Asian Auto Market | March 2025: BYD Leads, Chinese Brands Rise in Singapore

![]() 04/22 2025

04/22 2025

![]() 440

440

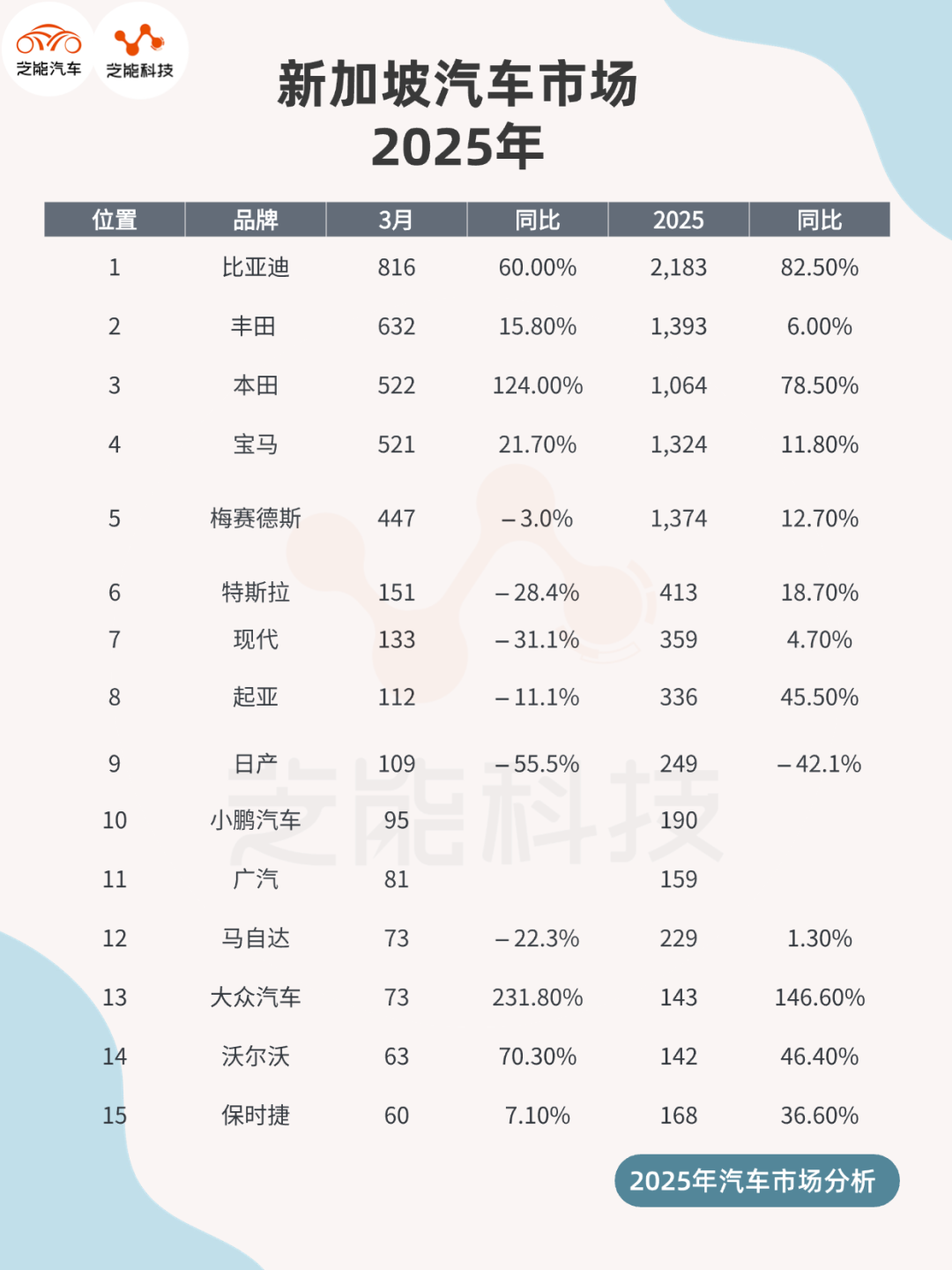

In March 2025, Singapore's auto market extended its growth trajectory, with new car sales surging 23.5% year-on-year to 4,333 units, and cumulative sales for the first quarter rising 33.7%.

BYD emerged as the market leader with an 18.8% share, marking a 60% increase from the previous year. Traditional heavyweights such as Toyota, Honda, BMW, and Mercedes-Benz maintained their top-five positions, while Tesla, Hyundai, and Nissan saw notable sales declines.

01

Singapore - March 2025

Sales Overview & Brand Performance

Singapore's new car sales reached 4,333 units in March 2025, up 23.5% year-on-year, with cumulative sales for the first quarter totaling 10,914 units, a 33.7% increase.

While specific powertrain data is not public, based on market trends and 2024 figures (EVs accounted for 33.6%), EVs are anticipated to maintain a substantial share of around 30%-35%, primarily fueled by brands like BYD, Tesla, and XPeng.

Hybrid vehicles (HEV/PHEV), led by Toyota and Honda, are expected to account for 20%-25% of the market, while traditional internal combustion engine (ICE) vehicles continue to lose ground, primarily confined to luxury brands like BMW and Mercedes-Benz.

● Brand Sales Rankings & Performance

◎ BYD: Led with 816 sales and an 18.8% market share, up 60% year-on-year. Models like the Atto 3, Dolphin, and Seal continue to attract consumers due to their pricing advantage under Category A COE (Certificate of Entitlement). Cumulative sales for the first quarter were 2,183 units, up 82.5% year-on-year.

◎ Toyota (including Lexus): Sold 632 units, accounting for a 14.6% market share, up 15.8% year-on-year, ranking second.

◎ Honda: Sold 522 units, accounting for a 12.0% market share, up 124% year-on-year, ranking third.

◎ BMW: Sold 521 units, accounting for a 12.0% market share, up 21.7% year-on-year, ranking fourth.

◎ Mercedes-Benz: Sold 447 units, accounting for a 10.3% market share, down 3% year-on-year, ranking fifth.

◎ Tesla: Sold 151 units, accounting for a 3.5% market share, down 28.4% year-on-year, ranking sixth.

◎ Hyundai: Sold 133 units, accounting for a 3.1% market share, down 31.1% year-on-year, ranking seventh.

◎ Kia: Sold 112 units, accounting for a 2.6% market share, down 11.1% year-on-year, ranking eighth.

◎ Nissan: Sold 109 units, accounting for a 2.5% market share, down 55.5% year-on-year, ranking ninth.

◎ XPeng Motors: Sold 95 units, accounting for a 2.2% market share, entering the top ten for the first time.

● Chinese Brands Excel in Singapore

◎ BYD led with 816 sales and an 18.8% market share.

◎ XPeng Motors entered the top ten with 95 sales, showcasing significant year-on-year growth, with the G6 and P7 models capturing attention.

◎ Brands like GAC (81 units, 1.9%), Chery (32 units, 0.7%), Dongfeng (25 units, 0.6%), and Zeekr (23 units, 0.5%) recorded positive growth despite lower sales, reflecting the rapid expansion of Chinese brands in the EV sector. In 2024, Chinese brands accounted for 70.7% of total EV sales in the market, a trend expected to persist in 2025.

02

Competitive Landscape Analysis

● Singapore's auto market, spurred by government EV promotion policies and the pricing advantage of Category A COE, is witnessing heightened competition in the EV segment.

◎ BYD has solidified its market leadership with a diverse product portfolio encompassing the Atto 3, Dolphin, and Seal, coupled with a dynamic sales strategy through multiple dealer networks. Its 18.8% share surpasses Tesla's (3.5%), which has seen waning competitiveness due to price adjustments and a limited product line consisting of the Model 3/Y.

◎ The entry of emerging Chinese brands like XPeng has further intensified competition in the pure electric market, with their strategy of affordable prices and high specifications appealing to young consumers.

◎ Traditional brands such as BMW and Mercedes-Benz have ventured into the market with premium EV models like the iX1 and EQS, but their high price points constrain their market share.

◎ Hybrid vehicles, spearheaded by Toyota and Honda, remain a vital component of the market, particularly in the mid-range segment. Toyota's Corolla and Honda's HR-V attract cost-conscious consumers with their reliability and fuel efficiency.

◎ The ICE vehicle market is primarily supported by luxury brands like BMW and Mercedes-Benz, but overall demand is waning, evidenced by Mercedes-Benz's 3% year-on-year sales decline in March.

● The success of Chinese brands in the Singapore market can be attributed to several key factors:

◎ First, they offer robust price competitiveness, with BYD and XPeng models primarily positioned under Category A COE, reducing purchase costs.

◎ Second, they boast rapid product iteration, delivering superior intelligence and endurance performance compared to some traditional brands.

◎ Third, their multi-dealer model and adaptable marketing strategies enhance market coverage. In contrast, traditional brands like Nissan and Hyundai have been slower in their EV transitions, with lagging product updates, leading to market share erosion.

● The competitive landscape in Singapore's market is polarizing: Chinese brands are swiftly expanding with EVs at their core, while traditional brands rely on hybrids and luxury ICE vehicles to maintain their footing.

In the near term, BYD's leading position is unlikely to be challenged, and with continued investments from emerging brands like XPeng and GAC, the EV market share is expected to exceed 40%, with Chinese brands potentially capturing half of the market.

Summary

In March 2025, Singapore's auto market achieved robust growth of 23.5%, fueled by the EV boom, with BYD firmly established at the top with an 18.8% market share. The swift penetration of emerging brands like XPeng and GAC underscores the competitive edge of Chinese EVs.