Collective outrage at weekly sales rankings, Chinese auto companies drop their harmonious masks in July

![]() 08/07 2024

08/07 2024

![]() 481

481

Data Analysis of New Energy & Auto

Going global will be a major focus in the future.

Total words in this article: 6066

Estimated reading time: 25 minutes

At the end of July, a public opinion war erupted around the "weekly sales rankings" of new energy vehicles.

Qin Lihong, co-founder of NIO, was the first to express his opinion that releasing weekly sales rankings was not rigorous and intensified competition. Ma Lin, from NIO's brand department, tweeted at Li Xiang, urging him to stop.

Yang Xueliang, VP of Geely, retweeted and said, "I also oppose weekly rankings."

He Xiaopeng echoed this sentiment on the same day, remarking that while venture capital firms in the US were investing heavily in large models and chips, he found upon returning to China that everyone was focused on weekly sales rankings...

This was a veiled criticism of Li Xiang's weekly sales rankings. In response, Li Xiang shared an illustration of the fable of the man who tries to steal a bell by plugging his ears, along with an emoji of a shushing gesture, seemingly acknowledging the controversy.

It seems that domestic new energy vehicles have entered a stage of heated debates.

#

Vol.1/ Inventory Pressure Remains

July marked a continued period of prosperity for the new energy vehicle market in China.

According to the China Association of Automobile Manufacturers (CAAM), China's automotive market has recovered strongly this year, with Chinese companies performing particularly well. The global chip shortage over the past two years has paradoxically driven strong exports of Chinese vehicles, filling gaps in international supply and demand and presenting rare development opportunities.

Against this backdrop, policies continued to intensify. Shanghai appropriately relaxed the conditions for auto consumer credit applications and reduced the down payment ratio for auto loans. Beijing's Yizhuang District will issue RMB 4 million in new energy vehicle consumption vouchers. The National Development and Reform Commission and the Ministry of Finance announced an increase in the subsidy standards for scrapping and replacing old vehicles. These measures facilitated the consumption of new energy vehicles, which continued to gain momentum despite the initial strong promotions earlier in the year.

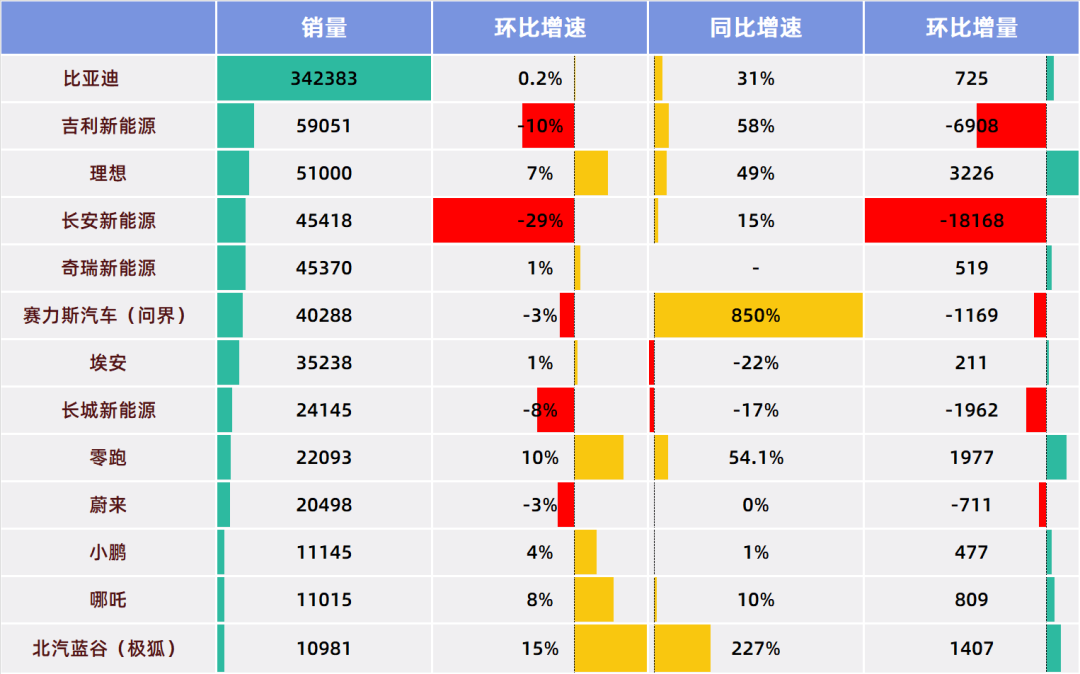

Among the 13 automakers that have released sales figures, only GAC Aion and Great Wall Motors saw year-on-year declines, while only five experienced month-on-month decreases. Monthly sales of over 10,000 units have become a basic condition for automakers to maintain competitiveness.

However, despite this continued growth, July felt more like a transition period.

On the one hand, inventory issues remained prominent. According to data from the China Automobile Dealers Association, the Chinese auto dealer inventory warning index was 62.3% in June, above the boom-bust line (50%), indicating a downturn in the auto circulation industry. In July, efforts were made to address inventory issues, reducing the index to 59.4%, but it remained above the boom-bust line, indicating continued inventory pressure.

Price promotions gradually subsided. The China Passenger Car Association believed that the sustained large promotions in the first half disrupted the normal price trends in the auto market, and it would take time for terminal prices to recover. Coupled with the overextension of consumer spending from the strong promotions in the second quarter, the effect of trading volume for price in July weakened slightly.

Automakers seemed to have entered a "skill cooldown" period, with fewer new car launches and less intense price promotions compared to previous months. Compared to June, the median and average sales of the 13 automakers declined slightly, with the average sales decreasing by 1,505 units.

Maintaining consistent high growth each month is already challenging, let alone publishing sales figures on a weekly basis. This is a significant reason why NIO, Xiaopeng, and Geely jointly opposed weekly sales rankings.

#

Vol.2/ Volatility and Differentiation

Despite opposition from competitors, Li Xiang showed no signs of backing down. The key reason is that Li Auto is currently on a strong upward trajectory, and sales rankings continue to reinforce its brand momentum. While some automakers are working to avoid internal competition, others are desperately trying to strengthen their growth trends, making it difficult to avoid conflicts that may become the norm going forward.

Automakers can broadly be categorized into three groups: those that continue to break through, those that grow amidst volatility, and those that struggle to make progress.

BYD, Li Auto, and Leapmotor are notable exceptions, having set new record highs in sales for the past three consecutive months. Li Auto briefly abandoned weekly rankings when MEGA encountered setbacks but has since resumed them amidst its positive growth momentum, making it unrealistic for competitors to prevent its promotions.

Most automakers are in a state of volatile growth. While Geely and NIO maintain a solid foundation, they have experienced varying degrees of month-on-month declines. Xiaopeng, Nezha, and Beijing Automotive Group BluePark have experienced continuous growth, but their deliveries are still barely over 10,000 units, placing significant sales pressure on them.

Several brands, including IM Motors, Voyah, Ora, and Weiying, have struggled despite being backed by powerful automaker groups and have yet to break through the 10,000-unit mark.

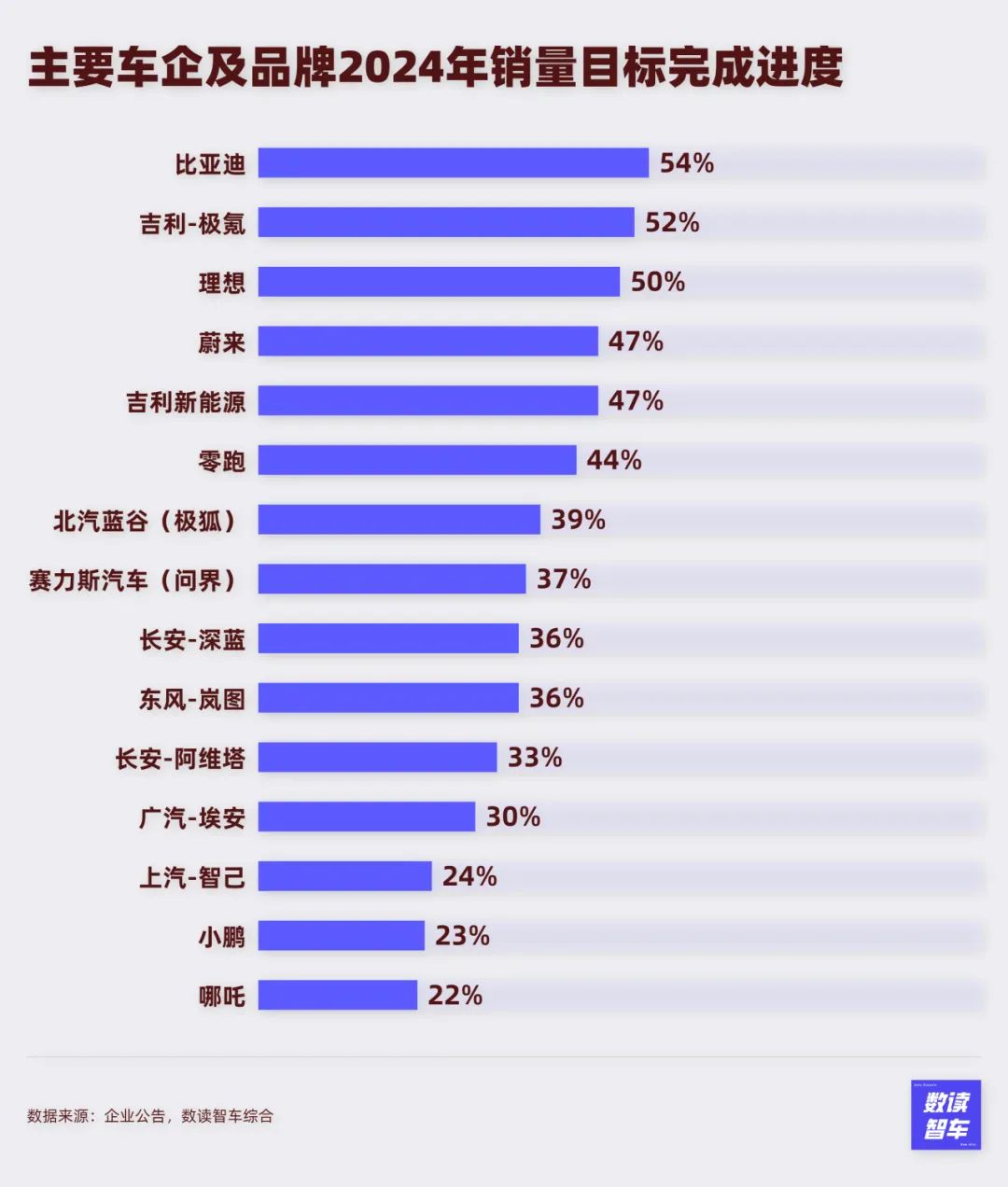

Automakers with strong sales performance are making good progress towards their sales targets. BYD has already achieved 54% of its annual target, putting it on track to exceed its goal.

After twice revising its sales target downwards, Li Auto has achieved 50% of its target in seven months. With monthly sales exceeding 50,000 units, it is likely to meet its adjusted annual target.

Notably, Xiaomi, which launched its new vehicle in April, is also expected to meet its target ahead of schedule. Lei Jun revealed in his annual speech that over 30,000 Su7 vehicles have been delivered to date, and the company aims to exceed its annual delivery target of 100,000 vehicles by November.

Apart from these companies, Geely and its subsidiary Zeekr are also making good progress, having achieved 47% and 52% of their targets, respectively, with a high likelihood of meeting their annual goals.

Thanks to their strong performance in recent months, NIO and Leapmotor have also gradually caught up, with NIO achieving 47% and Leapmotor achieving 44% of their targets.

However, most automakers may struggle to meet their ambitious annual targets set at the beginning of the year. In particular, Xiaopeng, Nezha, and IM Motors are unlikely to achieve even a quarter of their goals seven months into the year, while Aion, AVATR, Voyah, and Wenjie have also fallen short of expectations.

Despite the overall growth of the automotive market, low-volume brands and automakers may struggle to avoid operational challenges amidst intense competition. Before the earnings season, BAIC BluePark and Thalys successively released profit warnings. BAIC BluePark expects to incur a loss of RMB 2.7 to 2.4 billion in the first half of the year, an expansion from the same period last year. In contrast, Thalys achieved profitability, with a net profit attributable to shareholders of the parent company expected to range from RMB 1.39 to 1.7 billion. The disparity in sales between Thalys and BAIC BluePark is directly reflected in their respective operating conditions.

In an environment where competition is inevitable, automakers must seek new paths forward.

#

Vol.3/ Going Global, Adjustments, and Partnering with Huawei

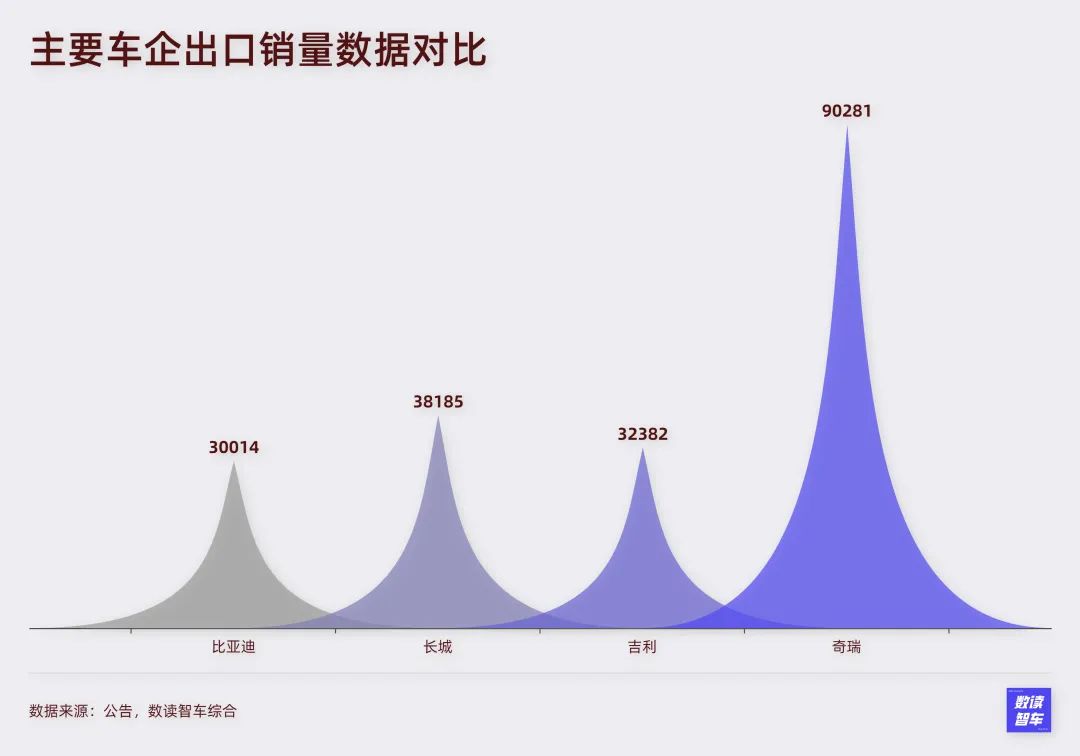

The trend towards automakers expanding overseas is evident.

In July, BYD completed its factory in Thailand with an annual production capacity of 150,000 vehicles. The project took just 16 months from groundbreaking to commissioning, and BYD now has 115 sales outlets in Thailand. In Cambodia, BYD will invest in an electric vehicle assembly plant with an annual capacity of 20,000 vehicles, marking its second factory in Southeast Asia. Beyond Southeast Asia, BYD reached a USD 1 billion agreement with Turkey for an electric vehicle factory, providing access to both the Turkish market and the EU.

Zeekr is actively advancing its localization efforts in Europe, planning to adopt a network layout combining direct sales and dealerships. Currently, Zeekr has entered Sweden and the Netherlands, and plans to open showrooms in Seoul and Gyeonggi Province, South Korea, by the end of next year, with deliveries scheduled for the first quarter of 2026.

Nezha, which has been intensively deploying in Southeast Asia for some time, launched a new vehicle in July. On July 25, the pure electric SUV Nezha X was simultaneously launched in Kuala Lumpur, Malaysia, and Bangkok, Thailand. Also in July, Nezha's first subsidiary in South America opened in São Paulo, Brazil, with the first three models expected to arrive in the third quarter, officially entering the Brazilian market.

After partnering with Stellantis Group, Leapmotor has shipped its first batch of Leapmotor C10 and T03 electric vehicles to Europe, with plans to expand into the Middle East, Africa, Asia Pacific, and South America.

Currently, most automakers are on an equal footing in terms of overseas expansion. Even industry leader BYD exported only 30,014 vehicles in July, fewer than Great Wall Motors, Geely, and Chery.

Personnel adjustments have also been a choice for struggling automakers. In July, BAIC, which struggled to increase sales, made a leadership change. Liu Yu stepped down as Chairman of BAIC BJEV, and Dai Kangwei, the former General Manager, was promoted to Deputy Chief Engineer of BAIC Group and Chairman of BAIC BJEV. Zhang Guofu, the former Executive Deputy General Manager, was promoted to Party Secretary and General Manager of BAIC BJEV. Liu Guanqiao, the former Minister of Business and Management of BAIC Group, took over marketing responsibilities.

Leapmotor, which still has shortcomings in marketing, once again changed its business leader. According to 21st Century Business Herald, Zhang Weili, Senior Vice President and Chief Marketing Officer (CMO) of Leapmotor, will resign after just one year and nine months with the company. The CMO position at Leapmotor is currently vacant and is temporarily filled by Cao Li, Senior Vice President and Head of Vehicle Manufacturing.

Avistar's channel reform, which began in April, was finally completed in July. As part of this reform, some experience centers (direct stores) were retained in first-tier cities, while most second- and third-tier cities transitioned to dealerships. Some direct stores and staff members were transferred to investors or dealer networks.

In July, Huawei continued to be a valuable partner for many automakers, with related collaborations progressing.

XIAOMI EV S9 made its official debut in Huawei stores, available in two versions: XIAOMI EV S9 Ultra (all-wheel-drive flagship) and XIAOMI EV S9 Max (rear-wheel-drive long-range). Additionally, ARCFOX announced that its ARCFOX S07 will be equipped with Huawei's HUAWEI ADS SE intelligent driving system, supporting intelligent driving assistance and smart parking functions. JAC Motor revealed that its first product with Huawei, the "Zunjie," has entered the vehicle validation stage and is scheduled to roll off the production line by the end of this year, with a launch planned for the first half of next year.

Due to the popularity among automakers, Huawei's Intelligent Automotive Solutions BU generated RMB 10 billion in revenue by early July 2024, exceeding the combined revenue of the previous two years in just half a year.

However, it should be noted that Huawei Select's second model, Zhijie, sold 2,555 units in July, a decrease of 440 units from the previous month, indicating less-than-ideal performance. The success of WENJIE may not be easily replicated or may require a process.

#

Vol.4/ Rise of Autonomous Ride-Hailing Services

The biggest controversy in the new energy vehicle industry in July was autonomous ride-hailing services.

Luobo Kuaipao, a subsidiary of Baidu, gained widespread attention in Wuhan. At the same time, various regions introduced positive policies to encourage the development of autonomous taxis. Shanghai launched its first batch of fully autonomous vehicles, offering free trials to users.

The Beijing Municipal Commission of Economy and Information Technology solicited public opinions on the "Regulations on Autonomous Vehicles in Beijing (Draft for Comment)." The document indicated that Beijing plans to support the use of autonomous vehicles for urban public transport, ride-hailing, and car rental services.

Guangzhou issued a document supporting the innovative application of intelligent and connected vehicles in highways, airports, ports, stations, and other transportation hubs, as well as for urban bus and taxi services.

Shenzhen enacted regulations as early as 2022 allowing self-driving vehicles to legally operate in designated areas, establishing legislative regulations for autonomous driving technology levels, traffic violations, and accident handling for the first time.

Currently, SAIC Motor's Robotaxi is conducting demonstration operations in multiple regions, including Shanghai and Suzhou, with nearly 100 vehicles and a cumulative mileage of 4 million kilometers, serving over 200,000 orders.

According to reports, Baidu plans to deploy 1,000 self-driving vehicles for 24/7 operations across Wuhan in 2024, aiming for profitability in 2025 after achieving a break-even point by the end of 2024, according to a securities research report.

The popularity of autonomous ride-hailing services in China has sparked linkage in overseas markets. On July 24, Alphabet (Google) announced that it would invest an additional USD 5 billion in its autonomous vehicle subsidiary, Waymo.

However, autonomous ride-hailing services are still in their infancy. Pony.ai believes that the current market share of self-driving vehicles has a negligible impact on the market and will not significantly alter traditional transportation modes for another five years.

#

WENJIE + Zhijie, Unable to Outsell Li Auto

The sales battle between Huawei and Li Auto has been ongoing since the beginning of the year.

At the start of the year, WENJIE's strong performance overshadowed Li Auto, which was struggling with the setback of MEGA. However, starting in April, Li Auto seemed to have overcome its struggles and experienced a steady increase in sales.

In July, Li Auto's monthly sales surpassed previous highs, reaching 51,000 units, marking three consecutive months of record-breaking sales. In contrast, Huawei's HarmonyOS-based models have yet to break the 50,000-unit mark, even with the launch of Zhijie models in June. Combined, the sales of WENJIE and Zhijie still fell short of Li Auto's figures.

Currently, Li Auto is focused on strengthening its autonomous driving capabilities. Li Auto's OTA 6.0 intelligent driving system will soon launch NoA (Navigate on Autopilot) without HD maps. This upgrade will cover Li Auto's MEGA, Li Auto L9, Li Auto L8, Li Auto L7, and Li Auto L6 AD Max models.

While Huawei's current lag is temporary, with the addition of "XIAOMI EV S9" and "Zunjie" and more models, it is only a matter of time before monthly sales reach new heights.

Moreover, Huawei's leading position in intelligent driving is evident. In July, Huawei reduced the price of its HUAWEI ADS (Qiankun Intelligent Driving) high-level feature package by RMB 6,000 for a one-time purchase. Yu Chengdong revealed that Huawei will launch its advanced intelligent driving system, ADS 3.0, in August, with WENJIE M7 and M9 scheduled for upgrades to ADS 3.0 in September.

Can be seen that AITO is Huawei's "firstborn" in terms of intelligent driving, and iterations in intelligent driving technology are prioritized for use in AITO. Seres, which collaborates with Huawei, undoubtedly benefits from this. In July, a subsidiary of Seres planned to acquire intellectual property rights related to the AITO trademark held by Huawei for RMB 2.5 billion, including textual and graphical trademarks as well as 44 related design patents, for a total acquisition price of RMB 2.5 billion. Assessments indicate that the market value of the acquired assets from Huawei is RMB 10.233 billion, effectively incorporating the AITO brand at an extremely low price.

Richard Yu publicly stated, "Due to national regulations requiring brand owners and manufacturers to be unified, we have transferred all four 'Jies' to the automaker... We have invested heavily in AITO, and in fact, this brand is worth at least tens of billions. Even the name 'AITO' has been transferred. Registering a brand starting with 'AI' as a four-letter acronym is difficult globally and is an excellent name." This demonstrates Huawei's cherishment of AITO.

Currently, Seres remains heavily reliant on AITO, with AITO sales accounting for nearly 90% of total sales in July. Seres' other models have struggled to achieve success, and in the long run, Seres will need to cling tightly to Huawei's strong support.

#

NIO and Leapmotor: Gradually Improving

Among the new-energy vehicle startups, although NIO and Leapmotor lag behind AITO and Lixiang in terms of strength, they are gradually catching up.

Before the launch of the low-priced Lido, NIO had already stabilized its monthly sales at 20,000 units. In July, sales reached 20,498 units, marking the third consecutive month of exceeding 20,000 units. Considering the higher price segment, it is not easy for a pure electric vehicle brand like NIO to achieve this milestone. With the upcoming launch of Lido L60 in September, NIO's sales are expected to continue to climb in the second half of the year.

To address range anxiety, Lixiang chose the extended-range approach, while NIO focused on battery swapping. After six years, NIO's battery swapping efforts have finally borne fruit, with its battery swapping stations exceeding 50 million swaps. Since November 2023, NIO has established battery swapping cooperation with Changan Automobile, Geely, Chery, JAC Motor, Lotus, GAC Motor, and FAW Group.

If the battery swapping market is fully validated, NIO will undoubtedly occupy an important niche, and its products will benefit accordingly. Spy shots of the first model from NIO's third brand, "Firefly," have been exposed, and the new vehicle will also adopt the battery swapping model.

Leapmotor has achieved sales growth through its exceptional cost-effectiveness. As a large six-seater flagship SUV, the Leapmotor C11 has a fully equipped price below RMB 200,000. The C11 has performed impressively, with over 10,000 orders in its first month on the market. Its cost-effectiveness has enabled Leapmotor to capture a portion of the market. In July, Leapmotor sold 22,093 units, surpassing NIO and XPeng and exceeding 20,000 units for the second consecutive month.

However, the Leapmotor C11 experienced another spontaneous combustion incident in July, with the front hood suddenly exploding while driving. This is the third fire incident involving the C11 this year, which may pose a potential risk for Leapmotor.

#

XPeng and Nezha: Struggling to Climb

Although Nezha and XPeng are experiencing slow sales growth, their competitors are growing faster, making these two companies appear to be lagging behind in the new-energy vehicle startups.

XPeng sold 11,145 units in July. Since March, XPeng's sales have been continuously growing, but the growth rate remains insufficient. Sales anxiety is a serious concern, and low-priced models will undoubtedly play a crucial role. In August, the low-priced new model MONA M03 will officially launch, with an expected price below RMB 200,000.

In addition, intelligent driving remains XPeng's primary focus. On July 30, XPeng held an AI intelligent driving technology conference and released the AI Tianji System XOS 5.2.0 version, which includes an upgraded XNGP system, emphasizing the transition from "usable nationwide" to "convenient nationwide." However, XPeng faces comprehensive competition. In the field of intelligent driving, it competes with Huawei's HarmonyOS, and Tesla is expected to obtain approval for its Full Self-Driving (FSD) in China and the European Union by the end of the year, posing severe challenges to XPeng's technological capabilities.

The concept of flying cars represents a potential future outlet for XPeng. On July 25, XPeng's subsidiary XPeng HT Aero signed a strategic cooperation agreement with the Hechi Municipal Government of Guangxi Zhuang Autonomous Region to jointly promote the testing, application, and supporting services of future flying cars in Hechi. Furthermore, XPeng HT Aero secured US$150 million in Series B1 funding earlier this month and simultaneously initiated Series B2 funding.

Nezha Automobile also faces sales anxiety but adopts a different approach. In July, Nezha sold 11,015 units, marking the third consecutive month of sales exceeding 10,000 units, a noteworthy achievement.

Unlike XPeng, Nezha lacks a better strategy and must turn to overseas markets for growth. Since June, Nezha's posters have begun to highlight data from its overseas business, with over 1,000 orders for the Nezha X in Thailand within 72 hours. Currently, Nezha is focusing on developing markets with high population densities.

#

GAC Aion: A Painful Consolidation Phase

On July 30, when Zhou Hongyi experienced the GAC Aion Hyper SSR, he personally tested the scissor doors' anti-pinch function but unfortunately got his hand caught in the door. Intending to "show off" the technology, he instead experienced an awkward moment.

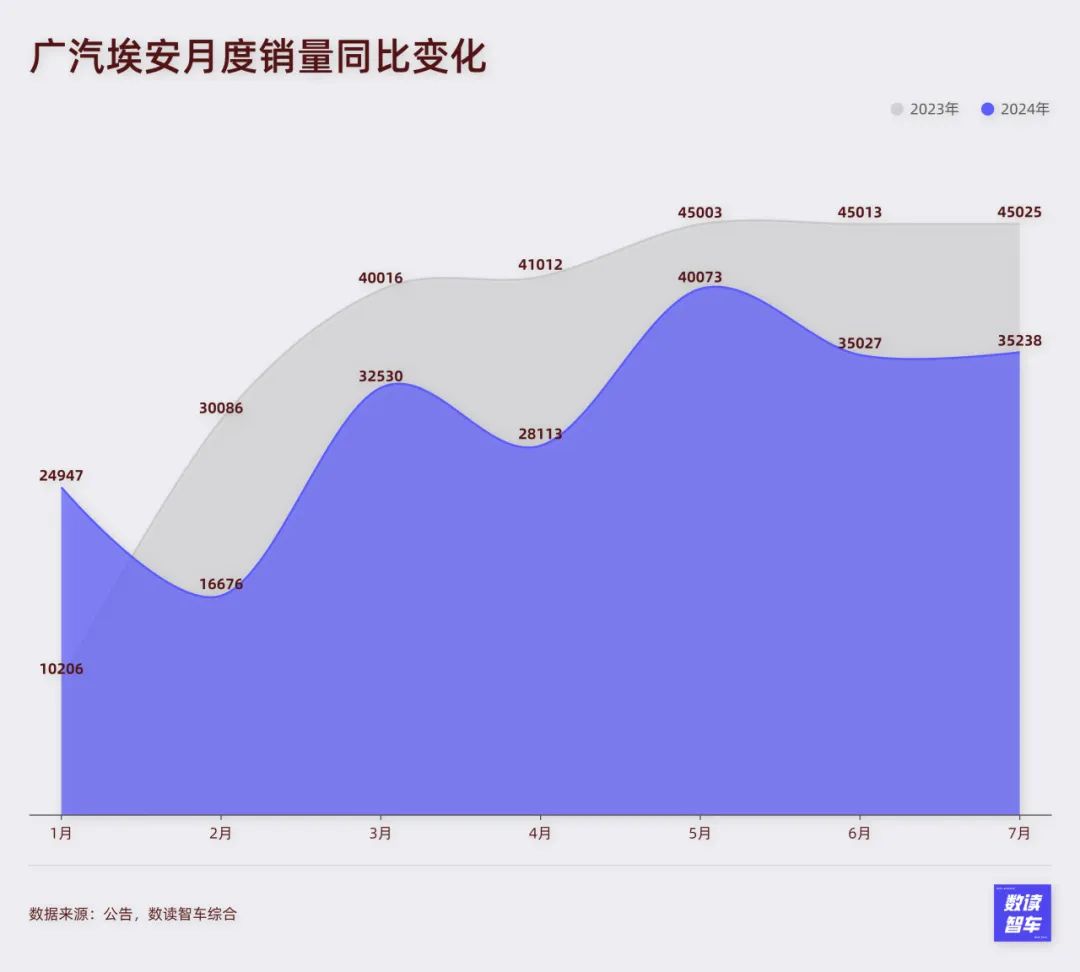

This incident seems to epitomize Aion's current awkward situation. Aion sold 35,238 units in July, a year-on-year decrease of 21.7%. In the first seven months of this year, Aion's sales declined year-on-year for six months. Only in May did sales exceed 40,000 units. Last year, Aion achieved sales of over 40,000 units for ten consecutive months, peaking at over 50,000 units in September.

In the first half of the year, the AION V sold only 8,582 units, accounting for 4.8% of total sales and dragging down overall performance. Currently, Aion has only completed 30% of its annual sales target. To achieve the full-year target of 700,000 units, Aion would need to sell over 97,000 units per month for the remainder of the year, a goal that is clearly unattainable.

On July 18, GAC Group repurchased 4.436 million H shares for approximately HK$12.7 million, aiming to send a positive signal and boost confidence. On July 23, Aion launched the second-generation AION V. For Aion, the performance of the AION V is directly related to whether it can stabilize sales at 40,000 or even 50,000 units per month, making it a potential focal point for reviving sales in the second half of the year.

Before reaching a new level, this consolidation phase is bound to be extremely challenging for Aion.

In July, most automakers did not maintain the aggressive stance they had at the beginning of the year, seemingly conserving energy for the second half of the year. Based on past experience, the fourth quarter will be crucial for sales sprints. After years of rapid market growth, the incremental market for domestic new-energy vehicles is shrinking, and competition is becoming increasingly intense. Seeking overseas markets has become a common choice for manufacturers to find new outlets. Going global will be an important focus in the future market.