ZEEKR's first 'report card' reveals signs of 'turning losses into profits'

![]() 08/23 2024

08/23 2024

![]() 420

420

ZEEKR has released its first financial report since going public.

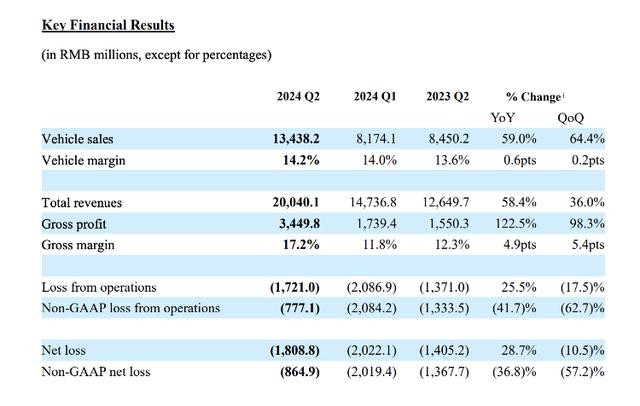

According to the report, in the second quarter of 2024, ZEEKR delivered 54,811 vehicles, a year-on-year increase of 100%, setting a new quarterly record since the brand began deliveries; achieved operating revenue of over RMB 20 billion, a new high, with a year-on-year increase of 58% and a quarter-on-quarter increase of 36%; and achieved a gross profit margin of 14.2% for complete vehicles, an increase of 0.6 percentage points year-on-year and 0.2 percentage points quarter-on-quarter.

Investors' reactions have also been positive. It is reported that as of the close of U.S. stock markets on August 21, ZEEKR's share price was $16.8, up 10.71%.

From key operating indicators, ZEEKR has indeed demonstrated strong growth momentum and reflects the high market sentiment to a certain extent. According to the China Association of Automobile Manufacturers (CAAM), China's new energy vehicle production and sales reached 4.929 million and 4.944 million units respectively from January to June 2024, up 30.1% and 32% year-on-year, with a market share of 35.2%.

Regarding this, Chen Shihua, Deputy Secretary-General of CAAM, said, "New energy vehicle consumption has become a new consumption trend, especially after 'oil and electricity have the same price' and 'electricity is cheaper than oil,' more and more consumers are willing to buy new energy vehicles."

However, it is well known that competition in the current new energy vehicle industry continues to intensify, and it is not easy for related automakers to achieve sales breakthroughs. ZEEKR's current growth is also supported by a set of basic strategies.

According to Tianyancha, ZEEKR was established in 2021. In just over three years, it has launched four models, including the ZEEKR 001, ZEEKR 007, ZEEKR 009, and ZEEKR X, which have contributed to the growth in sales.

Among them, the ZEEKR 001 is the company's main source of revenue growth. It delivered over 10,000 units for three consecutive months in the second quarter, firmly occupying the top spot in the sales of pure electric vehicles priced above RMB 250,000.

To achieve such sales volume, companies need to strengthen their efforts in R&D, channel layout, and other aspects. According to the financial report, in terms of R&D, since its establishment, ZEEKR has invested over RMB 21.5 billion in R&D, and the company's R&D investment reached RMB 2.62 billion in the second quarter of this year, an increase of nearly 90% year-on-year.

Based on full-stack self-research and development, ZEEKR's intelligent driving capabilities are continuously improving. According to the company, the 2025 ZEEKR 001 series will receive significant upgrades to its intelligent driving capabilities without changing the price, including replacing the intelligent driving chip with NVIDIA's dual Orin-X chips, upgrading the computing power from 48TOPS to 508TOPS, with a single chip's computing power being 3.5 times that of Tesla's HW3.0.

In terms of channel construction, the financial report shows that as of the end of July 2024, ZEEKR had opened 438 stores worldwide; the number of ZEEKR Homes, which integrate test drives, sales, deliveries, and after-sales services, increased to 79 and is planned to increase to 140 by the end of the year.

In addition, as of now, ZEEKR has entered nearly 30 international mainstream markets, including Sweden, the Netherlands, Thailand, and Mexico, and plans to enter 50 countries and regions worldwide by the end of the year.

Overall, ZEEKR has formed a solid foundation for development in terms of product development and channel construction. It is worth mentioning that in the second half of this year, ZEEKR will launch two new models, the ZEEKR 7X and the ZEEKR MIX. The former is expected to be launched at the end of September, and the latter will be officially launched in the fourth quarter, which may provide further support for the company's performance growth.

However, maintaining a balance between profits and losses is also a major challenge in this process. Currently, although ZEEKR has turned losses into profits after excluding the impact of share-based payments, inherent expenses related to R&D, sales, and other aspects still pose considerable pressure on the company's profitability. Financial report data shows that in the second quarter of this year, ZEEKR's sales and administrative expenses increased by 61.3% year-on-year to RMB 2.605 billion.

In addition, to boost sales growth, ZEEKR has implemented some price reductions. For example, the 2025 ZEEKR 007, with the exception of the top-of-the-line all-wheel-drive performance version, has seen price reductions of RMB 20,000 to RMB 30,000 across other versions with upgraded configurations. Such decisions may also have a certain impact on the company's profitability.

At the earnings call, the company's management stated that after turning profits in the second quarter, ZEEKR expects its gross profit margin to continue to improve in the second half of this year and has guided for a full-year gross profit margin of 15% for complete vehicles.

Whether ZEEKR can achieve its phased goals depends on whether it has mastered a more effective development methodology.