"One Body and Three Wings": Will Beike Take Off Again?

![]() 08/13 2024

08/13 2024

![]() 660

660

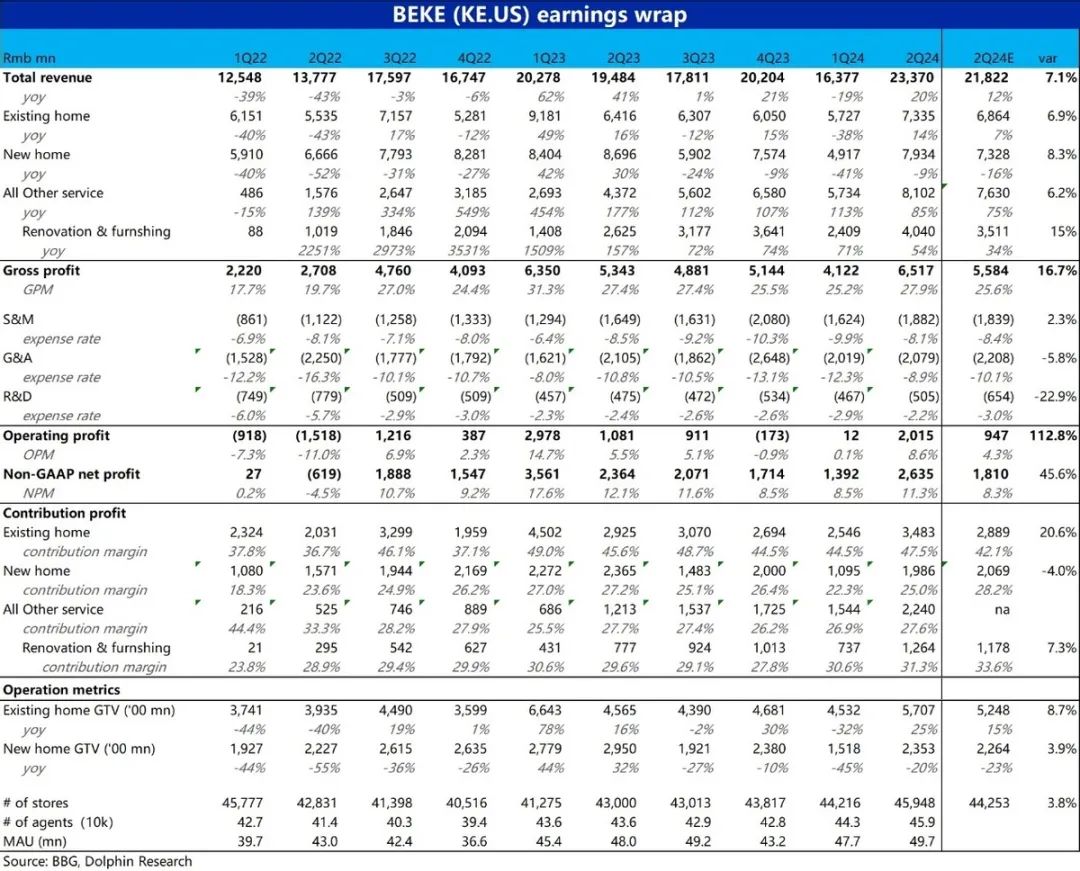

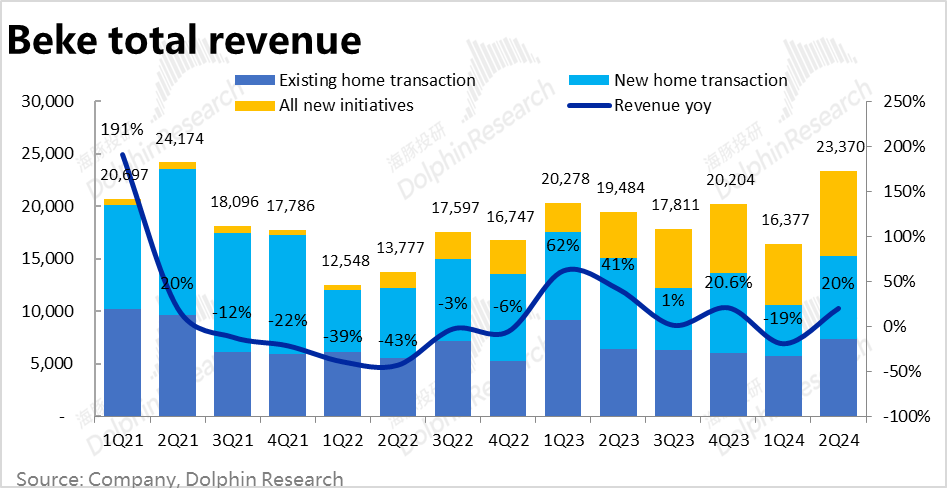

On the evening of August 12, Beijing time, before the US stock market opened, Beike (KE.US) released its financial report for the second quarter of 2024. Boosted by significant new real estate policies, the housing transaction business showed a clear recovery, delivering a report with both revenue and profit exceeding expectations. The key points are as follows:

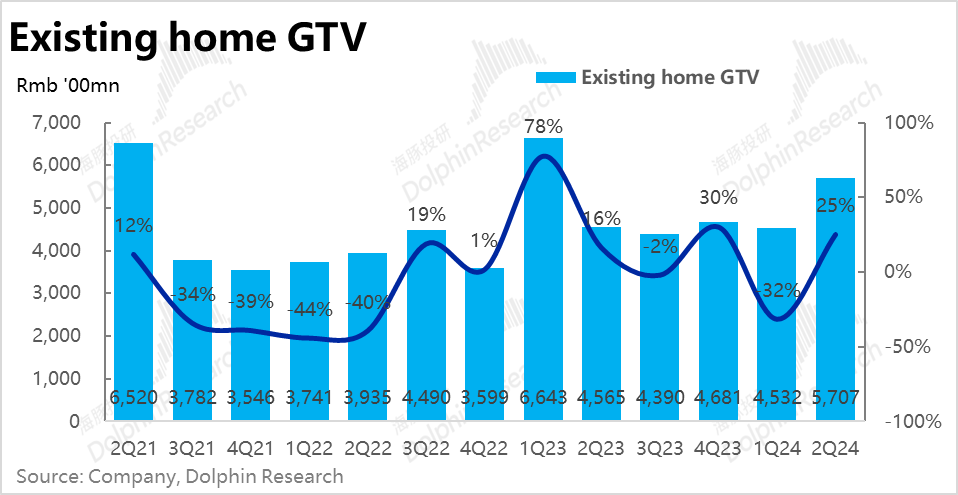

1. Stimulated by the new policy introduced on May 17, the secondary housing market experienced a notable recovery in the second quarter. Beike's gross transaction value (GTV) for existing homes increased by 25% year-on-year, significantly higher than the 15% growth rate expected by sellers. Although slightly lower than the 33.4% growth rate in transaction area across 74 cities during the same period, considering the impact of declining average prices, Beike's performance in the secondary housing market was at least on par with the overall market, if not stronger.

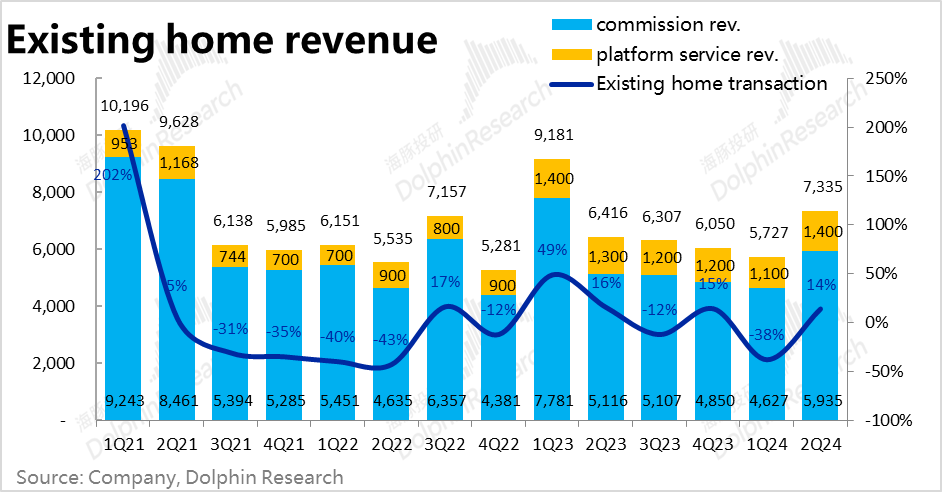

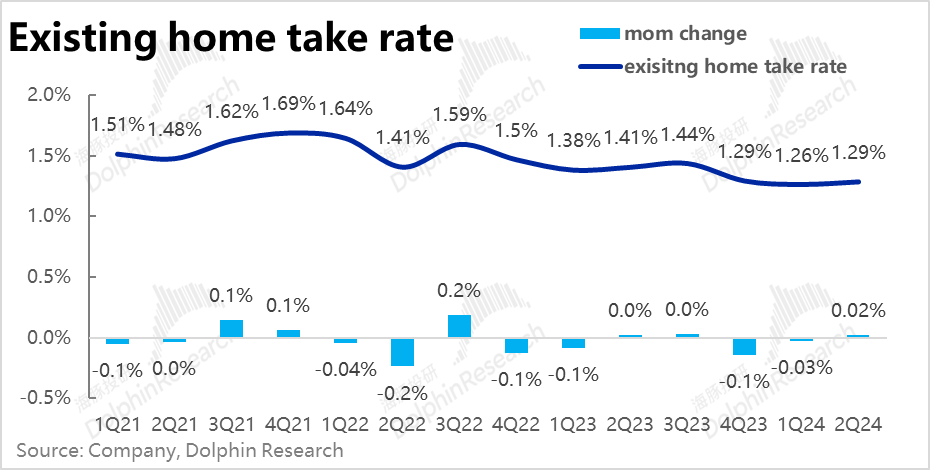

However, due to continued high inventory de-stocking pressure, Beike's monetization rate for existing homes declined by approximately 0.11 percentage points year-on-year, resulting in a revenue growth rate of 14%, significantly lower than the GTV growth rate. Nevertheless, benefiting from the improved market conditions in the second quarter, particularly in high-tier cities, the monetization rate increased by 0.03 percentage points quarter-on-quarter.

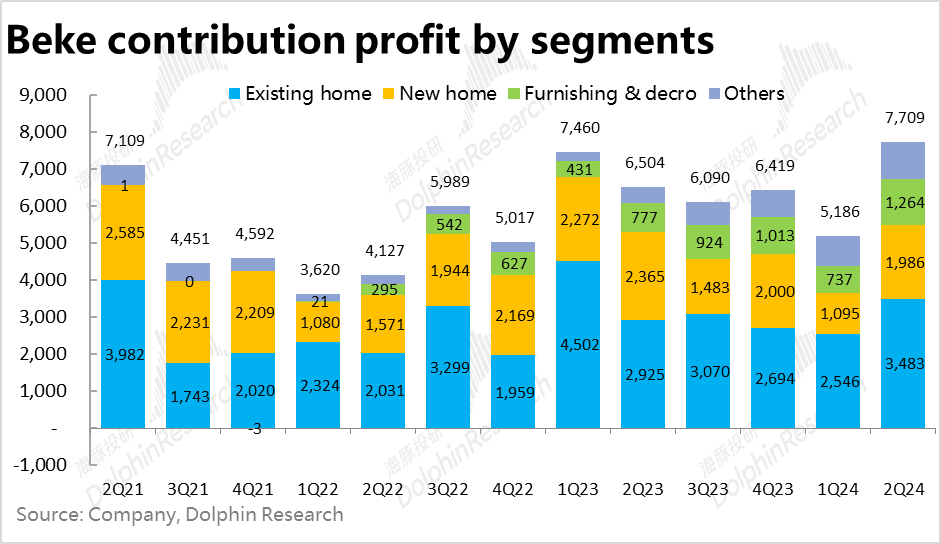

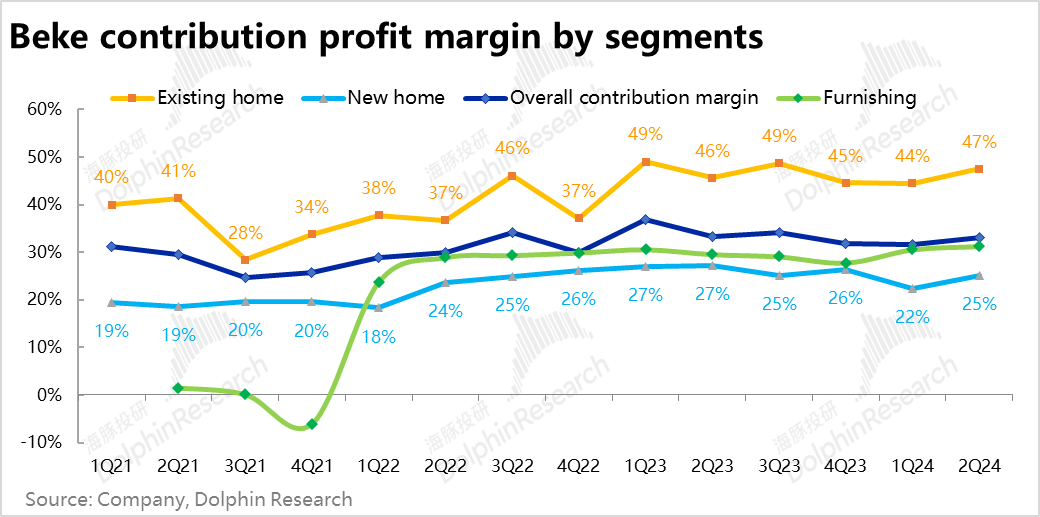

The recovery in transactions also drove an increase of approximately 3 percentage points in the contribution margin of the existing homes business to 47.5% quarter-on-quarter, resulting in a contribution profit of RMB 3.483 billion for the quarter, exceeding expectations by nearly 21%, a more significant margin than the revenue exceedance.

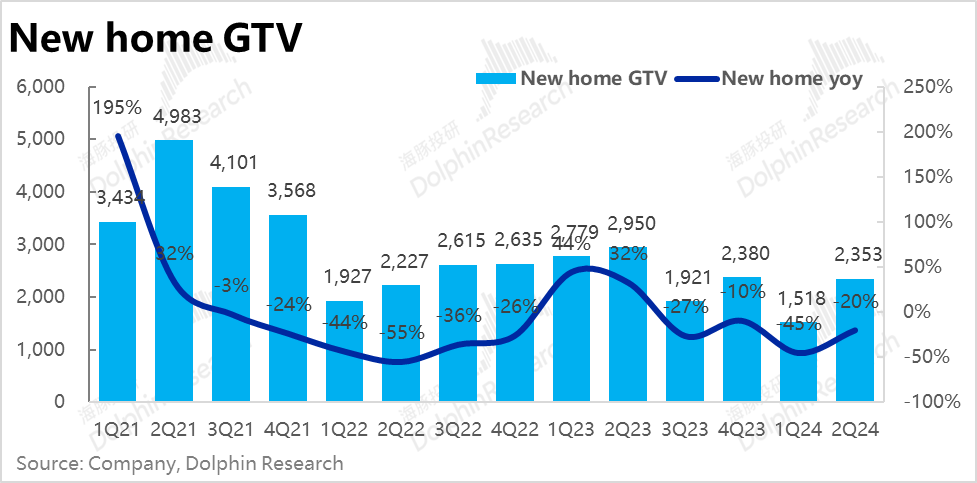

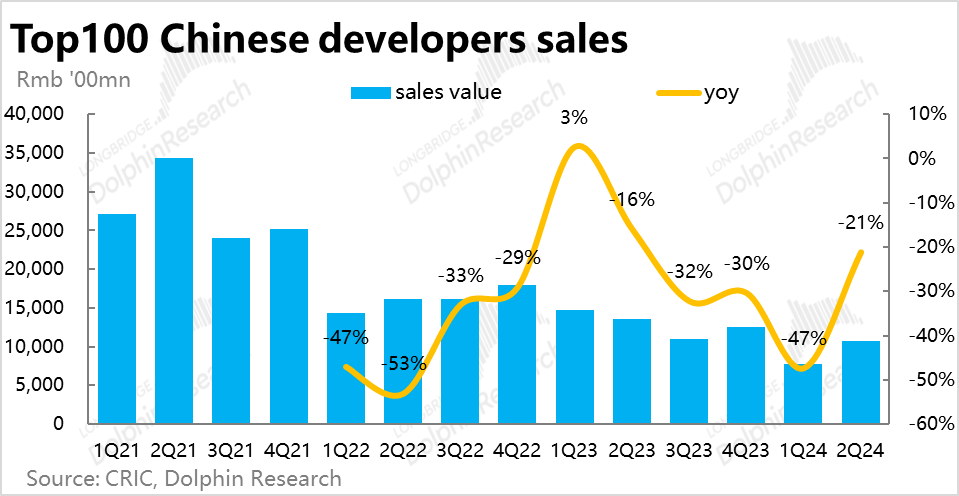

2. The new homes market saw a more modest improvement (partially due to the crowding-out effect of the existing homes market). Beike's new home transaction value declined by approximately 20% year-on-year in the second quarter, similar to the 21% decrease in sales revenue of the top 100 real estate developers during the same period. Neither outperforming nor underperforming the market.

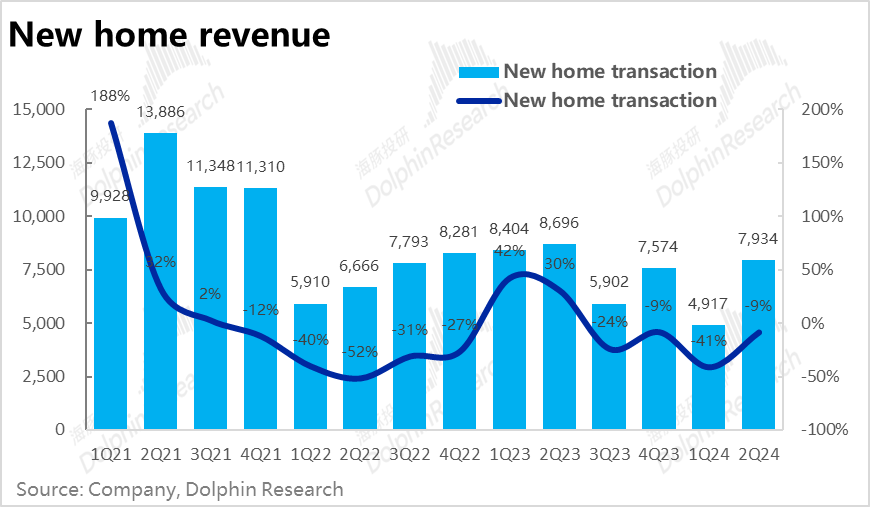

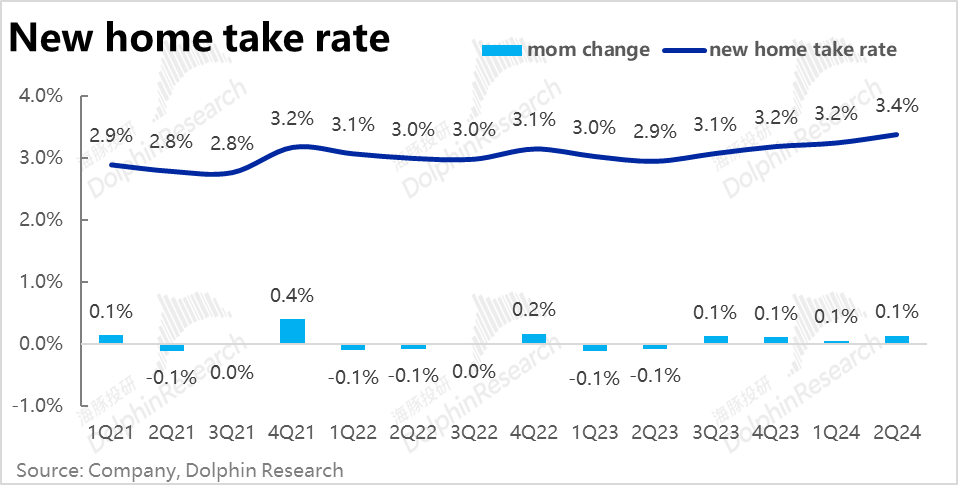

However, as the monetization rate for new home transactions continued to increase by 0.2 percentage points quarter-on-quarter (a cumulative increase of 0.5 percentage points year-on-year), the year-on-year decline in new home business revenue was only 9%, significantly lower than the market expectation of a 16% drop and the GTV decline. Dolphin Research believes that as land in key urban centers becomes increasingly scarce, and suburban projects lack natural customer flow and face difficulties in de-stocking, the bargaining power of channels over developers is likely to increase in the medium term.

However, the improvement in the contribution margin of the new home business was approximately 3 percentage points lower than market expectations, reaching 25% for the quarter. As a result, despite higher-than-expected revenue, the contribution profit of the new home business was 4% lower than anticipated.

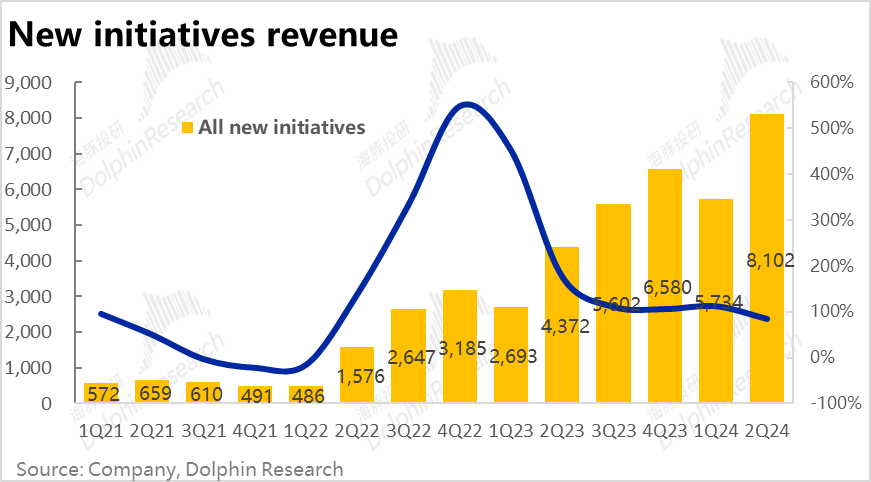

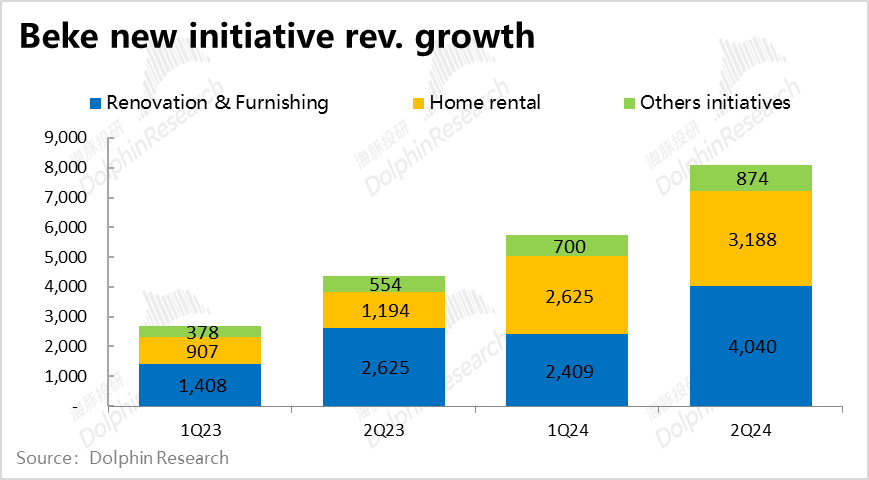

3. In addition to the recovery of agency services, Beike's second track, comprising home decoration, leasing, home furnishing services, and financial services, generated total revenue of RMB 8.1 billion in the quarter, maintaining a high year-on-year growth rate of 85%. By the end of the quarter, the second track accounted for 34.7% of Beike's total revenue, and with nearly double the year-on-year growth rate at a considerable scale, it has undoubtedly become the main driver of the company's revenue growth.

Not only in terms of revenue, but the second track also contributed a total of RMB 2.24 billion in profit for the quarter, accounting for 29% of the company's overall profit. This demonstrates that the second track is not merely inflating revenue but also making a solid contribution to profits. Specifically, the contribution margin of the home decoration business reached 31.3%, ranking above average among the company's various business segments. However, the contribution margin of the leasing business was only 5.8%, indicating that while it generates substantial revenue exceeding RMB 3 billion, its profit contribution accounts for less than 3% of the company's overall profit.

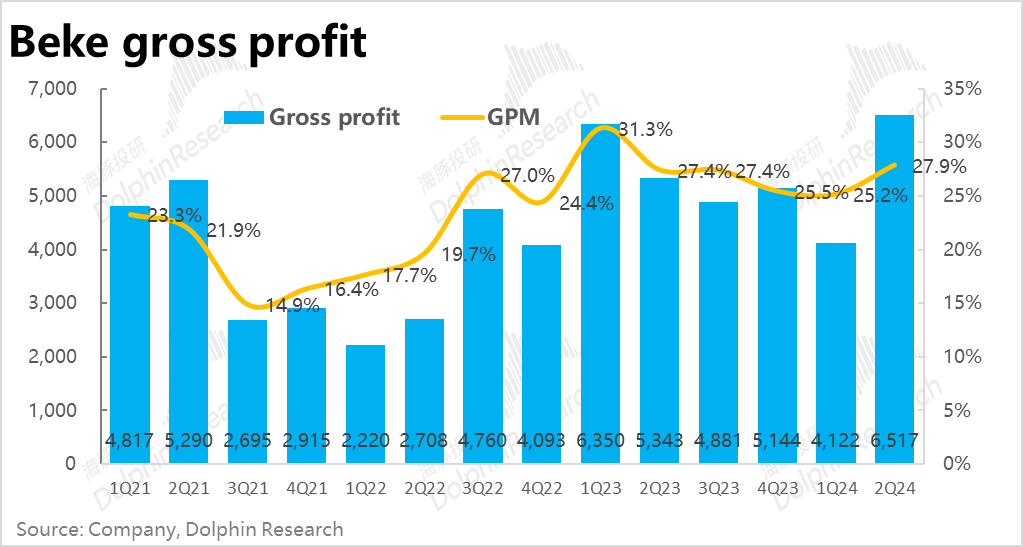

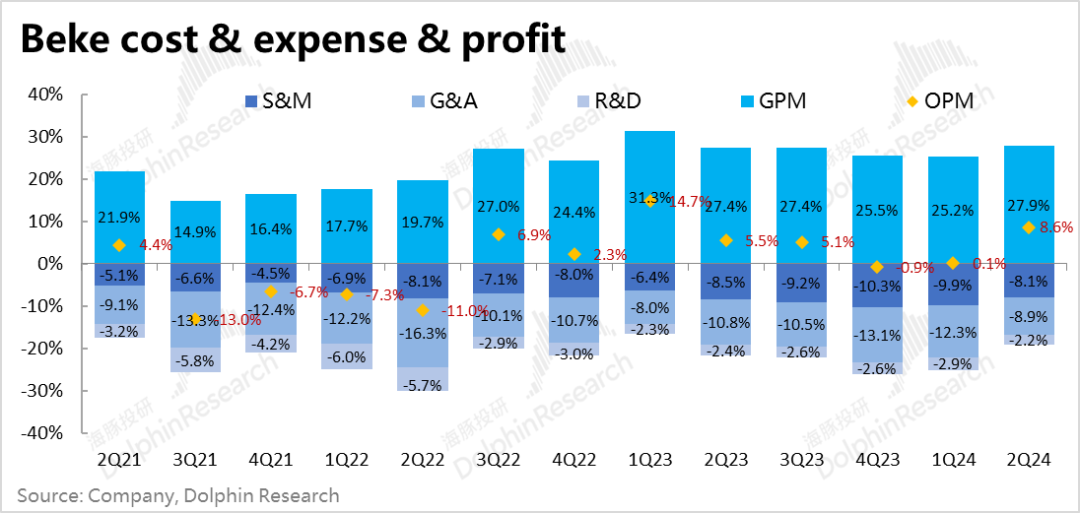

4. From a cost and profit perspective, gross profit reached RMB 6.52 billion in the quarter, nearly RMB 1 billion higher than expected. As revenue improved, the gross margin increased by 2.7 percentage points quarter-on-quarter. Breaking it down, the gross margins of the home decoration and leasing businesses increased by less than 1 percentage point quarter-on-quarter, with the majority of the improvement coming from the first track (benefiting from market recovery).

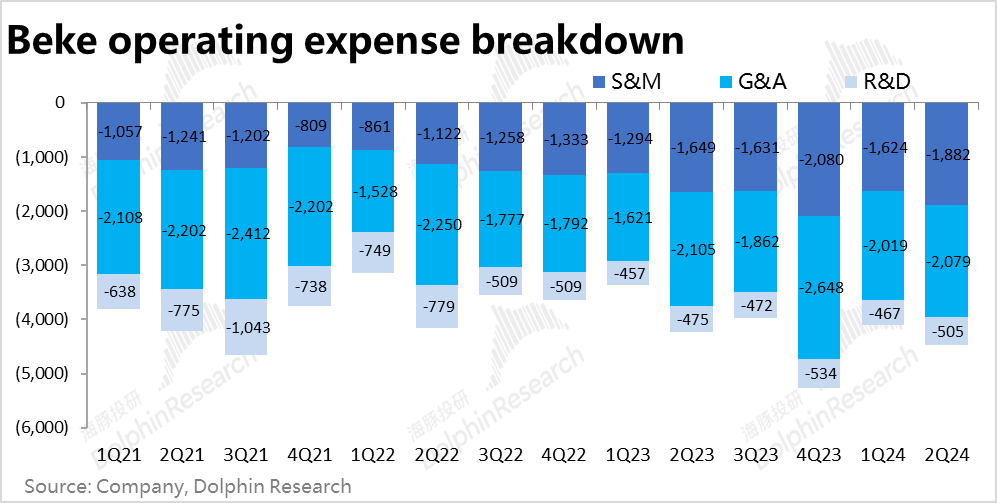

In terms of expenses, as the market recovered, all operating expenses at Beike returned to growth quarter-on-quarter, with marketing expenses rising the most significantly (+16% QoQ), and being the only expense item exceeding expectations.

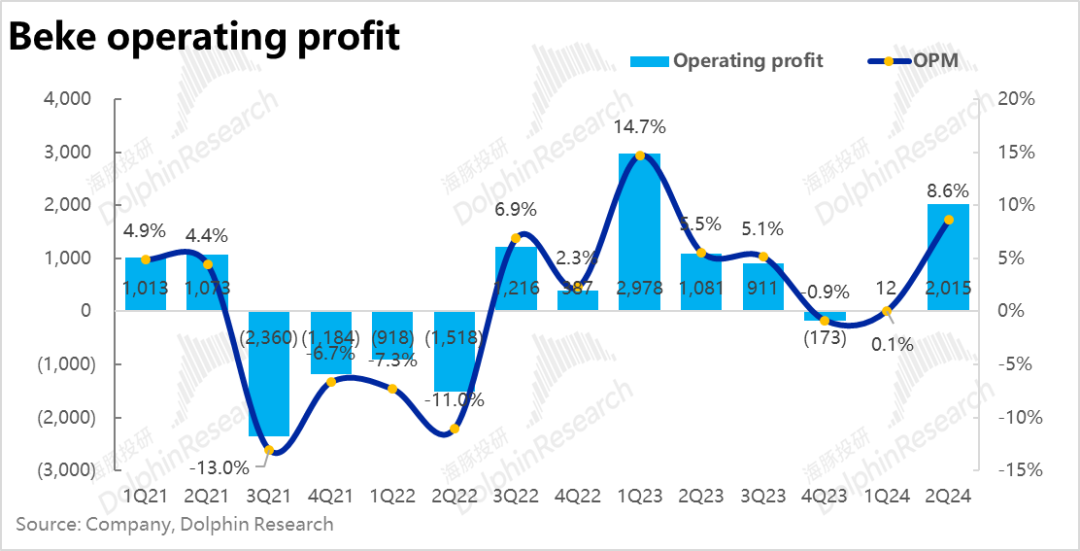

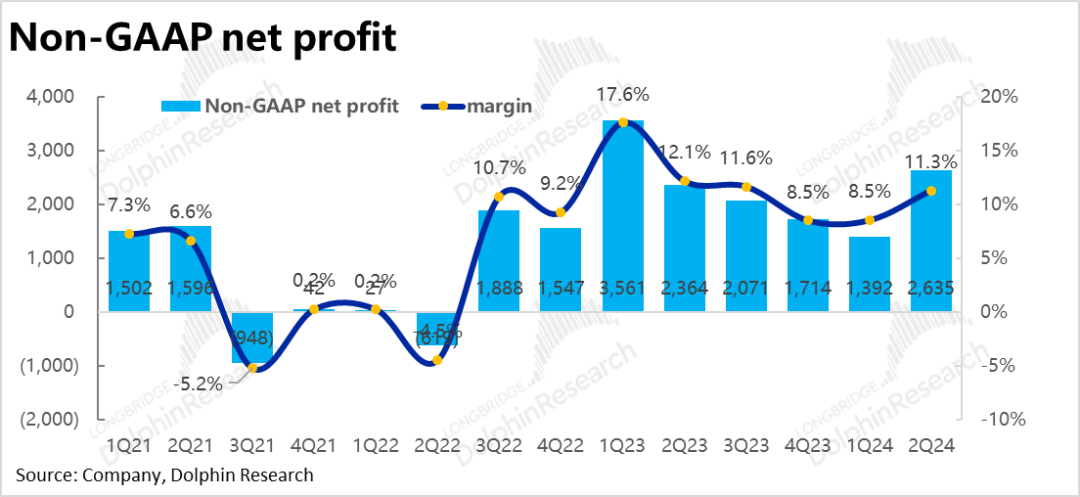

However, diluted by revenue growth, all expense ratios declined significantly, with the combined expense ratio decreasing by 6 percentage points quarter-on-quarter. Coupled with a 2 percentage point increase in the gross margin quarter-on-quarter, the operating profit margin rebounded to 8.6% in the quarter. As a result, operating profit reached RMB 2.02 billion, significantly higher than the expected RMB 950 million. Adjusted net profit for the quarter was RMB 2.64 billion, also exceeding expectations by approximately RMB 800 million.

Dolphin Research Viewpoint:

Overall, stimulated by new policies, some expectations may not have been updated in a timely manner, but Beike's second-quarter performance was clearly stronger than anticipated. Both the first track's existing and new home businesses showed notable improvements quarter-on-quarter, with the existing home market performing even stronger, delivering both revenue and profit exceeding expectations. Meanwhile, the second track now contributes approximately 30% of both revenue and profit, becoming more than just a supplement to the housing agency business and actually serving as the primary source of incremental revenue and profit for the company.

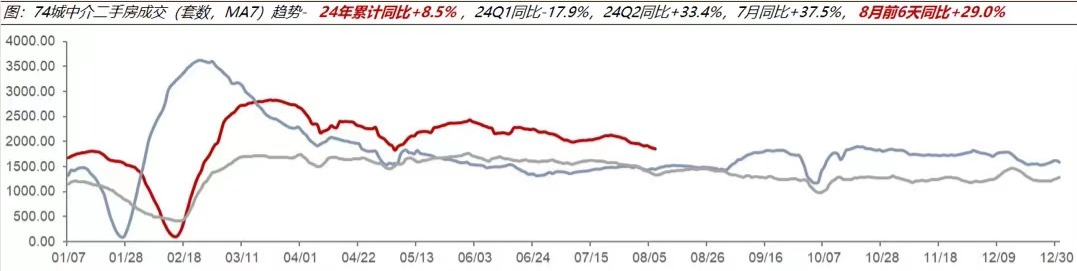

In the short term, following this excellent performance, the company's share price is likely to strengthen for some time. However, since August, transactions in the existing home market have shown a notable quarter-on-quarter decline. As the stimulus pulse from new policies flattens out, market focus in the medium term will continue to be on the subsequent trend of the real estate market. Attention can be paid to the management's guidance for the next quarter during the conference call.

In the long run, we believe that although the total transaction area of the real estate market is likely to shrink gradually over an extended period, as the proportion of existing home transactions gradually increases, the long-term impact on Beike may not necessarily be negative. At the same time, we can see that to gradually reduce reliance on the macroeconomic environment in the first track, Beike's new businesses have already accounted for a considerable proportion of revenue and profit. In the medium to long term, the factor with the greatest impact on Beike's performance and valuation will gradually shift from the first track to the second track. Therefore, the medium to long-term revenue and profit projections for home decoration and leasing businesses will be crucial in determining whether to maintain a bullish outlook on Beike.

In the short to medium term, Beike's clear market leadership in the first track has established a relatively solid valuation floor for the company. Even if subsequent real estate transactions fluctuate, as long as the entry point is reasonable, it is a target that does not require concern about "permanent loss of principal."

Detailed Analysis of This Quarter's Financial Report

I. Existing Homes: Significant Policies Boost Market Recovery, and Leading Player Beike Leads the Way

Following the most significant nationwide real estate policy introduced on May 17 and subsequent supportive policies in major cities, the domestic secondary housing market experienced a notable recovery in the second quarter. Reflecting on the company's performance, the GTV for existing homes in the quarter was RMB 570.7 billion, an increase of 25% year-on-year, significantly higher than the market expectation of a 15% growth rate. In comparison, the transaction area of existing homes across 74 cities increased by 33.4% year-on-year, according to brokerage statistics. Considering the impact of declining average prices, the growth in Beike's existing home transactions should be at least on par with the overall market, if not stronger.

Breaking it down, the GTV transacted by Lianjia, the company's self-operated brand, increased by 30% year-on-year, while the GTV transacted by 3P stores within the platform increased by 21% year-on-year. This indicates that Lianjia's self-operated performance was relatively stronger than that of franchised stores, consistent with the more significant marginal easing of policies in core cities during this round.

Breaking it down, the GTV transacted by Lianjia, the company's self-operated brand, increased by 30% year-on-year, while the GTV transacted by 3P stores within the platform increased by 21% year-on-year. This indicates that Lianjia's self-operated performance was relatively stronger than that of franchised stores, consistent with the more significant marginal easing of policies in core cities during this round.

However, the year-on-year growth rate of revenue from the existing homes business was 14%, significantly lower than the GTV growth rate, reflecting the increasing difficulty and longer cycle of de-stocking existing homes. As a result, Beike's monetization rate for existing homes declined by approximately 0.11 percentage points year-on-year. Nevertheless, as the market improved in the second quarter, with stronger performance in high-tier cities benefiting Lianjia's self-operated business (which generates revenue on a gross basis), the monetization rate rebounded by 0.03 percentage points quarter-on-quarter.

However, the year-on-year growth rate of revenue from the existing homes business was 14%, significantly lower than the GTV growth rate, reflecting the increasing difficulty and longer cycle of de-stocking existing homes. As a result, Beike's monetization rate for existing homes declined by approximately 0.11 percentage points year-on-year. Nevertheless, as the market improved in the second quarter, with stronger performance in high-tier cities benefiting Lianjia's self-operated business (which generates revenue on a gross basis), the monetization rate rebounded by 0.03 percentage points quarter-on-quarter.

II. New Homes Market Still Declining, but Channel Value Becomes More Apparent

In contrast, the new homes market continued to decline due to both the crowding-out effect of the recovering existing homes market and the less elastic recovery of new home supply compared to demand. Consequently, Beike's new home transaction value decreased by approximately 20% year-on-year in the second quarter, similar to the 21% decrease in sales revenue reported by the top 100 real estate developers during the same period. While this performance may not be outstanding, it is not significantly worse than the industry average.

II. New Homes Market Still Declining, but Channel Value Becomes More Apparent

In contrast, the new homes market continued to decline due to both the crowding-out effect of the recovering existing homes market and the less elastic recovery of new home supply compared to demand. Consequently, Beike's new home transaction value decreased by approximately 20% year-on-year in the second quarter, similar to the 21% decrease in sales revenue reported by the top 100 real estate developers during the same period. While this performance may not be outstanding, it is not significantly worse than the industry average.

However, in terms of revenue, as the monetization rate for the new home business continued to increase by 0.2 percentage points quarter-on-quarter (a cumulative increase of 0.5 percentage points year-on-year), the year-on-year decline in new home business revenue was only 9%, significantly outperforming the market expectation of a 16% decrease and the GTV decline. Dolphin Research believes that as land in key urban centers becomes increasingly scarce, and suburban projects lack natural customer flow and face difficulties in de-stocking, the bargaining power of channels over developers is likely to increase in the medium term.

However, in terms of revenue, as the monetization rate for the new home business continued to increase by 0.2 percentage points quarter-on-quarter (a cumulative increase of 0.5 percentage points year-on-year), the year-on-year decline in new home business revenue was only 9%, significantly outperforming the market expectation of a 16% decrease and the GTV decline. Dolphin Research believes that as land in key urban centers becomes increasingly scarce, and suburban projects lack natural customer flow and face difficulties in de-stocking, the bargaining power of channels over developers is likely to increase in the medium term.

III. New Business Track Contributes Over 30% of Revenue

Apart from the first track's housing transaction business, Beike's second track, comprising home decoration, leasing, home furnishing services, and financial services, generated total revenue of RMB 8.1 billion in the quarter, maintaining a high year-on-year growth rate of 85%. By the end of the quarter, the second track accounted for 34.7% of Beike's total revenue. With nearly double the year-on-year growth rate at a considerable scale, it has undoubtedly become the primary driver of the company's revenue growth.

III. New Business Track Contributes Over 30% of Revenue

Apart from the first track's housing transaction business, Beike's second track, comprising home decoration, leasing, home furnishing services, and financial services, generated total revenue of RMB 8.1 billion in the quarter, maintaining a high year-on-year growth rate of 85%. By the end of the quarter, the second track accounted for 34.7% of Beike's total revenue. With nearly double the year-on-year growth rate at a considerable scale, it has undoubtedly become the primary driver of the company's revenue growth.

Specifically, the home decoration business contributed approximately half of the second track's revenue at RMB 4.04 billion, making it the most significant among the new businesses. However, the year-on-year growth rate slowed to 54%, with a notable 17 percentage point decrease. Attention should be paid to management's explanation for this trend, as the market may be concerned about the subsequent growth prospects of the home decoration business. The leasing business, which contributes a smaller proportion of revenue, accounted for 40% of the second track's revenue, with a significant year-on-year growth rate of 167% due to a lower base.

Specifically, the home decoration business contributed approximately half of the second track's revenue at RMB 4.04 billion, making it the most significant among the new businesses. However, the year-on-year growth rate slowed to 54%, with a notable 17 percentage point decrease. Attention should be paid to management's explanation for this trend, as the market may be concerned about the subsequent growth prospects of the home decoration business. The leasing business, which contributes a smaller proportion of revenue, accounted for 40% of the second track's revenue, with a significant year-on-year growth rate of 167% due to a lower base.

When combining all businesses, Beike's total revenue for the quarter was RMB 23.37 billion, significantly higher than the market expectation of RMB 21.8 billion (although this expectation may not have been updated in a timely manner). Nevertheless, the revenue growth rate increased from -19% in the previous quarter to +20%, which is undoubtedly noteworthy.

When combining all businesses, Beike's total revenue for the quarter was RMB 23.37 billion, significantly higher than the market expectation of RMB 21.8 billion (although this expectation may not have been updated in a timely manner). Nevertheless, the revenue growth rate increased from -19% in the previous quarter to +20%, which is undoubtedly noteworthy.

IV. Both Revenue and Profit of Existing Homes Exceed Expectations, While Leasing Business Remains "Puffy"

In terms of contribution margin by segment (excluding human costs such as commission splits, which are close to the gross margin metric): 1) The contribution profit of the existing homes business was RMB 3.483 billion in the quarter, exceeding expectations by nearly 21%, a more significant margin than the revenue exceedance. This was primarily due to the notable recovery in transactions, which also drove an increase of approximately 3 percentage points in the contribution margin of the existing homes business to 47.5%. This reflects the significantly higher profit elasticity once the market recovers; 2) The new homes business, with declining transaction and revenue volumes, had a contribution margin of 25% in the quarter, approximately 3 percentage points lower than market expectations. As a result, despite higher-than-expected revenue, the contribution profit of the new homes business was 4% lower than anticipated; 3) The total contribution profit of all new businesses in the second track also reached RMB 2.24 billion in the quarter, accounting for 29% of the overall total. The new businesses are not merely inflating revenue but also contributing nearly 30% to profits. Specifically, the contribution margin of the home decoration business reached 31.3%, ranking above average among the company's various business segments. However, the contribution margin of the leasing business was only 5.8%, indicating that while it accounts for 40% of the second track's total revenue, it is relatively "puffy," contributing less than 3% of the company's overall profit.

IV. Both Revenue and Profit of Existing Homes Exceed Expectations, While Leasing Business Remains "Puffy"

In terms of contribution margin by segment (excluding human costs such as commission splits, which are close to the gross margin metric): 1) The contribution profit of the existing homes business was RMB 3.483 billion in the quarter, exceeding expectations by nearly 21%, a more significant margin than the revenue exceedance. This was primarily due to the notable recovery in transactions, which also drove an increase of approximately 3 percentage points in the contribution margin of the existing homes business to 47.5%. This reflects the significantly higher profit elasticity once the market recovers; 2) The new homes business, with declining transaction and revenue volumes, had a contribution margin of 25% in the quarter, approximately 3 percentage points lower than market expectations. As a result, despite higher-than-expected revenue, the contribution profit of the new homes business was 4% lower than anticipated; 3) The total contribution profit of all new businesses in the second track also reached RMB 2.24 billion in the quarter, accounting for 29% of the overall total. The new businesses are not merely inflating revenue but also contributing nearly 30% to profits. Specifically, the contribution margin of the home decoration business reached 31.3%, ranking above average among the company's various business segments. However, the contribution margin of the leasing business was only 5.8%, indicating that while it accounts for 40% of the second track's total revenue, it is relatively "puffy," contributing less than 3% of the company's overall profit.

Increased revenue and reduced expenses, resulting in a substantial profit rebound

Above, we analyzed the revenue and profit performance of each segment by business, as well as overall expenses and profit perspectives: 1) Gross profit reached RMB 6.52 billion this quarter, nearly RMB 1 billion higher than expected. Driven by robust growth, gross margin increased by 2.7 percentage points quarter-on-quarter, while the market consensus expected a largely flat quarter-on-quarter gross margin. Breaking it down, the gross margins of both the home decoration and leasing segments improved by less than 1 percentage point quarter-on-quarter, while the primary contribution came from significant improvements in the gross margin of the core business (benefiting from the market recovery).

On the expense side, with the market recovery, Beike's various operating expenses returned to growth quarter-on-quarter, with marketing expenses rising the most significantly (+16% QoQ). From an expectations perspective, only marketing expenses were slightly higher than expected by 2%, while other expenses remained below expectations.

However, due to the stronger revenue growth, all expense ratios still declined significantly, with the combined three expense ratios decreasing by 6 percentage points quarter-on-quarter. Coupled with a gross margin increase of approximately 2 percentage points quarter-on-quarter, compared to the nearly zero profit in the previous quarter, the operating profit margin rebounded directly to 8.6% this quarter. Ultimately, the operating profit for this quarter was RMB 2.02 billion, significantly higher than the expected RMB 950 million. Even after adding back equity incentives, impairment of credit, amortization, etc., the adjusted net profit for this quarter was RMB 2.64 billion, also nearly RMB 800 million higher than expected.

- END -

// Reprint Authorization

This article is an original work of Dolphin Investment Research. For reprinting, please obtain reprint authorization.