Never has HiPhi been saved by the court

![]() 08/12 2024

08/12 2024

![]() 490

490

To outsiders, HiPhi is no different from being bankrupt.

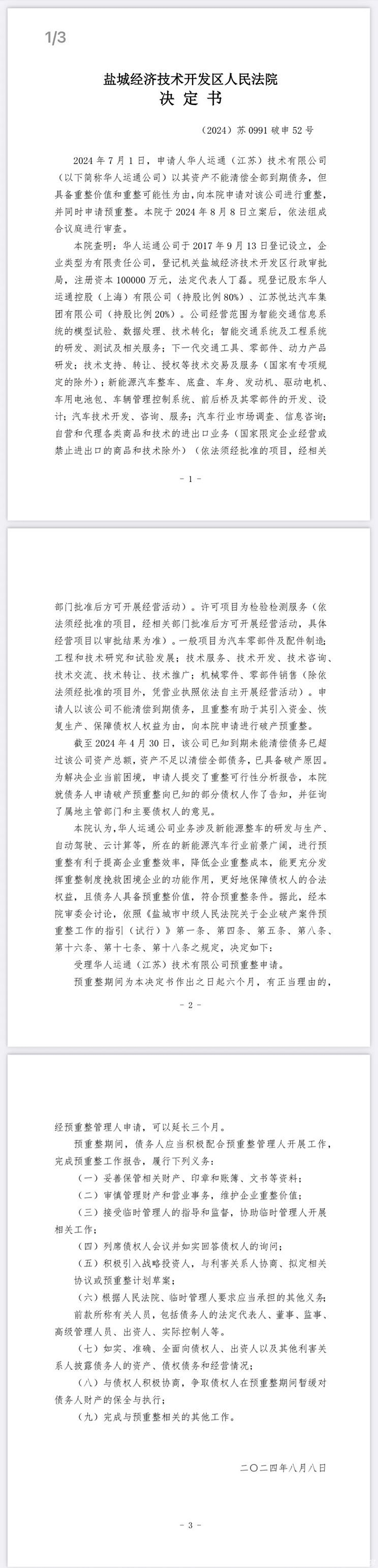

On August 8, a public document released by the Economic and Technological Development Zone People's Court in Yancheng City showed that Human Horizons (Jiangsu) Technology Co., Ltd., the parent company of HiPhi, had filed a pre-reorganization application that was accepted by the court.

After a long period of silence, HiPhi finally saw an opportunity for change. However, to outsiders, HiPhi's current situation is no different from bankruptcy. Nevertheless, they are still trying to struggle.

HiPhi stated that there were serious issues with some self-media and media reports currently circulating online.

"HiPhi has officially entered judicial pre-reorganization. The pre-reorganization system allows the enterprise undergoing reorganization to maintain control over its management, leveraging the shared interests of all stakeholders to negotiate and autonomously reach agreements under legal protection, helping troubled enterprises find more effective 'rebirth' solutions through self-rescue as soon as possible."

In fact, since February 18th of this year, when HiPhi announced a six-month production halt, Ding Lei subsequently told employees that HiPhi had only a three-month window of opportunity for rebirth. He vowed to try his best to save the company, and even if he failed, "at least we tried our best."

As the founder of the company, Ding Lei has a clear understanding of the timeline. Three months is indeed the critical window for HiPhi. Without securing investment within this period, HiPhi's prospects would be grim.

Half a year has passed, and only now, under the instruction of the local government, has HiPhi been approved for pre-reorganization. If there were truly investors interested, three months would have been ample time for negotiations, rendering the current situation unnecessary.

Despite HiPhi's continued resistance and verbal sparring with netizens at this point, it is more out of desperation than anything else. It seems that HiPhi can only resort to such verbal battles at present. Even more distressing is that, despite the differences between pre-reorganization, bankruptcy reorganization, and bankruptcy liquidation, to outsiders, HiPhi is no different from being bankrupt.

Is there any value in saving HiPhi?

Some industry analysts believe that the fact that HiPhi has reached the stage of judicial pre-reorganization indicates that the company still has some value.

The Yancheng Economic and Technological Development Zone Court also stated in its decision that "Human Horizons' business involves the research and development and production of new energy vehicles, autonomous driving, cloud computing, etc. The new energy automobile industry has broad prospects, and pre-reorganization will help improve the efficiency of corporate reorganization and reduce costs."

In fact, as long as a company does not deceive or confront the government like Sailun did, large automotive companies can generally receive support from local governments. After all, local state-owned assets also have equity stakes. It would be ideal if the company could be saved, pleasing everyone. Even if the efforts prove futile, it would merely waste some procedural matters, having little impact on the court.

Amidst the ongoing "bankruptcy storm," car owners online have initiated short video topics, showcasing HiPhi's fancy features to emphasize, "What a great car! How could it go bankrupt?"

Perhaps HiPhi's current embarrassing situation stems from blind confidence in its products.

In the automotive industry, especially for new automotive forces, financing capability is crucial in addition to product strength. Lixiang One has completed nine rounds of financing since its inception, raising over RMB 12 billion in total. XPeng and NIO continue to secure external funding even after going public.

"Over the years, not a single new automotive force that has falsified or exaggerated their funding amounts remains. They have all vanished. Some who attempted to resurrect their companies under different names ultimately failed. The investors who colluded in the falsification of numbers also generally performed poorly in recent years due to shared values."

Li Xiang once tweeted, "NIO, XPeng, and Lixiang One have never falsified their financing figures. The three founders are among the few who have invested billions of their own money. Those who falsify numbers typically don't invest a dime of their own and instead register numerous related companies to embezzle funds."

HiPhi once had several opportunities to secure funding, but Ding Lei, unwilling to relinquish equity, turned them all down. In his view, good products would inevitably attract money. However, market changes are often unpredictable, and in recent years of economic downturn, even wealthy landlords have run out of resources.

Currently, HiPhi's official WeChat account still displays New Year greetings from earlier this year. There have been rumors of potential buyers, including Chang'an Automobile, AVATR, and FAW Group, but these have either been denied or remain unconfirmed.

Fundamentally, HiPhi may have some product highlights here and there, but these are easily replicable simple technologies that merely increase manufacturing costs. From an investor's perspective, there are few aspects of HiPhi that truly warrant substantial investments.

Even the production qualifications that automakers value most are lacking in HiPhi. In fact, HiPhi relies on the Yancheng government to broker deals with Yueda Kia's factory for production. Although there are some crossovers at the equity level, HiPhi essentially remains an unqualified manufacturer, requiring Yueda Kia's logo on its vehicles.

What remains valuable for HiPhi are perhaps its product design drawings and land and real estate resources. However, in the eyes of investors, HiPhi is burdened with liabilities such as employee salaries, supplier debts, and various commercial loans.

Furthermore, in the current market environment, tightening monetary policy and holding onto cash is a consensus among investors. Even Warren Buffett is selling stocks. Who can be expected to invest in industries?

A drop in the bucket

According to Tianyancha, Ding Lei, the founder and legal representative of HiPhi, is currently associated with five consumer restriction notices totaling approximately RMB 185,200 and has been listed as a dishonest person subject to enforcement.

The fact that Ding Lei cannot even afford RMB 200,000 sends a clear message to the outside world: HiPhi is in deep trouble.

While HiPhi faces financial difficulties and market challenges, the company has also suffered another blow from within the industry. Jia Yueting, the founder of Faraday Future (FF), publicly accused HiPhi and its founder Ding Lei in March of stealing FF's intellectual property and technical data.

Jia Yueting alleged that while serving at FF, Ding Lei, the founder of HiPhi, abused his position to steal FF's trade secrets and continued this behavior after leaving the company to join HiPhi.

This accusation not only caused a sensation in the industry but also cast a shadow over HiPhi's brand image. Objectively speaking, there are indeed some similarities between HiPhi and FF91 in terms of vehicle appearance.

While Jia Yueting's accusations may not cause substantial harm to HiPhi, they pose a significant legal risk for external investors, potentially deterring them. This blow at a time when HiPhi needs money the most has hit its Achilles' heel, leaving it tarnished and unapproachable.

In mid-May, overseas sources reported that HiPhi's parent company, Human Horizons, and the automotive investment consulting platform iAuto signed a comprehensive strategic cooperation agreement in Hong Kong on May 10. The scope of cooperation includes but is not limited to production collaboration for completed sales orders, equity mergers and acquisitions, technological cooperation, brand and international sales connections, as well as supply chain and manufacturing-related integrations.

Furthermore, a reorganization working group was established, with Jack Yeung, co-founder and CEO of investor iAuto, serving as one of the leaders. He will work with Ding Lei, the founder of HiPhi, to formulate overall strategic plans, budgets, and compensation systems. It is speculated that Jack Yeung is related to Yeung Yung, the actual controller of iAuto.

With the guarantee of relevant investment institutions, iAuto plans to invest USD 1 billion as the first-round turnaround fund for Human Horizons' reorganization. The goal is to complete the transaction before the release of the 2024 first-half financial report.

Judging from the current situation, this investment plan has fallen through, which explains why HiPhi has resorted to judicial pre-reorganization.

According to the court's decision, as of April 30, 2024, the company's known matured debts that have not been repaid exceeded its total assets, indicating that its assets were insufficient to cover all liabilities, fulfilling the criteria for bankruptcy. This may have been what Ding Lei meant when he mentioned the three-month window earlier.

However, after filing for pre-reorganization, HiPhi has a six-month preparation period, which can be extended by an additional three months. This means that HiPhi has at least nine months, or 300 days, to make a comeback.

Unless HiPhi can significantly open up its corporate control and continuously secure external financing or even go public, like NIO, XPeng, and Lixiang One, the current rounds of reorganization and investment will merely be a drop in the bucket.

Note: Some images are sourced from the internet. If there is any infringement, please contact us for removal.