July sales ranking of seven major domestic brands: BYD and Chery lead, Geely left Changan behind?

![]() 08/12 2024

08/12 2024

![]() 631

631

Recently, the China Passenger Car Association released national passenger car sales figures for July. In July, 1.72 million passenger cars were sold in the retail market, down 2.8% year-on-year. From January to July, 4.988 million passenger cars were sold.

Specifically, 0.84 million conventional fuel vehicles were sold in July, while 0.657 million were sold from January to July. For new energy vehicles, 0.878 million were sold in July, and 0.4988 million from January to July. Cumulatively, 11.556 million new energy vehicles have been sold this year, up 2.3% year-on-year.

As the “Big Seven” of China’s leading traditional automakers, how did they perform in July? Has the landscape changed? Let's take a look.

1. BYD

July sales: 340,800 units (passenger cars)

January-July sales: 1,955,000 units

In July, BYD sold 342,383 vehicles, up 30% year-on-year. From January to July, BYD sold a total of 1,955,366 vehicles, up approximately 29% year-on-year.

Specifically, BYD Dynasty and Ocean networks sold a combined 328,178 vehicles in July, up 31.3% year-on-year. DENZA sold 10,340 units, HiPhi sold 439 units, and FANGCHENGBAO sold 1,842 units. In terms of overseas exports, BYD shipped 30,014 vehicles, up 65% year-on-year.

Regarding exports, BYD exported 30,014 vehicles in July and 233,418 vehicles from January to July.

2. Chery Group

July sales: 196,000 units

January-July sales: 1,296,000 units

In July, Chery Group sold 195,759 vehicles, up 30.1% year-on-year. Among them, 90,281 vehicles were exported, up 16.8% year-on-year; 45,370 new energy vehicles were sold, up 254.5% year-on-year. From January to July, Chery sold a total of 1,296,380 vehicles, up 45.4% year-on-year.

Performance of the four main passenger car brands: Chery sold 123,123 vehicles in July, Star Track sold 14,443, JETOUR sold 41,106, and iCAR sold 6,065 vehicles.

In terms of exports, Chery exported a total of 622,439 vehicles from January to July, up 27.4% year-on-year. Among domestic automakers, Chery is one of the few that have not abandoned the conventional fuel vehicle market while expanding into the new energy vehicle market.

3. Geely

July sales: 150,700 units

January-July sales: 1,106,000 units

Geely announced that it sold 150,782 vehicles in July 2024, up 13% year-on-year. From January to July, cumulative sales reached 1,106,512 vehicles, up over 36% year-on-year. In July, 59,051 new energy vehicles were sold, up 58% year-on-year. From January to July, 379,236 new energy vehicles were sold, up 105% year-on-year. In July, 32,382 vehicles were exported, up 65% year-on-year. From January to July, 229,810 vehicles were exported, up 67% year-on-year.

Geely operates four sub-brands: Geely, Geely Galaxy, Lynk & Co, and ZEEKR. In July, Geely sold 113,855 vehicles, including 16,704 from the Geely Galaxy series; Lynk & Co sold 21,272 vehicles; and ZEEKR sold 15,655 vehicles.

In terms of overseas exports, Geely sold 20,482 vehicles in July. The two new models unveiled in Angola are expected to drive further growth for the company overseas.

4. Changan Automobile

July sales: 97,100 units (independent passenger cars)

January-July sales: 919,100 units

According to Changan Automobile, it sold 170,600 vehicles in July, down 17.86% year-on-year. Among them, 45,400 new energy vehicles were sold, up 14.94% year-on-year, accounting for 26.1% of total sales.

From January to July, Changan sold a total of 1,504,700 vehicles, including 1,260,500 independent brand vehicles, 919,100 independent passenger cars, and 344,500 independent brand new energy vehicles. Compared to its annual sales target of 2.8 million vehicles, Changan has achieved 53.74% of its sales target in the first seven months.

Currently, Changan has only disclosed specific information on its independent brand new energy vehicles. From January to July, Changan Qiyuan delivered 85,400 vehicles, exceeding 10,000 units for multiple consecutive months. SL03 delivered 100,600 vehicles. The new S07 model, equipped with the SL Super Extended Range and Huawei Kunpeng Intelligence, is expected to bring additional sales. AITO delivered 32,700 vehicles. In terms of exports, Changan exported 326,000 vehicles from January to July, up 57.9% year-on-year.

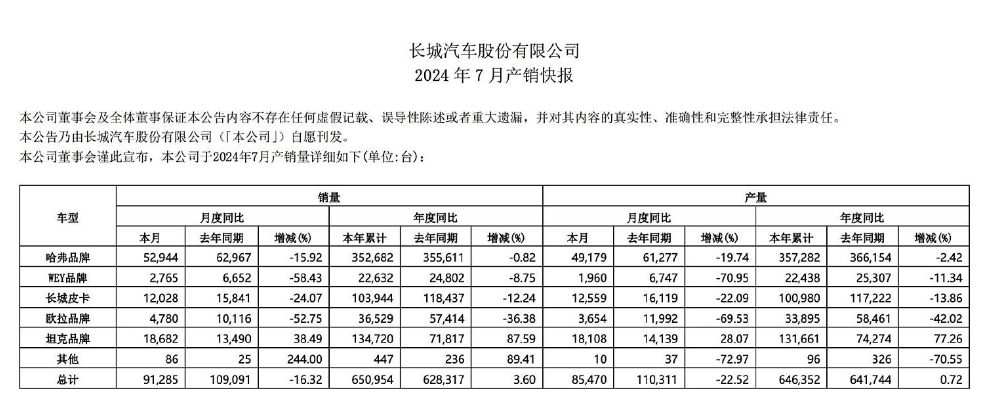

5. Great Wall Motor

July sales: 91,000 units (including commercial vehicles)

January-July sales: 650,000 units

Great Wall Motor sold a total of 91,285 vehicles in July, with cumulative sales of 650,954 vehicles from January to July. In the new energy vehicle segment, Great Wall sold 24,145 vehicles in July and 156,519 vehicles from January to July.

Specifically, Haval remains Great Wall's mainstay, selling 52,944 vehicles in July. WEY sold 2,765 vehicles, Great Wall Pickup sold 12,028 vehicles, and ORA sold 4,780 vehicles. In contrast, Tank performed well, selling 18,682 vehicles in July.

Although domestic sales have been sluggish, Great Wall's overseas sales have been increasing month by month. In July, Great Wall exported 38,185 vehicles, and cumulative overseas sales reached 239,685 vehicles in the first seven months of the year.

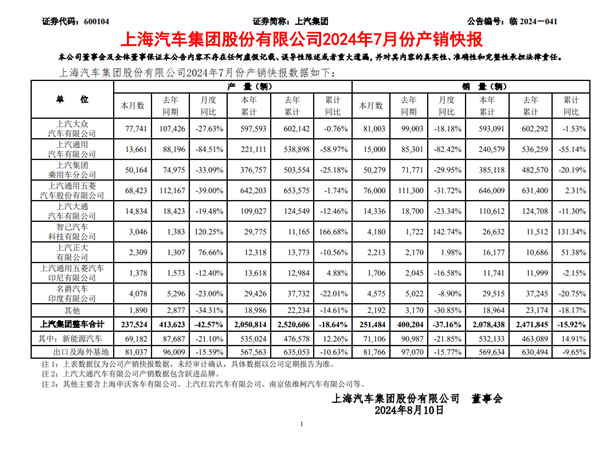

6. SAIC Passenger Vehicles

July sales: 59,000 units

January-July sales: 441,000 units

SAIC Motor announced that it sold 251,484 vehicles in July 2024, down 37.16% year-on-year. Among them, SAIC Passenger Vehicles sold 50,279 vehicles, down 29.95% year-on-year; IM Motors sold 4,180 vehicles; and MG Motor India sold 4,575 vehicles.

Currently, SAIC Passenger Vehicles operates three major brands: Roewe, MG, and Feifan. Roewe has launched the D series, which can run on both gasoline and electricity. MG focuses on the overseas market, while the future of Feifan remains uncertain. IM Motors, which focuses on the premium market, currently offers four models: IM L7, IM LS7, IM LS6, and IM L6.

7. GAC Group

July sales: 54,000 units

January-July sales: 369,000 units

GAC Group released its July sales report, showing a total of 141,196 vehicles sold in July, down 25.37% year-on-year. From January to July, cumulative sales reached 1,004,234 vehicles, down 25.83% year-on-year. Among them, GAC Aion and Trumpchi, the independent brands, sold 28,287 and 25,797 vehicles in July, respectively.

Affected by the “price war,” GAC Group has seen declining sales, facing significant pressure ahead. In particular, its once-proud new energy vehicle segment has become a drag. It appears challenging for GAC to rely solely on new energy vehicles to achieve a breakthrough.

Closing Remarks

In 2024, the domestic auto market will undergo further consolidation. Currently, the rankings of the top seven domestic brands remain relatively stable: BYD firmly holds the top spot, while Geely closely follows Chery for second place.

Clearly, competition in the domestic auto market will continue to intensify. Overseas exports and new energy vehicles remain growth areas, with many domestic brands seeking transformation and renewed momentum. 2024 may mark a turning point. Let's wait and see how the domestic auto market unfolds this year. Stay tuned to “CarDomain Unlimited” and share your thoughts in the comments below!