TCL Smart Home: The Long Road Ahead for AI Smart Appliances

![]() 08/07 2024

08/07 2024

![]() 668

668

Two and a half months have passed since TCL Smart Home officially changed its name to TCL Smart Home (002668.SZ, referred to as TCL Smart Home hereinafter). Initially, the company's share price experienced an upswing after being tied to TCL, even reaching a five-year high of 13.22 yuan per share on May 15.

Since then, the company's share price has fluctuated downwards. As of August 5, the closing price was 8.81 yuan per share, down 2.65%, with a current total market value of 9.551 billion yuan. According to Securities Star statistics, during this stock price downturn, the company's share price has fallen by more than 30% cumulatively, with a market value erosion of over 4 billion yuan.

Securities Star notes that the company has experienced ups and downs throughout its journey, suffering significant setbacks in its financial technology business and falling into a quagmire of losses. Subsequently, with the assistance of its controlling shareholder TCL Appliance, the company refocused on its core home appliance business, leading to improved performance.

Now, the birth of 'TCL Smart Home' also signifies the company's commitment to advancing its globalization strategy and embracing AI smart appliances as its development direction. Further research by Securities Star reveals that TCL Smart Home still has a long way to go on this path, whether evaluated by its business layout, revenue scale, or R&D capabilities.

01

TCL Smart Home's Past and Present

Public information indicates that TCL Smart Home was previously known as Homa Appliances, founded in 2002 with refrigerators and freezers as its flagship products. At the time, TCL Smart Home was hailed as the 'King of Refrigerator Exports' due to its years of consecutive wins as China's top refrigerator exporter. In 2012, the company successfully went public, but just as its performance was steadily growing, its founder Cai Shier began to contemplate retirement.

In October 2015, Zhao Guodong, former vice president of JD.com, took over TCL Smart Home. Leveraging his extensive experience in the financial sector, Zhao established a dual-track strategy of 'Refrigerators + Financial Technology' for the company, leading it into commercial factoring, loan facilitation, auto loans, and other financial sector businesses.

By 2018, as the regulatory environment for micro-loans tightened and the P2P lending industry experienced frequent 'thunderstorms,' some of TCL Smart Home's loan facilitation businesses defaulted, and some accounts receivable from commercial factoring, loan facilitation, and auto loan businesses were deemed uncollectible. These factors contributed to the company's staggering loss of 1.903 billion yuan in 2018, marking a turning point in its performance.

Past financial reports show that TCL Smart Home's net profit attributable to shareholders from 2018 to 2021 was -1.903 billion yuan, 53.2885 million yuan, -987 million yuan, and -79.9079 million yuan, respectively, for a cumulative loss exceeding 2.9 billion yuan.

Worse still, in 2021, the company's subsidiary Tibet Wangjin was implicated in an alleged illegal external guarantee involving 145 million yuan in time deposits, leading to a trading warning and ST designation for the company's stock.

Also in 2021, TCL Appliance continued to increase its stake in TCL Smart Home through judicial auctions, centralized bidding, and tender offers. On May 7 of that year, TCL Appliance became the controlling shareholder of TCL Smart Home.

After TCL Appliance took over, TCL Smart Home terminated its financial technology business entirely and refocused on its refrigerator business. Meanwhile, TCL addressed historical risk issues, enabling the company to shed its 'ST' designation in 2022 and turn profitable.

In 2023, to address competition between TCL Smart Home and its controlling shareholder TCL, TCL Smart Home acquired 100% of TCL Hefei, TCL's refrigerator and washing machine business entity. This acquisition further improved TCL Smart Home's performance in 2023, with both revenue and net profit growing.

02

Domestic Sales Dilemma Remains Unsolved

Currently, TCL Smart Home operates two main entities: Homa Refrigerators and TCL Hefei, with primary products including refrigerators (including freezers) and washing machines. Among them, the refrigerator business remains the company's primary revenue driver, contributing over 80% of its income.

From a business model perspective, the company primarily adopts an ODM export model with a distinct export advantage. In 2023, the company sold 14.19 million refrigerators, up 36% year-on-year, ranking first in China's refrigerator exports for 15 consecutive years. While TCL Smart Home has achieved some success in the refrigerator sector, this appears to be its only notable strength.

In the broader home appliance market context, TCL Smart Home's export business volume is relatively small. While peers Haier Smart Home and Midea Group vigorously develop diversified businesses, TCL Smart Home remains stagnant in the refrigerator segment. In 2023, both Haier Smart Home and Midea Group surpassed 100 billion yuan in export revenue, far exceeding TCL Smart Home's 10.238 billion yuan.

Securities Star notes that while the company's domestic sales business was inferior to its exports early on, it still had a certain scale and a place in China's refrigerator market. However, during the company's foray into financial technology, its domestic sales gradually declined.

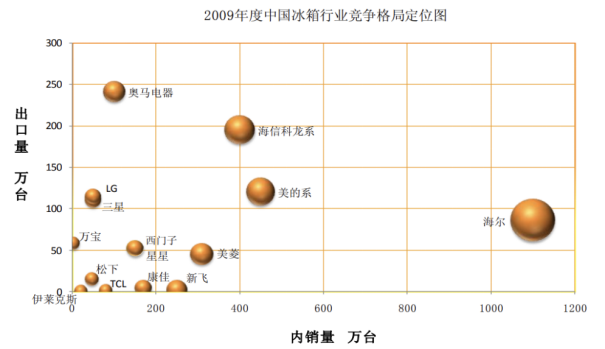

According to the '2009 China Refrigerator Industry Research Report,' in 2009, Haier held an absolute leading market position in China's refrigerator industry, followed by Midea Group (including Midea, Rongshida, Hualing, and Little Swan sub-brands), Hisense Kelon Group (including Hisense, Kelon, and Rongsheng sub-brands), Meiling, and TCL Smart Home.

Regarding domestic sales revenue, from 2013 to 2018, TCL Smart Home's domestic market revenue remained around 2.5 billion yuan, accounting for over 30% of total revenue. However, since 2019, the company's domestic market revenue has declined sharply to around 1.5 billion yuan, with a revenue share dropping to around 20%. Since then, the gap between TCL Smart Home's domestic sales business and leading companies has widened.

In recent years, the company has also increased its emphasis on domestic sales. After acquiring TCL Hefei in 2023, the company's domestic sales business surged 161% year-on-year to 4.942 billion yuan.

However, industry insiders point out that TCL refrigerators, washing machines, and Homa refrigerators currently hold a relatively low domestic market share, lagging behind Haier, Siemens, Meiling, Hisense, Midea, and others. Moreover, TCL's overall white goods business does not rank among the top tier in China's white goods market, remaining a second- or third-tier brand.

According to AVC Compass data, the gaps between brands in terms of online and offline sales volume throughout 2023 were significant.

Taking the 2023 refrigerator market share as an example, online, the top three refrigerator brands by sales volume were Haier, Midea, and Rongsheng, with market shares of 31.69%, 15.68%, and 12.69%, respectively. TCL ranked 8th with a 3.33% share, while Homa ranked 20th with a 0.42% share.

In the offline market, the top three refrigerator brands by sales volume were Haier, Casarte, and Rongsheng, with market shares of 22.74%, 16.29%, and 12.38%, respectively. TCL ranked 15th with a 0.3% share. The 2023 rankings demonstrate that TCL Smart Home failed to maintain its previous position amidst fierce market competition.

03

Challenges Ahead for AI Smart Appliances

Currently, TCL Smart Home appears to be moving towards AI smart appliances. In its 2023 annual report, the company mentioned that it is developing towards AI smart appliances, using technology to drive further industry progress.

On the evening of May 9 this year, TCL Smart Home announced that it had completed the industrial and commercial registration and filing procedures related to its name change, officially becoming Guangdong TCL Smart Home Appliances Co., Ltd. From May 10 onwards, the company's stock abbreviation was changed to TCL Smart Home accordingly. This change also expanded the company's business scope, adding various businesses related to the manufacture and sale of smart home consumer devices, as well as artificial intelligence and IoT devices.

It is important to note that in the era of AI prevalence, the home appliance industry is undergoing a significant transformation. Embracing AI has become an essential label for industry leaders in the race for technological innovation in home appliances.

Industry insiders point out that smart homes represent a major future trend. Not only home appliance companies but also technology enterprises like Xiaomi and Huawei are making layouts in this direction, which requires a solid foundation of capabilities and competitiveness across multiple product categories.

Securities Star's research reveals that TCL Smart Home still has a long way to go on this path.

First, in terms of business layout, TCL Smart Home appears relatively monolithic and limited, with its primary focus on refrigerators and washing machines. In contrast, Haier Smart Home boasts multiple brands like Haier, Casarte, and Leader, covering a diverse range of products including refrigerators, HVAC, washing machines, kitchen and bathroom appliances, among others. This limits TCL Smart Home's flexibility and adaptability in market competition.

Second, in terms of revenue scale, TCL Smart Home lags significantly behind industry leaders. In 2023, Midea Group generated revenue of approximately 373.7 billion yuan, Haier Smart Home of approximately 261.4 billion yuan, and Gree Electric Appliances of approximately 205 billion yuan, whereas TCL Smart Home's current revenue was approximately 15.18 billion yuan, making it difficult to compete with these giants.

Finally, in terms of R&D capabilities, Securities Star notes that before acquiring TCL Hefei, the company last mentioned its patent situation in its annual report in 2020, boasting 400 authorized patents, including 29 invention patents. After acquiring TCL Hefei, the company mentioned in its 2023 annual report that as of December 31, 2023, TCL Hefei had accumulated 1,635 domestic patents, including 156 invention patents. Does this imply that the company's R&D achievements are reliant on TCL Hefei?

Compared to its peers, as of the end of 2023, Haier Smart Home had accumulated over 103,000 global patent applications, including over 67,000 invention patents; Midea Group maintained over 80,000 authorized patents worldwide, with over 4,000 invention patents, far surpassing TCL Hefei in both numbers. (This article was originally published on Securities Star, written by Li Ruohan)

- End -