Is Ke Holdings stable after its transformation?

![]() 08/23 2024

08/23 2024

![]() 466

466

Text/Dou Wenxue

Editor/Ziye

In 2024, as the real estate market continued to adjust, Ke Holdings, a real estate transaction service platform, was also affected by the broader economic environment.

Recently, Ke Holdings released its interim results for 2024. Compared to last year's counter-cyclical growth, several key financial indicators recorded declines in the first half of 2024.

During the reporting period, Ke Holdings achieved total operating revenue of RMB 39.75 billion, a year-on-year decrease of 0.04%; net profit attributable to shareholders was RMB 2.324 billion, a year-on-year decrease of 42.70%; and gross profit was RMB 10.64 billion, a year-on-year decrease of 9.01%.

However, Ke Holdings' stabilization can still be observed in its quarterly performance.

According to its unaudited financial data for the second quarter, Ke Holdings achieved net revenue of RMB 23.4 billion, a year-on-year increase of 19.9%; net profit was RMB 1.9 billion, a year-on-year increase of 46.2%; and adjusted net profit reached RMB 2.69 billion, a year-on-year increase of 13.9%.

Ke Holdings' second-quarter financial data, Source: Ke Holdings' official WeChat account

In terms of quarter-on-quarter growth, Ke Holdings' net revenue in the second quarter increased by 43.67% compared to the first quarter, and its net profit attributable to shareholders surged more than three times.

Ke Holdings' performance has always been a microcosm of the real estate industry, and its significantly better performance in the second quarter compared to the first also indicates that the easing of real estate policies in May this year has had an impact on the market. Ke Holdings has also undergone a series of adjustments, reversing the somewhat sluggish performance in the first quarter.

On the other hand, the difficulty in selling homes is evident in Ke Holdings' performance report. In the first half of 2024, Ke Holdings achieved a total transaction value of RMB 1,468.9 billion, a year-on-year decrease of 16.2%. Among them, new home transactions plunged, while second-hand home transactions declined less significantly.

While its core business is struggling due to the environment, its "side hustle" is thriving, earning Ke Holdings the reputation as a "model of alpha outperforming beta."

Since 2021, Ke Holdings has positioned its rental and home improvement businesses as the "two wings" of the company, complementing its "one body" of real estate brokerage to form a new growth trajectory. In 2023, Ke Holdings upgraded its "two wings" to "three wings" by launching a third line of business – residential development.

From the financial report, it can be seen that Ke Holdings' first two wings have achieved impressive results, with both its home rental services and home improvement businesses experiencing varying degrees of growth.

Its newly launched "third wing" also successfully secured its first deal recently. On July 30, Ke Life, a subsidiary of Ke Holdings, acquired two residential land parcels in Xi'an, marking its first successful land acquisition.

For its future development, Ke Holdings has sent a new signal to the secondary market.

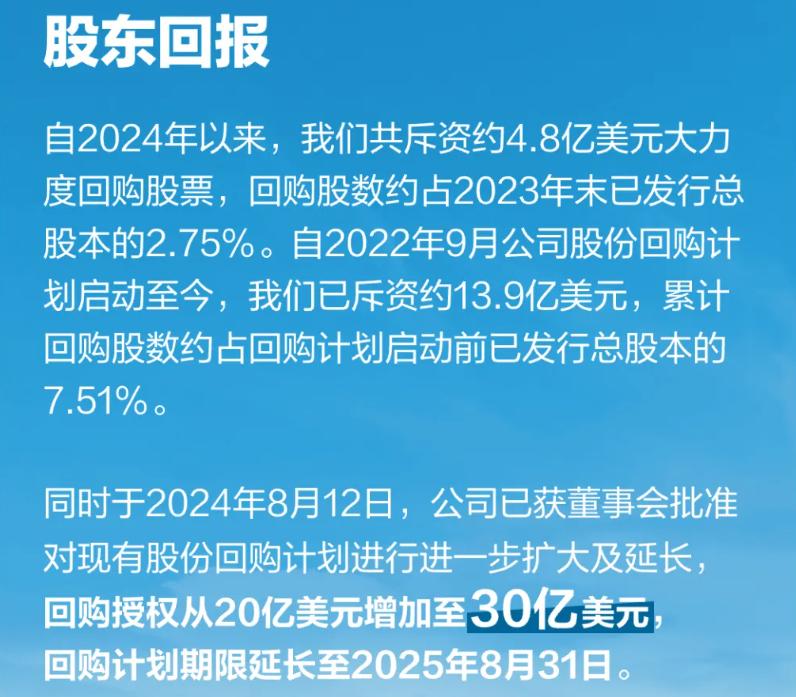

Alongside its earnings report, Ke Holdings announced an expanded and extended share repurchase program, increasing the authorization for share repurchases from USD 2 billion to USD 3 billion and extending the repurchase program until August 31, 2025.

How will the capital market view Ke Holdings under this series of combined punches?

1. Ke Holdings is stable, but challenges remain

In the increasingly sluggish real estate market of 2023, Ke Holdings emerged as a counter-cyclical growth company.

As a leading real estate transaction service platform, Ke Holdings' performance has always been a barometer of the real estate market. For a time, there were many voices that judged the real estate market as "not so bad" or "about to recover" based on Ke Holdings' performance rebound.

However, in the first quarter of this year, the real estate market rebounded again, with sales indicators declining further.

According to data released by the State Council Information Office in April this year, real estate development investment decreased by 9.5% in the first quarter. The sales area of newly built commercial housing nationwide was 226.68 million square meters, a year-on-year decrease of 19.4%; and sales of newly built commercial housing amounted to RMB 2,135.5 billion, a decrease of 27.6%.

Ke Holdings' performance was also affected to some extent. According to the financial report, the company achieved revenue of RMB 16.4 billion in the first quarter of 2024, a year-on-year decrease of 19.24%; net profit attributable to shareholders was RMB 432 million, a year-on-year decrease of 84.28%; and adjusted net profit was RMB 1.392 billion, a year-on-year decrease of 61%.

However, as Sheng Laiyun, Deputy Director of the National Bureau of Statistics, said at a press conference, the decline in real estate sales indicators in the first quarter was due to the high base in the previous year, and the absolute volume was not low.

Similarly, while Ke Holdings' performance seemed to decline significantly from the previous year, it actually fluctuated with the market environment, showing a similar trend.

Therefore, although Ke Holdings' key financial indicators in the second quarter also declined year-on-year, to understand whether Ke Holdings has made "progress," it is necessary to consider quarter-on-quarter indicators as well.

In the second quarter of this year, Ke Holdings achieved net revenue of RMB 23.4 billion, a year-on-year increase of 19.9% and a quarter-on-quarter increase of 42.68%; net profit attributable to shareholders was RMB 1.9 billion, a year-on-year increase of 46.2% and a quarter-on-quarter increase of 338.63%; and adjusted net profit was RMB 2.69 billion, a year-on-year increase of 13.9% and a quarter-on-quarter increase of 93.25%.

In terms of profitability, Ke Holdings' gross margin and net margin both increased compared to the first quarter. The gross margin was 26.77%, an increase of 1.6 percentage points from 25.17% in the first quarter; the net margin was 5.87%, an increase of 3.23 percentage points from 2.64% in the first quarter.

During the reporting period, Ke Holdings' total transaction value rebounded slightly from the first quarter to RMB 839 billion, an increase of 33.20% from RMB 629.9 billion in the first quarter.

According to Insight's observations, the real estate market recovered in the second quarter thanks to a series of policy support measures.

According to China Real Estate Information Corporation, domestic real estate policies continued to ease in May this year. At the central level, favorable policies such as reducing the minimum down payment ratio for first and second homes and personal housing provident fund loan interest rates were introduced; at the local level, 98 real estate regulatory policies were issued in coordination with the central government.

Despite policy support and better-than-previous performance, it cannot be denied that houses were still difficult to sell in the first half of 2024. While Ke Holdings increased its stores and personnel, its total transaction value decreased.

According to the financial report, Ke Holdings had nearly 46,000 stores, an increase of 6.9% year-on-year, and the number of active stores increased by 8.1% to 44,400 compared to the same period last year; the number of agents increased by 5.2% year-on-year to approximately 458,700, with approximately 411,500 active agents.

However, as of the end of June, Ke Holdings achieved a total transaction value of RMB 1,468.9 billion, a year-on-year decrease of 16.2%.

Among them, new home transactions declined sharply, with a transaction value of RMB 387.1 billion, a year-on-year decrease of 32.4%. External agents and Lianjia agents contributed transaction values of RMB 313.8 billion and RMB 73.3 billion, respectively, with year-on-year declines of 33% and 29.9%, respectively.

The situation for second-hand homes was better than that for new homes.

In the first half of 2024, Ke Holdings' total transaction value for existing home transactions was RMB 1,023.8 billion, a year-on-year decrease of 8.7%. Among them, the transaction value of existing homes facilitated by Lianjia stores decreased by 11.9% year-on-year to RMB 412.4 billion, while the transaction value facilitated by Beilian agents on the Ke Holdings platform decreased by 6.3% year-on-year to RMB 611.5 billion.

According to Insight's observations, while recent second-hand market transactions have become more active, second-hand home prices have not declined significantly. This means that demand in high-tier cities is abundant, and the effectiveness of policies has been verified to some extent.

Overall, facing the numerous challenges of the broader economic environment, Ke Holdings' real estate brokerage business remains relatively stable.

2. Seeking diversified transformation, has Ke Holdings found a new growth trajectory?

With housing prices continuing to decline, Ke Holdings is no longer anxious about the sustained pressure on its real estate brokerage business and is attempting to pursue diversified transformation.

Since 2021, Ke Holdings has proposed a "one body, two wings" strategy, positioning real estate brokerage as its main line of business and rental services (Huiju) and home improvement services (Ke Home Improvement) as new growth trajectories.

In 2023, Ke Holdings expanded its "two wings" to "three wings" by launching a third line of business – residential development through its subsidiary Ke Life. It aims to gradually transform from a traditional real estate brokerage service platform into a comprehensive residential service provider.

Ke Holdings' efforts towards transformation in the first half of this year were first evident in its investment in the "one body, three wings" strategy.

As mentioned above, Ke Holdings not only opened more stores but also hired more employees.

It also revealed in its financial report that the company is promoting the large-store model and developing different types of store formats, such as increasing community coverage through neighborhood convenience service stations or integrating home improvement scenarios into stores to become one-stop residential service entry points.

These undoubtedly require more costs to maintain.

However, due to the reduction in transaction business scale, Ke Holdings' store costs and commissions paid to external agents and internal employee salaries decreased.

In the first half of the year, Ke Holdings' store costs decreased from RMB 1.415 billion in the same period of 2023 to RMB 1.365 billion, and commissions paid to external agents decreased from RMB 11.4 billion in the same period of the previous year to RMB 8.9 billion; internal commissions and salaries decreased from RMB 9.4 billion in the same period of 2023 to RMB 8.1 billion.

Ke Holdings invested more money into the first two wings of its "three wings" strategy.

According to the financial report, Ke Holdings' home improvement costs increased from RMB 2.8 billion in the same period of 2023 to RMB 4.4 billion, an increase of 57.5%; rental services increased from RMB 2.2 billion in the same period of 2023 to RMB 5.5 billion, an increase of 1.5 times.

Ke Holdings' interim operating costs for 2024, Source: Ke Holdings' official website

Accordingly, Ke Holdings' investments have paid off.

Home improvement has become the fastest-growing segment of Ke Holdings in recent years. In the second quarter, this business achieved a contract value of RMB 4.2 billion, a year-on-year increase of 22.3%; the new retail contract value, including custom furniture and soft furnishings, was RMB 1.22 billion; net revenue was RMB 4 billion, a year-on-year increase of 53.9%; and the business contributed a profit margin of 31.3%.

As of mid-2024, the total transaction value of this segment was RMB 7.6 billion, an increase of 24.0% year-on-year, and revenue increased by 59.9% year-on-year, accounting for 16.23% of total revenue.

Another business, home rental services, increased its net revenue from RMB 2.1 billion in the same period last year to RMB 5.8 billion this year, a growth rate of 176.7%; the profit margin contributed by this business increased from 5.5% quarter-on-quarter to 5.8%.

According to the financial report, the main reason for this business growth was the increase in the number of managed properties under the Worry-Free Rental model. Data showed that the number of managed properties under the Worry-Free Rental model exceeded 300,000 at the end of the second quarter, up from over 240,000 in the previous quarter and over 120,000 in the same period last year. The number of managed properties in centralized long-term rental apartments was over 14,000, up from over 7,000 in the same period last year.

With the steady improvement of the first two wings, Ke Holdings began to venture beyond its role as a real estate transaction service platform and into residential development.

At the end of July this year, after two failed attempts, Ke Holdings' residential development service platform, Ke Life, successfully acquired two commercial and residential land parcels totaling 14.475 acres in Xi'an's Weiyang District for a total transaction price of RMB 130 million.

This business did not stray from Ke Holdings' platform advantages. It is understood that Ke Life is positioned not as a traditional real estate developer but as a data-driven residential development service platform, primarily providing "1+2" comprehensive solutions for partners such as property owners and developers. "1" refers to product solutions, and "2" refers to diverse funding services and integrated online and offline marketing services.

With the "one body" stabilized and the "three wings" showing signs of improvement, Ke Holdings has gained confidence in itself.

3. Will increasing the share repurchase plan to USD 3 billion give shareholders more confidence?

Along with its interim report, Ke Holdings also announced an expanded and extended share repurchase plan.

The announcement stated that, with the approval of the board of directors, the repurchase plan was increased from USD 2 billion to USD 3 billion, and the term was extended from the end of August this year to the end of August next year.

In fact, this extended share repurchase plan began in September 2022. As of August 12, Ke Holdings had spent approximately USD 1.39 billion on share repurchases, equivalent to nearly RMB 10 billion, and the number of repurchased shares accounted for approximately 7.5% of the company's total issued share capital before the launch of the repurchase plan.

Among them, from the beginning of this year to August 12, Ke Holdings repurchased shares worth a total of USD 480 million, accounting for 2.7% of the total share capital at the end of last year.

Ke Holdings' share repurchase plan, Source: Ke Holdings' official WeChat account

Ke Holdings' share repurchase was quite sincere, as it did not convert the shares into treasury shares and then distribute them as equity incentives to executives but instead canceled them directly. For example, all USD 719 million worth of shares repurchased by Ke Holdings in 2023 have been canceled.

According to Market Value Storm, from the beginning of this year to August 13, Ke Holdings repurchased shares worth HKD 3.83 billion, ranking eighth in the Hong Kong stock market.

In terms of cash flow, Ke Holdings' book value supports its confidence. In the first half of this year, the company's net operating cash flow was RMB 3.858 billion, and its asset-liability ratio remained at 42.3%. As of June 30, 2024, Ke Holdings' cash, cash equivalents, restricted funds, and short-term investments totaled RMB 59.7 billion.",

It is generally believed in the industry that the real estate industry will still experience a long period of adjustment. In this environment, Beike can only try to maintain a stable "output", respond quickly to market changes, and seek second-curve growth.

For Beike, its current "one body, three wings" strategy has already shown some results. The next step is to make all businesses move forward together, enhance the ability to cross cycles, and give capital markets more confidence in it.

(The headline image of this article is from the official WeChat account of Beike Real Estate.)