Xiaomi's first quarterly report for its automotive division: annual sales target achieved ahead of schedule, losing 66,000 yuan per car sold

![]() 08/22 2024

08/22 2024

![]() 517

517

Bianniushi News Today

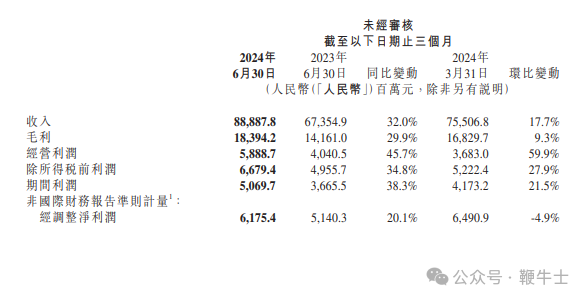

On August 21st, Xiaomi released its second-quarter financial report for 2024, reporting revenue of 88.89 billion yuan, an increase of 32% year-on-year, exceeding market expectations of 86.85 billion yuan. Adjusted net profit was 6.2 billion yuan, a year-on-year increase of 20.1%.

In the second quarter of 2024, Xiaomi Group invested 5.5 billion yuan in research and development, a year-on-year increase of 20.7%. Xiaomi attributed this growth to increased R&D expenses related to innovative businesses such as smart electric vehicles. The total number of R&D personnel reached 18,290.

In the second quarter of 2024, Xiaomi's gross profit was 18.39 billion yuan, representing a nearly 30% increase from the same period last year, with an overall gross margin of 20.7%.

Business Segments Overview:

1. Xiaomi Mobile x AIoT

In the second quarter, revenue from the Mobile x AIoT segment reached 82.5 billion yuan, a year-on-year increase of 22.5%, with a gross margin of 21.1%.

In June 2024, Xiaomi's global monthly active user count reached a new high of 670 million, up 11.5% year-on-year. As of June 30, 2024, the number of IoT devices connected to Xiaomi's AIoT platform (excluding smartphones, tablets, and laptops) increased to 820 million, up 25.6% year-on-year.

1. Smartphones

In the second quarter, Xiaomi shipped 42.2 million smartphones globally, up 28.1% year-on-year, generating revenue of 46.5 billion yuan, up 27.1% year-on-year, with a gross margin of 12.1%.

According to third-party data, Xiaomi's smartphone shipments ranked top three in 58 global markets and top five in 70 markets. Its market share in Latin America and Southeast Asia reached 18.6% and 17.2%, respectively. In the Middle East, Xiaomi maintained its second position in shipments.

2. IoT and Consumer Products

In the second quarter, revenue from IoT and consumer products reached a record high of 26.8 billion yuan, up 20.3% year-on-year, with a gross margin of 19.7%, up 2.2 percentage points year-on-year.

As of June 30, 2024, Xiaomi Group's cash reserves amounted to 141 billion yuan.

3. Internet Services

In the second quarter, revenue from internet services reached a record high of 8.3 billion yuan, up 11.0% year-on-year, with a gross margin of 78.3%, up 4.2 percentage points year-on-year.

Advertising revenue reached 6 billion yuan, up 16.9% year-on-year, while game revenue was 1 billion yuan.

2. New Energy Vehicles

This is Xiaomi's first disclosure of its automotive business performance.

Xiaomi's smart electric vehicles and other innovative businesses generated revenue of 6.4 billion yuan, of which 6.2 billion yuan came from car sales.

In terms of sales, Xiaomi delivered 27,307 SU7 vehicles in a single quarter, achieving over 10,000 deliveries per month for two consecutive months.

This translates to an average selling price of approximately 227,000 yuan per SU7 series vehicle.

The financial report shows that innovative businesses such as smart electric vehicles incurred an adjusted net loss of 1.8 billion yuan.

In other words, Xiaomi incurred an average loss of approximately 66,000 yuan for each SU7 sold in the second quarter.

Of course, given Xiaomi's relatively late entry into the automotive market and its current lack of market scale, short-term losses are inevitable, and some upfront investment costs are also factored into these losses. Therefore, the above results are for reference only.

Furthermore, as of June 30, 2024, Xiaomi Group had cash reserves of 141 billion yuan, indicating that as long as Xiaomi's automotive business continues to grow, the company has sufficient funds to support its expansion to a larger scale.

In terms of gross margin, Xiaomi's smart electric vehicles and other innovative businesses achieved a gross margin of 15.4% in this quarter, which is at the industry average.

For comparison, NIO had a gross margin of 20.6% in the first quarter, Xpeng's was 14% in the second quarter, and Li Auto's was 9.2% in the first quarter. Thalys had a gross margin of 21.5% in the first quarter, while Tesla's automotive gross margin was 14.6% in the second quarter, and BYD's was 23% in the first quarter.

Compared to other manufacturers, as a newcomer, Xiaomi's automotive gross margin is relatively good.

During the earnings call, Lei Jun, Xiaomi's CEO, expressed satisfaction with this gross margin level, which he attributed to Xiaomi's supply chain management capabilities, intelligent manufacturing standards, and suppliers' confidence in Xiaomi. Xiaomi's automotive suppliers offer Xiaomi cost benefits based on larger order volumes, releasing significant costs in advance.

The financial report indicates that Xiaomi expects to complete its annual delivery target of 100,000 vehicles ahead of schedule in November and aims to achieve a new annual target of 120,000 vehicles.

As of June 30, 2024, Xiaomi had 87 automotive sales outlets covering 30 cities in mainland China.