"Wandering" realme, trapped in the slogan of "Dare to Leapfrog"

![]() 08/06 2024

08/06 2024

![]() 680

680

When we come to the second half of 2024, realme follows the footsteps of automobile manufacturers and engages in "price reductions with enhanced configurations".

On July 15, 2024, the realme GT6 officially went on sale, priced at 2,799 yuan for the 12GB+256GB version. Customers who place orders now can also enjoy trade-in subsidies, battery warranties, interest-free installments, and other preferential policies, making it highly cost-effective.

It's worth noting that after the discontinuation of the Master Series, the GT Series has become realme's most premium product line. Last year's realme GT5 had an initial price of 2,999 yuan. The price reduction and enhanced configurations of the realme GT6 largely indicate that realme is struggling to break into the high-end market and can only continue to compete fiercely within the mid-range segment.

Considering that OPPO has chosen to "let realme fend for itself," and the smartphone industry's dividends are rapidly diminishing, realme may only be able to scramble desperately on the path of high cost-effectiveness.

I. OPPO's shipments peak, realme becomes a "scalpel" for change

Similar to most sub-brands tasked with expanding the main brand's market influence, realme was born due to OPPO's shipment bottleneck.

Image source: Sino Market Research

According to Sino Market Research, in 2018, OPPO shipped 76.37 million smartphones, topping the charts but experiencing a year-on-year decline of 6%, making it the brand with the largest decline among the top five smartphone brands.

OPPO's position as the sales leader is attributed not only to its high-quality products but also to its highly effective "provincial agent" sales model. It is reported that OPPO's primary agents are called "provincial agents," who usually hold shares in OPPO's various branches. Selling OPPO phones not only generates higher gross margins but also dividends.

This model shares similarities with Gree's sales channel partnership system, both strengthening ties with dealers through sales rebates and equity transfers. Relying on these eager dealers, the main brand can easily expand its market influence with high-margin products at low cost.

However, it is important to note that while the "provincial agent" model is highly effective, the sales chain is too long, ultimately relying on "low-configuration, high-price" products to generate profits. Around 2018, Xiaomi emerged as a force to be reckoned with in the Chinese smartphone industry through its online direct sales model, offering consumers high-quality products at affordable prices, significantly diverting OPPO's market influence.

Against this backdrop, due to the excessive influence of "provincial agents," OPPO found it difficult to directly expand into online and operator channels, prompting the incubation of the realme brand. Official records show that Li Bingzhong, former vice president of OPPO responsible for overseas business, left OPPO in July 2018 to found realme.

As the founder was previously in charge of overseas business, and OPPO did not want to provoke resistance from domestic "provincial agents," realme initially focused on overseas markets.

With OPPO's support and a focus on extreme cost-effectiveness, realme grew aggressively. For example, in August 2018, realme 2 was officially launched in India, selling 200,000 units within the first five minutes of its debut on the Indian e-commerce platform Flipkart. In November, realme became the number one smartphone brand in the Indian market, with over 3 million users.

Image source: realme

In May 2019, realme officially entered the Chinese market, launching the realme X series. During the 618 shopping festival, it became the best-selling new model in the 1,500-2,000 yuan price range on JD.com.

Overall, as of November 2023, realme had sold over 200 million smartphones globally, becoming the fastest brand to achieve this milestone. It took realme 3 years to sell its first 100 million units and another 2 years to reach 200 million.

II. OnePlus becomes OPPO's favored son, while OPPO "lets realme fend for itself"

In fact, OPPO is not solely reliant on realme as its cost-effective direct sales brand. In 2013, at the dawn of the mobile internet era, Liu Zuohu, former deputy general manager of OPPO, founded OnePlus, joining the ranks of internet smartphone brands.

Previously, OnePlus and OPPO developed relatively independently, with the former focusing on online channels and premium flagship products under the slogan "Never Settle," while the latter relied on dealers to implement a sea of devices strategy. However, as mentioned earlier, after 2018, OPPO faced increasing downward pressure, prompting it not only to launch realme but also to significantly adjust OnePlus's positioning.

In June 2021, Liu Zuohu sent an internal email announcing that to better leverage synergies and integrate resources, OPPO and the OnePlus team would fully integrate, with OnePlus becoming an independent brand under OPPO.

Image source: OnePlus

A year and a half later, Liu Zuohu announced that OnePlus would be positioned as OPPO's performance-focused pioneer brand, with OPPO's online presence becoming synonymous with OnePlus. Concurrently, OPPO pledged to invest 10 billion yuan exclusively in OnePlus over the next three years, providing support in technology, channels, and services.

Since then, OnePlus has moved away from its "one premium product" strategy, adopting a Redmi-like approach with multiple product lines focused on extreme cost-effectiveness. For example, in early 2024, OnePlus launched the OnePlus Ace 3, equipped with a Qualcomm Snapdragon 8 Gen 2 processor, a 1.5K AMOLED display, a 5,500mAh battery, and 100W fast charging, priced at just 2,599 yuan for the 12GB+256GB variant.

Thanks to OnePlus's established brand recognition and OPPO's deep supply chain support, the transition to a performance-focused pioneer brand has continued to drive strong sales. In early 2024, Li Jie, President of OnePlus China, revealed that OnePlus was one of the fastest-growing smartphone brands in the Chinese market in 2023, with year-on-year growth of 285%, ranking second in the online market for Android phones priced above 2,500 yuan.

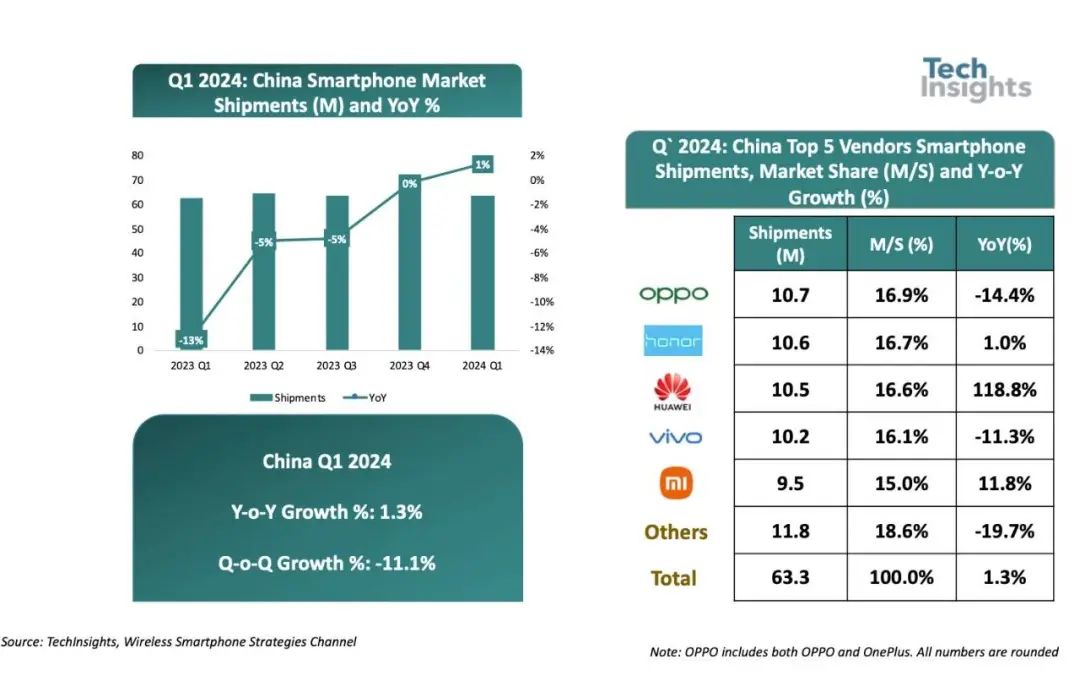

Image source: TechInsights

OnePlus's strong sales performance has significantly stabilized OPPO's market position. According to TechInsights, in Q1 2024, OPPO (including OnePlus) shipped 10.7 million smartphones, capturing a 16.9% market share, ranking first.

Admittedly, realme has also grown aggressively, but for OPPO, the profit margins for cost-effective online-focused brands are limited, and the overlapping positioning of OnePlus and realme could easily lead to internal competition. Therefore, as OnePlus gained traction in the market, OPPO began to "let realme fend for itself."

In June 2022, OPPO ceased handling realme product after-sales services. The following month, OPPO's official store stopped selling realme products. Since then, realme has rarely introduced smartphones that simply "copy" OPPO or OnePlus products.

All of these developments suggest that OPPO no longer wishes to invest more resources in realme, hoping instead that it will grow on its own.

III. Pushing into the mid-to-high-end market, realme confronts an identity crisis

Drawing from Xiaomi's experience, if the internet smartphone boom were still on the horizon, realme, having already successfully tapped into the market, could continue to grow aggressively on its own.

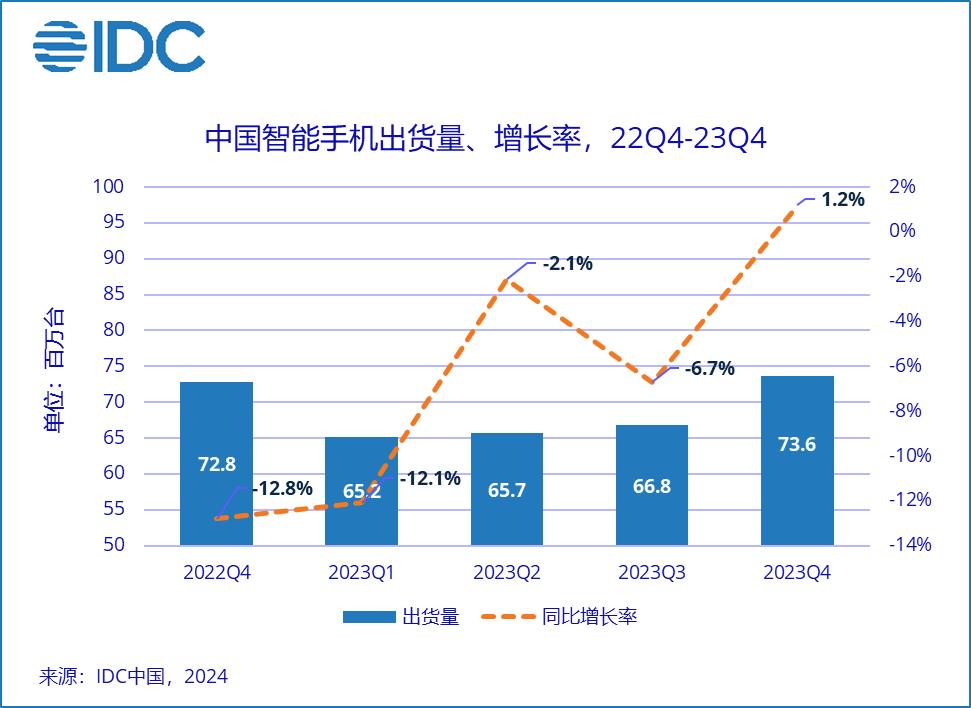

Image source: IDC

Unfortunately, the smartphone industry has begun to resemble the PC industry, with market dividends declining and limited room for further growth for realme. IDC data shows that Chinese smartphone shipments totaled approximately 271 million units in 2023, a year-on-year decline of 5.0%, marking the lowest shipment record in nearly a decade.

Image source: IDC

Against this backdrop, most smartphone brands struggle to maintain steady shipment growth. IDC statistics show that the top five Chinese smartphone brands experienced year-on-year negative growth in shipments in 2023.

In general, when market dividends shrink, companies can no longer rely solely on massive incremental demand for revenue generation and must focus on premium products to offset downward pressure through higher price premiums. Currently, brands like Xiaomi and Honor, which previously focused on cost-effectiveness, are striving to enter the high-end market.

For example, in Q1 2024, Xiaomi captured a 10.1% market share in the 5,000-6,000 yuan price segment in the Chinese smartphone market, a year-on-year increase of 5.8 percentage points. Thanks to this, Xiaomi's smartphone business revenue reached 46.5 billion yuan in the same period, a year-on-year increase of 32.9%.

In fact, realme has also recognized this trend, launching the "Leapfrogging Plan" for the future in August 2023, focusing on the 2,000-4,000 yuan price segment and aiming to break into the above 4,000 yuan price segment to compete in the mid-to-high-end market.

On the product front, realme has introduced higher-end GT Series and Master Explorer Series models. For example, the top-spec version of the realme GT2 Master Explorer Edition, launched in July 2022, was priced at 3,999 yuan. The top-spec version of the realme GT5 Pro, launched at the end of 2023, reached an even higher price of 4,299 yuan.

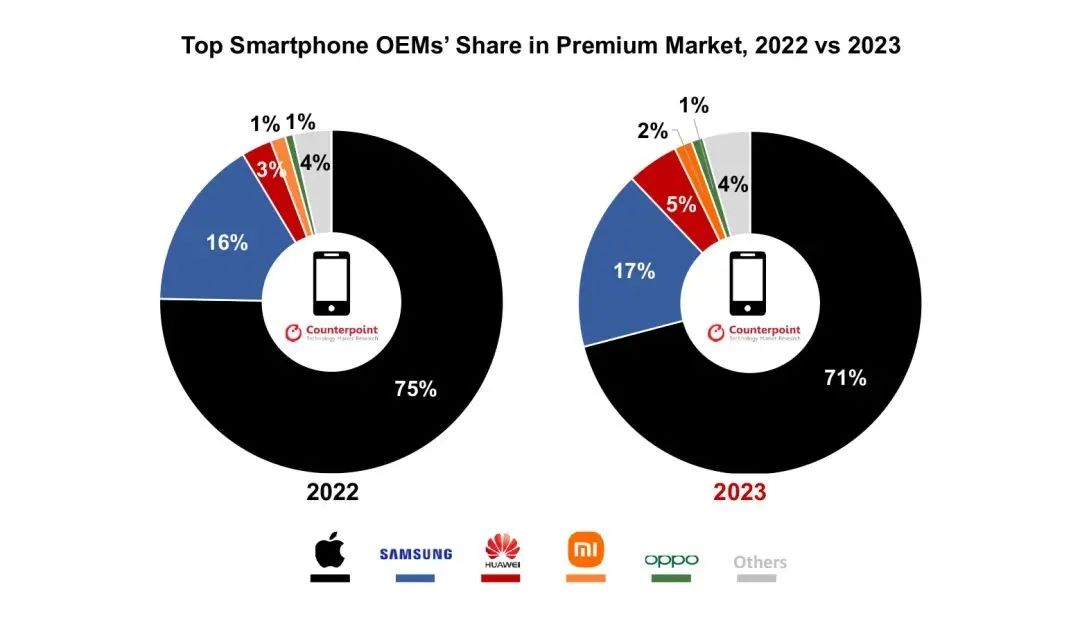

Image source: Counterpoint Research

Unfortunately, realme's high-end products have struggled to gain traction in the market. According to Counterpoint Research, realme was virtually unknown in the premium smartphone (wholesale price ≥ $600) rankings in 2023, sharing a 4% market share with numerous small and micro-brands.

Considering specific models, it becomes evident that realme's high-end products have performed mediocrely. JD.com data shows that the realme GT5 Pro currently has just over 100,000 reviews. In contrast, the Xiaomi 14, launched simultaneously with the realme GT5 Pro and positioned similarly, boasts over 500,000 reviews on JD.com.

Due to poor sales, realme has even discontinued some of its mid-to-high-end product lines. In April 2023, Xu Qi, Vice President of realme, Global Marketing President, and President of realme China, announced that the realme product line would be reorganized, and there would no longer be "Master Explorer Edition" phones.

realme's delay in penetrating the high-end market may be attributed to its limited brand image. It is well known that consumers choose high-end products not only for superior experiences but also for the social cachet provided by premium brands. Currently, renowned high-end smartphone brands such as Apple, Samsung, and Huawei possess strong premium pricing power and brand recognition, offering consumers significant emotional value.

In contrast, realme continues to pursue branding with limited premium pricing power, such as "Dare to Leapfrog" and "King of Quality-to-Price Ratio," and its product configurations are highly homogenized, lacking the high-end positioning moat similar to iOS for Apple or Kirin for Huawei, making it difficult to break into the high-end market.

Precisely because of its limited brand image, despite years of attempts to break into the high-end market, realme's GT Series has struggled to reach the truly premium 5,000 yuan price segment. Instead, the latest GT6 product has even proactively reduced its price by 200 yuan, continuing to hold onto the 2,000 yuan price segment.

Given the intensifying competition in the smartphone market ahead, with mid-to-low-end product sales unlikely to continue rising, realme, which has struggled to break into the high-end market, may face significant downward pressure and enter a "darkest hour."