Cao Fang Poached Talent from Her Brother's Company

![]() 08/06 2024

08/06 2024

![]() 608

608

The full text contains 4741 words and takes approximately 16 minutes to read.

Written by Rui Finance and Economics Cheng Mengyao

In 2014, Cao Fang, 56, retired from Fuyao Glass (600660.SH) due to "personal age reasons," which did not attract much attention at the time.

However, ten years later, at the age of 66, Cao Fang returned to the public eye when Jiangsu Zhengli New Energy Battery Technology Co., Ltd. (hereinafter referred to as Zhengli New Energy) submitted an IPO application to the Hong Kong Stock Exchange, garnering significant attention. Just two days before submitting the application, Zhengli New Energy had completed its Series B funding round, with a valuation of 18.2 billion yuan.

As both the younger sister of Cao Dewang, the founder of Fuyao Glass and the "King of Glass," and the founder of Zhengli New Energy, the market's attention to Cao Fang's identity temporarily overshadowed that of Zhengli New Energy's performance. After all, it is a consensus that making cars burns money, and the new energy vehicle industry chain loses money. Zhengli New Energy, which has been established for five years, has indeed not escaped its fate of losing money. Since the beginning of this year, the vast majority of new energy vehicle-related companies queuing up for listing on the Hong Kong Stock Exchange have been loss-making enterprises.

With the disclosure of the prospectus, Cao Fang's entrepreneurial journey since retiring from Fuyao Glass ten years ago and the process of packaging Zhengli New Energy and pushing it towards the capital market have emerged. Was the emergence of Zhengli New Energy Cao Fang's own choice, or was it guided by Cao Dewang behind the scenes?

As everyone knows, Fuyao Glass grew from a small company specializing in automotive safety glass into a world-class automotive glass supplier, with major automakers as its end customers. Currently, Zhengli New Energy's performance is also heavily dependent on major automakers, with its top five customers contributing approximately 80% of its revenue from 2021 to 2023.

What is easy to overlook is another identity of Cao Fang—a former employee of Fuyao Glass. In fact, half a year before her retirement, she began investing in automotive power batteries and achieved certain results.

It cannot be ignored that Zheng Li's other founder, Chen Jicheng, is also a veteran of Fuyao Glass. Although he left Fuyao Glass two years later than Cao Fang, both were deputy general managers of Fuyao Glass when they left, holding important positions.

With a younger sister on one side and a core executive on the other, Cao Dewang has also supported Zhengli New Energy by indirectly holding a 2.52% stake through directly controlled enterprises.

In addition, while pushing Zhengli New Energy towards the capital market, Cao Fang and Chen Jicheng have frantically cashed out their equity through the wholly-owned Zhongyuan Venture Capital and Zhengli Investment, lining their pockets.

01 Cao Dewang's Younger Sister Retires to Start a Business

Partnering with a Veteran of Fuyao Glass

With the eldest brother involved in politics, the second brother a doer, and the third sister now a successful entrepreneur, the Cao family seems poised to recreate the glory of being the richest family in Fuqing City.

Cao Fang, 66 years old this year, is 12 years younger than Cao Dewang. Cao Dewang also has an older brother, Cao Degan, who is two years older and has long served in Fujian, once reaching the deputy provincial level. Currently, 78-year-old Cao Dewang is still on the front lines of business, vowing to work until he is 100; public information shows that after retiring in May 2010, Cao Degan joined the He Ren Charity Foundation founded by Cao Dewang as its chairman.

From a timeline perspective, Cao Fang's entrepreneurial venture into automotive power batteries was not a spur-of-the-moment decision after retirement. Inviting Chen Jicheng, another veteran of Fuyao Glass who had not yet reached retirement age, to join her in starting a business raises questions about whether Cao Fang received guidance from Cao Dewang behind the scenes of her retirement.

Cao Dewang founded Fuyao Glass in 1987, and it was listed on the ChiNext in June 1993. Cao Fang joined Fuyao Glass as a director in 1997, became deputy general manager in February 2011, and left her position as deputy general manager due to personal age reasons in April 2014, at the age of 56. Although she joined after Fuyao Glass had achieved success, Cao Fang accumulated rich management experience and resources during her 17 years at the company.

Chen Jicheng, 53 this year, joined Fuyao Glass in October 2003 and held various positions, including executive director from October 2015 to April 2016 and deputy general manager from February 2011 to April 2016, working at Fuyao Glass for 13 years.

Although 13 years apart in age, Cao Fang and Chen Jicheng are seasoned partners. In addition to working together at Fuyao Glass for 11 years, they are also neighbors, residing in the same building in the same community in Changshu, Jiangsu Province.

In March 2013, while still employed at Fuyao Glass, the two co-founded Zhongyuan Venture Capital and, in November of the same year, jointly established Zhongyuan Toyota with Toyota to provide battery systems for Toyota's hybrid and plug-in hybrid models. Zhongyuan Venture Capital holds a 50% stake in Zhongyuan Toyota, with Cao Fang serving as its chairman.

This successful collaboration with Toyota in new energy vehicle power batteries became the starting point for Cao Fang's future entrepreneurial endeavors. Six months after becoming chairman of Zhongyuan Toyota, in April 2014, Fuyao Glass officially announced Cao Fang's departure. Two years later, in April 2016, Chen Jicheng also chose to leave Fuyao Glass.

Just two months later, in August 2016, Cao Fang and Chen Jicheng "bloomed again" by jointly founding Zhengli Investment to invest in the field of electric vehicle core components, expanding their investment scope. In December of the same year, they jointly established Suzhou Zhengli New Energy with NIO Auto's Weilai Nanjing, with each party holding 65% and 35% of the shares, respectively.

02

Reverse Merger and Asset Acquisition Completed

Cao Dewang Holds a 2.52% Stake Behind the Scenes

After joining forces outside of Fuyao Glass, Cao Fang and Chen Jicheng have been active in the new energy vehicle market as investors. In addition to collaborating with established automakers, they have also been seeking greater returns by investing in startups. Jiangsu Tafel, which was newly established, caught their attention and became the core asset of Zhengli New Energy in the future. However, this acquisition also laid a hidden danger for Zhengli New Energy's performance.

Founded in December 2018, Jiangsu Tafel is a power battery manufacturer. Just three months after its establishment, Zhengli Investment made a minority equity investment in it to help expand its production capacity, acquiring a 6.78% stake in its registered capital for 160 million yuan. Subsequently, Cao Fang followed suit, and the two jointly established the listing entity Zhengli New Energy on February 26, 2019, with Zhengli Investment and Jiangsu Tafel holding 70% and 30% of the shares, respectively.

At this point, Cao Fang had already acquired three joint ventures: Zhongyuan Toyota, Suzhou Zhengli New Energy, and Zhengli New Energy, holding 50%, 65%, and 70% stakes, respectively. With assets in hand, the next step was to integrate them, leading to different fates for these three companies. Zhengli New Energy became the listing entity, Suzhou Zhengli New Energy became a wholly-owned subsidiary, and Zhongyuan Toyota was consolidated as a joint venture for performance reporting.

In May 2020, Zhengli Investment once again invested 1.08 billion yuan to expand its shareholding in Jiangsu Tafel to 43.47% through equity capital increases and transfers, becoming its controlling shareholder. At the same time, Zhengli Investment transferred its entire 70% stake in Zhengli New Energy to Jiangsu Tafel for 238 million yuan. Zhengli New Energy became a wholly-owned subsidiary of Jiangsu Tafel, with Cao Fang and Chen Jicheng controlling Jiangsu Tafel through Zhengli Investment.

On December 28, 2021, Jiangsu Tafel's shareholders at the time acquired 100% of Zhengli New Energy's shares for a total consideration of 2.538 billion yuan. In February 2022, Zhengli New Energy acquired Jiangsu Tafel and its subsidiaries' assets for 1.855 billion yuan. At this point, Cao Fang completed the acquisition of Jiangsu Tafel through Zhengli New Energy, absorbing its employees and inheriting its suppliers and customers. Since then, Jiangsu Tafel has ceased all business operations and was deregistered in January 2024.

Currently, the management of Zhengli New Energy includes several executives from Jiangsu Tafel.

Yu Zhexun, who was recently appointed as an executive director in July 2024, served as a senior manager at Jiangsu Tafel before joining Zhengli New Energy. He joined Zhengli New Energy seamlessly in March 2022 as the Director of the Platform Center and has served as the Chief Product Officer since December 2022.

Liu Gang, the Equipment Manager at Jiangsu Tafel, also joined Zhengli New Energy immediately after leaving in November 2020. He currently serves as the Equipment Manager of Zhengli New Energy, General Manager of Yinhe Base, General Manager and Executive Director of Suzhou Zhengli New Energy.

During the process of integrating her assets, Cao Fang severed ties with NIO Auto. On February 24, 2022, Zhengli Investment acquired a 35% stake in Suzhou Zhengli New Energy from Weilai Nanjing for 92.6873 million yuan, achieving full control of Suzhou Zhengli New Energy. Subsequently, Zhengli Investment transferred 100% of the shares of Suzhou Zhengli New Energy to Zhengli New Energy for 307 million yuan. In other words, NIO Auto was "ousted."

However, Cao Fang has maintained her relationship with Toyota. In December 2023, Zhongyuan Venture Capital transferred its 50% stake in Zhongyuan Toyota to Zhengli New Energy for a total consideration of 3.311 billion yuan, including 496 million yuan in cash and 2.815 billion yuan in share payments. As a joint venture, Zhongyuan Toyota's performance was consolidated.

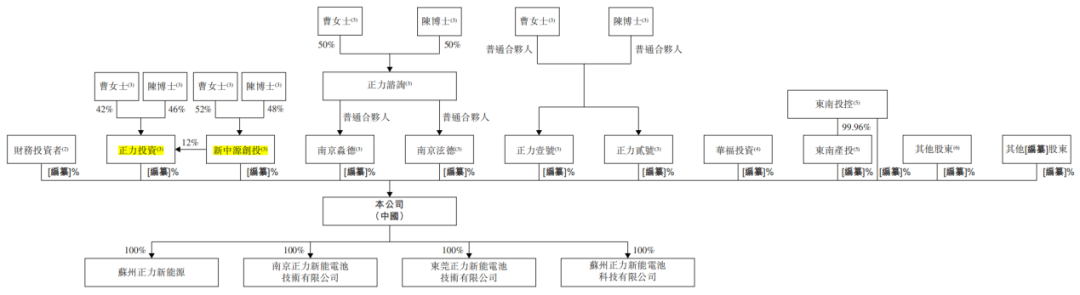

In summary, it took Cao Fang approximately six years to complete the asset injection and integration of Zhengli New Energy, establishing its current listing structure. Currently, Cao Fang serves as Chairman of Zhengli New Energy, while Chen Jicheng is the General Manager. At the time of submission, the two held a combined 64.6% stake in Zhengli New Energy, jointly controlling the company.

Cao Dewang is also indirectly invested in Zhengli New Energy. The prospectus shows that Sanyi Development Company Limited, wholly owned by Cao Dewang, holds a 73.56% interest in Fujian Yaohua, which in turn holds a 2.52% stake in Zhengli New Energy.

Founded in May 1992, Fujian Yaohua is primarily engaged in real estate development and management, construction engineering, property management, housing leasing, and non-residential real estate leasing.

03

Cao Fang and Chen Jicheng Cash Out 1.718 Billion Yuan

Receive 700 Million Yuan in Dividends from Joint Ventures

Catching the wave of rapid development in the new energy vehicle industry, Zhengli New Energy quickly received capital support. After restructuring, Zhengli New Energy, which was still losing money, managed to raise its valuation to 18.2 billion yuan through just two rounds of funding.

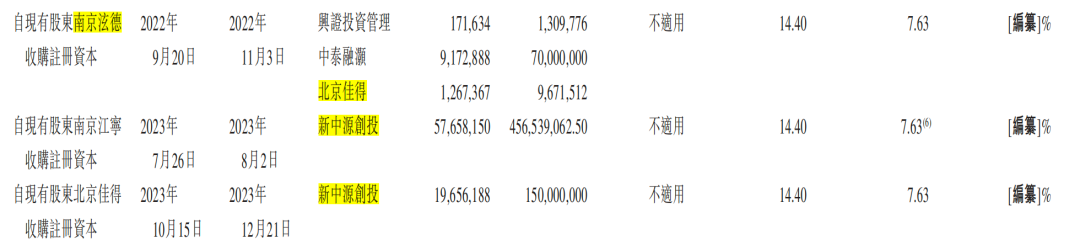

In July 2022, Zhengli New Energy completed its Series A funding round, raising 2.4 billion yuan with a post-investment valuation of 14.4 billion yuan. Investors included Haisong Capital, CICC SAIC, Xiamen International Trade Group, C&D Capital, and Nanjing Hefei Investment, among others. However, just one year after investing, in July 2023, Nanjing Jiangning transferred all of its registered capital from the Series A funding round to Zhongyuan Venture Capital, cashing out 457 million yuan and exiting the investment. Including investment interest, the actual cost was approximately 7.92 yuan per share.

Exiting simultaneously was Beijing Jiade, which had invested through equity transfers. In November 2022, Beijing Jiade acquired 1.2674 million yuan of registered capital from Nanjing Xuande for 9.6175 million yuan. In December 2023, it exited by cashing out 150 million yuan.

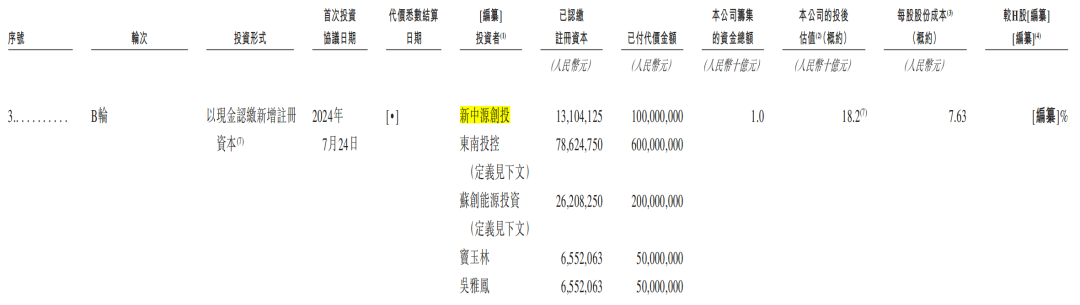

On July 24, 2024, just two days before submitting its IPO application, Zhengli New Energy completed its Series B funding round, raising 1 billion yuan from Zhongyuan Venture Capital, Southeast Investment Holdings, Su Chuang Energy Investment, Dou Yulin, and Wu Yafeng, with a post-investment valuation of 18.2 billion yuan. Zhongyuan Venture Capital is jointly owned by Cao Fang and Chen Jicheng, holding 52% and 48% stakes, respectively, and also holds a 12% stake in Zhengli Investment.

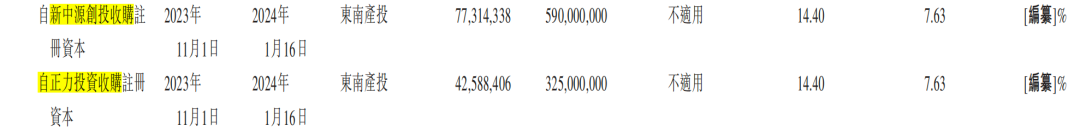

From July 2022 to July 2024, Zhengli New Energy underwent two funding rounds and one equity transfer. During the process of introducing investors through equity transfers before the Series B funding round, Cao Fang and Chen Jicheng cashed out a total of 915 million yuan by transferring shares in Zhongyuan Venture Capital and Zhengli Investment to Southeast Investment Holdings.

Southeast Investment Holdings, which holds a 99.96% interest in Southeast Investment Control, was indirectly wholly owned by the State-owned Assets Supervision and Administration Commission of Changshu City. Its director, Hong Ping, is also the supervisor of Zhengli New Energy.

If we also count the 307 million yuan cashed out from the transfer of 100% of the shares of Suzhou Zhengli New Energy by Zhengli Investment in February 2022, and the 496 million yuan in cash received from the transfer of a 50% stake in Zhongyuan Toyota by Zhongyuan Venture Capital in November 2023, Cao Fang and Chen Jicheng have cashed out a total of 1.718 billion yuan in just two years through equity transfers.

And that's not all. From 2020 to the first half of 2023, Zhongyuan Toyota distributed dividends of 287 million yuan, 480 million yuan, 508 million yuan, and 182 million yuan, respectively. Based on a 50% stake, Cao Fang and Chen Jicheng collectively took away 729 million yuan in dividends.

04

Performance Reliant on Automakers, Accumulating Losses of 2.7 Billion Yuan in Three Years

Suspected Exposure to Weima Motor's Financial Crisis in 2022

As a manufacturer of power and energy storage batteries, Zhengli New Energy currently provides integrated solutions for battery cells, modules, battery packs, battery clusters, and battery management systems.",

Array

Array

Array

Array

Array

Array

Array

Array

Array

Array

Array

Array

Array

Array

Array

Array

Array

Array

Array