OPPO Lags Behind: AI Mobile Phone Business Fails to Solve Urgent Problems

![]() 08/14 2024

08/14 2024

![]() 500

500

As the overall mobile phone market gradually recovers and major brands welcome sales growth, OPPO stands out as an exception. According to data from multiple authoritative institutions, OPPO's market share and shipments have both seen significant declines.

Stockstar notices that in recent years, the company has frequently encountered setbacks in its business layout. From chips to XR, projects that have invested massive resources have all ended unsatisfactorily, with one being completely "cut off" and another being put on "pause".

After initiating a "slimming" mode, OPPO began vigorously deploying AI business to seek a breakthrough. It should be noted that for the mobile phone market, AI large models and other product updates will not become rigid consumer demands in the short term, making it difficult for the company to reverse the situation in this way.

01. Mobile Phone Sales Drop to Sixth Place

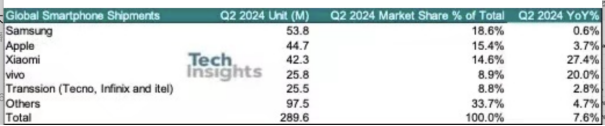

According to the second-quarter global smartphone shipment report released by market research firm TechInsights for 2024, global smartphone shipments rebounded 7.6% year-on-year in the quarter, reaching 289.6 million units, marking the third consecutive quarter of recovery. This trend indicates that after years of downturn, the global mobile phone market is showing positive signs of recovery.

In terms of market share, Samsung leads with nearly 19% of shipments, followed by Apple with 15%. Xiaomi, vivo, and Transsion hold the top five spots, followed by OPPO (including OnePlus), Honor, Lenovo-Motorola, realme, and Huawei.

Stockstar notes that among the many mobile phone manufacturers mentioned above, OPPO's shipments are the only ones that have declined. In this quarter, OPPO (including OnePlus) shipments decreased by 8% year-on-year, maintaining an annual decline for the past eleven consecutive quarters.

In comparison, Xiaomi shipped 42.3 million global smartphones in this quarter, a year-on-year increase of 27%, maintaining growth for four consecutive quarters. vivo shipped 25.8 million units globally in this quarter, a year-on-year increase of 20%. Transsion Group (including Tecno, Infinix, and itel) shipped 25.5 million global smartphones in the second quarter of 2024, a year-on-year increase of 3%.

OPPO's performance was also poor in the domestic market.

According to TechInsights data, Chinese smartphone shipments increased by 5% year-on-year in the second quarter of 2024, reaching 67.4 million units. vivo led the Chinese market with a 19% shipment share, followed by OPPO (including OnePlus), Huawei, Honor, and Xiaomi.

Notably, although OPPO ranks second, the company shipped 11.2 million units in the second quarter, a year-on-year decrease of 8%, marking the fourth consecutive quarter of negative growth.

It should be noted that TechInsights' statistics are based on shipments. If statistics are based on sales, OPPO's domestic market ranking would have declined even more significantly.

According to Counterpoint data, Chinese smartphone sales increased by 6% year-on-year in the second quarter of 2024, with vivo, Apple, Huawei, and Xiaomi ranking among the top four in market share. OPPO's market share fell from 17.2% in the same period last year to 14.6%, dropping from third to sixth place.

02. Frequent Failures in Business Layout

Stockstar notices that the company's performance has been unsatisfactory both in product lines and business layout, which is the main reason for its lagging behind.

Firstly, in terms of product lines, from the Find series, Reno series, A series, K series, etc., the options are overwhelming. The Find series is a high-end flagship model, the Reno series targets the mid-to-low-end market, and the A series focuses on cost-effectiveness.

The current situation facing OPPO is that the Find series has not lived up to its high-end aspirations; the Reno series lacks a clear positioning and sufficient resolution; and the cost-effective A series lags behind Xiaomi in brand image. OPPO's sub-brand OnePlus also falls far behind vivo's iQOO and Xiaomi's Redmi brands.

Industry insiders also point out that instead of forming a synergetic force, OPPO's various products are competing against each other, resulting in a blurred brand image.

Secondly, in terms of business layout, projects that have invested massive resources, from chips to XR, have all ended unsatisfactorily, with the former being cut off and the latter put on hold.

As a domestic mobile phone manufacturer, OPPO naturally hopes to achieve technological breakthroughs and innovations through self-developed chips. In 2019, OPPO established ZEKU to embark on its chip journey. OPPO's founder and CEO Tony Chen even announced plans to invest 50 billion yuan in self-developed chips.

However, at the time, Jiang Bo, OPPO's Senior Director of Chip Products, stated that from a commercial perspective considering costs and return on investment, the Mariana Y chip was "very uneconomical" due to its high tape-out costs. This seemingly foreshadowed the shutdown of ZEKU, and after four years of chip development, OPPO announced the closure of ZEKU and disbanded its R&D team in 2023, marking the end of its chip journey.

OPPO's journey in XR has also been bumpy. OPPO began exploring XR in 2019 and unveiled its first-generation AR glasses at its annual Future Tech Conference at the end of that year.

Subsequently, OPPO launched XR test products such as OPPO AR Glass 2021, OPPO AR Glass 2, and OPPO AR Glass 3. However, OPPO's XR products have not yet entered mass production. In June 2023, OPPO unveiled the OPPO MR Glass ahead of Apple's Vision Pro launch. However, market sources indicate that actual shipments were limited to just a few hundred units for developers.

Meanwhile, global XR shipments are also declining. According to Counterpoint data, global XR headset shipments declined by 19% year-on-year in 2023, with market leader Meta also facing a 38% year-on-year decline in shipments.

Since the beginning of this year, there have been continuous updates about OPPO's XR business. According to multiple sources, XR-related personnel will shift to AI, exploring directions such as AI devices or robots, while retaining a small number of personnel to continue pre-research in AR.

03. Betting on AI Mobile Phone Business

This time, OPPO is turning to AI business. At the beginning of this year, OPPO's founder Tony Chen issued an internal letter defining 2024 as the first year of AI mobile phones, followed by an AI strategy conference announcing OPPO's entry into the AI mobile phone era.

Since the rise of AI large models last year, they have become a new focus of competition among mobile phone manufacturers, with domestic and international players such as Huawei, vivo, Xiaomi, Honor, Samsung, and Apple all launching AI large models.

At Huawei's HDC Developer Conference on June 21, 2023, Huawei's Executive Director Yu Chengdong announced the official launch of the developer beta test for HarmonyOS NEXT, which deeply integrates AI with the OS to create a new HarmonyOS native intelligence framework.

vivo's AI BlueCore large model enables over 700 mobile phone-related functions, providing AI services such as intelligent Q&A, content creation, search, management, and interaction to over 20 million users.

OPPO's AI large model, Andes, is a 7 billion-parameter model deployed on the device side. It leverages the "device-cloud collaboration" architecture to achieve local and cloud collaboration, making mobile phones smoother and more intelligent.

Meanwhile, mobile phone manufacturers are emphasizing AI capabilities in their products. For example, Samsung launched the Galaxy S24 series with generative AI technology, supporting features like AI call translation and intelligent image extraction. On April 18, Huawei introduced the Pura 70 series flagship phone, supporting AI photography and one-click removal of objects.

OPPO's recently launched Find X7 series also features AI call summaries, image removal, and a new AI assistant as its main selling points.

But will consumers really pay for AI features? Stockstar notices that currently, the AI functions of mobile phones are generally not highly regarded by consumers. Taking the OPPO Find X7 series as an example, when making purchases, consumers pay more attention to factors like phone heating and battery life, rather than the "AI trial" mentioned in the product introduction.

Guo Tianxiang, Senior Analyst at IDC China, has also stated that for the mobile phone market, AI large models and other product updates will not become rigid consumer demands in the short term.

Against this backdrop, it begs the question: Can AI truly help OPPO achieve significant sales growth in the short term? (This article was originally published on Stockstar by Li Ruohan)

- End -