Debt Tricks of Evergrande Auto

![]() 08/12 2024

08/12 2024

![]() 664

664

Introduction

Introduction

Paying one's own debts and suing oneself.

A saying goes, 'If you mess around, you'll eventually have to pay the price.' This saying applies equally to the long-absent Mr. Xu, the former Evergrande boss.

After Mr. Xu's "Oscar-worthy" performance of jumping off a building, as well as his calls for "working hard for 100 days" and "ensuring delivery of housing projects," following the aftermath of Evergrande's massive debt crisis amounting to 2.44 trillion yuan, on August 5, Evergrande Auto was subjected to a bankruptcy reorganization application filed by creditors.

The name 'Evergrande' literally means 'forever great,' but the reality is quite different. Firstly, Evergrande's debts are immense, totaling 2.44 trillion yuan in 2023. Secondly, its losses are staggering, exceeding 800 billion yuan in 2021 and 2022 alone, more than the GDP of Hainan Province. Furthermore, Evergrande's troubles have extended beyond real estate into the new energy vehicle industry.

Legally, the relevant local people's court held a hearing and ruled that the related subsidiaries should enter bankruptcy reorganization proceedings. These "related subsidiaries" refer to Evergrande Auto's wholly-owned subsidiaries, Evergrande New Energy Vehicle (Guangdong) Co., Ltd., and Evergrande Smart Auto (Guangdong) Co., Ltd.

This marks the largest 'thunder' in China's new energy vehicle sector to date. According to Evergrande Auto's latest financial report, the company delivered a total of 1,389 vehicles in 2023, generating revenue of only 1.34 billion yuan and suffering a net loss of 11.995 billion yuan (a 56.64% decrease year-on-year).

Currently, Evergrande Auto's total assets amount to 34.851 billion yuan, while its total liabilities reach 72.543 billion yuan, with cash and cash equivalents of just 129 million yuan. In other words, even if all of Evergrande Auto's assets were sold, it would still owe over 30 billion yuan, a classic case of insolvency.

An important concept to understand is that Evergrande's current situation is one of bankruptcy reorganization, not bankruptcy liquidation (or bankruptcy settlement). This is similar to the actions taken by WM Motor's parent company, Human Horizons AI Technology Co., Ltd.

Both reorganization and liquidation are legal procedures initiated by the company or its creditors when insolvency occurs. In this case, it is a last resort for Evergrande Auto's other creditors. But what exactly is going on here?

Tricks in debt repayment

Let's first examine the debts behind Evergrande Auto's false accounting (which involves PricewaterhouseCoopers, see later).

Debts can be classified into several types. For example, 26.483 billion yuan of these debts are loans, which are often secured debts. As such, they have a higher priority in repayment.

These debts typically involve contractual agreements using the borrower's movable or immovable property as collateral. If the debt cannot be repaid on time, the collateral is used to settle the debt.

Apart from secured debts, the next highest priority debts are those that, while unsecured, have a high priority, such as unpaid wages, taxes, and social security contributions.

Lower priority debts include unsecured general debts like accounts payable to suppliers and rent. Judging from Evergrande Auto's debt structure, its secured priority debts alone amount to 26.483 billion yuan, highlighting the depth of its debt troubles.

First, let's discuss bankruptcy liquidation. Unlike bankruptcy reorganization, liquidation involves ceasing operations and liquidating assets to repay creditors based on the priority of debts. Once the liquidation application is approved by the court, a liquidator is appointed to inventory the company's assets and distribute them to creditors according to debt priority.

For secured debts, the collateral is transferred to creditors. For example, if a factory is used as collateral for a 10 million yuan loan, the factory is transferred to the creditor if the loan is not repaid. Similarly, if a land parcel with a 70-year leasehold is used as collateral for a 10 million yuan loan and 60 years remain, the remaining 60 years of leasehold are transferred to the creditor.

After secured debts are settled, the remaining assets are liquidated and distributed among unsecured creditors. Finally, the company is dissolved, marking the end of its existence. This is the general process of bankruptcy liquidation.

However, the goal of bankruptcy reorganization is not to dissolve the company but to give it a final chance to revive.

In other words, the company's operations must continue. If the management and creditors cannot reach an agreement, the court steps in to facilitate a reorganization plan, which may be proposed by either the management or creditors.

In Evergrande Auto's case, the reorganization was initiated by creditors. However, it's crucial to note that debt repayment prioritization can be manipulated to the detriment of creditors, highlighting the need for court intervention to address any unreasonable prioritization.

Paying oneself's debts?

The most bizarre aspect of Evergrande Auto's debt crisis is not just its insolvency but the fact that Xu Jiayin, Evergrande's former chairman, is himself a creditor of Evergrande Auto. This allows him to prioritize repaying himself, effectively safeguarding his assets while shifting them to safer grounds.

How did Xu accomplish this? In 2018, through Evergrande Auto's controlling company, Xu issued $1.8 billion in foreign debt, making himself an overseas creditor. Consequently, this debt takes priority in repayment, allowing him to legally and seamlessly transfer funds overseas.

After Evergrande Group and Evergrande Real Estate imploded, Evergrande Auto remained a relatively valuable asset, holding intellectual property, production equipment, and semi-finished materials. However, the responsibility for debt repayment fell on Evergrande Auto's shoulders, with Xu Jiayin, albeit 'invisible,' remaining a high-priority creditor.

Being one's own creditor has distinct advantages. When the company is profitable, one can reap high returns. When difficulties arise, one can participate in collective creditor negotiations to secure favorable repayment terms.

However, there's always the possibility that other creditors have similar or higher priority. When they claim their share of limited assets, what happens?

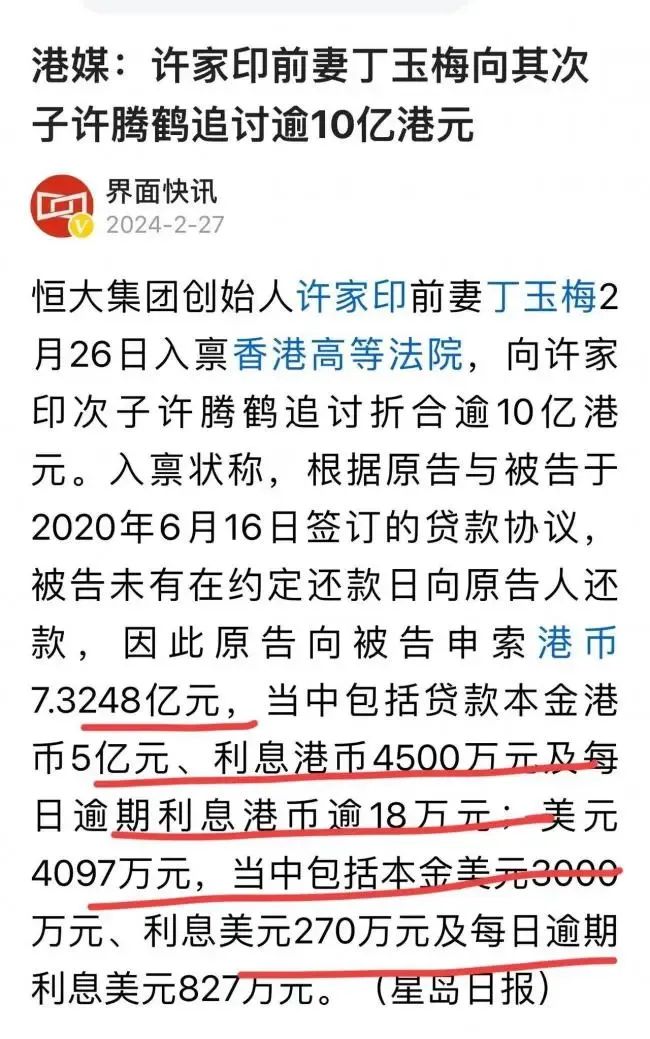

The lack of ethical boundaries in these maneuvers is astonishing, including the 'technical debt collection' of 'suing oneself.' In February 2024, Xu's ex-wife, Ding Yumei, sued their youngest son, Xu Heteng, for failing to repay a 1.05 billion HKD loan as agreed. By filing the lawsuit, she effectively froze the funds, temporarily safeguarding them for the family while hindering other creditors.

This move stunned everyone, but the truth soon emerged. The court froze the 1.05 billion HKD involved in the case, effectively preserving the funds for the Xu family. Although they couldn't access the money, neither could other creditors, allowing them to delay repayment while keeping the funds within reach.

Moreover, this scenario was made possible by Xu's meticulous planning over the years. He transferred much of the company's assets and debts to his wife, Ding Yumei, who then relocated overseas after their 'technical divorce' in 2022. Legally separated, she could claim debts from Evergrande subsidiaries as a creditor, essentially safeguarding family assets.

Furthermore, since its listing, China Evergrande has distributed dividends totaling 73.386 billion yuan. With Xu and his wife holding approximately 70% of the company's shares, they likely received over 50 billion yuan, or about 68% of the total dividends.

However, given the current situation, it's unlikely that Xu himself will initiate the debt reorganization. It could significantly impact his control over the company, so it's more plausible that desperate creditors, fearing a repeat of 'suing oneself,' preemptively propose the reorganization.

Therefore, the key to bankruptcy reorganization lies in reassessing the repayment priority of secured debts, aiming to move the Xu family from the front of the line to the back.

Have you been eye-openingly surprised by these revelations? It turns out things can be played this way.

'A Bottomless Pit of Money Burning'

Currently, Evergrande Auto's bankruptcy reorganization process is dragging on, showing signs of spiraling out of control.

Evergrande Auto represents one of Evergrande Group's remaining quality assets. In the context of China's new energy industry, money can create vehicles, potentially prolonging Evergrande's life, albeit with slim chances.

Historically, up to the end of 2023, Evergrande Auto, as a crossover automaker, had accumulated losses exceeding 110 billion yuan, with a loss of about 12 billion yuan in 2023 alone. Since renaming itself Evergrande Auto in 2020, it has suffered cumulative losses of 91.673 billion yuan over three years, truly a 'bottomless pit of money burning.'

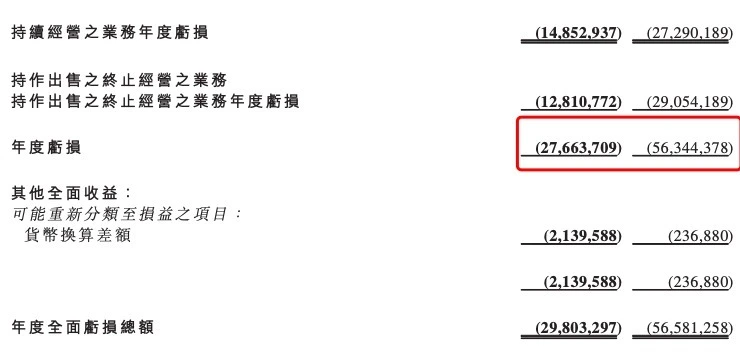

On July 26 last year, Evergrande Auto released its 2021 annual, 2022 interim, and 2022 annual financial reports simultaneously. The data showed losses of approximately 56.344 billion yuan in 2021 and 27.664 billion yuan in 2022.

Why such significant losses? A closer look reveals the reasons.

According to Evergrande Auto's 2022 financial report, its Global Research Institute employed over 3,200 researchers across 11 professional research institutes, attracting industry heavyweights like Fang Chi, former president of Dongfeng Motor Research Institute, and Xu Xingyi, former senior technical expert at Ford Motor Company. By the end of 2022, Evergrande Auto had 4,506 employees and filed 3,512 patents in related research fields, with 2,632 already granted.

In terms of personnel expenses, even if each employee's annual salary is estimated at 200,000 yuan, the annual salary expenditure would exceed 900 million yuan. Additionally, establishing research institutes and factories requires significant investments. During this period, even individuals like Dai Lei, known for his lavish spending, sought funding opportunities. In short, with Xu's lavish spending habits, even 110 billion yuan wouldn't suffice.

Given the current circumstances, even if Evergrande Auto undergoes bankruptcy reorganization, it's unlikely that anyone would be willing to take over the reins.

China Evergrande, as Evergrande Auto's largest shareholder with a 58.5% stake, was once rumored to have found a buyer for Evergrande Auto, igniting hope among shareholders and creditors. However, it turned out to be another ruse, leading everyone to realize it was all just a story.

As Xu Jiayin's last hope for a comeback, Evergrande Auto was supposed to be his shining star. Its collapse, however, signals the end of that hope, potentially triggering a chain reaction of lost faith and patience among creditors across various industries.

Actually, in addition to Evergrande Auto's announcement, China Evergrande Group also announced on August 5 that the liquidators would seek to recover dividends and remuneration totaling approximately US$6 billion (approximately RMB 42.7 billion) from seven defendants, including Xu Jiayin and his wife Ding Yumei. Meanwhile, the company will remain suspended until further notice.

This money, it is said, represents dividends and remuneration paid based on the financial statements for fiscal years ending December 31, 2017, 2018, 2019, and 2020. Notably, Ding Yumei, Xu Jiayin's ex-wife from a "technical divorce" that was recently revealed, is included in this list. Previously, there were only three individuals involved.

The most crucial reason is that PwC, which served Evergrande for 14 years and consistently issued "unqualified opinions" on its financial reports, has now had its hand caught in the cookie jar. In May of this year, the China Securities Regulatory Commission disclosed that Evergrande Real Estate had falsely inflated its revenues by RMB 564.1 billion in its 2019 and 2020 annual reports.

Since it's falsified accounting, there's likely something fishy about the money that was distributed. However, even if China Evergrande's creditors have a legitimate claim to recover dividends and remuneration, it doesn't necessarily mean they'll be able to get their money back.

Industry Debt Ratio

We often say "learn from past mistakes." So, extending from Evergrande Auto to China's new energy industry, what will be the key to future industry competition?

The key lies in which players in the saturated new energy market have the lowest debt ratio once profits start to decline. This logic is similar to that in the real estate industry, where companies with lower debt ratios have more cash on hand, allowing them to offer larger price cuts. As a result, they are better equipped to liquidate inventory and have a higher chance of survival.

So, what is the asset-liability ratio in China's electric vehicle industry? It's not excessively high, but it's also not low. According to industry data from 2023, among the new force automakers of "NIO, XPeng, and Li Auto," Li Auto's total asset-liability ratio is 57.8%. XPeng's is 56.8%, while NIO's is higher at 74.79%.

Another notable player, Xiaomi Auto, which garnered significant attention in the first half of the year, does not have specific data in this regard. However, Xiaomi Group's overall debt-to-asset ratio is 49.3%, which is considered relatively healthy.

Generally speaking, an asset-liability ratio of 40-60% is considered a healthy range in financial terms, while ratios exceeding 70% are considered risky. Based on this standard, NIO's financial situation poses a relatively high risk. Additionally, BYD, the electric vehicle brand with the highest market share in China, had an asset-liability ratio of 77.9% at the end of 2023, indicating signs of excessive debt.

Comparing this to the first half of 2020, when China's housing prices were still high, the average asset-liability ratio of listed real estate companies exceeded 79%. In comparison, the overall debt ratio in China's automotive industry is not considered very high and is better than that of the real estate industry. However, a deeper analysis reveals underlying issues.

Why are new energy vehicles selling well now? One reason is their affordable prices, which are made possible by a series of subsidies and policy support. For instance, there are subsidies for consumers purchasing electric vehicles and tax exemptions for vehicle purchase taxes. However, as these policies gradually phase out, the industry will face a downturn.

The current vehicle purchase tax exemption policy applies to new energy vehicles purchased from January 1, 2024, to December 31, 2025, with a maximum exemption of RMB 30,000. From January 1, 2026, to December 31, 2027, the purchase tax for new energy vehicles will be halved.

As these policies gradually diminish and price wars intensify, the new energy industry will face increasing competition and potential overcapacity. This will severely test automakers' cost control capabilities.

According to relevant data, BYD and Li Auto are the only companies with gross margins above 20% in 2023, with Tesla China closely behind at just under 20%, at approximately 18%. NIO and XPeng, on the other hand, are struggling, with NIO's gross margin at 9.5% and XPeng's at a mere 1.5%.

In terms of net profit margin, XPeng was in the red last year, leading some foreign industry experts to speculate that they could be among the first to be eliminated. However, domestically, NIO's battery swapping model is showing signs of success. Reports emerged in the first half of the year that 20% of its swapping stations had become profitable, and the number of partners continued to grow, putting it in a unique position that its competitors cannot match.

In conclusion, all new energy automakers in China will face significant challenges in the coming years.

Unfortunately, Evergrande has exposed the first major issue in China's new energy industry. However, Evergrande Auto's foray into vehicle manufacturing was not successful and can be considered a failure before it even got off the ground. Comparing it to current automakers is not appropriate. Moreover, the competitive landscape in China's new energy industry is changing rapidly, making it unlikely that anyone would take over Evergrande's operations even if they wanted to.

The warning from Evergrande Auto's troubles is that as China's automotive market undergoes significant internal and external changes, the "burn rate model" has reached its limits. Only by making genuine investments and focusing on technological research and development can automakers find a way forward. To suggest that Evergrande Auto is a "bellwether" for China's entire electric vehicle industry is misguided; it has never been that influential.