1688 opens member stores: Different from Sam's Club in its core, aiming to build a supply chain platform

![]() 08/21 2024

08/21 2024

![]() 431

431

1688 may not simply aim to do B2C or B2B business but to build a path similar to the "upstream flow of agricultural products" for "upstream flow of source factories," helping factories in industrial belts transform from contract manufacturing to new productivity.

"1688 will increase its focus on the C-end market and attempt a membership store model," which has become a focus of industry attention recently, indicating that the fiercely competitive membership store sector will welcome another cross-border player.

As a leading B2B platform, 1688 is striving to shine its "C-end" label. Its proposed membership store model is not simply creating an online "Sam's Club" but targeting the trend of bulk alternative consumption, seeking to differentiate itself from the established membership store players like Costco and Sam's Club, as well as e-commerce entrants represented by East Study.

01 Supply chain platform, the core of the online "Sam's Club"

It is understood that 1688's membership stores will focus on specialized and personalized purchasing behaviors such as "periodic purchases, bulk purchases, scenario-based purchases, and customized purchases." Its core aim is not only to meet individual consumption needs but also to cater to the needs of light entrepreneurs and side hustlers (small B-ends).

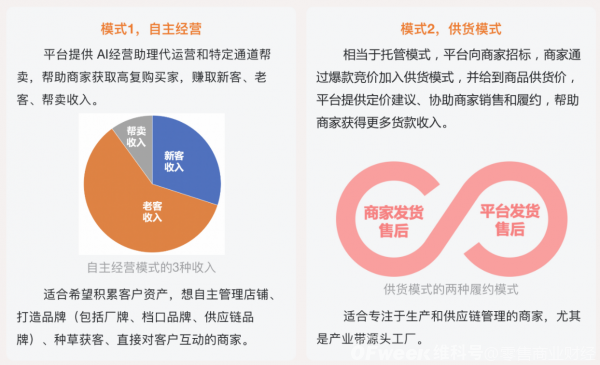

In terms of the model, the core of 1688's membership stores remains the millions of manufacturers on the platform, connecting them with C-ends and small B-ends with long-tail effects. The membership stores are more like a new supply-demand model bridging Taobao (C2C) and 1688 (B2B), aiming to redefine the boundaries between retail and wholesale ecosystems.

This model opens up new business opportunities for manufacturers by reaching a broader user base. However, the challenge lies in the significant difference between B-end procurement and C-end/small B-end procurement models. The former tests supply capabilities such as production capacity and customization, while the latter requires service and operational capabilities.

Whether manufacturers, accustomed to dealing with B-end procurement, can adapt to and promptly meet the diverse needs of new customer segments in the face of diversified business growth remains to be seen over time.

It is worth noting that most factories follow a low-margin, high-volume business model, with profits sometimes reaching single digits. Under this model, it remains questionable whether factories are willing to participate in small-batch purchases.

According to "Business News," after 1688 vigorously introduced C-end traffic, merchants faced costs for free shipping exceeding product prices, and pressures from inventory management and marketing investments soared.

Shifting from B-end to C-end, the challenge for the platform goes beyond merely opening up a traffic channel; it also involves balancing the mismatch in demand between supply and demand sides.

Currently, 1688 is leveraging AI technology to launch a "butler" service for store operations, but its effectiveness remains to be seen. However, taking a deeper look, 1688's move may also aim to accelerate manufacturers' transformation, potentially giving birth to a new brand within this model. The story of "Taobao brands" may be repeated in "Taobao factories."

Image source: Internet

Overall, 1688's membership stores tap into consumers' "wholesale-oriented" family stockpiling needs. They build a new supply system centered on user groups, offering services ranging from product endorsement to development and omnichannel operations across online and offline channels.

Although membership stores share similarities, they differ in business logic from those like Sam's Club and Costco. Their core suppliers are factories rather than well-known brands. Based on current information, 1688's supply focus remains on factories rather than building its own brands.

1688's move presents a new industry approach, distinguishing itself from traditional membership stores focused on building supply chains around proprietary brands. Instead, 1688 constructs a "supply chain platform" that brings source factories to the forefront with innovative thinking.

02 Moving to the forefront, redefining the boundaries between "retail and wholesale"

For 1688, membership stores are just one of its moves to step into the spotlight and align with consumption trends.

In recent years, the trend of "quality-to-price ratio" has gained momentum, transforming consumption patterns and providing a lift-off opportunity for 1688, a hub for contract manufacturing. As the source of domestic e-commerce, 1688 boasts numerous contract manufacturers for well-known and even international brands, attracting consumers with "high-quality, low-cost" products.

It is reported that in 2022, 1688's "first customer" shifted from sellers to buyers, with 97% of GMV contributed by small B-end buyers. Many "big C, small B" users flooded the platform. By the end of 2023, Yu Yong, CEO of 1688, said in an interview that the current user growth rate was over 40%.

Thus, in 2023, 1688 officially launched its membership-based "white label supermarket" PLUS membership stores, featuring discounted prices for big brands and enabling consumers to directly access source products from brand contract manufacturers in a non-self-operated model, catering to the procurement needs of individuals and families in the Z generation and the new middle class. On September 6, 2023, during the "Merchants' Festival," the number of 1688 PLUS membership buyers increased by over 140% year-on-year.

In March this year, 1688 embarked on a "full integration into Taobao" strategy, opening 1688 Selected Taobao stores, 1688 Business Self-Procurement Tmall stores, and 1688 Industrial Expert Selection Tmall stores. The Selected stores focus on consumer goods; Industrial Expert Selection stores specialize in industrial products; and Business Self-Procurement stores cater to office supplies.

Image source: Taobao

At that time, according to media reports, 1688's Taobao stores would be integrated into "channels" to continuously sell source factory products on Taobao.

Among them, 1688 Selected directly "targets" Sam's Club, with test page product copy featuring the phrase "Sam's Club alternative." In particular, its focus on personal stockpiling scenarios aims to provide users with lower-priced alternatives from Sam's Club's contract manufacturers and source suppliers.

Gradually moving from behind the scenes to the forefront is not only 1688's response to consumer demands but also a manifestation of Ali Group's reassessment and adjustment of business priorities.

In November 2023, following Ali Group's business adjustments, 1688 and Xianyu became "first-tier businesses," elevating 1688's internal status. Industry insiders believe this signals Ali's intensified focus on low-price competition.

However, according to Retail Business Review, 1688's platform nature does not solely equate to "low prices"; its core logic lies in wholesale, which caters not to single purchases but to bulk orders. In other words, 1688's low prices differ from the price competitiveness that e-commerce platforms have cultivated around "retail" in recent years. Pushing 1688 into the spotlight is a result of Ali redefining the boundaries between retail and wholesale, centered on "quality improvement and efficiency enhancement" for merchants.

From an industry perspective, 1688's true ambition may not be simply B2C or B2B business but to build a path similar to "upstream flow of agricultural products" for "upstream flow of source factories," helping factories in industrial belts transform from contract manufacturing to new productivity.

An insider at 1688 once revealed that the purpose of opening stores on Taobao was not to sell products but to test products in a larger market, incubate super products, and transform them into commodities within 1688's digital supply chain for sales across the entire network, transforming 1688 from a source of the entire network to a source of new products.

"1688's overall strategy in the future is to become China's strongest digital supply chain. This is our core main strategy," said Yu Yong, CEO of 1688.

Returning to the new move of deploying the membership store model, the consumption scenarios targeted by 1688 (periodic purchases, bulk purchases, etc.) exhibit high-frequency repurchase characteristics. These consumption data can assist manufacturers in transforming their product offerings towards newer, more popular products with greater sales potential.