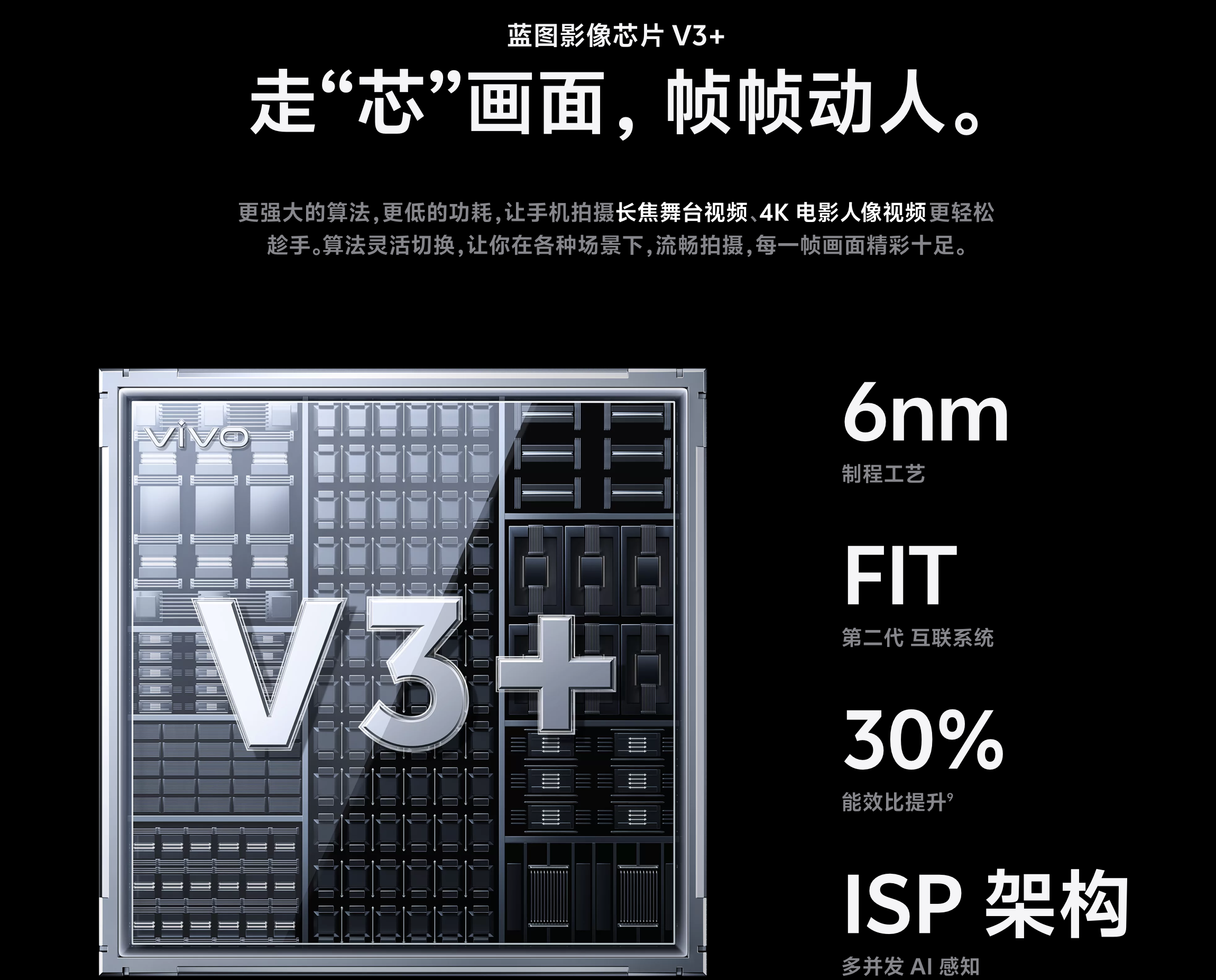

(Image source: vivo official website)

For example, Xiaomi, Huawei, and vivo's photography capabilities, OPPO's AI capabilities, Lenovo's ecosystem capabilities, etc. These capabilities, which have been proven by the market to form a closed business loop, are worth continued investment by mobile phone manufacturers to deepen and strengthen their competitive edges.

In the long run, in an incremental market, mobile phone manufacturers will also actively explore more possibilities, such as whether the pace of going abroad will accelerate, whether individual manufacturers will consider restarting their self-developed chip plans, etc., all of which are worth looking forward to.

The smartphone industry has gone through the darkest and most difficult times. Although shipments are still more than 20% lower than the peak of the mobile phone market, the industry as a whole still exhibits a positive "attitude". With the arrival of the second half of the year, we can be optimistic about the development of the mobile phone market and look forward to more innovation and competition, bringing better product experiences to consumers.

Source: Leikeji