Automakers' annual sales target completion rate review: NIO leads with 50%, while XPeng and Nezha fall short of a quarter

![]() 08/06 2024

08/06 2024

![]() 502

502

Biannews Today

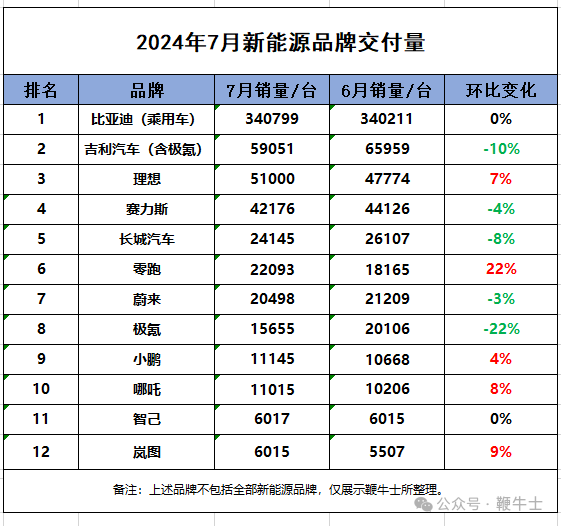

August 5 news: As of now, the July sales reports of new energy automakers have been basically announced. From the data of various automakers, there are some obvious changes in market trends in July compared to June.

Among the 12 automakers surveyed by Biannews, Geely, Thalys, Great Wall Motor, NIO, and Zeekr saw month-on-month declines, accounting for nearly half, with Zeekr experiencing a severe 22% decline.

Two automakers, BYD and IM Motors, showed little change from July to June. Although BYD's large market volume can explain its stability, IM Motors had actually achieved 45% growth in June but failed to sustain the momentum in July.

Among the other five automakers that achieved month-on-month growth, only Zero Run recorded a significant 22% increase, while the others' growth rates were generally low, hovering in single digits.

Overall, this reflects two points to some extent:

1. After the price war in the first half of the year, automakers have begun to return to rationality, and the price war has noticeably eased. Even foreign luxury automakers like BMW, Mercedes-Benz, and Audi, which struggled in the price war, have announced their withdrawal from it. Without the stimulus of steep discounts, consumers' waiting periods will lengthen.

2. With the rapid and unexpected development of the new energy automobile industry in recent years, market demand is starting to saturate.

Recently, Cui Dongshu, Secretary-General of the China Passenger Car Association, also analyzed that some manufacturers have realized the unsustainability of the price war and are reassessing their pricing strategies to seek a more stable profit model. The price war may ease in the second half of the year. After intense competition in the first half, the market may gradually form a new price equilibrium.

As the market begins to stabilize, automakers must consider whether and how to achieve their annual sales targets set at the beginning of the year. After all, the price war in the first half was fierce, involving virtually all players, which many automakers likely did not anticipate. This has led to deviations from the initial targets.

For example, Li Auto initially set a target of 800,000 annual sales but later revised it downward to 480,000.

Now, more than half of 2024 has passed. Biannews reviews the progress of automakers in achieving their annual sales targets to see who should be anxious and who can remain calm after the fierce competition.

BYD's annual sales target is 4.5 to 5 million vehicles. As of July 31 this year, it has sold a cumulative total of 1.9553 million vehicles, representing a completion rate of 39% to 43%. Comment: Even if we calculate based on the lowest standard of 4.5 million, BYD's completion rate is still below 50%, but there is still hope of achieving its target.

Aion's annual sales target is 700,000 vehicles. As of July 31 this year, it has sold a cumulative total of 212,600 vehicles, representing a completion rate of 30%. Comment: With a total sales volume of 480,000 in 2023, setting a target of 700,000 for this year was not unrealistic, but it was overly optimistic about this year's competition. It will be difficult to achieve the target. Given the current sales situation, it is questionable whether this year's sales will even exceed last year's.

Li Auto's current annual sales target is 480,000 vehicles. As of July 31 this year, it has sold a cumulative total of 240,000 vehicles, representing a completion rate of 50%. Comment: Li Auto has the highest completion rate, indicating that Li Xiang's judgment was accurate. With a strong push in the second half of the year, there is hope of achieving the target.

Wenjie's annual sales target is 600,000 vehicles. As of July 31 this year, it has sold a cumulative total of 222,700 vehicles, representing a completion rate of 37%. Comment: Although Wenjie garnered much attention in the first half of the year, the price war has leveled the playing field, making it challenging to achieve the target. A slight downward adjustment would be more realistic.

Xiaomi's annual sales target is 100,000 to 120,000 vehicles. As of July 31 this year, it has sold more than 35,700 vehicles, representing a minimum completion rate of 36%. Comment: As a newcomer this year, Xiaomi is at a disadvantage in terms of sales cycle, production ramp-up, and market education. This makes Xiaomi a special case. Even if it fails to meet its target by the end of the year, it has valid excuses. However, if it does meet the target, it will be a remarkable achievement. Of course, Lei Jun and other Xiaomi executives have repeatedly expressed confidence in achieving the target, and we will wait and see.

Zero Run's annual sales target is 250,000 vehicles. As of July 31 this year, it has sold more than 108,800 vehicles, representing a completion rate of 44%. Comment: The completion rate is acceptable. As one of China's overseas brands, Zero Run recently shipped its first batch of vehicles to Europe with the support of the Stellantis Group. Meanwhile, given Zero Run's strong July sales growth, if it can maintain this momentum, achieving its target is within reach.

NIO's annual sales target is 230,000 vehicles. As of July 31 this year, it has sold 108,000 vehicles, representing a target achievement rate of 47%. Comment: NIO has the second-highest completion rate. NIO's new brand, Ledo, has been launched, and its affordable model, L60, will be officially launched in late September. We will see how it performs then.

Zeekr's annual sales target is 230,000 vehicles. As of July 31 this year, it has sold 103,500 vehicles, representing a target achievement rate of 45%. Comment: The completion rate is acceptable. According to the Ministry of Industry and Information Technology's new product announcement, Zeekr will launch a "baby bus"-style pure electric MVP in the second half of the year. We will see how it performs then. Meanwhile, the industrial version of the humanoid robot Walker S Lite has officially entered Zeekr's 5G smart factory, marking the first time a humanoid robot has performed material handling tasks in China's automotive industry. This move may improve production efficiency. Overall, Zeekr still has room for growth.

XPeng's annual sales target is 300,000 vehicles. As of July 31 this year, it has sold 63,000 vehicles, representing a target achievement rate of only 23%. Comment: The situation is dire. XPeng's current trump card is the MONA M03, an affordable new car priced below 200,000 yuan. However, there are still many competitors in this price range, making it unlikely that the new car will turn things around for XPeng.

Nezha's annual sales target is 300,000 vehicles. As of July 31 this year, it has sold 64,800 vehicles, representing a target achievement rate of only 22%. Comment: Nezha was overly optimistic when setting its initial target. Although it is now keen on expanding overseas, the brand education phase in overseas markets is still in its infancy, and it will likely take time to see significant results. In addition, Nezha X, a new five-seat pure electric SUV, has officially launched, with an official price range of 89,800 to 124,800 yuan. We will see how the new model performs. Overall, however, it is highly unlikely that Nezha will achieve its target.

Avatar, IM Motors, and Voyah, the three second-tier brands, are unlikely to achieve their targets in the second half of the year without introducing highly competitive new products with attractive pricing.

Seven months into the year, on average, a completion rate of 58% is considered on track. However, none of the automakers have reached this normal progress, with Li Auto leading at 50% and XPeng and Nezha falling far short of even a quarter of their targets, making it almost certain that they will not achieve them.

Moreover, no automaker dares to claim that they are on solid ground at this point.

Of course, this does not represent the final outcome, but based on the current data alone, the situation is not optimistic. Additionally, as the market becomes increasingly saturated, explosive growth is unlikely to occur again. Now, it remains to be seen which brand's new products or initiatives can help achieve significant improvements.

In summary, it is already foreseeable that most automakers will fail to meet their initial annual targets by the end of the year.