Xiaomi phones break into Japan's top three, joining forces with Google to challenge Apple?

![]() 08/09 2024

08/09 2024

![]() 580

580

Those who frequently watch Japanese film and television works may have noticed that in the past two years, the presence of Google's Pixel series phones in various works has been increasing.

However, the changes in the Japanese mobile phone market are not limited to the Pixel. Xiaomi phones are also becoming increasingly attractive to Japanese consumers. Recently, a well-known Japanese actress who just joined Bilibili was seen using the Xiaomi 14 Ultra, which was released earlier this year.

In mid-May, Lu Weibing, President of Xiaomi Group, revealed on Weibo that the Xiaomi 14 Ultra had "dominated all charts" on Japanese e-commerce platforms. Xiaomi Japan's official account also noted that sales of the Xiaomi 14 Ultra were exceptionally strong, with inventory running low and the next batch potentially arriving only in a month.

Image/Weibo

However, it is understood that Lu Weibing's claim of "dominating e-commerce charts" refers only to the Xiaomi 14 Ultra topping the charts on Rakuten on its first day of release.

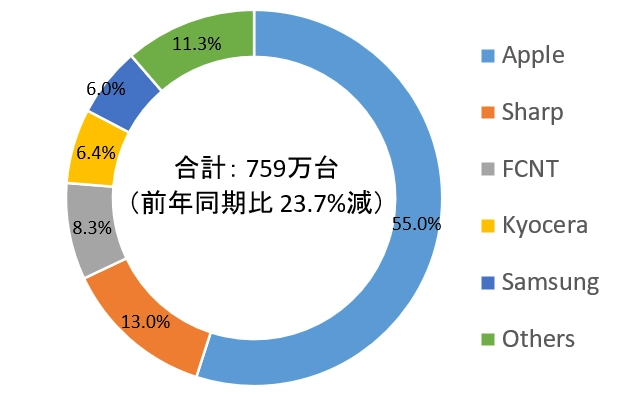

Nevertheless, market reports also confirm the "popularity" of Xiaomi phones in the Japanese market. Xiaomi Japan's recent promotional poster cites a report from market research firm Canalys, stating that Xiaomi's shipments in the Japanese market surged by 359% in the second quarter of 2024, with its market share increasing to 6%:

Reaching third place in Japan.

Image Xiaomi

It's both unexpected and predictable.

On the one hand, Xiaomi entered the Japanese market earlier and attaches greater importance to it than OPPO, vivo, Honor, and (current) Huawei. Since last year, it has also collaborated with Japanese telecommunication operators. On the other hand, Xiaomi's success in premiumizing its phones is evident in the product capabilities of its flagship devices, particularly advancements in camera technology, which is also appealing to Japanese consumers.

Moreover, the sudden rise of Google Pixel in the Japanese market proves that it's not just Apple that knows how to "preach."

In contrast, only one Japanese brand, Sharp, remains among the top five mobile phone brands in Japan, and it has long been acquired by Hon Hai Group (the parent company of Foxconn).

The decline of Japanese mobile phones

The decline of Japanese mobile phone brands is well-known. Taking Sony, the most familiar Japanese mobile phone brand in China, as an example, it has had its moments of glory in both the feature phone era and the early days of smartphones, but it has since been marginalized.

However, in 2023, we could still see the presence of Japanese domestic mobile phone brands in various market reports, including Sony, Kyocera, and FCNT (formerly Fujitsu Mobile Communications).

Japan's smartphone market in Q1 2023, Image/IDC

In IDC's report on Japan's smartphone market in Q1 2023, FCNT and Kyocera ranked third and fourth, respectively, behind Apple and Sharp. In Counterpoint Search's report, Sony even briefly tied with Sharp for second place in Japan in Q4 2023.

However, even so, Japanese brands such as Kyocera, FCNT, and Balmuda withdrew from the mobile phone market in May 2023:

Kyocera announced its exit from the consumer mobile phone market, with sales to end in March 2025, and a shift towards providing mobile phone products and services primarily to enterprises. FCNT, struggling financially, declared bankruptcy in the same month. Balmuda, a startup that had only launched one mobile phone model, also decided to end its mobile phone business.

FCNT phone models, Image/FCNT

By the time the full-year data for 2023 was released, the Japanese mobile phone market had been largely dominated by American, Korean, and Chinese brands.

Despite a 6% year-on-year decline in shipments, Apple continued to dominate half of the market, with a market share of 51.9%. Sharp, despite a 9% decline, managed to hold onto second place with a 10.9% share. Google saw an astonishing 527% growth, boosting its share by 10.7% and nearly catching up with Sharp. Samsung ranked fourth, while Lenovo and Kyocera, the only Japanese brand on the list, tied for fifth.

2024 poses an even greater challenge.

According to Canalys data, in Q2 2024, all Japanese brands were squeezed out of the top five, with Google and Xiaomi even teaming up to push Sharp to fourth place. It is foreseeable that the Japanese market will be carved up by overseas mobile phone brands, and even Sharp, now owned by Hon Hai, has limited time left.

On the other hand, the focus of the Japanese mobile phone market is shifting to Xiaomi and Google: How far can they go?

The long-planned rise of Xiaomi

In early December 2019, Xiaomi held its first press conference in Tokyo, Japan.

Press conference scene, Image/Xiaomi

Xiaomi's initial foray into Japan was cautious, with the launch of six products, including the Xiaomi Note 10 series, Xiaomi Mi Band 4, and Mijia IH Rice Cooker. The previous year, Xiaomi had also reached a global licensing agreement with Japan's largest mobile operator, NTT Docomo, laying the groundwork for Xiaomi phones to enter the Japanese market.

Xiaomi was likely aware that the Japanese market required a gradual approach. Coupled with the impact of the pandemic, Xiaomi's actions in the Japanese market were limited, with a focus on bringing more new products to the market and increasing Japanese consumers' awareness of the Xiaomi brand.

However, Xiaomi became more active in 2023. First, SoftBank announced the exclusive sale of the Xiaomi 12T Pro (a variant of the Redmi K50 Ultimate Edition). Then, Xiaomi opened its first Mi Home in Tokyo's Shibuya district, and product advertisements for Xiaomi also increased, particularly around the launch of the Xiaomi 13T/13T Pro (variants of the Redmi K60 Ultimate Edition) in the second half of the year.

Image/Xiaomi

As Wang Shihao, Xiaomi's General Manager for East Asia, told Nikkei, Xiaomi prefers to launch high-end models in Japan to expand its market presence. This includes bringing the Xiaomi 14 Ultra to the Japanese market just three months after its release.

Xiaomi's promotional efforts were also unprecedented. Twitter users reported seeing offline advertisements for the Xiaomi 14 Ultra in major Japanese cities like Tokyo and Osaka, and the company was expanding its distribution channels. Additionally, Xiaomi placed numerous online advertisements, and many YouTubers conducted tests and experiences focused on the camera features of the Xiaomi 14 Ultra.

These efforts contributed to the strong sales of the Xiaomi 14 Ultra, combined with shipments of models like the Xiaomi 13T/13T Pro through carriers and e-commerce platforms, leading to a surge in Xiaomi's shipments in Japan in Q2 2024.

Joining forces with Google to encircle Apple?

The era of Japanese domestic brands is largely over, but who will dominate the Japanese market? Before the rise of Google Pixel, Apple was the only answer, consistently occupying over 60% of the Japanese market and being the most popular phone brand among teenagers and young adults:

Comparable to Apple's dominance in the US market.

Image/Apple

While Apple still holds "half of the sky" in the Japanese mobile phone market, it cannot be denied that the rise of Google and Xiaomi is affecting the market landscape. In fact, Google and Xiaomi are the only two brands among the top five that are still growing (or even growing rapidly), and this growth is likely to continue based on product and channel factors.

Pixel has emphasized its AI advantage over the past few years, and this has led to a qualitative change in the Pixel 8/8 Pro generation. Xiaomi 14 Ultra's photographic leadership has also received universal recognition. In contrast, recent iPhone generations have seen only minor changes between iterations, leading even die-hard Apple fans to have limited motivation to upgrade.

Moreover, Apple has been slow to adopt large language models, with its latest Apple Intelligence still in a beta state.

Furthermore, while Apple's distribution channels are largely established, Xiaomi and Google have only seen significant results since 2023 and still have ample room for expansion.

However, it is important to note that there are still significant uncertainties surrounding Xiaomi and Google's ability to challenge Apple and capture a larger market share. Apple's brand loyalty and ecosystem advantages remain a formidable "moat."

The only certainty is that no kingdom lasts forever. Once dominant Japanese brands have fallen, withdrawn, or been marginalized. Even Apple must continuously adapt to new market demands and technological developments, or it too will be ousted from its throne by new forces like Xiaomi and Google.

Source: Leitech