Taobao's new rules officially implemented, some rejoicing while others sorrowful?

![]() 08/09 2024

08/09 2024

![]() 528

528

Balancing consumer rights and merchant interests: How will Taobao manage this delicate tightrope?

As competition among e-commerce platforms intensifies, every change in platform rules attracts close attention from both merchants and consumers. Behind these rule changes lie intricate negotiations between different platforms, merchants, and users.

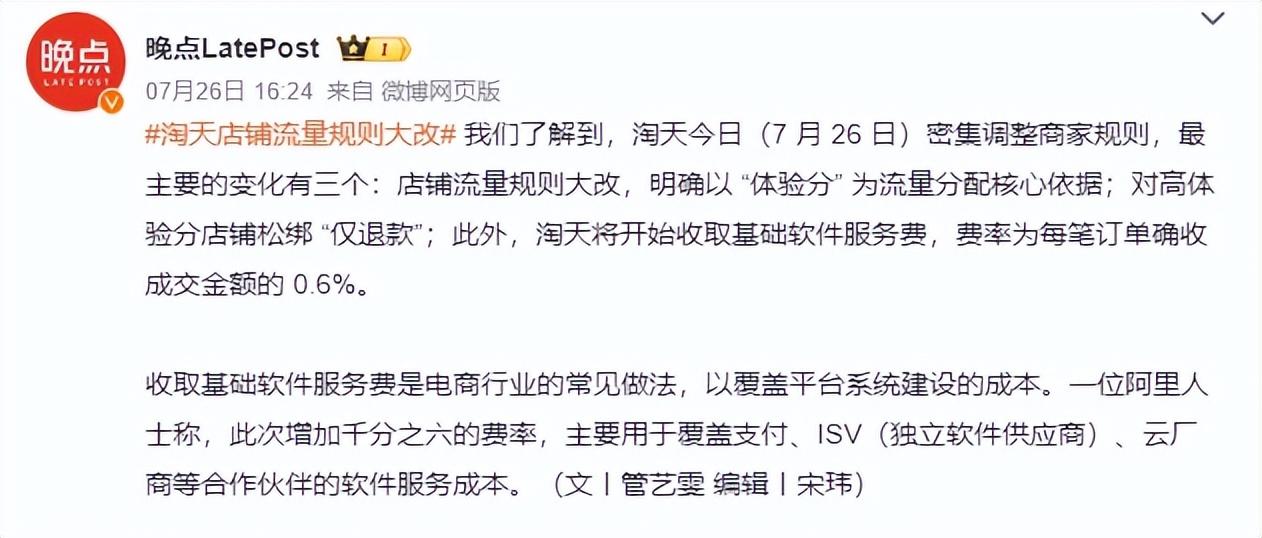

On August 9, Taobao's new "only refund" rule after optimization and "loosening" was officially implemented. Based on the new experience score, merchants are given more autonomy in after-sales service, with interventions reduced or eliminated for high-quality stores. For stores with an experience score exceeding 4.8, the decision to issue a refund is returned to them.

Additionally, Taobao announced that the "basic software service fee for platform transactions would be charged at a rate of 0.6%" and that the "annual software service fee for Tmall platform would be abolished," both of which took effect on August 9 and will be officially implemented on September 1.

Image source: Weibo screenshot

In the past, Taobao's adjustments to merchant operating costs often met with merchant resistance. However, by announcing the "loosening of only refund" policy alongside the "service fee collection," Taobao achieved a "soft landing."

Over the past year, while the outside world focused on Jack Ma's slogan of "returning to Taobao, users, and the internet," the new CEO Wu Yongming's emphasis on "facing reality and restarting" was overlooked.

01. "Flexible" Only Refund

At the end of last December, Taobao and JD.com simultaneously introduced the "only refund" service. This feature, first introduced by Pinduoduo in 2021, has become the new standard in the e-commerce industry after "seven-day no-reason return and exchange."

However, despite the similarity in name, the specific rules and enforcement vary significantly.

Industry insiders point out that compared to Pinduoduo, Taobao's "only refund" policy not only classifies sellers but also buyers, with the latter's credibility affecting the refund outcome. Additionally, Taobao merchants can appeal against "only refund" decisions, and the amounts involved are usually not high.

However, even with good buyer credibility and valid reasons, obtaining a "only refund" can be challenging. Li Tian (pseudonym) bought a kitchen storage cabinet on Tmall in April this year but found serious stability issues, uneven painting, and a strong odor after installation. Frustrated, he requested a "only refund."

The outcome surprised him. The seller only agreed to a 50-yuan refund, with the remaining 138 yuan compensated by Tmall as a "guarantee deposit."

Image source: Taobao APP screenshot

Moreover, as Taobao and Tmall have focused on a "brand route" in recent years, some merchants and product categories are inherently unsuitable for the "only refund" service. According to the new media outlet "Wan Dian LatePost," two Alibaba industry operations employees even suggested that the "only refund" policy may only apply to 10% of Taobao's products.

The "only refund" policy is a necessary step for Taobao in the e-commerce competition. However, if the policy itself is not universally enforced, how can it be considered "loosened" now?

Furthermore, the current "loosening" of the "only refund" policy still imposes requirements on merchants.

In this policy adjustment, the store's "experience score" becomes a core indicator. For stores with a comprehensive experience score of 4.8 or above, the platform will not intervene through Wangwang or support only refunds after receipt but will encourage merchants to negotiate with consumers first. For other score segments, the platform will grant varying degrees of autonomy based on the experience score and industry nature. The higher the experience score, the greater the merchant's autonomy.

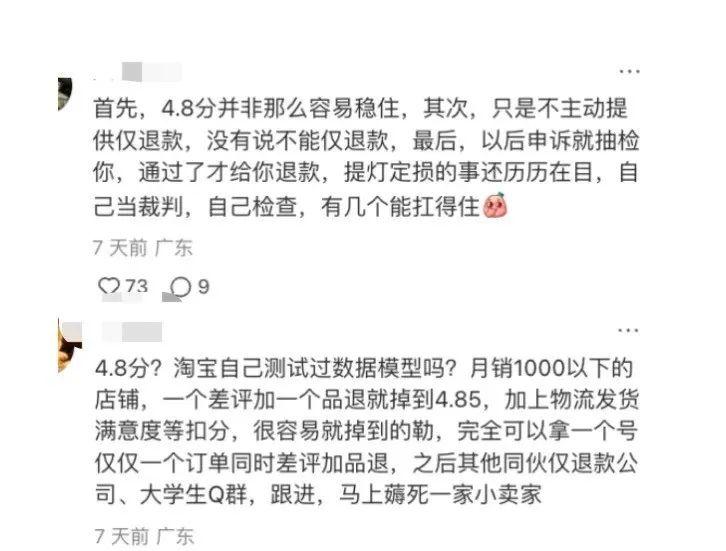

However, maintaining a 4.8 score is not easy. One merchant publicly stated on a social platform: "A 4.8 score is not easy to maintain. For stores with monthly sales below 1000, one negative review and one product return can drop the score to 4.85, and with factors like logistics satisfaction, it's easy to fall below 4.8."

Image source: Xiaohongshu screenshot

Moreover, even with a 4.8 score, merchants cannot completely avoid "only refunds." While merchants with scores above 4.8 have autonomy, the platform merely refrains from proactive intervention and optimizes the refund appeal process.

Some argue that the "loosening" benefits top merchants but further compresses the survival space for small merchants. "What can they do? Either recharge or leave," they say.

Image source: Bolangxian FT WeChat official account screenshot

The experience score not only affects "only refunds" but also one of the lifelines of sellers: "traffic." In this policy adjustment, Taobao announced that the experience score would become a core indicator for traffic allocation, replacing the previous DSR (Detailed Seller Ratings) system. However, the specific weight remains unclear to sellers.

02. Where are the new rules aimed?

On July 26, when Taobao announced the "loosening of only refunds," it also disclosed another critical adjustment that may significantly impact platform seller operating costs.

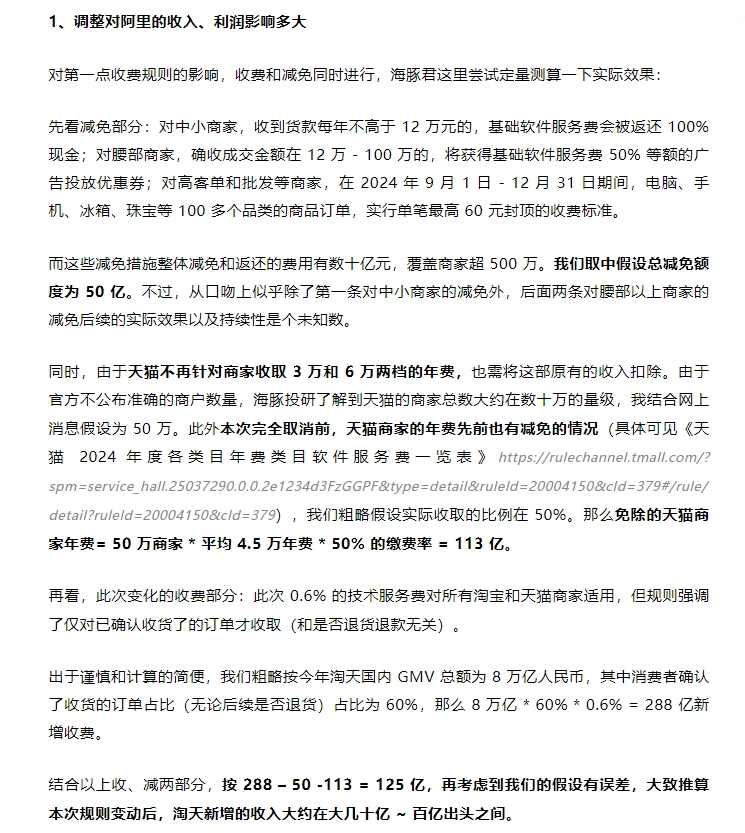

Specifically, "Taobao will charge a software service fee at a rate of 0.6% of the confirmed transaction amount per order," and "from September 1 this year, the annual fees of 30,000 and 60,000 yuan, previously charged only to Tmall merchants, will be abolished, and the 2024 annual fees already paid will be refunded."",According to calculations by the secondary market research team "Dolphin Research," Taobao's fee reduction and refund measures will overall amount to billions of yuan, covering over 5 million merchants. Assuming a total reduction of 5 billion yuan, the basic software service fee is estimated to bring in an additional 28.8 billion yuan annually for Taobao. After deducting the refunded annual fees, Taobao's annual additional revenue may still be in the range of tens to hundreds of millions of yuan.

Image source: Dolphin Research WeChat official account screenshot

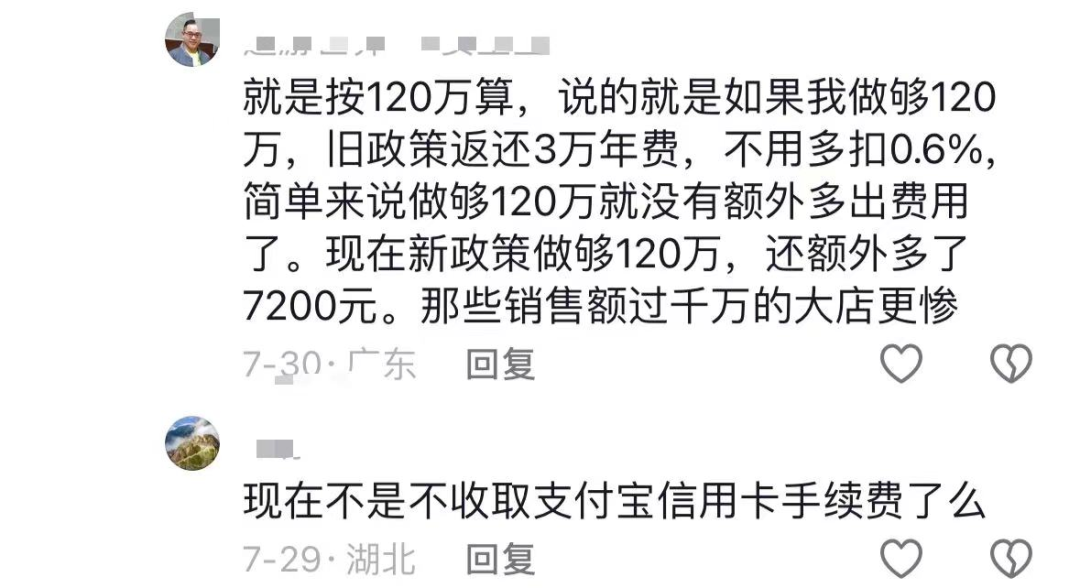

While these estimates may not be precise, the change in seller operating costs is more apparent. On social media platforms, some have roughly calculated that for a store with an annual revenue of 1.2 million yuan, the old policy would refund an annual fee of 30,000 yuan without additional costs. However, under the new policy, with the same revenue, an additional 7,200 yuan in fees would be incurred. For large merchants with annual revenues of tens of millions of yuan, costs would be even higher.

Image source: Douyin screenshot

Small sellers also face rising costs. Taobao-related e-commerce platforms, including second-hand trading platforms like Xianyu, have also started charging a basic software service fee of 0.6% (capped at 60 yuan) on the actual transaction amount per order. One Xianyu seller estimates that with a monthly turnover of 50,000 yuan, monthly costs would increase by 700 yuan under the new rules.

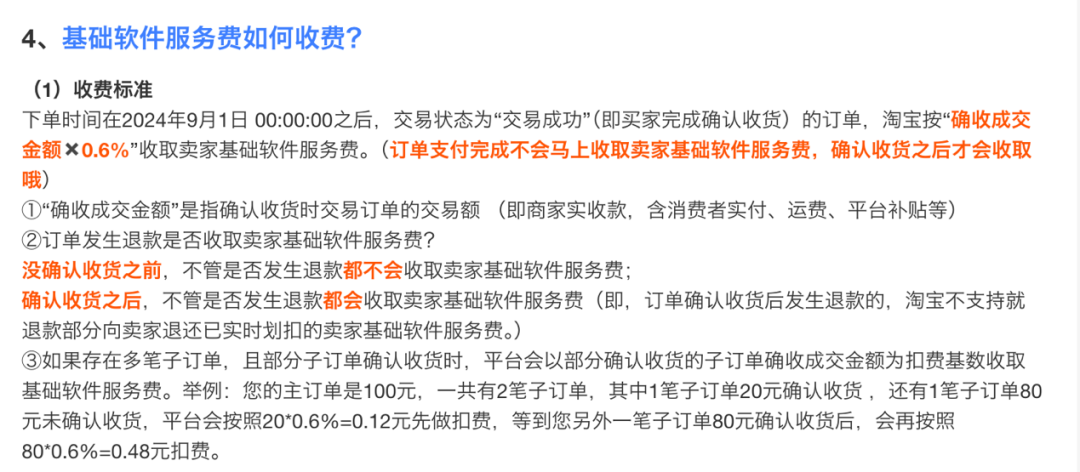

Image source: Taobao Merchant Service Hall screenshot

From another perspective, the policy adjustment impacts operating costs differently for various merchants.

According to "Qu Jie Shang Ye," the operating costs for merchants on Taobao platforms generally include deposits, annual fees, fees for business tools like Business Consultant, platform service fees (including the newly added basic software service fee), traffic promotion fees, after-sales fees, and logistics and warehousing fees.

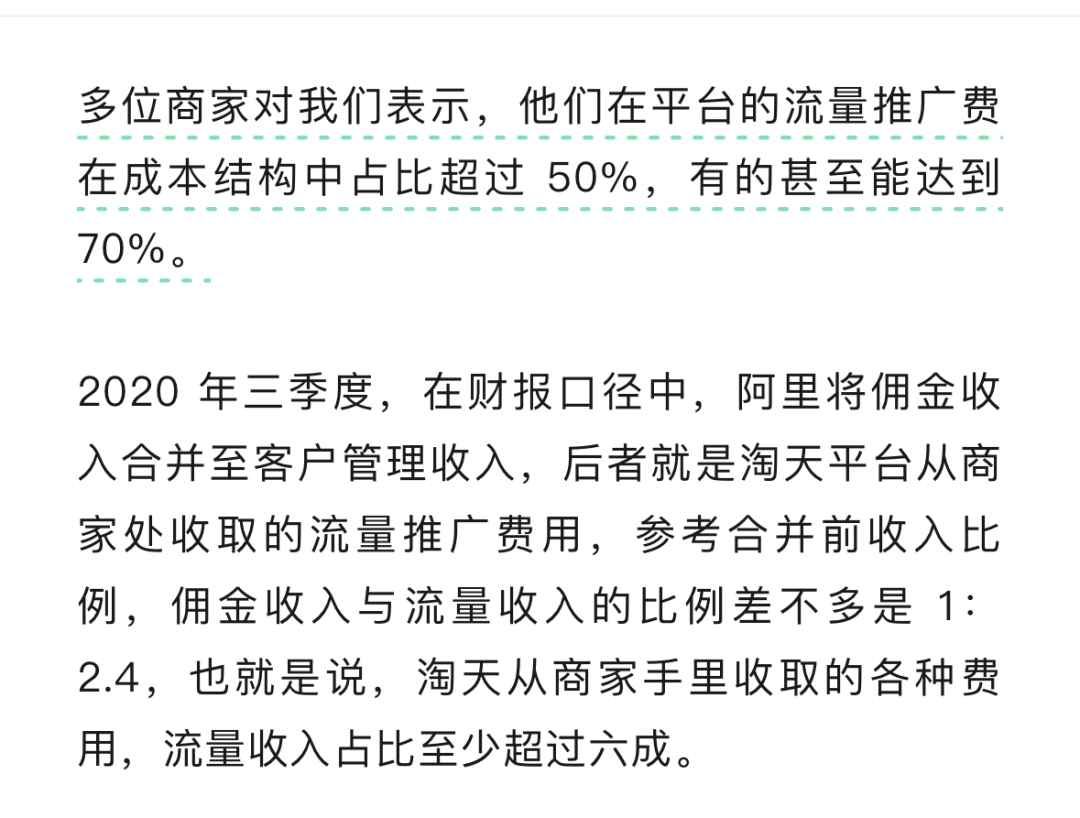

According to the new media outlet "Wan Dian LatePost," traffic promotion fees constitute a significant portion of merchant costs, sometimes reaching 50%-70%. Furthermore, more than 60% of Taobao's revenue from merchants comes from traffic-related income.

Image source: Wan Dian LatePost WeChat official account screenshot

For small and medium-sized sellers, even with platform concessions, higher traffic costs due to decreased platform traffic can still lead to significant operating challenges.

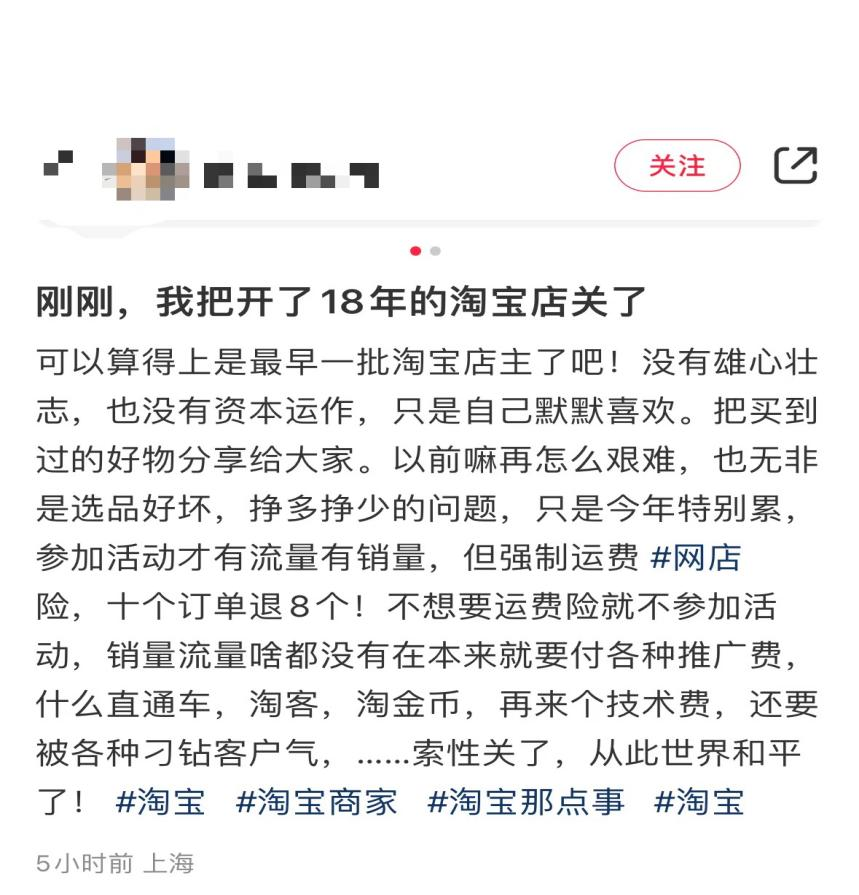

"I closed my 18-year-old Taobao store," one store owner posted on a social platform in early August. "I was one of the earliest Taobao store owners. This year has been exhausting. I had to participate in events to get traffic and sales. With various promotion fees, technical fees, and demanding customers, I decided to close the store," they said.

Image source: Xiaohongshu screenshot

This store owner's experience reflects why some small and medium-sized merchants choose to close their stores. With the peaking of e-commerce traffic dividends, overcapacity on the supply side, and intensified platform competition, large merchants are the focus of platform efforts, and platform resources and policies favor them. This trend further narrows the profit margins of small and medium-sized merchants.

03. Taobao needs a "new balance"

Today, the supply and demand landscape in the e-commerce ecosystem has fundamentally changed. Those who control traffic control the market. Last year, Jack Ma proposed for Taobao to "return to users, return to Taobao, return to the internet." Over the past year, Taobao's narrative has centered around "low prices," "recalling small and medium-sized merchants," and developing live streaming, short videos, and supporting "Kuangkuang" to enrich the platform's product and content ecosystem, driving traffic growth.

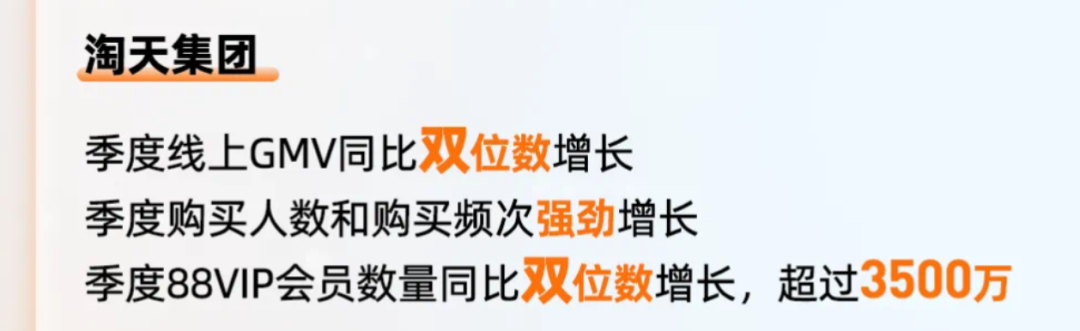

The results are noteworthy. According to Alibaba Group's fiscal year 2024 and Q4 financial results released in May, the number of buyers and purchase frequency on Taobao and Tmall increased significantly, driving double-digit year-on-year growth in online GMV and order volume.

Image source: Alibaba's battle report screenshot

However, traffic growth does not necessarily correlate with revenue growth.

On May 14, Alibaba Group released its fiscal year 2024 fourth-quarter and full-year results (April 2023 to March 2024). Despite the "Singles' Day" event, Taobao's revenue grew by only 2% year-on-year in Q4 2023. In Q1 2024, Taobao's adjusted EBITA (Earnings Before Interest, Taxes, and Amortization, excluding amortization expenses) declined by 1% year-on-year. In contrast, in Q4 2022, Taobao and Tmall's revenue grew by 9% year-on-year, and their adjusted EBITA grew by 1% in Q1 2023.

After the financial results were released, the market reacted swiftly, with Alibaba's US stock price falling over 8% pre-market and continuing to decline after the opening bell.

For investors, the key indicator is monetization rate, i.e., the revenue generated per 100 yuan of GMV for the platform. Over the past period, Taobao's performance has not met capital market expectations.

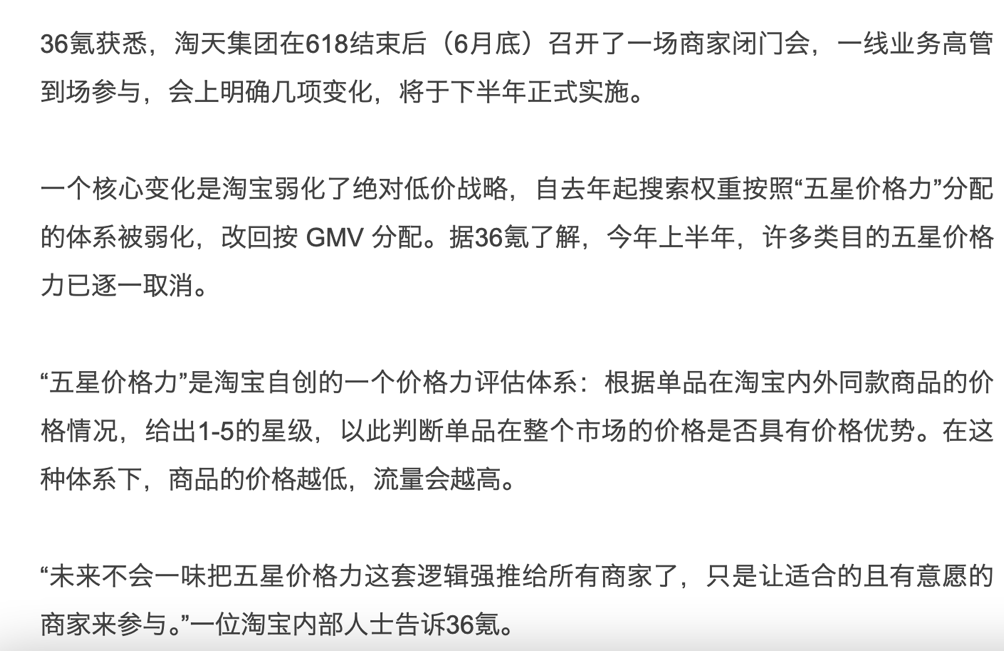

Taobao is actively adjusting. In July, 36Kr reported that after the 6.18 sale, Taobao Group held a closed-door meeting with merchants, outlining several changes. A core change was de-emphasizing the absolute low-price strategy. Since last year, the search weight based on the "Five-Star Price Force" system has been weakened and reverted to GMV allocation. Furthermore, this year, Taobao's assessment focus shifted to GMV and AAC (Average Amount per Customer) rather than pursuing high DAC (Daily Active Customers) driven by low prices.

Image source: 36Kr screenshot

Zhuang Shuai, an expert in the retail e-commerce industry and founder of Bailian Consulting, believes that replacing fixed fees with non-fixed percentage fees based on GMV indicates Taobao's return to GMV assessment. This internally incentivizes employees to help merchants increase GMV and is fairer, as higher GMV leads to higher fees instead of a one-size-fits-all fixed fee.

The de-emphasis on price competitiveness and the current policy adjustments for Taobao merchants essentially aim for the same goal: finding new growth points and telling a new story to the capital market.

This echoes Wu Yongming, Taobao's new CEO, who wrote in an internal letter at the end of last year, "Face reality and restart."

From Taobao's introduction of the "only refund" policy to its current "loosening," only half a year has passed. Looking back, it is crucial for Taobao to balance enhancing consumer experience while protecting merchant rights as much as possible.

Image source: Canned Stock Photo

Compared to Pinduoduo and Douyin, one of Taobao's advantages lies in its high-value 88VIP customers. Industry insiders estimate that the annual GMV of 88VIP customers is roughly equivalent to that of Douyin's entire e-commerce platform.

However, maintaining high customer value contradicts low prices and traffic growth. If Taobao aims to increase its monetization rate, it will inevitably raise merchant operating costs and pressure, which could adversely affect its efforts to recall small and medium-sized merchants and diversify product categories.

Today's e-commerce market is vastly different from a decade ago. In a sense, Wu Yongming's emphasis on "restarting" seems more fitting for the turbulent e-commerce landscape today.

Zhuang Shuai believes that the future e-commerce industry will exhibit two major trends: First, differentiation will be crucial for e-commerce platforms to continue growing. Second, platform rules and systems must achieve a win-win situation for consumers, merchants, and the platform itself, fostering healthy competition and making such platforms the first choice for both consumers and merchants.

After the new regulations come into effect, Taobao still keeps the initiative in its hands, and exerts both kindness and severity on merchants to force them to improve service and product quality, so as to screen good merchants and eliminate poor ones. While large merchants will gain greater benefits, they will also have more sufficient marketing budgets, bringing more revenue to the platforms, but also pushing up the cost of traffic. As for the future of small and medium-sized merchants, they will "vote with their feet". If such changes become a trend, they will in turn affect the adjustment of platform policies, and ultimately achieve a dynamic balance among consumer rights, merchant interests, and platform interests through continuous game-playing.