Entering the government procurement lists of multiple regions, has Tesla paved the way for multiple businesses?

![]() 08/12 2024

08/12 2024

![]() 465

465

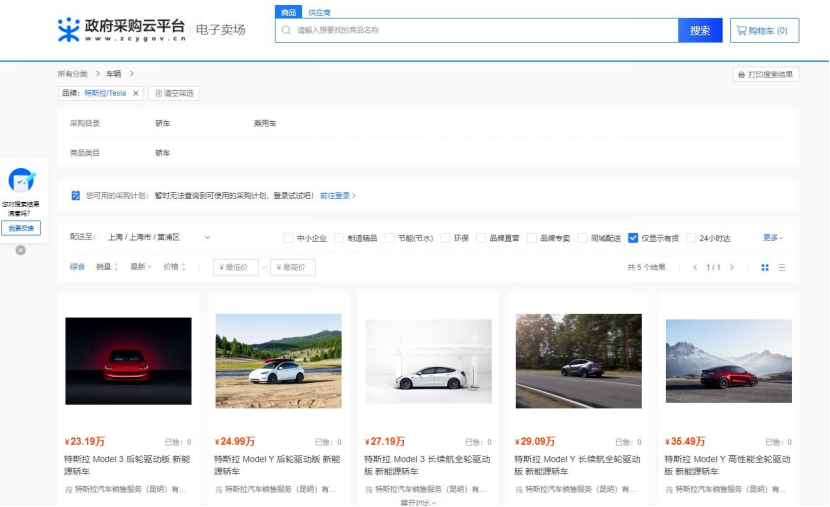

The list of local governments that have included Tesla in their procurement lists is growing.

On July 4th, Tesla's Model Y was included in the Jiangsu Provincial Government's vehicle procurement list for the first time. Following this, several state-owned enterprises such as Shanghai Chengtou Xinggang Group and Lingang Investment Holding Group also purchased a batch of Tesla Model Y vehicles for corporate functions. Subsequently, provinces such as Yunnan and Jilin also included Tesla models in their government vehicle procurement lists.

Regarding this, CCTV News commented on July 25th, "This move provides a strong guarantee for promoting Tesla products into various sectors nationwide."

Entering the government procurement lists of multiple regions indicates that Tesla has met the domestic security requirement of 'not exporting data,' which paves the way for Tesla's FSD (Full Self-Driving) technology to enter China in the future.

▍Data Security 'Already Compliant'

Tesla's inclusion in the procurement lists of local governments and state-owned enterprises helps transform some stereotypes about Tesla among consumers and addresses the concerns of some customers.

Previously, Tesla faced issues related to data security. It is also a fact that Tesla models struggled to gain access to some venues in China.

To alleviate concerns, Tesla established the Tesla Shanghai Data Center in 2021 to achieve localized data storage. Additionally, Tesla engaged third-party authorities to audit its information security management system and obtained ISO 27001 certification. Tesla has also publicly stated that it will continue to establish more local data centers to ensure that all data generated by vehicles sold in mainland China is stored domestically.

In April this year, the China Association of Automobile Manufacturers announced that all models produced at Tesla's Shanghai Gigafactory fully comply with the four compliance requirements for automotive data security. This report serves as evidence of Tesla's compliance with data processing security.

Tesla has also stated that its compliance with automotive data security aligns with China's relevant requirements, which will significantly benefit government agencies, airports, highways, and other entities that previously restricted Tesla. This clears the way for Tesla's development in the Chinese market.

Public information worldwide reveals that multiple countries and regions' government departments have begun using Model Y and Model 3 for various official purposes, such as police cars, fire trucks, medical service vehicles, and security patrol vehicles.

▍FSD/Car Insurance May Become 'Unhindered'

Notably, in April this year, when Tesla CEO Elon Musk visited China at a rapid pace, it coincided with the China Association of Automobile Manufacturers' announcement on automotive data security. During this crucial juncture, insiders suggested that Musk would promote the launch of Tesla's FSD system in China.

Since the beginning of the year, Tesla has repeatedly announced that FSD will soon enter the Chinese market, and the domestic market has maintained a positive attitude towards this development. During Tesla's Q2 earnings call in July, Musk reiterated that FSD would arrive in China, Europe, and other countries by the end of the year, likely in version V12.5 or 12.6.

Tesla has yet to announce a specific timeline for FSD's entry into China, and the official launch date remains to be announced. However, industry insiders believe that Tesla's FSD entering China is a foregone conclusion, with only the timing left to be determined. Nevertheless, Tesla's inclusion in multiple government procurement lists has, to some extent, cleared obstacles for FSD's entry into the Chinese market.

Regarding the technology's safety performance, Tesla's Q2 2024 Vehicle Safety Report states that, thanks to the safety provided by its Autopilot driver assistance system and FSD full self-driving suite, for every 1.08 million miles driven in the US under normal conditions, there is one accident, while for Tesla vehicles with Autopilot enabled, there is one accident for every 11.07 million miles driven.

Meanwhile, Tesla has once again ventured into the insurance industry in China, aiming to promote its in-house insurance products. On July 30th, Tesla Insurance Brokerage (China) Co., Ltd. was officially registered with a registered capital of 50 million yuan, specializing in insurance brokerage services.

This is Tesla's second attempt to register an insurance company in China. In mid-2020, Tesla registered an insurance company domestically, but due to various policy and regulatory restrictions, the insurance brokerage license was not approved for a long time, and the company was deregistered in April this year.

It is undeniable that new energy vehicle insurance is a crucial part of the automaker's ecosystem. During the reform of new energy vehicle insurance, Tesla sparked industry discussions and consumer dissatisfaction due to significantly increased premiums. Tesla's latest move in the insurance sector has garnered significant market attention.

Elon Musk has stated that Tesla aims to offer cheaper, better, and even 'revolutionary' insurance services. Currently, Tesla's UBI (Usage Based Insurance) is already operational in multiple US states.

It's important to note that Tesla's newly established entity is still an insurance brokerage. While brokerages do not have the qualification to develop insurance products, they can collaborate with insurance companies to tailor exclusive insurance products for consumers based on their needs and relevant business scenarios.

Industry insiders in the auto insurance sector believe that this brokerage business may only be the beginning of Tesla's insurance layout in China. In the future, Tesla may pursue a more valuable property insurance license to leverage its experience and advantages in the UBI insurance field.

Additionally, it's worth mentioning that domestic auto brand BYD has pioneered vehicle property insurance and received positive feedback, potentially pointing Tesla towards a suitable insurance path for the Chinese market.

After meeting data security compliance requirements, Tesla is gradually opening up the TO G market, which will also benefit FSD as it enters its countdown phase for launch. Furthermore, with its entry into the insurance industry, the premium pain point that concerns consumers the most may also be addressed. These developments bode well for Tesla's growth in the Chinese market. Prior to this, Tesla's Model Y has repeatedly topped the sales charts for new energy passenger vehicles in the domestic market, according to data from the China Passenger Car Association.

Typesetting by Yang Shuo | Image Sources: Shutterstock, Shanghai Government Procurement Platform, Tesla