Great Wall Motor raises the banner of fairness and justice in the automotive industry

![]() 08/09 2024

08/09 2024

![]() 511

511

For China's automotive industry, the present is the best of times and the worst of times, filled with both opportunities and concerns.

At present, the automotive industry is mired in an endless cycle of internal competition, with battles over traffic, pricing, and marketing reaching a fever pitch. The relentless pursuit of sales volume has led to the neglect of quality, and the 'turning over the table' approach to competition has pushed costs to unsustainable levels. This disorderly and somewhat unsavory method is harming the progress of the automotive industry.

At this crucial juncture, where overtaking is possible on the bends, automakers with responsibility, duty, and courage must step forward.

[Say 'No' to Meaningless Internal Competition]

The automotive industry's endless internal competition seems to be reaching its limits.

Recently, BMW, Benz, and Audi (BBA) have announced their withdrawal from the price war, and simultaneously, more and more enterprises are recognizing its harmfulness.

Excessive price wars not only harm brand value but also put immense pressure on dealers. According to incomplete statistics, over 10,000 4S stores have closed down in the past five years, and Guanghui Auto, once the sales leader with a market value exceeding 130 billion yuan, is on the brink of delisting.

A price war without boundaries is detrimental to the entire automotive supply chain and hinders the progress of China's automotive industry, serving no meaningful purpose for industry development.

For instance, in the 150,000-yuan plug-in hybrid market, a certain brand's new model is priced at just 138,700 to 173,700 yuan. The battery for this model is supplied by Hive Energy, and based on estimates, such pricing amounts to selling cars at a loss.

Earlier this year, the 'king of competition,' BYD, sparked a price war with the slogan 'electricity cheaper than oil,' offering plug-in hybrid sedans starting at just 79,800 yuan. Industry insiders claimed this left no room for joint venture gasoline-powered vehicles. Within a single day, models like the Tang DM-i Glory Edition were significantly discounted by 30,000 to 70,000 yuan, prompting nine new energy automakers to announce price cuts within a day, with reductions ranging from 5% to 15%.

Statistics show that from 2023 to the first half of this year, domestic auto retail prices fell by approximately 20% due to the price war. Many automakers saw sharp declines in profits or even incurred losses. Recently, layoffs at automakers have become frequent, and a wave of 4S store closures has arrived, leading to massive layoffs among auto sales staff.

The health of the automotive industry has been severely compromised. News of WM Motor's restructuring and COHO Automotive's suspension still echoes, while XPeng and NIO have had to sacrifice prices for volume, enduring massive losses. BAIC BluePark has suffered losses exceeding 20 billion yuan in four years, and Changan Automobile saw a steep 83.39% decline in net profit in the first quarter of this year.

BYD's price war boosted sales but decimated the residual value of its cars, with rumors even suggesting that the residual value of the Qin DMI could plummet to zero after three and a half years.

Great Wall Motor Chairman Wei Jianjun urgently calls out, 'Without profitability, one cannot go far. It is essential to maintain strong self-sufficiency.' He has repeatedly urged the industry in public to return to normal competitive order. Industry leaders such as Zeng Qinghong, Chairman of GAC Motor, and Li Shufu, Founder of Geely, have also explicitly criticized vicious competition.

Throughout the history of automotive development worldwide, profitable products fund R&D investments, which in turn create even better products, forming a virtuous cycle that has given birth to numerous renowned automotive brands. This is also the most fundamental economic principle.

Statistics show that among the world's most profitable automakers in 2023, Ferrari earned 710,000 yuan per vehicle sold, Tesla nearly 60,000 yuan, and Toyota, renowned for its fine management, earned 24,000 yuan per vehicle.

Compared to world-class automakers, Chinese enterprises lag significantly in profitability. In 2023, Geely earned just over 3,000 yuan per vehicle, while BYD earned just over 8,000 yuan per vehicle. Considering the impact of the price war, profitability this year is likely to continue declining.

Amidst fierce competition, some automakers adhere to a bottom-line mindset and long-term vision, leveraging their strengths and pursuing quality market share. Products with particularly severe losses are sold in moderation, while those with higher profits, advantages, and consumer appeal are vigorously promoted.

For instance, due to severe losses in 2022, Great Wall Motor decisively discontinued the popular Ora White Cat and Black Cat models. Since the beginning of this year, Great Wall Motor's product mix has become healthier, with 140,533 vehicles priced above 200,000 yuan, accounting for 25.11% of total sales and a year-on-year increase of 64.28%.

The popular Tank brand sold a cumulative 116,000 vehicles in the first half of this year, nearly doubling year-on-year. The high-end new energy brand Wey sold 19,867 vehicles in the first half of the year, up 9.46% year-on-year.

It is precisely this rational strategy that allows Great Wall Motor to escape the trap of internal competition. Its net profit for the first half of 2024 is expected to reach 6.5 to 7.3 billion yuan, representing a growth rate of 377% to 436%. Based on the median estimate, net profit per vehicle reaches 12,300 yuan, ranking among the world's best.

Lixiang One is also a typical example. Positioned as a 'dad car,' Lixiang One has become China's first new-energy automaker with annual revenue exceeding 100 billion yuan and profits exceeding 10 billion yuan. Its profit per vehicle exceeds 30,000 yuan, ranking among the top five globally.

Only by rejecting internal competition can enterprises return to a path of healthy development, not only significantly outperforming competitors in terms of profit per vehicle but also continuously enhancing brand power, value creation capabilities, and profits, thereby effectively rewarding investors.

[Healthy Development, Eliminating Illnesses]

The current automotive industry is somewhat impetuous, and many illnesses must be eliminated; otherwise, a large number of consumers will be trapped and become victims of unfair competition among some automakers.

BYD's 2024 sales target is as high as 4.5 to 5 million vehicles, representing a massive increase of 1.5 to 2 million vehicles over last year's 3.02 million. Such an enormous and exaggerated target necessitates aggressive pricing strategies.

Of course, appropriately and reasonably passing on benefits to consumers is commendable. However, resorting to sudden price cuts solely for sales is not advisable. On July 29, FENGSHENG BAO 5 announced a price reduction of 50,000 yuan to a range of 239,800 to 302,800 yuan.

What angered consumers was that the general manager had previously stated that there would be no price war, and this betrayal directly infuriated car owners. On Sina's Black Cat Complaint Platform, numerous complaints alleged that FENGSHENG BAO was involved in 'false advertising.' In such disorderly competition, consumers suffer the most and will ultimately turn against automakers.

Several illnesses have emerged in the industry. Firstly, there is the sole focus on sales volume, with automakers engaging in loss-making price cuts to gain sales rankings and attract consumer attention and recognition.

It is important to note that automobiles are significant consumer goods for households, typically lasting over a decade. Automakers should prioritize quality, technology, performance, environmental protection, reputation, and other multi-dimensional factors.

Wei Jianjun points out that ranking solely based on sales volume is meaningless. Rankings should be comprehensive, considering factors such as customer complaints, consumer reputation, corporate favorability, profits, and taxes paid.

Currently, the industry is flooded with various rankings, leaving people dizzy. Li Bin has strongly criticized weekly sales rankings, and both Geely and XPeng have expressed dissatisfaction with weekly rankings.

Secondly, while domestic brands are rapidly rising, there are voices of blind arrogance spreading online, particularly unfriendly attitudes towards foreign and joint venture automakers, and even some assertions advocating for driving them out. Such views do more harm than good to China's automotive industry development.

The automotive industry has evolved into a globally industrialized and specialized sector, with openness and inclusiveness as its overarching theme. As cars become increasingly intelligent, akin to smartphones, even powerful companies like Apple and Samsung rely on global supply chains; no single entity can do it all alone.

As Wei Jianjun notes, China's automotive future does not involve doing everything but rather leveraging global resources. 'No enterprise can succeed without participating in the global market. Learning from established automakers is crucial for better global competition and surpassing them,' he said.

Currently, China's automotive exports are booming. In the first half of the year, Chery exported a cumulative 532,000 vehicles, up 29.4% year-on-year, maintaining its position as China's top automotive exporter. Great Wall Motor exported over 200,000 vehicles, up 62.59% year-on-year.

Exports have become a new growth point for Chinese enterprises. Looking at the globalization journeys of Toyota, Volkswagen, and Tesla, integrating into global supply chains, expanding into global markets, and leveraging global resources are essential paths. Disrupting the long-term development of the entire industry for the sake of short-term gains is unacceptable.

Furthermore, some enterprises have reduced costs and prices to boost sales, even willing to risk 'fraud.' Last year, Great Wall Motor discovered that certain automaker models used atmospheric pressure fuel tanks, suspected of failing to meet emission standards, and proactively reported this to relevant authorities. Considering the significant sales volume of this automaker, the impact is comparable to Volkswagen's emissions scandal, but the company used various means to obstruct Great Wall Motor's stance and hastily switched to high-pressure fuel tanks in an attempt to cover up the issue.

The root cause lies in the disregard for quality amidst fierce competition. To return to a path of healthy development, this adverse competitive culture must be reversed.

[Cool Reflection Amidst the Heat]

While China's achievements in the new energy sector are exciting, a cool reflection is even more crucial amidst the fervor.

Wei Jianjun, who took the helm of Great Wall Motor at just 26 years old and has been building cars for 34 years, deeply understands the challenges faced by China's automotive industry. The times have presented Great Wall with opportunities, and Wei Jianjun's love and responsibility for the automotive industry run deep. At present, the automotive industry needs a surgical intervention, and this is the earnest desire of a seasoned automotive veteran facing industry chaos, eager to dispel the fog and restore order.

Today, this reflection is gaining recognition from more and more enterprises. 'Internal competition' has shifted from being welcomed to being ridiculed, criticized, and even causing frustration, howls, and rebellion among some automakers and suppliers.

Currently, the state advocates developing new productive forces and achieving high-quality economic development. The recent leadership meeting explicitly stated the need to 'strengthen industry self-discipline and prevent vicious internal competition.'

Automakers should focus on technological research and development rather than disrupting the market, as there are still significant gaps in areas such as high-end chips, high-end machine tools, quality, suppliers, and process management.

Hyundai and Subaru, which have been ridiculed for not understanding the Chinese market, still made substantial profits in 2023. Foreign automakers that have been written off are actually thriving.

Despite missing the new energy transition, Toyota's profits more than doubled to nearly 5 trillion yen in fiscal year 2023, the highest in Toyota's 91-year history, exceeding the combined profits of China's top ten automakers.

Zeng Qinghong, who recently returned from a study tour in the US, has a profound understanding of this. He bluntly stated that Toyota and Honda sell well in the US. 'Does Toyota engage in a price war? Price wars are fine, but they should pass on benefits, not cut costs,' he said.

The internationalization, quality management, product strategies, and market strategies of these automotive predecessors are worth learning from by their Chinese counterparts.

Creating a high-quality car, providing consumers with superior products, enabling enterprises to grow, and rewarding investors while promoting healthy and benign competition throughout the industry is the essence of a commercial society.

Lei Jun publicly stated that Xiaomi plans to invest over 100 billion yuan in R&D over the next five years, focusing on core technologies. Leveraging the 'human-vehicle-home' ecosystem and unique consumer insights, Xiaomi SU7 has become a phenomenal product since its launch.

Similarly, Great Wall Motor has a motto for technological research and development: 'excessive investment,' which means boldly climbing technological peaks and making long-term investments.

'Excessive R&D' has led to a technological explosion, with domestic milestones like the first 6x6 super off-road platform, the off-road super hybrid architecture Hi4-T, and the world's only horizontally opposed eight-cylinder engine in the motorcycle sector, all originating from Great Wall Motor.

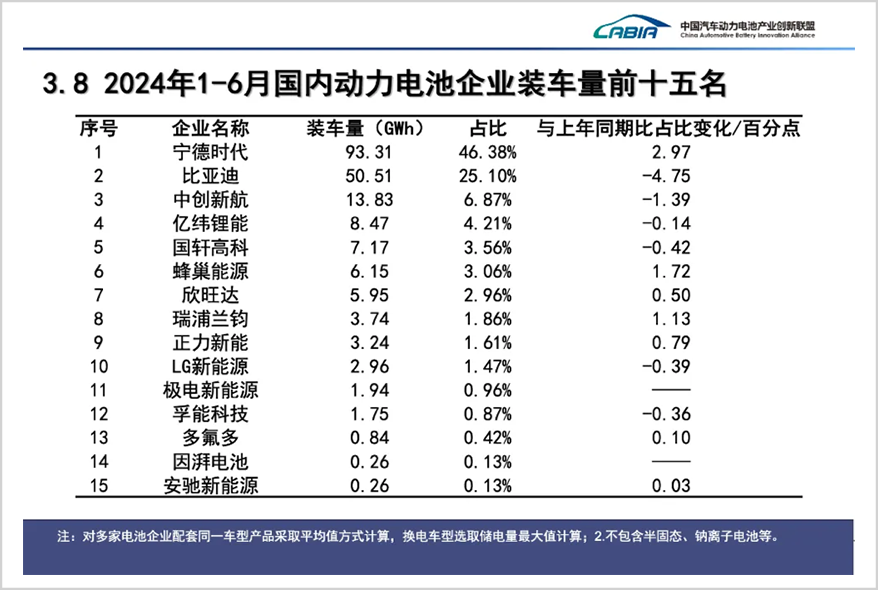

Currently, Great Wall Motor and BYD are the only two automakers with battery R&D and production capabilities. In the first half of the year, its subsidiary Hive Energy installed 6.15 GWh of batteries, with a market share increase of 1.72 percentage points and over 100% growth in overseas shipments. It has also secured a super order of nearly 90 GWh for BMW Europe, valued at up to 96 billion yuan.

Great Wall Motor is also one of China's best automotive brands in terms of intelligent driving applications. Furthermore, the company can discern market demands. While the automotive industry is fully embracing new energy, Great Wall Motor has developed a 3.0T engine and 9AT transmission to meet the individual needs of different global markets.

Knowing what to do and what not to do demonstrates the great responsibility and vision of benchmark enterprises.

Amidst the excitement and fervor in the automotive industry, it is imperative not to fan the flames. Only those enterprises that speak out boldly, reflect calmly, and dare to criticize deserve respect.

Disclaimer

The content related to listed companies in this article is based on the author's personal analysis and judgment of information publicly disclosed by the companies in accordance with legal requirements (including but not limited to temporary announcements, periodic reports, and official interaction platforms). The information or opinions in this article do not constitute any investment or other business advice. Market Value Observation assumes no responsibility for any actions taken as a result of adopting this article.

–END–