Focus Media: Jumping from Pessimism, Real Boom or False Rebound?

![]() 08/12 2024

08/12 2024

![]() 506

506

Hello everyone, this is Dolphin Capital! Focus Media released its 2024 half-year report on August 8th, Beijing time. Since the first quarter's results are already known, I will focus on the marginal changes reflected in Q2.

Core Financial Report Highlights:

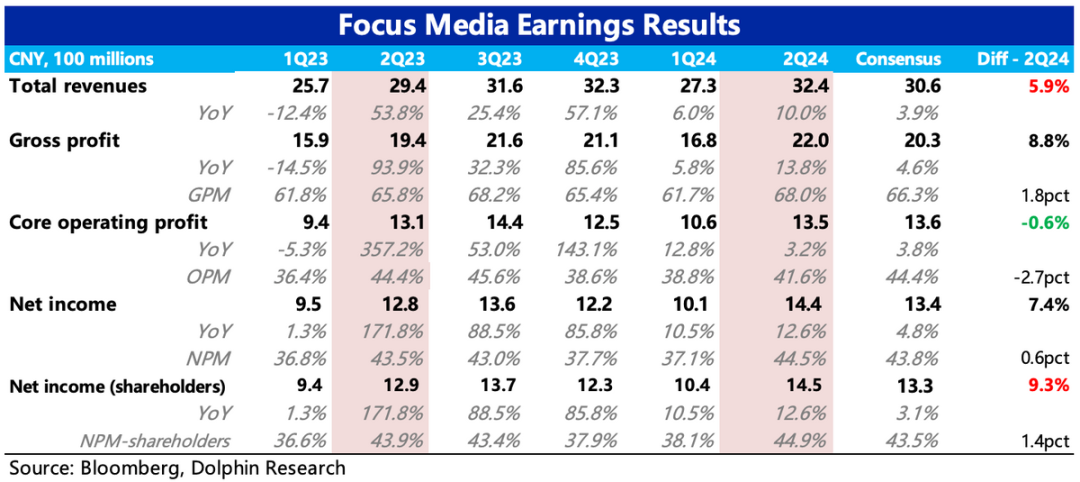

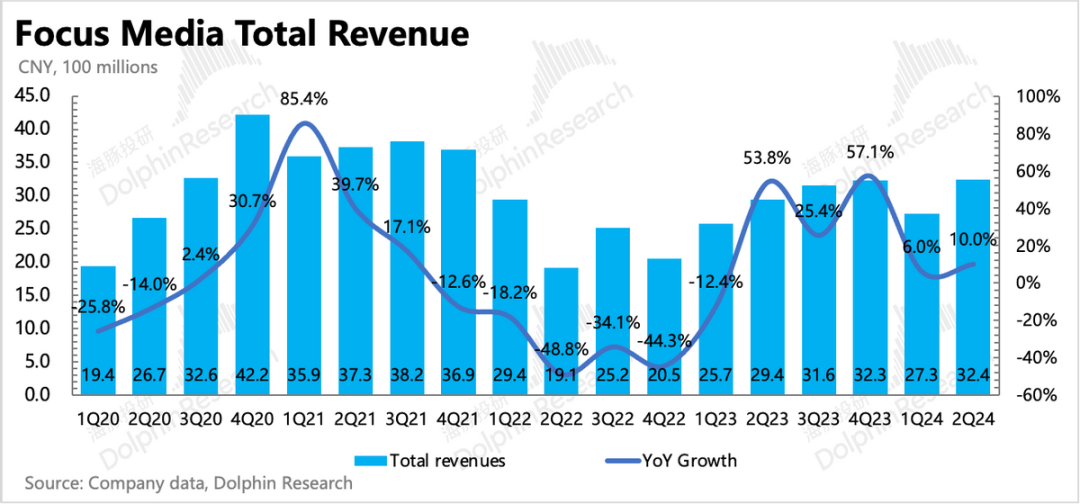

1. Revenue Significantly Exceeded Expectations? The Market Was Overly Pessimistic: Q2 revenue for Focus Media grew by 10%, significantly exceeding market expectations of 4% and also exceeding Dolphin Capital's expectations of 5%-10% growth. The low market expectations stemmed from the low base effect in Q1, where year-over-year growth was only 6%. This made it difficult for the market to have normal or optimistic expectations for Q2, which had a higher base and worse macroeconomic data. In fact, if we look solely at the Q2 growth rate, it basically aligns with the normal trend of a 10% price increase at the beginning of the year, which does not necessarily mean the macroeconomic environment is much better than we thought. As Dolphin Capital mentioned in the Q1 review, the current environment is complex, with price increases, the Olympics, and continued e-commerce competition providing relative benefits this year, so we cannot be overly pessimistic. Similarly, we should not be overly optimistic about the current macroeconomic environment just because Q2 results exceeded expectations. From indicators reflecting client payment schedules, the current macroeconomic pressure is objectively present.

2. Changes in Advertising Strategies Led to Greater Expectation Gaps: However, this is not entirely a mindless linear extrapolation by the market. Estimating based on seasonal variations from previous years also fails to reach the actual income level. The real reason lies in changes in advertisers' advertising strategies. Facing consumers with tighter budgets, businesses are now focusing more on aligning their advertising strategies with e-commerce festivals, while opting for a more cautious approach during usual shopping off-seasons. For advertising platforms like Focus Media, this tends to exhibit seasonal characteristics of "peak seasons getting peakier and off-seasons getting quieter." February to May are generally off-seasons, but this year's 618 shopping festival started earlier and ended later, extending the promotional period, making May and June peak marketing periods for businesses. Since most resources were allocated to 618, March and April were quieter than usual. Consequently, Focus Media's Q1 and Q2 revenues, regardless of base effects and macroeconomic changes, showed an "against-the-trend" shift with unusually low Q1 growth and a rebound in Q2 growth.

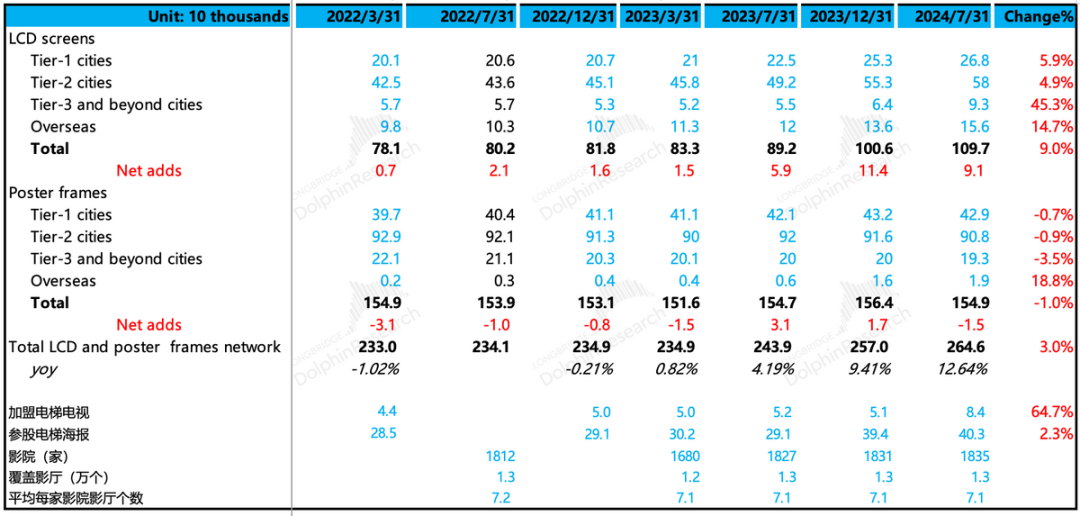

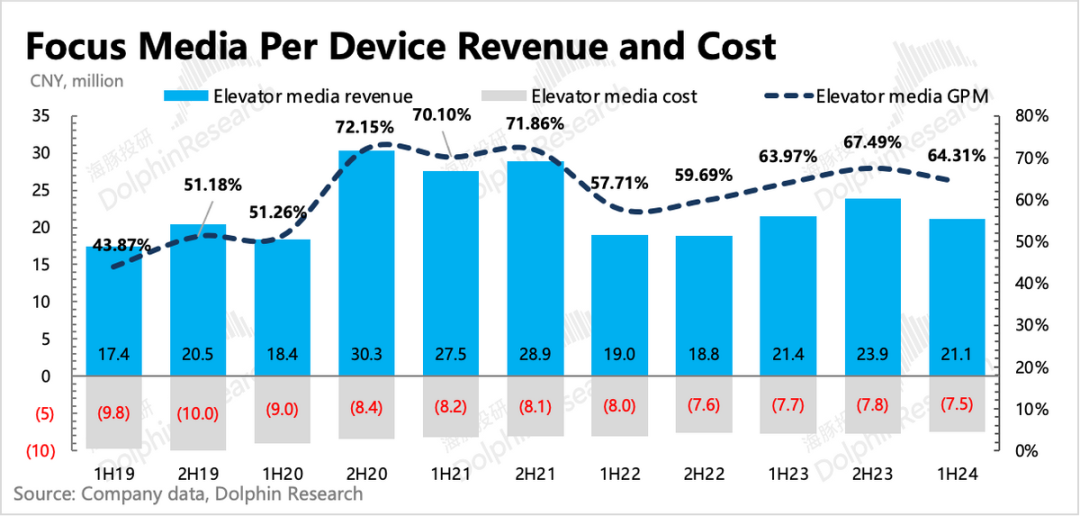

3. Accelerated Expansion into Lower-tier Cities, with Further Optimization of Average Cost per Location: Since last year, Focus Media's media locations have continued to expand. In the first half of this year, the number of elevator LCD screens continued to increase net, with second- and third-tier cities being the focus of this round of expansion. These are areas where Focus Media is relatively weaker, so expanding into these locations fills a gap in line with the broader trend of "consumption downgrading" (compared to the steeper decline in consumption in first-tier cities, lower-tier cities have seen less significant declines due to relatively less pressure). Covering more locations in lower-tier cities is also the foundation for Focus Media's subsequent cooperation with Meituan. Of course, first-tier cities have not completely contracted but are also experiencing simultaneous minor densification. However, the rapid expansion of locations has started to affect the gross margin of elevator media this year, with a 3ppt decrease in the first half compared to the previous quarter. Nonetheless, the average cost per location is still declining due to the lower costs associated with the newly added locations in lower-tier cities. Considering that new locations have a ramp-up period, the benefit per location is expected to improve in the future, restoring the overall gross margin of elevator media.

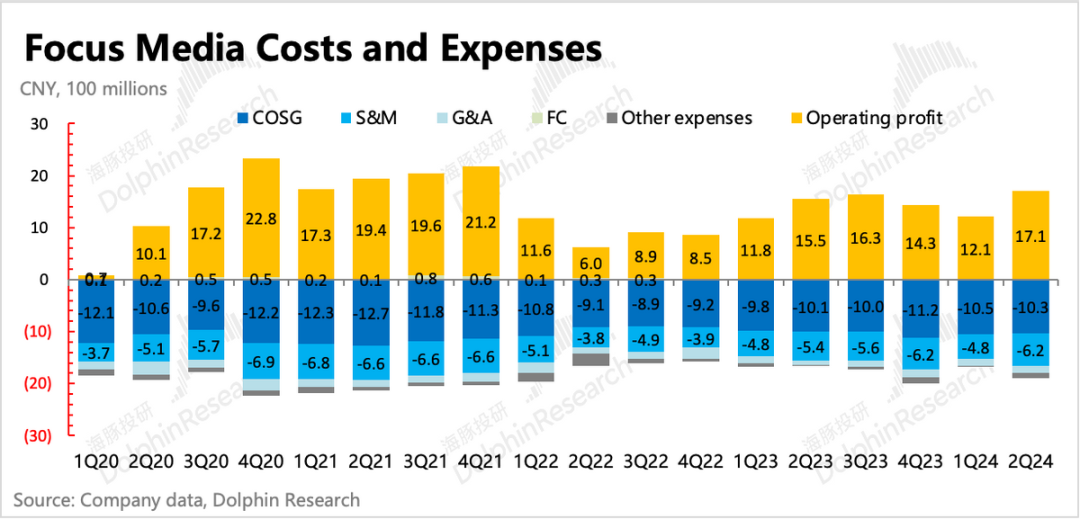

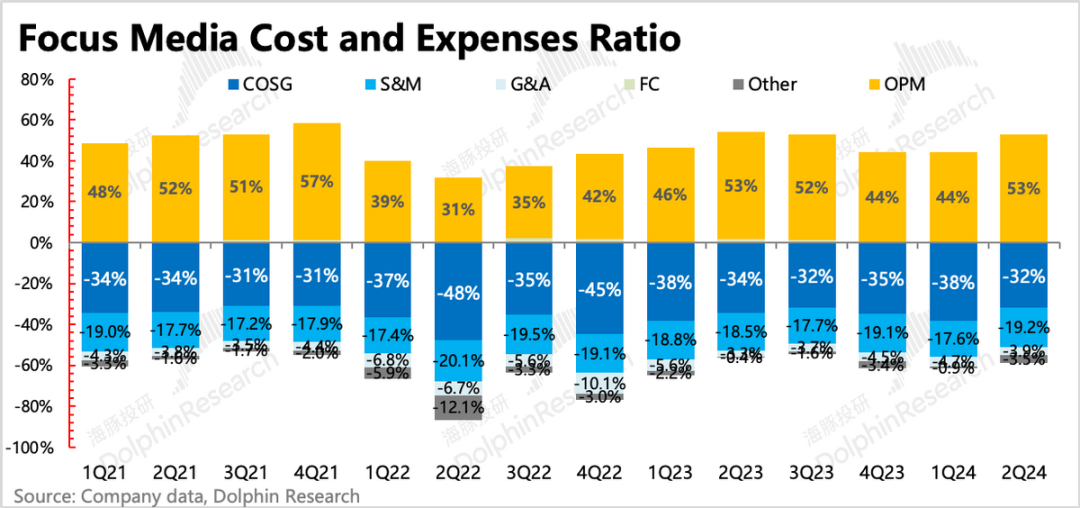

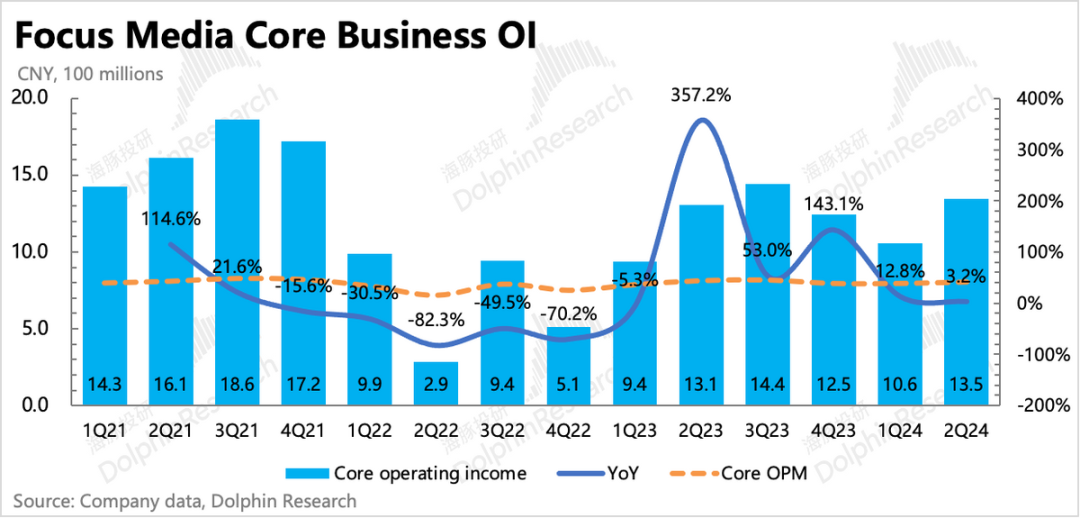

4. Flat Profits That Did Not Exceed Expectations? Higher Marketing Expenses: The impact on the gross margin of elevator media was offset by the recovery of the cinema gross margin. However, ultimately, Focus Media's core business operating profit (excluding non-operating expenses, investment income, etc.) performed flatly and did not exceed expectations due to excessive marketing expenses. To some extent, this reflects that Focus Media is currently expanding its locations and continuously exploring customers in lower-tier markets. On the other hand, does the increase in marketing expenses also indicate a severe current environment, with some loss of old customers and ineffective acquisition of new customers, necessitating more marketing investments? In the short term, the marketing expense ratio is still within its historical range, so there's no need to panic yet. It's worth paying attention to the conference call explanations and continuing to track the next quarter's situation.

5. Cash Flow Recovery Confirms Q1 as an Occasional Fluctuation: Last quarter, apart from a significant miss on growth, operating cash flow declined by 40% year-over-year despite a 10% year-over-year increase in profit. The company explained that this was mainly due to base effects. Q1 2023 included a significant amount of cash inflows that should have been received in Q4 2022 due to the pandemic, thus inflating the base. Operating cash flow in Q2 recovered normally compared to the previous quarter but surged significantly year-over-year due to the low base in Q2 2023, basically confirming the company's explanation of an occasional fluctuation.

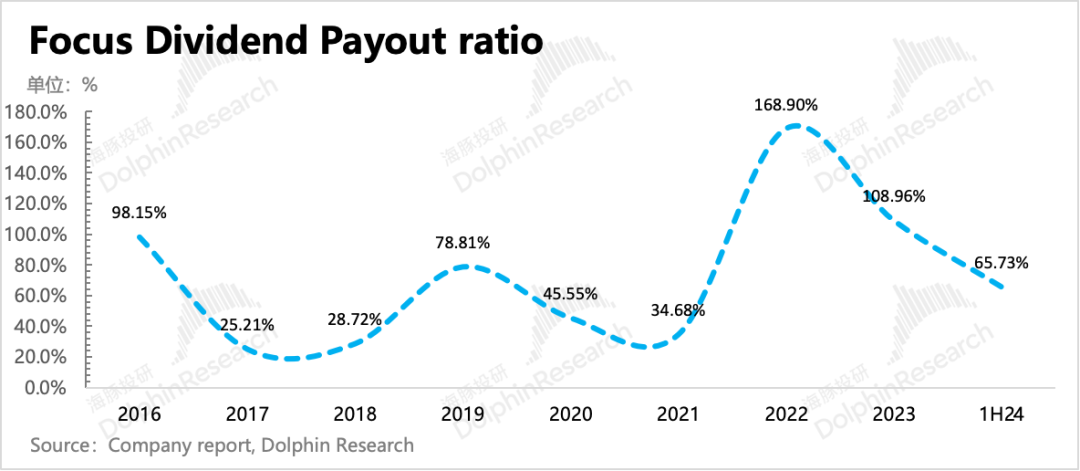

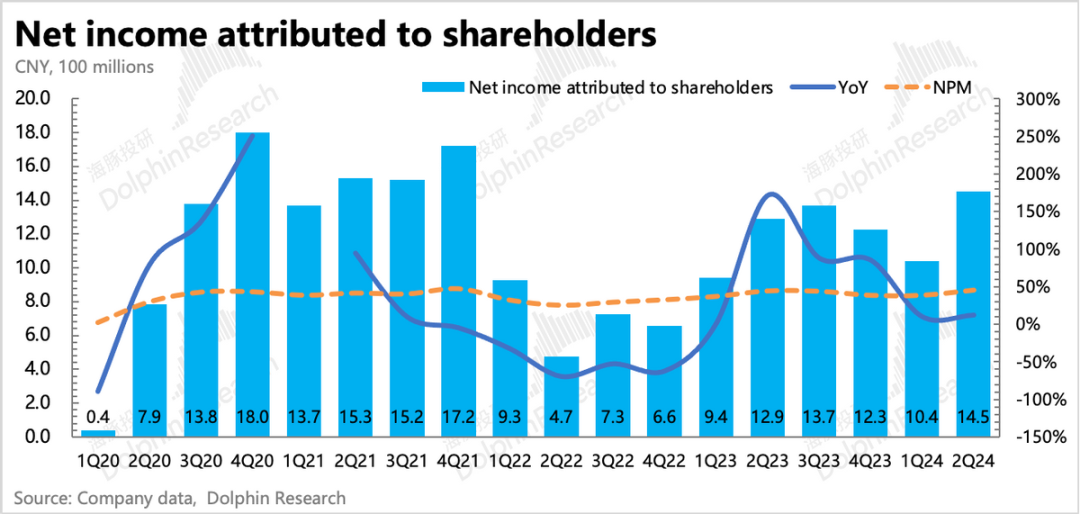

6. Expected High Dividend: Based on its first-half performance, the company expects to distribute a dividend of RMB 1.44 billion, representing a dividend payout ratio of nearly 60%. The company previously guided for a mid-year dividend payout ratio of no more than 80%, so the actual dividend is in line with expectations.

7. Comparison of Key Performance Indicators with Market Expectations: (Since few institutions make separate expectations for Q2 performance in public reports, there is some deviation between the Bloomberg consensus expectations and actual expectations. Dolphin Capital will focus on comparing the actual Q2 performance with the expectations of 2-3 leading institutions.)

Dolphin Capital's View: Overall, Q2 performance exceeded expectations amidst collective pessimism. This significant difference in expectations stems from multiple factors. Apart from Focus Media's absolute advantage in offline elevator media, advertisers' advertising strategies that differ from previous years are also key reasons for the larger-than-expected gap between market and actual performance. Although this new advertising strategy may not significantly increase the overall annual advertising budget, it can temporarily alleviate the excessive panic caused by the unexpected slowdown in Q1.

Furthermore, the Olympics in July and August of the second half of the year can help smooth out fluctuations between peak and off-peak seasons in Q3 and Q4 and offset some of the severe macroeconomic pressures. Currently, Focus Media is in an investment and expansion cycle, and the potential impact on future profitability cannot be ignored despite the revenue exceeding expectations. However, judging from the marginal change in gross margin in Q2, the ramp-up speed of elevator media is fast, and the newly expanded locations in lower-tier cities have relatively low costs. The subsequent increase in marketing expenses may be mostly related to initial customer acquisition, which can still be digested or reduced in the future.

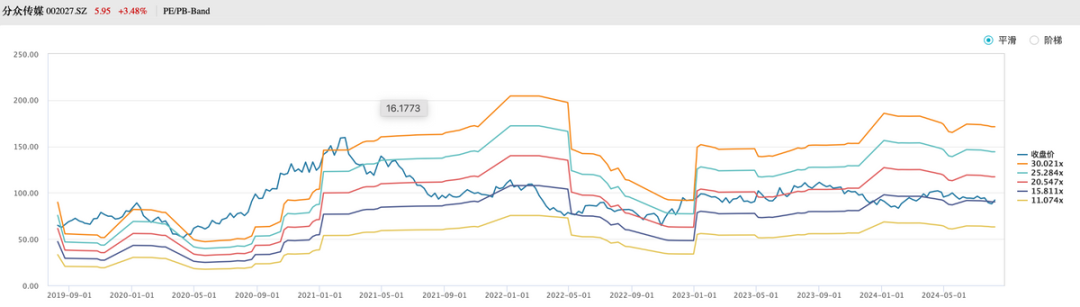

Therefore, maintaining profitability remains the core key, with revenue performance being the central factor. Due to macroeconomic pressures in the second quarter, clients' payment schedules slowed slightly. However, as the global interest rate cut cycle approaches, at least from an expectation perspective, the market's expectations for the macroeconomic environment in the second half of the year have improved slightly. Compared to the awkward position in Q1, the current valuation has adjusted to create some room, and expectations may have hit a bottom and are rebounding, thus slightly improving the comfort level of holding shares. However, the driving force to further solidify and push up valuations still depends on the actual implementation of policies.

Detailed Analysis of This Quarter's Financial Report

I. Panic-Driven Linear Extrapolation from Low Q1 Growth, Actually Exceeding Expectations

Focus Media's revenue grew by 10% in Q2, significantly exceeding market expectations of 4%. The low market expectations stemmed from the low base effect in Q1, where year-over-year growth was only 6%. This made it difficult for the market to have normal or optimistic expectations for Q2, which had a higher base and worse macroeconomic data. In fact, if we look solely at the Q2 growth rate, it basically aligns with the normal trend of a 10% price increase at the beginning of the year, which does not necessarily mean the macroeconomic environment is much better than we thought. As Dolphin Capital mentioned in the Q1 review, the current environment is complex, with price increases, the Olympics, and continued e-commerce competition providing relative benefits this year, so we cannot be overly pessimistic. Similarly, we should not be overly optimistic about the current macroeconomic environment just because Q2 results exceeded expectations. From indicators reflecting client payment schedules, the current macroeconomic pressure is objectively present.

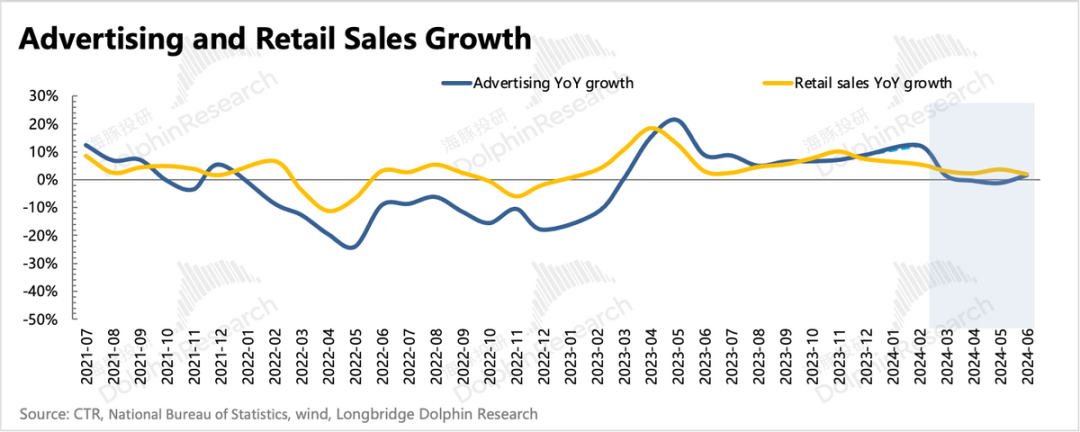

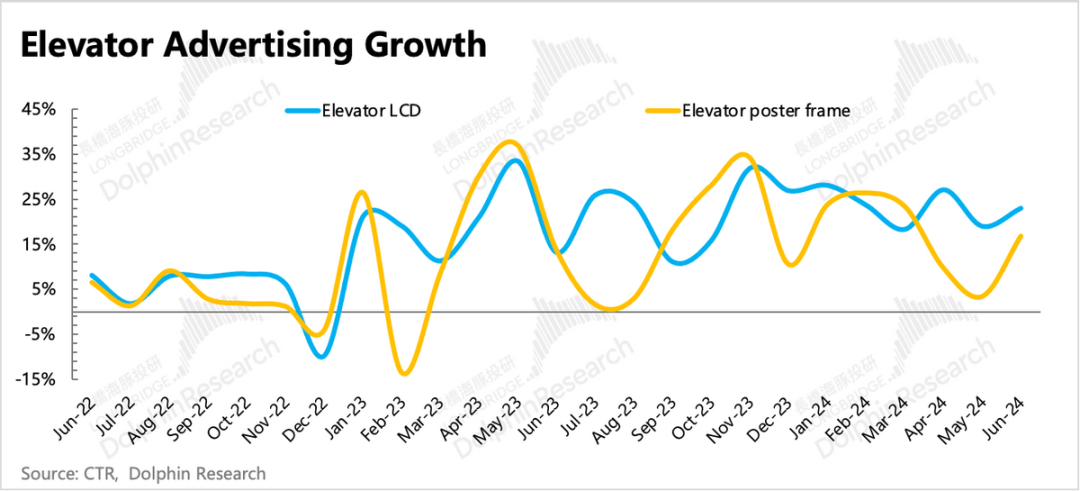

From an industry perspective, overall advertising experienced significant pressure in April-June due to the high base and weakening retail sales growth. However, elevator media grew by around 25%, performing impressively. Breaking it down, LCD growth trends were even better, while elevator posters experienced greater monthly volatility.

Looking ahead to Q3, although July and August are typically off-seasons, this year's Olympics are expected to buffer the impact of the off-season. However, whether the advertising trend can be maintained after the Olympics depends on the broader macroeconomic conditions. Currently, the global interest rate cut cycle is approaching, which can increase the space for domestic policy easing to some extent, and market expectations are showing signs of improvement. Therefore, Dolphin Capital expects Q3 growth to continue at around 10%, similar to the year-start expectations and not significantly revised upwards due to Q2 exceeding expectations. In addition, during periods of severe macroeconomic conditions or operational issues, Dolphin Capital will also assess the actual situation and future trends through changes in downstream clients' payment schedules.

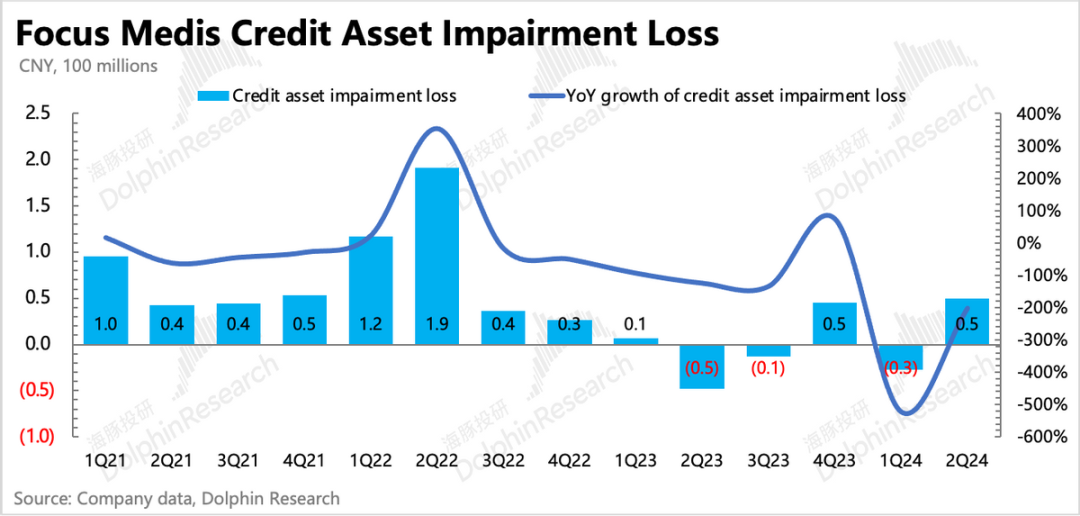

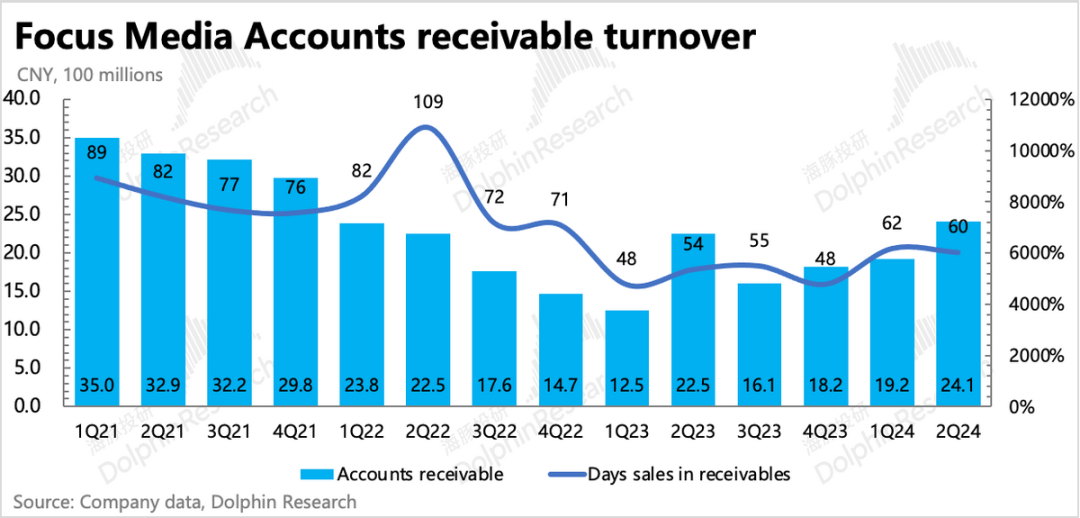

(1) Impairment of Credit Assets: There was some increase in the impairment of credit assets in Q2, which typically occurs during economic stress.

(2) Accounts Receivable Turnover Days: The turnover days in Q2 remained basically flat quarter-on-quarter but were still higher year-on-year, indicating that the current payment speed is slower than last year, which also reflects some current pressures.

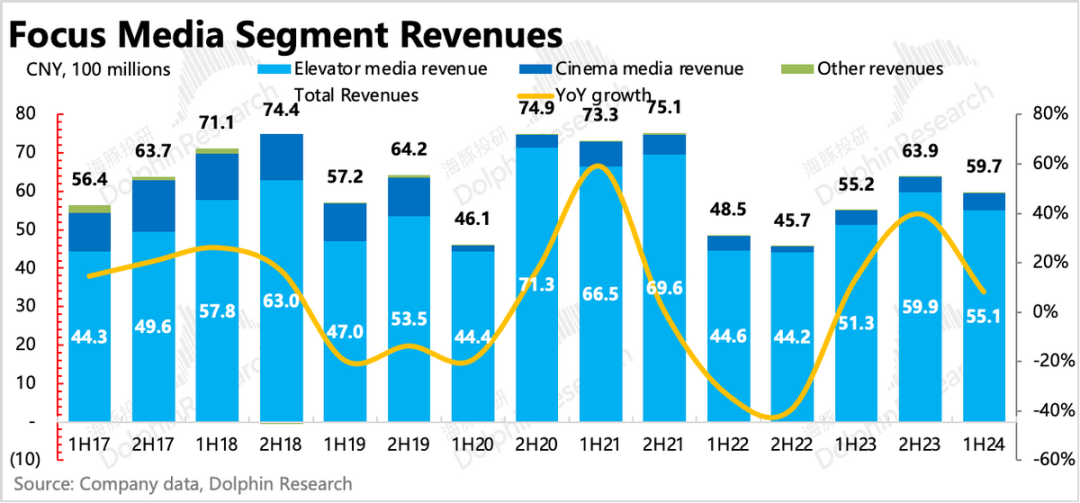

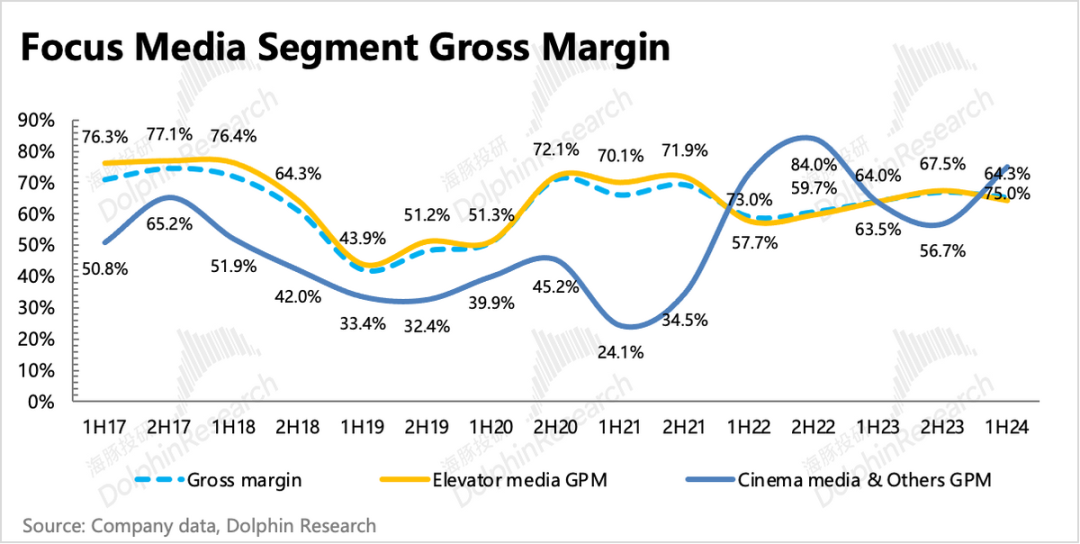

II. Segment Performance: Slowdown in Elevator Media in the First Half, Cinema Recovery, but Marginal Changes Move in Opposite Directions

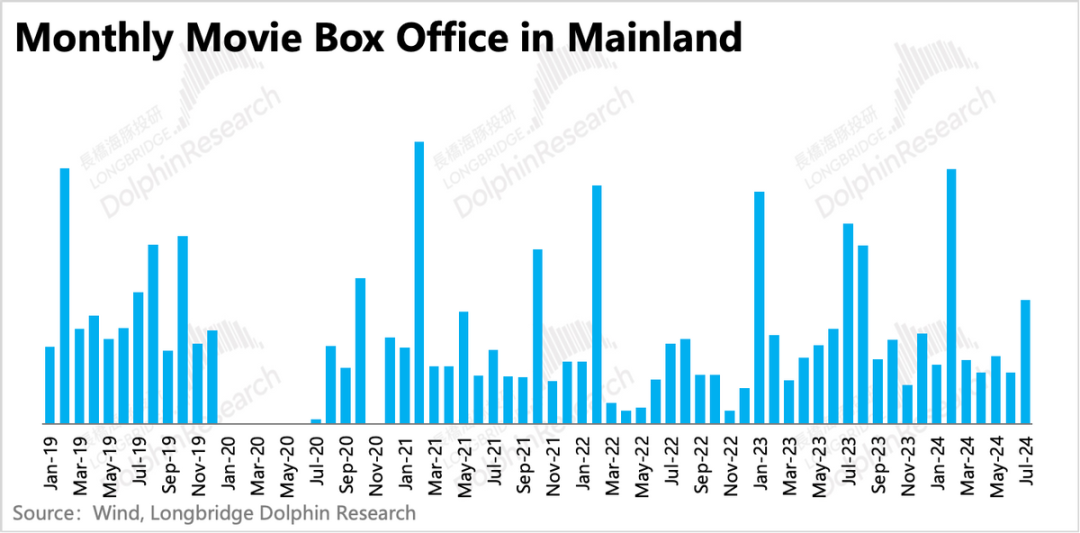

In terms of segment performance, elevator media grew by 7.3% year-over-year in the first half of 2024, a significant slowdown from the second half of last year as the post-pandemic bonus faded. Cinema advertising, on the other hand, grew by 20.8% year-over-year on a low base, still recovering along with the resurgence in movie demand. However, in terms of box office trends, the main contribution was in Q1, while Q2 performed relatively poorly due to a lack of high-quality supply. Apart from the recovery in movie demand, Focus Media has also been expanding its cinema coverage over the past year, contributing to revenue growth. The company also netted four new cinemas in the first half of the year, up from eight new cinemas in the same period last year. Looking ahead to Q3, while there are commercially successful films like "Doll Catching," the industry's box office performance is still below last year's levels, so cinema advertising is expected to face some pressure in Q3.

III. Slowing Consumption, Internet Sector Faltering Again

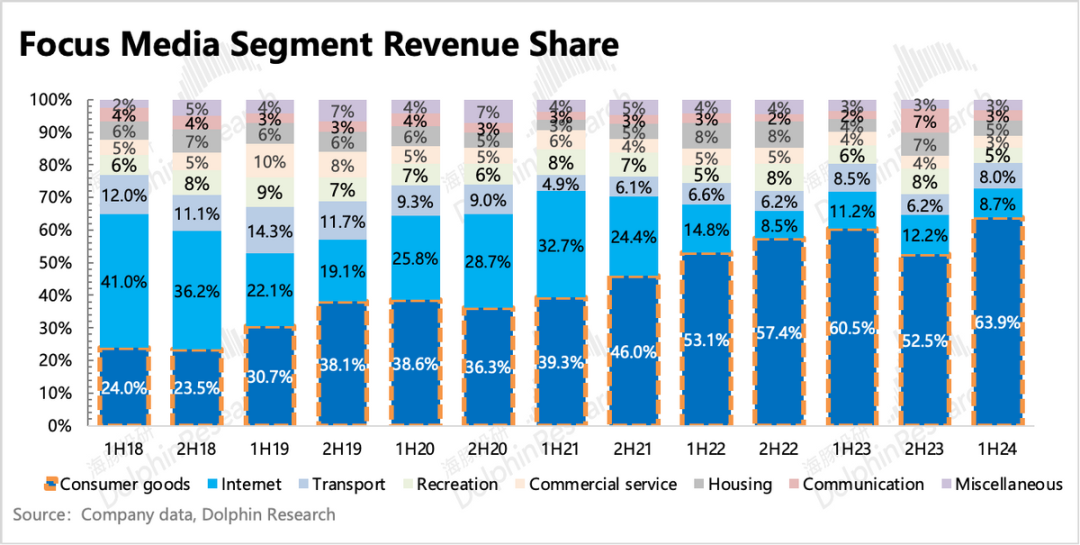

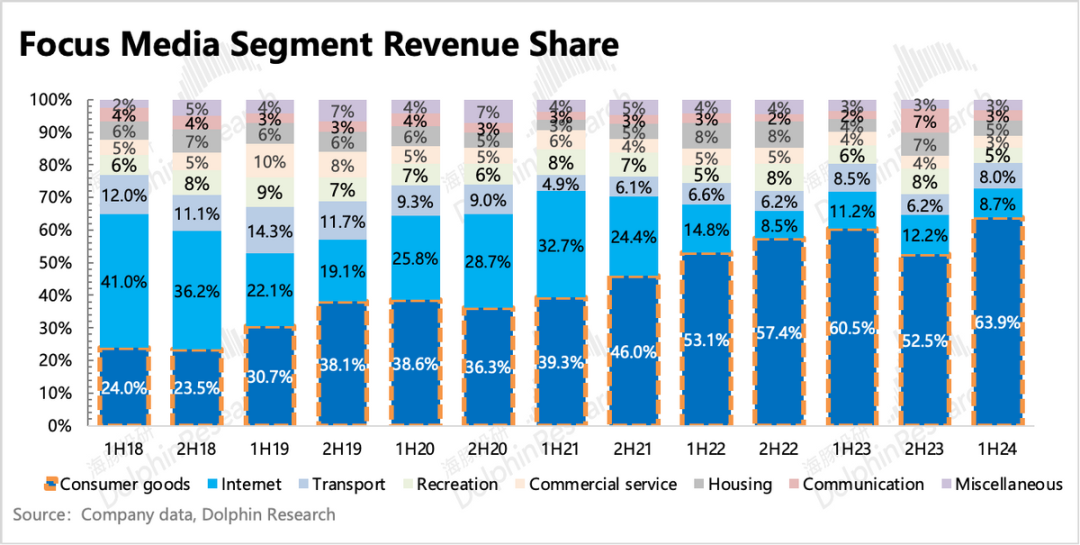

In the first half of 2024, Focus Media's largest customer industry was still consumer goods, accounting for 64% of revenue, rebounding from previous levels. This increase in proportion does not necessarily indicate robust growth in consumption; in fact, consumption growth is also slowing. However, since industries like internet, entertainment, and local commerce performed worse, declining year-over-year, the proportion of consumption revenue passively increased.

The slowdown in the internet and business services sectors was concentrated in e-commerce, where competition continues, but companies are still in a cost-reduction and efficiency-improvement cycle. To meet consumers' desire for low prices, companies have increased cash coupon subsidies while also slowing down external advertising expenditures. The entertainment sector also saw a 12% year-over-year decline, which is related to the relatively limited game supply in the first half of the year, with most projects concentrated among a few major studios. These major studios have many advertising channels, and offline elevator media is not their primary choice, so they cannot benefit from increased competition among the studios. However, in the second half of the year, especially during the summer vacation, the overall supply of the industry is expected to increase significantly, potentially alleviating the revenue pressure on the entertainment sector.

In addition, the resurgent education sector is also experiencing rapid growth and recovery, which could help revive internet advertising revenue. On the one hand, industry supply has increased to some extent. On the other hand, policy attitudes towards the education sector have improved. In the recently issued "Opinions on Promoting High-Quality Development of Service Consumption," it was mentioned that service consumption demand should be further unleashed, stimulating vitality in improved consumption areas such as cultural entertainment, tourism, sports, education and training, and residential services.

Regionally, the first half of the year saw notable north-south differences in growth rates, with southern and southwestern regions outperforming northern and central regions.

How does the investment period affect short-term profitability?

Since last year, Focus Media has been expanding its presence, particularly in second- and third-tier markets. This aligns with the broader trend of consumption downgrading and sinking. The recent announcement of a partnership with Meituan also reflects Focus Media's sinking strategy. Generally, the investment period significantly impacts profitability. Gross margins may be affected as new locations added during the ramp-up phase may not be fully occupied with advertisements yet, leading to a temporary decrease. Additionally, the investment period requires new customer acquisition efforts, resulting in increased marketing expenses.

In the context of Focus Media, there are some nuanced differences in the details:

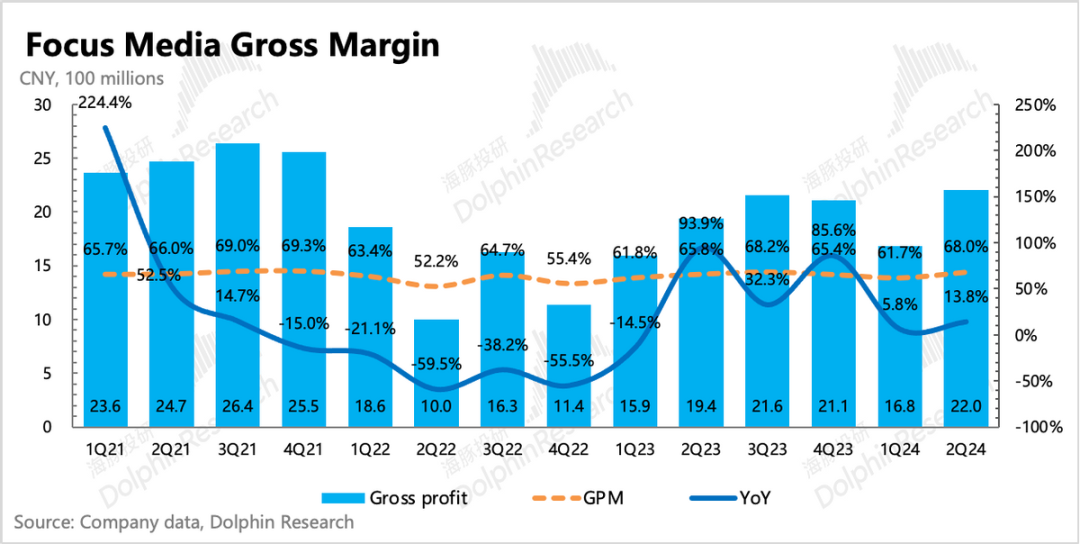

1) Limited impact on gross margin ramp-up: In the first half of the year, the gross margin for elevator media was 64.3%, a 3 percentage point decline from the second half of last year. However, in the second quarter, Focus Media's gross margin reached 68%, not only showing a significant rebound from the first quarter but also remaining at a relatively high level over the past three years.

Dolphin Insights believes that the rapid rebound in cinema advertising has contributed to the increase in gross margin. Additionally, the quarter-over-quarter improvement from Q1 to Q2 suggests that the ramp-up period for newly expanded locations is not as slow as anticipated. Furthermore, rental costs for locations in sinking markets are significantly lower than those in first-tier cities. The company expects to add 100,000 building TVs in sinking markets this year, with an estimated incremental cost of only tens of millions. As shown in Dolphin's calculations, the average cost per location in the first half of the year was approximately RMB 75,000, with both year-on-year and quarter-on-quarter trends indicating a downward trajectory.

2) Short-term surge in marketing expenses: The primary change in operating expenses lies in marketing expenses. As locations expand and operations normalize, customer activities, including new customer acquisition and maintenance of existing clients, will increase. In the second quarter, marketing expenses reached RMB 620 million, representing a 15% year-on-year increase despite a high base in the previous year. Does the increase in marketing expenses indicate a challenging environment, with some loss of existing customers and insufficient new customer acquisition, necessitating higher marketing investments? In the short term, the marketing expense ratio remains within its historical range, so there is no need for immediate concern. Focus Media's management has a forward-looking perspective on the industry's realities. Historically, high investments have not indicated pessimism about the current environment. Stay tuned for upcoming conference calls for further explanations and continued monitoring of subsequent quarters.

In the end, the core operating profit for the second quarter was RMB 1.35 billion, a year-on-year increase of 3.2%, lower than the revenue growth rate. Net profit attributable to shareholders reached RMB 1.45 billion, a year-on-year increase of 12.6%, primarily due to increases in non-operating income such as investment income. Although the net profit attributable to shareholders exceeded expectations, Dolphin Insights primarily focuses on the profitability of the core business when tracking fundamentals. Compared to market expectations, the growth in core business profitability for the second quarter was within expectations.

- END -

// Reprint Authorization

This article is originally created by Dolphin Investment Research. For reprinting, please obtain authorization.