Wei Jianjun can't stand BYD

![]() 08/12 2024

08/12 2024

![]() 566

566

"If the government needs it, we can conduct an audit of the entire automobile industry, starting with Great Wall Motors, and Great Wall Motors will cover the audit fees."

On August 7, Wei Jianjun, Chairman of Great Wall Motors, unleashed a ripple effect in the automotive industry with his words. In a promotional video, he expressed his dissatisfaction with the current state of the industry, including "dirty tricks," "sales rankings," and "price wars," stating that "things have gotten a bit messy in the industry's development so far."

Between the lines, one can't help but think of the controversy between Great Wall Motors and BYD. Great Wall Motors has accused BYD of issues with its high-pressure fuel tank and has also engaged in heated debates with them online.

When Wei Jianjun created the sales miracle of the Harvard H6 in 2013, BYD had not yet grown into its current stature, and no one could have imagined that a decade later, Great Wall Motors would need to look up to BYD.

It's clear that after 34 years of ups and downs, Wei Jianjun has a deep love for the automotive industry. However, the outside world may not necessarily share his passion, as Great Wall Motors has lost some of its luster from past achievements.

"What value is there in just ranking sales?" Wei Jianjun asked. Some view this attitude as adhering to principles and staying true to oneself, while others criticize it as an excuse to avoid the real issues.

Regardless, the problems in the industry are objectively present, and it is a fact that Great Wall Motors has fallen behind in the new energy era. How to move forward steadily is a topic worth exploring.

01

Who can't Wei Jianjun stand?

"Playing fake cards, cheating, can Chinese enterprises still progress?"

Wei Jianjun's criticism of the automotive industry can be described as "loving deeply, scolding severely." In fact, he has long been dissatisfied with the current state of affairs.

He mentioned that the "fuel tank incident is no less impactful than Volkswagen's emissions scandal," believing that it not only affects the automotive industry but also harms the country's international image. He then declared, "I must be the defender who upholds order and justice."

△Source: Sina Finance interview with Wei Jianjun, video screenshot

He says what he means and means what he says.

In April 2023, Great Wall Motors discovered that some of BYD's hybrid models used atmospheric pressure fuel tank systems that did not fully comply with national evaporative emissions standards. Consequently, they publicly accused BYD. At that time, BYD circumvented the emissions issue through technical means and later quietly switched its models to high-pressure fuel tanks.

Great Wall Motors and BYD, a pair of "rivals," have had multiple "love-hate" relationships.

Initially, BYD transferred the "Wei" trademark to Great Wall Motors, and Great Wall Motors reciprocated by transferring other registered trademarks to BYD. The prevailing sentiment at the time was that "both parties will work together to achieve common progress for Chinese brands." However, there have since been multiple conflicts and heated debates.

Earlier this year, when BYD Chairman Wang Chuanfu called on Chinese automakers to "stick together," other friendly competitors eagerly supported him, but Great Wall Motors executives broke the harmonious atmosphere by saying, "This is just sugarcoated words with hidden malice. It's better to have a fight first."

In June, during the launch of the new Harvard H6, Great Wall Motors began with a 20-minute "rant" about the industry's "price wars" before even introducing the car, using terms like "cheating" and "overturning the table" to describe the situation. It was clear to outsiders who the criticism was aimed at.

In July of this year, BYD once again paid tribute to Great Wall Motors' SUV achievements during its Song twins launch event, stating that "Great Wall Motors accomplished this feat single-handedly." However, Great Wall Motors was not receptive, with Vice President Liu Xiangshang responding sarcastically on Weibo, saying, "I'm embarrassed to accept such praise," implicitly criticizing BYD and emphasizing, "It should always be industry self-discipline that safeguards the Great Wall of Chinese automobiles."

It's understandable why Great Wall Motors might not be receptive to BYD's gestures – they feel like they've been ambushed in their own backyard.

In the first half of this year, BYD's Song PLUS, Song Pro, and Yuan PLUS occupied the top three spots in SUV sales rankings, with a combined sales volume exceeding 410,000 units. Meanwhile, the once-legendary Harvard H6 fell to 15th place with sales of only 70,000 units.

Currently, the strongest "fortress" of Great Wall Motors is the off-road market, where its Tank brand dominates. However, BYD has recently launched a fierce attack with its Equation Beast brand, which is targeted directly at Great Wall Motors' Tank models.

"Equation Beast 5," equipped with a non-load-bearing body, is capable of tackling off-road scenarios while also offering the advantage of low fuel consumption for urban driving. From its positioning as a "good partner for urban travel," it's clear that Equation Beast also aims to capture the daily SUV market.

While Great Wall Motors' Tank has traditionally been the off-road king in China, BYD is a newcomer to the challenge. However, in terms of sales, Equation Beast has already posed a significant threat to Tank.

In terms of pricing, Equation Beast 5 competes directly with Tank 400 Hi4-T and Tank 500 Hi4-T. In the first half of this year, the three models delivered 18,283, 19,515, and 20,248 units domestically, respectively, showing that they are neck and neck in the market.

The Tank's secret weapons for domination have always been its cost-effectiveness and integration of intelligence and new energy technologies into its off-road models, enabling it to differentiate itself from competitors. However, these advantages have gradually been weakened under BYD's direct price cut of 50,000 yuan.

Industry insiders have revealed that the popularity of Equation Beast 5 after the price reduction has surpassed its initial launch period.

The rivalry between Great Wall Motors and BYD is only set to intensify as they engage in close combat.

02

Slow to Adapt to New Energy

Wei Jianjun is particularly critical of the "price wars" that prioritize sales volumes above all else. He has repeatedly stated publicly that Great Wall Motors does not wish to participate in price wars and will adhere to a bottom-line mindset and long-term perspective, pursuing "quality market share."

He criticizes, "Why don't you rank quality? Publicly state consumer reputation rankings and corporate favorability rankings. What value is there in just ranking sales?"

This criticism again falls on BYD. In terms of sales, BYD is number one, and it also leads the price wars, especially in the price range below 200,000 yuan, where it holds significant influence.

BYD's dominance in price wars has been certified by Yu Chengdong, Chairman of Huawei's Intelligent Automotive Solutions BU: "In smart electric connected vehicles, BYD is the world's number one competitor due to its ultra-low-cost capabilities."

Great Wall Motors also has advantages in ultra-low costs. Wei Jianjun introduced Toyota's lean production methods early on to improve production efficiency, reduce costs, and establish a vertically integrated supply chain system. He notes, "If Great Wall Motors can't make money, no one else can either."

In the first half of 2024, Great Wall Motors expects to achieve a net profit of 6.5 to 7.3 billion yuan, an increase of 377.49% to 436.26% year-on-year. Such profit margins are envied by competitors struggling with losses.

While adhering to its principles and avoiding price wars has allowed Great Wall Motors to earn money honorably, the pressure of low sales volumes continues to loom over the company.

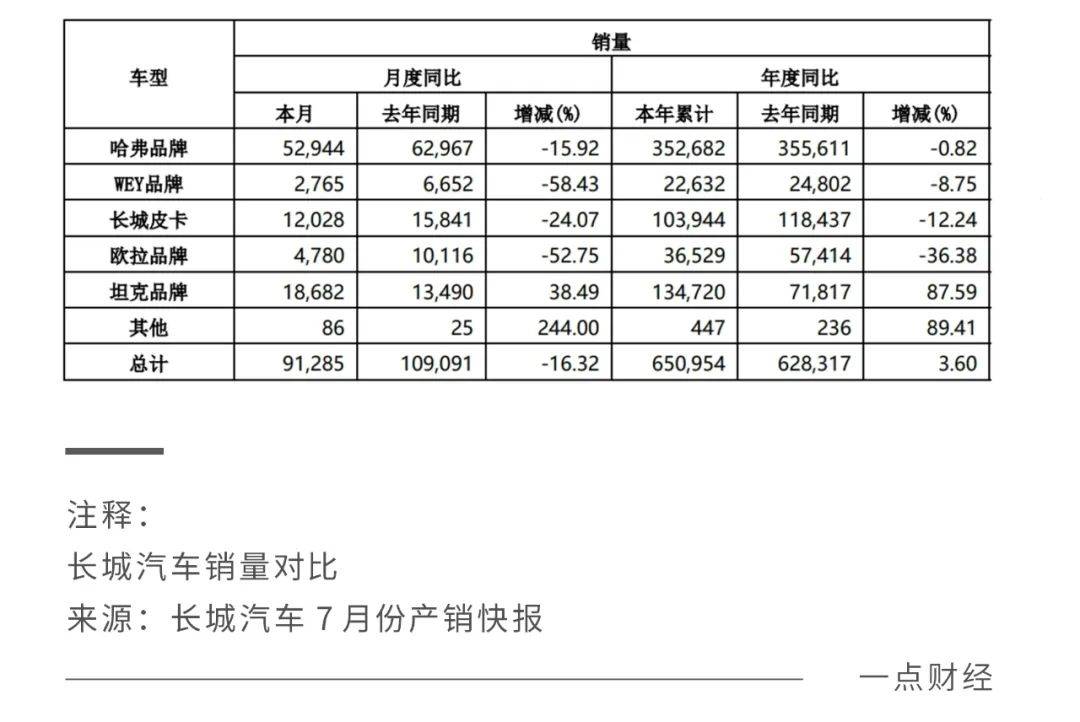

From January to July this year, Great Wall Motors sold approximately 651,000 vehicles, achieving 34% of its 2024 sales target of 1.9 million vehicles. In July, except for the Tank brand, which saw a year-on-year increase in monthly sales, Harvard, WEY, Ora, and Great Wall Pickup all experienced year-on-year declines in monthly sales. WEY, which focuses on the high-end market, saw a 58.43% year-on-year decrease.

The legendary Harvard H6 once held the sales champion title for 103 consecutive months, with global sales exceeding 4 million units, making Great Wall Motors the leader in domestic SUVs. However, the turning point came in 2022, when sales declined by 16.7%. Although sales rebounded slightly in 2023, they still fell short of 2021's 1.28 million units by 50,000.

In the first half of this year, Great Wall Motors no longer appeared in the top 10 domestic SUV sales rankings.

In response to outside criticism, Wei Jianjun once defended his company, saying, "Great Wall Motors' products are actually very capable, but the current problem is that we are not very good at selling cars, especially high-end ones." In other words, our products are strong, but we disdain marketing.

However, is poor marketing the only reason Great Wall Motors has fallen from grace? Probably not.

Let's rewind to the turning point. In March 2021, BYD launched its first DM-i super hybrid model, the Song PLUS DM-i. Within a year, its sales surpassed those of the Harvard H6, and the gap between the two has continued to widen since then.

Looking back, this seems to mark the transition between the old and new energy eras. While BYD bet big on new energy, Great Wall Motors appeared to be resting on its laurels.

Great Wall Motors' lemon hybrid DHT technology was not initially implemented in the iconic Harvard H6 but instead given to the WEY brand, failing to quickly ramp up production and missing market opportunities. This strategy runs counter to BYD's approach of popularizing new energy vehicles.

In recent years, Great Wall Motors has faced criticism for its confusing model naming, positioning deviations, unstable product systems, and the cancellation of small hit models due to lack of profitability. Such criticisms reflect a sense of disappointment and urgency for the company to improve.

Great Wall Motors has reached a critical juncture where it must break through to achieve new heights.

03

Surviving the Next Year

At the end of Great Wall Motors' 30th-anniversary documentary, Wei Jianjun asked the camera with a firm gaze, "Can Great Wall Motors survive the next year?"

Given Great Wall Motors' profitability, there is naturally no need for short-term concern. However, buildings do not collapse overnight; cracks deserve attention.

Wei Jianjun has internally reflected that Great Wall Motors has become too complacent in niche markets, always content with "small comforts." Li Ruifeng, CGO of Great Wall Motors, has also reflected that the company has enjoyed the benefits of market growth but has lost the drive for reform and innovation.

In other words, the achievements of the past 30 years have now become a burden, as the company has become trapped in a path dependency, less sensitive to changes in the new situation and slower to adapt, leading to its lag in the new energy vehicle era.

As the saying goes, "One knows best whether the water is hot or cold when one drinks it oneself." The confidence of Great Wall Motors' internal staff has gradually eroded. Talented individuals recruited by Wei Jianjun, such as Shan Hongyan, Liu Zhifeng, and Ning Shuyong, have left the company within a few years. In 2022, Wang Fengying, a long-time external-facing executive at Great Wall Motors, also left to join XPeng after departing the company.

Facing internal and external challenges, Wei Jianjun can no longer sit idly by. The usually low-key and pragmatic Wei Jianjun has personally taken charge, striving to keep up with marketing trends.

During an internal meeting, Wei Jianjun harshly criticized the marketing efforts of the Harvard H6: "They don't understand marketing at all, lack a user mindset, and have no idea what users are concerned about."

In today's era of online traffic, even the finest wine fears being hidden in a remote alley. Inspired by Lei Jun's success in the automotive industry, traditional automakers' CEOs such as Li Shufu and Yin Tongyue have emerged from behind the scenes to do live streams, post short videos, and promote their products.

In terms of learning marketing, Wei Jianjun has shown strong action and humbly learned from Lei Jun by reactivating his 13-year-old Weibo account for intense live streaming. He aims to become a "quality internet celebrity" and set an example for senior executives by encouraging them to actively engage in marketing.

△Wei Jianjun (left) and Lei Jun (right) exchanging ideas at the Beijing Auto Show. Source: Great Wall Motors Official Weibo

Lei Jun live-streamed tests of intelligent driving, introduced the company's internal workings, and interacted with industry bloggers. Wei Jianjun quickly replicated these practices, despite not being particularly eloquent. He has attended multiple press conferences and brand events, emphasizing the importance of truly listening to consumer needs and understanding the market.

In addition to strengthening promotion, Great Wall Motors has also promoted direct sales and adopted a dual-sales model to get closer to consumers and address the issue of "not knowing how to sell high-end cars." Recently, it has undergone several rounds of organizational adjustments, establishing a 3.0 marketing organization model with a "small front desk, medium-sized middle desk, and strong back desk." In the future, the direct sales model is expected to play a key role in customer acquisition for Great Wall Motors.

However, Great Wall Motors currently lacks a true blockbuster hit, and optimizing the marketing system alone is not enough. To return to its former glory, there is still much work to be done.

04

Conclusion

Although Wei Jianjun has pointed out some of the current issues in the automotive industry, changing them is not up to him alone. As the saying goes, "When in Rome, do as the Romans do." If one does not participate in the competition, they will be left behind.

As Lei Jun once said, "Price wars are just a tactic. The real battles should be fought on products, technology, and ecosystems." Great Wall Motors has also fallen short in these areas.

The entire industry has entered an elimination round, and the warning of "whether it can survive the next year" still hangs over Great Wall Motors. This year, Great Wall Motors has undergone greater changes than ever before. What kind of answer it can provide next year is worth waiting to see.