Wendatong rushes to IPO in Hong Kong: 60% of revenue comes from property services

![]() 08/21 2024

08/21 2024

![]() 525

525

This article is written based on publicly available information and is intended for information exchange only, not constituting any investment advice.

Produced by | IPO Team, Company Research Lab

On August 13, Qingdao Wendatong Technology Co., Ltd. (hereinafter referred to as "Wendatong") submitted its listing application to the Hong Kong Stock Exchange's main board, with Shansheng Securities International and Hope Capital as its joint sponsors.

In 2014, Wendatong was listed on the New Third Board. Since 2021, Wendatong has successively aimed to list on the ChiNext and Beijing Stock Exchange, but due to changes in the market environment, Wendatong shifted its listing destination to the Hong Kong Stock Exchange in 2024.

At its inception, Wendatong was a company focused on smart products such as fingerprint locks, fingerprint access control, and building intercom systems. Today, Wendatong has transformed into an enterprise primarily focused on smart city construction and property services.

In 2021, Wendatong won the bid for a PPP project from the Qingdao West Coast New Area Bureau of Industry and Information Technology, leading to a significant increase in the company's revenue in 2022, albeit accompanied by an increase in debt. In recent years, the debt ratio has consistently hovered around the high level of 70%.

Before applying for IPO in Hong Kong, the company received 10 questions from the Listing Division

Founded in 2001, Wendatong is a subsidiary of Ruiyuan Holdings Group, specializing in smart community construction, smart city construction, property services, and urban lifestyle services.

According to public information, Ruiyuan Holdings Group was established in 1997 and is involved in various fields such as green construction, healthcare, smart cities, high-end intelligent manufacturing, real estate development, financial services, cross-border e-commerce, education, ecological agriculture, and port logistics. Wendatong falls under the smart city segment.

In December 2011, Wendatong was converted into a joint-stock limited company and listed on the New Third Board in January 2014.

In the past few years, Wendatong has been seeking opportunities to list on the A-share market, but without success.

In September 2021, Wendatong filed for Tutoring registration with the Qingdao Securities Regulatory Bureau, aiming for a listing on the ChiNext. In November 2022, the company shifted its listing target to the Beijing Stock Exchange, but still failed to achieve its goal. In December 2023, Wendatong withdrew its Tutoring registration .

After the ChiNext and Beijing Stock Exchange, Wendatong turned its attention to the Hong Kong Stock Exchange. In July 2024, Wendatong announced its intention to apply for listing in Hong Kong. On August 13, Wendatong officially submitted its listing application to the Hong Kong Stock Exchange.

However, on August 8, five days before submitting its application to the Hong Kong Stock Exchange, the company received an annual report inquiry letter from the Listing Division, raising 10 questions related to revenue, accounts receivable and contract assets, other receivables, and goodwill. Among them, the question about accounts receivable and contract assets is primarily related to the PPP project won by Wendatong in 2021.

In the inquiry letter, the Listing Division requested Wendatong to submit relevant explanations by August 22, 2024. Currently, there has been no public response from Wendatong.

Property services account for over 40% of revenue, with PPP project revenue declining sharply in 2023

Wendatong's revenue primarily comes from three sources: information system integration solutions services, property services, and community lifestyle services.

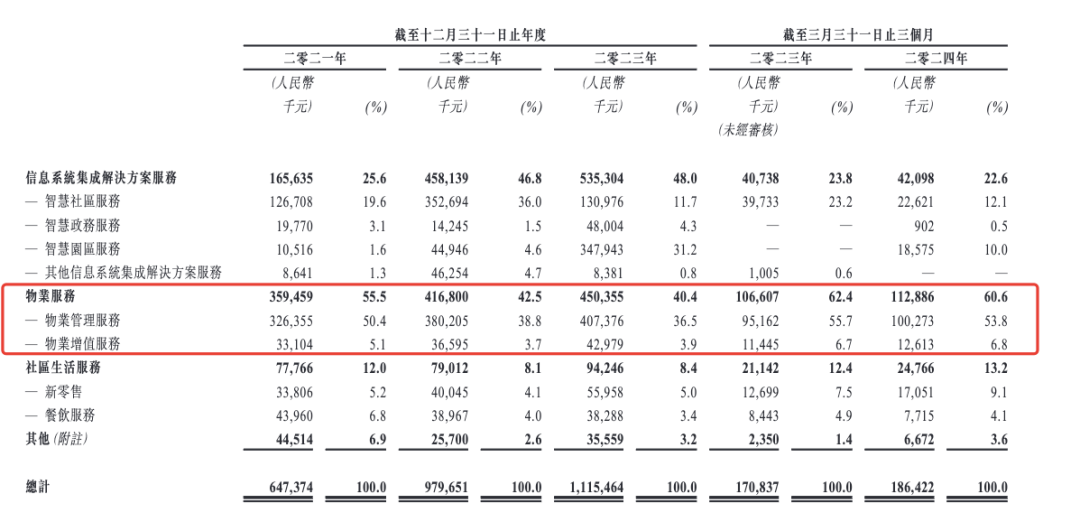

From 2021 to 2023 and the first three months of 2024, Wendatong's revenue was 650 million yuan, 980 million yuan, 1.12 billion yuan, and 190 million yuan, respectively. Among them, revenue from property services was 360 million yuan, 420 million yuan, 450 million yuan, and 110 million yuan, accounting for 55.5%, 42.5%, 40.4%, and 60.6% of total revenue, respectively.

In the inquiry letter, the Listing Division was more concerned with Wendatong's smart community services rather than its property services. This business segment saw a surge in revenue in 2022 but a significant decline in 2023.

In 2021, Wendatong signed a PPP contract with the Qingdao West Coast New Area Bureau of Industry and Information Technology for the construction and maintenance of smart communities and streets. The project had a construction period of two years and an operation period of eight years.

According to the announcement at the time, the total investment in the project was approximately 609 million yuan, with a feasibility gap subsidy of 1.051 billion yuan. Wendatong contributed 110 million yuan, accounting for 90% of the total, funded by its own capital.

According to the prospectus, the project completed its construction phase in January 2024 and transitioned to the operation phase in February 2024.

In 2021 and 2022, the project generated revenue of 94.349 million yuan and 320 million yuan, respectively. In 2022, this PPP project contributed substantially to Wendatong's revenue.

However, this growth trend did not continue into 2023 and the first three months of 2024, with revenue from the PPP project dropping to 110 million yuan and 5.53 million yuan, respectively.

In the inquiry letter, the Listing Division requested Wendatong to explain the initial investment scale and funding sources of the smart community project, the rights and obligations of the project company and the government, the cooperation model, and the progress of the construction and operation phases, including whether the project progress fell short of planned or expected timelines.

Currently, Wendatong has not yet responded.

PPP project increases debt burden, with debt ratio hovering around 70%

While PPP projects can provide policy subsidies or stable expected revenue for enterprises, they pose a significant challenge to the financial capabilities of these enterprises.

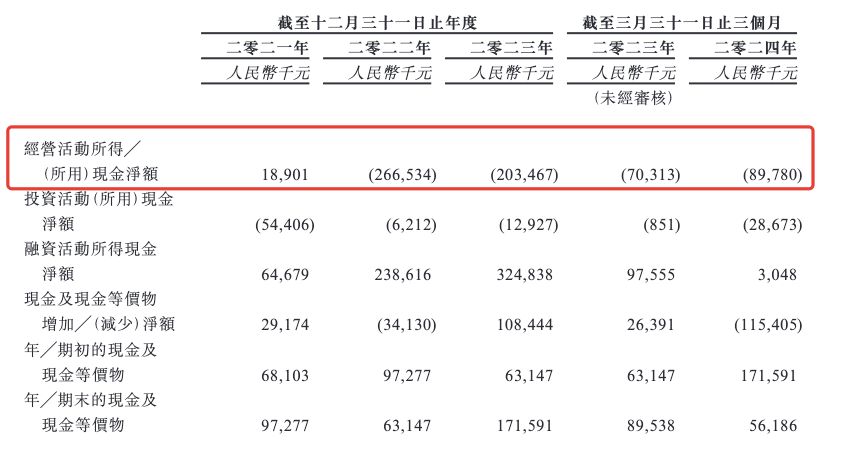

From a cash flow perspective, Wendatong's net operating cash flow has been consistently negative since 2022.

From 2021 to 2023 and the first quarter of 2024, Wendatong's net cash flow from operating activities was 18.901 million yuan, -270 million yuan, -200 million yuan, and -89.78 million yuan, respectively.

After winning the bid for the PPP project, Wendatong conducted multiple financing rounds.

According to the prospectus, in March 2022, Wendatong signed a syndicated loan contract with the Qingdao West Coast New Area Branch of the Agricultural Bank of China and the Qingdao Branch of Industrial Bank for the smart community and smart street PPP project, with a loan limit of up to 479 million yuan and a loan term of 10 years.

However, bank loans also increased Wendatong's debt ratio.

From 2021 to the first quarter of 2024, Wendatong's asset-liability ratio was 59.46%, 69.08%, 71.23%, and 69.63%, respectively. Since 2022, Wendatong's debt ratio has consistently remained at a high level of around 70%.

To address this, Wendatong has conducted two private placements.

In April 2021, Wendatong initiated its first private placement, aiming to raise 89.285 million yuan and successfully raising the full amount. In December 2022, Wendatong launched its second private placement, targeting 85 million yuan and raising 63.945 million yuan.

The proceeds from these two private placements were primarily used to supplement working capital and repay bank loans/borrowings.

In addition to private placements, Wendatong has also set its sights on the capital market. Since 2021, the company has successively pursued listings on the ChiNext and Beijing Stock Exchange, and now it has shifted its listing destination to the Hong Kong Stock Exchange.

According to the announcement, the proceeds from this IPO will be used by Wendatong to enhance smart city solution capabilities, upgrade products, expand business through strategic alliances, investments, and acquisitions, strengthen staffing and talent pools, repay part of its borrowings, and fund operating capital and other general corporate purposes.