How does Manbang navigate growth in a competitive market?

![]() 08/22 2024

08/22 2024

![]() 495

495

The digital freight platform Manbang Group has achieved a round of countercyclical growth.

It is understood that the current freight market sentiment is not high. According to the research report of Guotou Securities, since August, the national truck freight traffic index has decreased by 4.2% year-on-year. Additionally, according to the China Federation of Logistics & Purchasing, the growth rate of road transport capacity is higher than that of cargo supply, resulting in an oversupply of vehicles and a shortage of cargo.

Despite this background, Manbang has not deviated from its growth trajectory. According to the company's recent financial report, in the first half of this year, Manbang achieved revenue of RMB 5.033 billion, a year-on-year increase of 33.70%; net profit reached RMB 1.427 billion, a year-on-year increase of 39.83%.

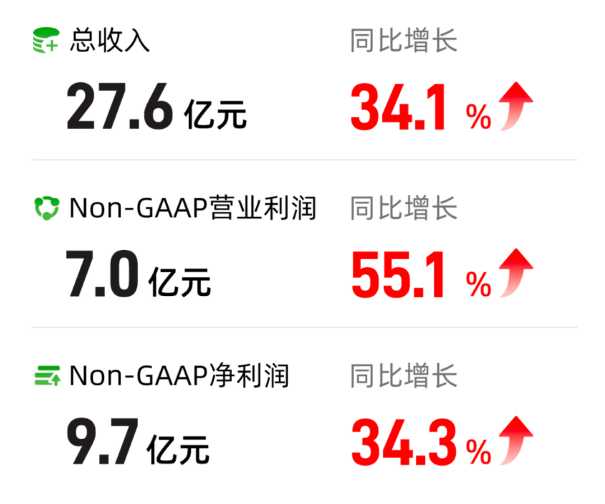

In particular, in the second quarter, Manbang Group generated revenue of RMB 2.76 billion, a year-on-year increase of 34.1%; net profit was RMB 970 million, a year-on-year increase of 34.3%, both setting new record highs.

From a business segment perspective, in the second quarter, Manbang's freight brokerage service revenue was RMB 1.165 billion, a year-on-year increase of 22.7%; freight information publishing service revenue was RMB 212 million, a year-on-year increase of 5.6%; and transaction service revenue was RMB 952 million, a year-on-year increase of 63.4%.

Upon closer examination, in a market with low sentiment, the company's ability to maintain stable business growth is largely attributable to measures that stimulate demand.

According to the financial report, in the second quarter, Manbang achieved new breakthroughs in key data indicators by continuously strengthening brand promotion and implementing a supply-side combination of "instant access to good cargo + driver rating system + driver behavior score".

The financial report shows that as of the second quarter, Manbang had 2.65 million monthly active shippers, a year-on-year increase of 32.8%; the number of active drivers who fulfilled contracts over the past 12 months reached 3.98 million, setting a new peak; the fulfillment rate reached 33.7%, and the platform fulfilled 49.1 million orders, both setting new records.

Furthermore, actively responding to new demands of the times has also strengthened the company's growth momentum.

It is reported that in July this year, the "Decision of the CPC Central Committee on Further Comprehensively Deepening Reforms and Advancing China's Modernization" clearly stated, "We must improve institutional mechanisms for developing new types of productivity tailored to local conditions."

Against this backdrop, Manbang continues to solidify its digital foundation and promote the green transformation and upgrading of its business, including focusing on the construction and upgrade of new logistics infrastructure and increasing investments in new energy transport capacity. The financial report shows that in the first half of 2024, the proportion of new energy transport capacity in Manbang's fulfilled orders approached 20%, and the growth rate of new energy transport capacity orders doubled.

Based on the current development achievements, Manbang Group expects continued strong growth, with revenue for the third quarter of 2024 projected to reach RMB 27.6-28.2 billion, an increase of 21.9%-24.6% year-on-year.

However, the future development trend of the industry remains challenging. Yan Qinghua, Director of the Network Business Department and Secretary-General of the Logistics Information Service Platform Branch of the China Federation of Logistics & Purchasing, once stated that China's transport capacity market is currently oversupplied, with more drivers than available loads. This situation has also affected drivers' actual earnings.

According to the "2023 Survey Report on the Employment Status of Truck Drivers" released by the CFLP, over 50% of individual drivers earn less than RMB 10,000 per month on average, and over 60% do not have stable cargo sources.

In addition, according to the survey, truck drivers face several issues when using freight platforms, such as low cargo quotes, low barriers to entry for vehicles, difficulty in securing orders, and repeated or inaccurate cargo information.

This implies that there is still significant room for upgrading the digital freight industry. For leading companies like Manbang, it is essential to play a demonstrative role while also focusing on cost management and stabilizing profit levels during the improvement of business operations.

According to the financial report, in the second quarter of 2024, Manbang Group's costs and expenses were RMB 2.2 billion, an increase of 27% from RMB 1.734 billion in the same period last year. Among them, sales and marketing expenses were RMB 372.3 million, general and administrative expenses were RMB 219.2 million, and research and development expenses were RMB 223.1 million.

Overall, facing challenges in a downturn market, Manbang needs to be better prepared.